Energy Transfer's Diversified Asset Portfolio Drives Strong Cash Flow Generation

Summary

- ET updated its guidance. It expects Adjusted EBITDA to be between $13.05 billion and $13.45 billion by year-end - an increase from its previous estimate of $12.9-$13.3 billion.

- 29.4% of the company's FCF generated is derived from 1Q 2023 compared to consecutive quarters since 1Q 2022.

- The company has received good ratings among some of its peers due to its lower debt-to-EBITDA ratio of 3.9x compared to the average of 4.07x.

spooh

Introduction

Energy Transfer LP (NYSE:ET) is a company that specializes in natural gas midstream, transportation, and storage, as well as crude oil, NGL, and refined products transportation. The company generates cash flows through its investments in subsidiaries such as Sunoco LP (SUN) and USA Compression Partners (USAC). After fulfilling its obligations to partners, covering operational expenses and debt services, ET distributes any remaining cash to unitholders on a quarterly basis. Energy Transfer operates one of the largest intrastate pipeline systems in the United States and provides energy logistics to major industrial areas throughout the country. With approximately 11,600 miles of natural gas transportation pipelines and 11,315 miles of crude oil trunk and gathering pipelines in the U.S., they own and operate around 120,000 miles of pipelines and associated energy infrastructure.

Energy Transfer's diversified asset portfolio

Fortunately, Energy Transfer has a well-diversified asset portfolio, which should help the company remain secure during times of fluctuating commodity prices. In addition to its participation in Sunoco LP and USAC companies, which contributed $221 million and $118 million respectively to its Adjusted EBITDA in 1Q 2023, the company is active in several segments including midstream, NGL and refined products, crude oil, intrastate and interstate transportation and storage. The NGL and refined products transportation segment had the highest Adjusted EBITDA of $939 million in the previous quarter, accounting for less than 30% of the total Adjusted EBITDA of $3.43 billion. This segment's Adjusted EBITDA increased by 34% year over year compared to 1Q 2022 due to higher volumes from the Permian region and other pipelines. Meanwhile, ET generated $641 million from its midstream segment as the second-highest Adjusted EBITDA in 1Q 2023, slightly lower than the same period in 2022 by 20%.

ET financial outlook

During the economic downturn of 2020, the management team implemented several strategies to rescue the company, including a 50% reduction in dividend payments. However, they promised to increase dividends once they overcame these challenges. As a result, loyal unitholders who stuck with the company will now see a change in their investment. In 2022, Energy Transfer began increasing its dividend payments every quarter and announced that the 2Q 2023 payment would be $0.3075, slightly higher than the previous quarter's $0.305.As a midstream company, ET is heavily dependent on fluctuating oil and gas prices. Despite this volatility, the company's strong operations and profit generation have allowed management to target a 3% to 5% annual distribution growth rate through dividend payments or unit buybacks. During Q1 of 2023, ET increased its volumes across different segments compared to the same period last year. This included a 13% increase in NGL transportation volumes and a 14% increase in Midstream gathered volumes for new partnership records. Additionally, crude terminal volumes rose by 6%, among other improvements. In pursuit of strategic growth, ET completed the acquisition of Lotus Midstream Operations for $900 million in cash and 44.5 million issued common units. These improvements have allowed ET to update its guidance for 2023; it now expects Adjusted EBITDA to be between $13.05 billion and $13.45 billion by year-end - an increase from its previous estimate of $12.9-$13.3 billion.

During the first quarter, ET increased its cash balance by 28% to $330 million compared to the previous quarter's $257 million. This increase in cash generation resulted in a slight decline in net debt levels, from $48.8 billion at the end of 2022 to $47.7 billion in 1Q 2023. Fortunately, the company's equity level is high at approximately $41 billion, and based on their 2023 outlook for Adjusted EBITDA and capital investment, as well as their growing strategic asset base, it is likely that there will be further declines in debt levels by the end of 2023.In 2022, ET achieved several strategic milestones: they completed the acquisition of Woodford Express, which owns a gas gathering and processing system in Southern Oklahoma. Additionally, they sold their interest in Energy Transfer Canada while purchasing membership interest in Caliche Coastal Holdings, thereby increasing their underground storage facilities. The management strategies overview indicates that the company could generate a significant amount of operating cash flow of about $3.3 billion in the first quarter of 2023 - the highest amount during the last year. This combined with $853 million of capital expenditures led to a free cash flow of $2.5 billion. As a result, 29.4% of the company's FCF generated is derived from 1Q 2023 compared to consecutive quarters since 1Q 2022 (see Figure 1).

Figure 1 - ET cash and capital structures (in millions)

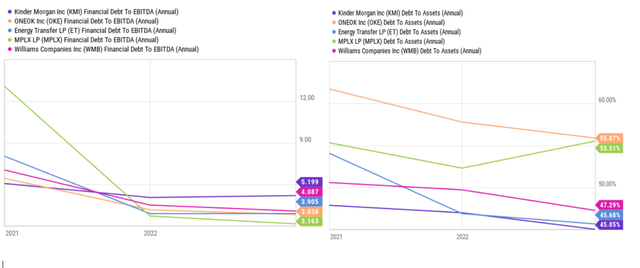

Energy Transfer's competitive advantage over its peers lies in its diverse portfolio of assets spread across different geographic regions. Each segment generates earnings that are less than 30% of the company's Adjusted EBITDA, ensuring a balanced revenue stream. Moreover, the majority of the company's margins come from fees, which may make it less vulnerable to commodity price fluctuations. In Q1, Energy Transfer reduced its long-term debt by $1 billion, improving its leverage position compared to some of its peers. The company has also received good ratings among its peers due to its lower debt-to-EBITDA ratio of 3.9x compared to the average of 4.07x. Also, their debt to asset ratio is approximately 45.6%, which is the second lowest amount after Kinder Morgan (KMI) in the peer group (see Figure 2).

Figure 2 - ET's leverage ratios vs. its peers

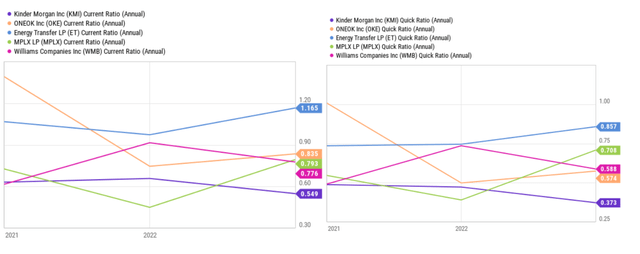

It comes as no surprise that ET boasts the best liquidity condition among its peers. The company's ample free cash flow and Adjusted EBITDA have provided a unique opportunity for significant improvement in liquidity over recent years. Despite a slight decline in current assets, current liabilities decreased by 25% in 1Q 2023 compared to the same period in 2022. As a result, the current ratio increased to 1.65x, significantly higher than ONK's next-best record of 0.83x. Similarly, ET's quick ratio, which indicates their ability to pay short-term obligations, reached a peer group high of 0.7x, with ET's quick ratio sitting at 0.85x. Overall, ET's recent acquisitions and diversified portfolio of assets cater to profitable capital projects and bring about further EBITDA growth and liquidity improvements (see Figure 3).

Figure 3 - ET's liquidity ratios vs. it peers

Risks

Like any other company in various industries, Energy Transfer is exposed to several potential risks that could impact its operations and financial condition. Therefore, it is recommended that investors monitor these risks closely. Firstly, the recent monetary policies by the Federal Reserve may make it more challenging for Energy Transfer to secure debt or equity financing for capital projects. Additionally, Energy Transfer's cash flow heavily relies on the cash distributions it receives from its subsidiaries, including Sunoco LP and USAC. Thus, if the subsidiaries' cash available for distributions falls due to the issuance of additional common units by them, the amount of cash generated by Energy Transfer could fluctuate considerably. Another significant risk associated with Energy Transfer is its dependence on a limited number of key producers for natural gas supply and transportation. The loss of any of these key producers could adversely affect Energy Transfer's operations and financial results. For example, in 2022, two customers generated approximately 42% of Energy Transfer's intrastate natural gas transportation and storage revenues. As there are other options available for these producers besides Energy Transfer, any reduction in their volumes of natural gas supplied to Energy Transfer would negatively impact its results.

Conclusion

Energy Transfer's diversified asset portfolio has enabled the company to generate strong cash flow, as evidenced by their improved financial statements. Although the company had to cut its dividend payment over two years ago due to the 2020 downturn, they have since been able to gradually increase it. In fact, they have recently announced plans to raise unitholders' payments to approximately $0.3075 in 2Q 2023 and increase investors' returns by 3-5% annually. Despite potential risks, after analyzing ET's financial statements and operational strategies, I conclude that a buy rating is appropriate for ET stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.