Western Alliance Bancorp Surges On Further Signs Of Stabilizing

Summary

- Western Alliance Bancorp's shares spiked by 10.2% after management released positive financial data, showing a reduction in uninsured deposits and an increase in insured deposits.

- The company aims to reduce its borrowings and increase its CET1 capital above 10% by the end of Q2 2023.

- Despite the risks, the improvements in the company's financial standing make it a favorable risk-to-reward prospect, causing me to keep it rated a 'strong buy' for now.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Hero Images Inc

May 17 proved to be something of a reprieve for investors in Western Alliance Bancorp (NYSE:WAL). After some interesting news was released by management, shares of the company spiked, closing up 10.2% for the day. This is great to see for a company that has been down as much as 91.4% from its 52-week high, that is still down 40.5% this year, and that is currently down 59.9% from its 52-week high. Clearly, the amount the stock has fallen even after factoring in this spike implies that some really nice upside might still be on the table. To some who watch the company, this may seem like a pipe dream, but if current trends persist, this could very well become a reality.

Some great improvements

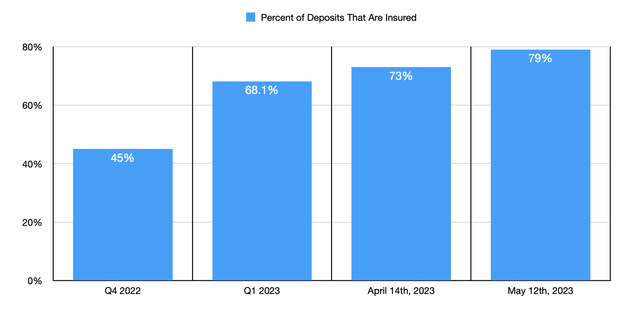

Like many other regional banks, Western Alliance Bancorp was slammed earlier this year by fears of a bank run. It all began with the collapse of Silicon Valley Bank, with the contagion spreading from there and impacting the enterprises that were most exposed from a business perspective to the same kinds of clients that Silicon Valley Bank was and that were most susceptible to a bank run because they had large amounts of uninsured deposits. Truthfully, Western Alliance Bancorp made for a pretty good target. At the end of the 2022 fiscal year, 55% of the company's deposits were uninsured. So, it makes sense that pessimism would build around it.

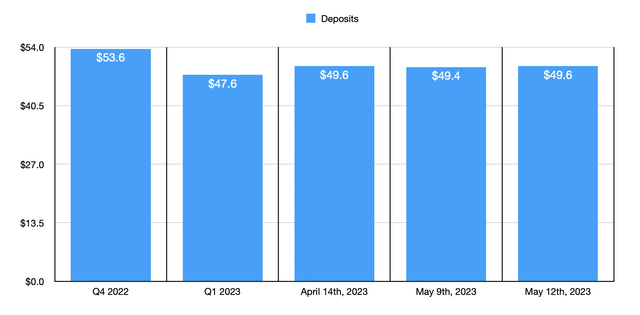

As time has gone on, the picture for the company has improved considerably. In an article that I published on the business in April, I discussed the financial results covering the first quarter of the company's 2023 fiscal year. Leading up to that point, management had been rather opaque when it came to important financial data. But what they revealed was that the company had significantly reduced its uninsured deposits from $29.5 billion to $13.4 billion on April 14. At the same time, insured deposits grew enough so that overall deposits stabilized and actually increased to some degree. After dropping from $53.6 billion at the end of 2022 to $47.6 billion at the end of the first quarter, overall deposits for the company inched up to $49.6 billion by April 14.

It was at this time that I became incredibly bullish on the company, going so far as to rate it a 'strong buy' to reflect my view that shares should outperform the broader market for the foreseeable future. But renewed pessimism regarding the sector caused the stock to plunge further. At the end of the day, perception in the marketplace can go a long way toward creating what is ultimately a self-fulfilling prophecy. In this scenario, the fear was that concerns about the contagion spreading could cause depositors to withdraw their capital, effectively squeezing the bank and causing it to collapse even if it otherwise would not have. This has been the death of many a bank over the past few centuries.

Thanks to management, we now have an updated look on the fundamental health of the enterprise. During its first quarter earnings release, management stated that overall deposits were $47.6 billion. But this number increased to $49.6 billion by April 14. In an update covering through May 9, management revealed that deposits had dipped to $49.4 billion. But that was still $1.8 billion above what they ended at during the first quarter of this year. By May 12, however, this number had increased such that overall deposit growth since the end of the first quarter was in excess of $2 billion. We don't know exactly where that number lies. But what it does show is stability and a reading of at least the $49.6 billion that it previously stabilized at on April 14.

This is fantastic to see, but management also provided some other important details. More than 79% of all deposits for the company are insured. That's up from 73% on April 14 and compares nicely to the 45% that the company had as of the final quarter of 2022. In theory, a bank that has 100% of its deposits insured, or some number very close to it, is immune from a bank run. So even though deposits have only stabilized instead of grown from where they were a month ago, the fact that the share that is classified as insured has increased is really bullish in my eyes.

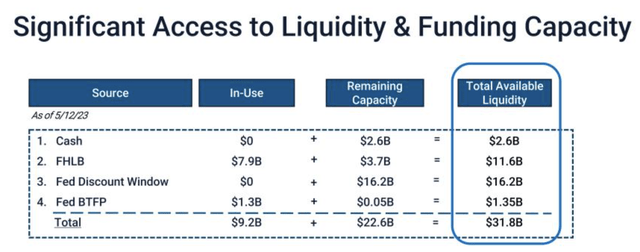

There were some other interesting data points that management made available. Outside the deposit discussion was management's conviction in reducing some of its borrowings. As of May 12, the company said that it had $2.6 billion in cash and cash equivalents on its books. It also has $22.6 billion of remaining capacity to borrow. But ultimately, its goal is to reduce these borrowings as much as possible. In particular, management is hoping to pay down its Federal Reserve Bank Term Funding Program debt down to $0 using proceeds from asset sales.

As of May 12, borrowings under this were only $1.3 billion. However, management also plans to reduce its Federal Home Loan Bank borrowings down to around $5 billion from the $7.9 billion where they are currently. This will all be achieved as the company sells off around $6 billion worth of loans that are classified right now as held for sale. And management has said that around 50% of that $6 billion figure should be sold imminently. Although it's painful to sell off any loans, since those loans bring in income, the interest rates on these borrowings are quite high. During the most recent quarter, for instance, the weighted average interest rate on Federal Home Loan Bank advances was 5.06% per annum. And for its Federal Reserve Bank Term Funding Program debt, the number was 4.76%.

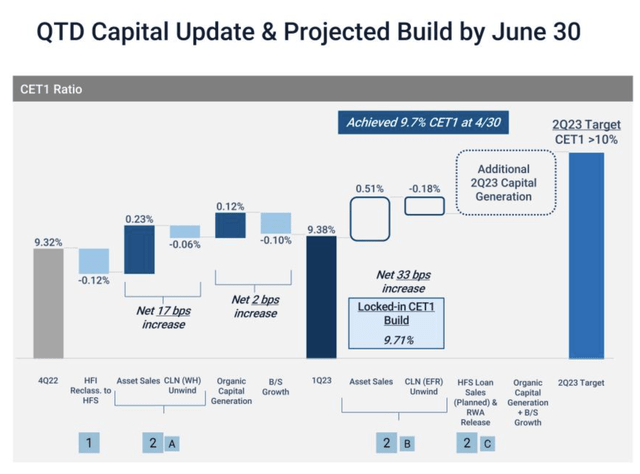

There were a couple of other developments as well. For starters, management detailed that it plans, by the end of the second quarter of this year, to get its CET1 capital above 10%. At the end of last year, it came in at 9.32%. And by the end of the first quarter, it had inched up to 9.38%. By April 30, management had increased it further to roughly 9.7%. For those who don't know, CET1 capital is considered the highest quality of regulatory capital that a bank has. This is classified as the sum of common shares and stock surplus, retained earnings, other comprehensive income, qualifying minority interest, and regulatory adjustments, that are on the company's books. Having a certain amount of capital means that the company has the ability to absorb losses immediately should they occur.

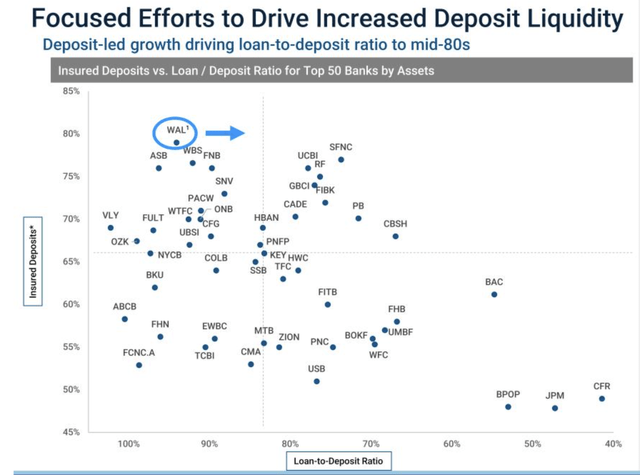

The last data point that I think deserves some attention involves how the company is positioned on a loan/deposit ratio relative to other top banks in the US. Looking solely at held for investment loans divided by total deposits, the ratio for the company came in at 94% on May 12. This was down from 98% at the end of the first quarter. If we focus solely on insured deposits relative to loans, this number does drop to less than 80%. However, as management detailed in their investor presentation, this still places them as having the highest insured deposits versus loan to deposit ratio out of the top 50 largest banks in the country. At first glance, it may seem positive to have a higher ratio of loans relative to deposits. After all, that would mean even greater interest income from the loans that the company has on its books. But the downside of this is that the higher this number is, the less in reserves the bank has in order to easily meet its cash needs should there be a bank run. The fact that this number is improving is great. But further improvements are definitely needed.

Takeaway

From all that I can see, Western Alliance Bancorp is doing quite well for itself right now. I understand that investors might be a bit cautious still. And this would not necessarily be a bad way to approach matters. This is far from a riskless opportunity. Having said that, I do think that the most recent data provided by management shows an improvement in the company's standing, and it demonstrates that the enterprise makes for a very favorable risk to reward prospect at this time. As such, I have no problem keeping the company rated the 'strong buy' I had it rated previously.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in WAL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.