USTB: Short-Term Bond Fund, 5.4% Yield

Summary

- VictoryShares Short-Term Bond ETF is a fixed-income exchange-traded fund.

- The vehicle has a low duration of only 1.8 years and focuses on the short end of the curve.

- The fund is mostly investment-grade, with a small bucket for not rated issuers and below investment-grade ones.

- The only concern for this name is its high 25% exposure to Financials, although the collateral pool does not include any of the regional banks currently in the news.

twohumans

Thesis

VictoryShares Short-Term Bond ETF (NASDAQ:USTB) is a fixed income exchange traded fund. As per its literature, the vehicle:

Offers short-term bond exposure that seeks high current income with preservation of principal. The fund invests primarily in corporate bonds, U.S. Treasuries, state and local issuance and mortgage-and asset-backed securities with a weighted average portfolio maturity of less than 3 years.

Currently the vehicle has a duration of 1.8 years and is overweight corporate bonds and ABS securities. We believe most of the rates driven negative performance is behind us, with the only hits to NAV going forward coming from actual defaults. The vehicle does not contain any of the 'problem banks' in its portfolio, but does have other issuers such as Vornado, which is a NY Office REIT and has been in the news lately.

The collateral pool here is investment grade, but financials represent over 25% of the portfolio, which could be problematic. We have seen in today's environment how regional banks can default quite fast, even if they have investment grade ratings.

USTB has a better performance than its peer PIMCO Enhanced Short Maturity ETF (MINT), but is also more volatile. In a normalized economic and rates environment we would categorize USTB as a proper 'cash parking vehicle'. In today's environment it falls more on the risky side. Not so from an actual loss of principal, but more from a lowering of its 5.4% 30-day SEC yield as a result of portfolio defaults. The portfolio is granular, and the fund is solidly build, so we do not think there is a NAV issue, but when risk free assets such as T-Bills and MBS bonds yield 4.5% to 5% in the short end of the curve, why bother taking any credit risk for an additional 40 bps?

USTB is a solid fund that has had robust historic returns, and although it sports a longer than normal duration, most of the rates implications are behind us. What concerns us is its large Financials bucket and the possibility to have defaults which decrease its yield substantially. We would look elsewhere for the front end of the curve, namely at names such as OPER which we covered here, or SGOV which was covered here.

Analytics

- AUM: $0.48 billion

- Sharpe Ratio: 0.24 (3Y)

- Std. Deviation: 2.25 (3Y)

- Yield: 5.4%

- Premium/Discount to NAV: n/a

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income - Short term IG Bonds / ABS

- Duration: 1.8 yrs

- Expense Ratio: 0.35%

Holdings

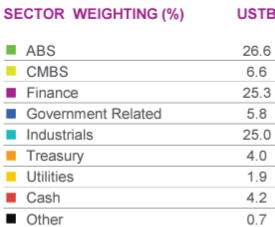

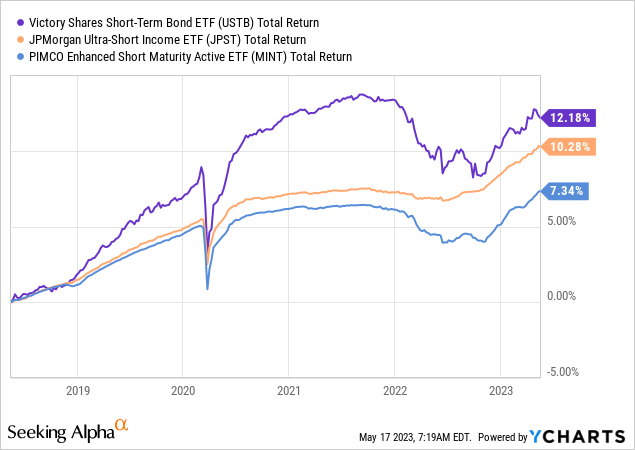

The fund holds a mix of corporate bonds and ABS securities:

Sectors (Fund Fact Sheet)

The main industries for the corporate bond book are Finance and Industrials. Looking through its collateral in detail, the fund does not have any of the 'issue bank' names in there, but it does contain some other issuers which have been in the news, such as Vornado, the NYC Office REIT.

Most of the collateral is investment grade here:

Ratings (Fund Fact Sheet)

We looked at the below investment grade bucket, and most of the names are energy names with strong balance sheets. We feel any 'surprises' will actually come from the investment grade name bucket.

The fund keeps its duration rather short, but does contain bonds with maturities out five years:

Maturity Profile (Fund Fact Sheet)

Performance

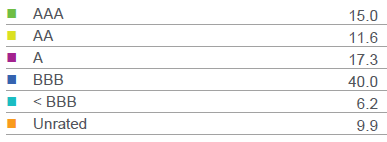

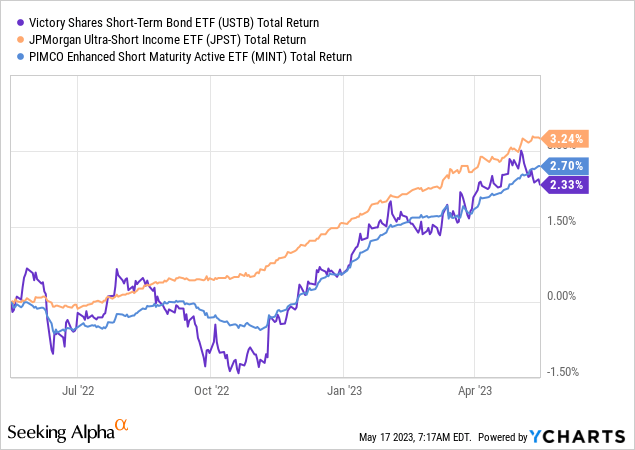

In the past year, JPST has had a similar performance as its peers:

The above graph is a total return one, and embeds the dividend yields. On a longer term basis we can observe USTB is more volatile, yet higher yielding:

Conclusion

USTB is a fixed income exchange traded fund. The vehicle focuses on the front end of the curve, with a 1.8 years duration for its portfolio. The holdings are composed of corporate bonds and ABS securities, the vast majority being investment grade. Most of the junk bonds are actually energy names with robust balance sheets, so we have no concerns regarding that bucket. Even if it does not hold any of the 'problem' regional banks, the fund still has a 25% allocation to financials, which could pose a problem. The portfolio is granular, hence any default would only impact the yield of the fund. But with short term risk free assets yielding 4.5% to 5%, we are hard pressed to see why we would buy USTB here for a 5.4% 30-day SEC yield and the additional risk. We are on Hold with respect to this name.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.