Cloudflare: High Growth At A High Price

Summary

- After a disappointing guidance, Cloudflare's stock fell more than 20% in a single day, to then recover partially as the market digested the news.

- The price correction we just witnessed might be a prelude to further significant price corrections as the market starts to demand more than just growth from the company.

- Growth alone cannot justify the current market price in my view, and based on my assumptions, Cloudflare future cash flows are not enough to justify the current price.

imaginima/iStock via Getty Images

Investment Thesis

After a disappointing management guidance, reducing the expected target growth for the second quarter and full year from 37% to 31%, Cloudflare (NYSE:NET) fell more than 20% in a single day, to then recover partially as the market digested the news. As typical for a growth stock, the market is willing to give a premium value only if growth expectations are met, or even better if beaten.

Now, despite the guidance that came lower than expected, Cloudflare remains a growth stock with growth rates forecasted to stay in the range of 30% in the coming years. However, the price correction we just witnessed might be a prelude to further significant price corrections as the market starts to demand more than just growth from the company, especially in terms of profitability.

In today's analysis, we will assess why Cloudflare, despite being expected to keep growing strong in the future and maintain a dominant market share, doesn't represent a good investment opportunity at today's prices.

Business Model

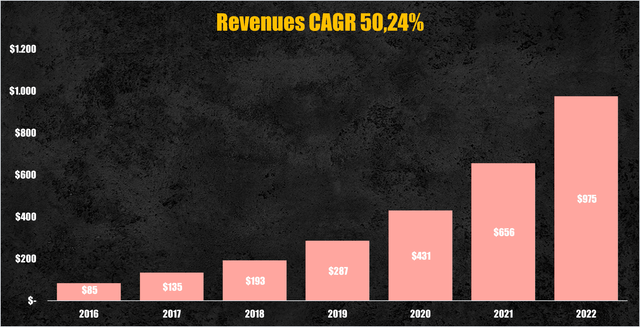

Cloudflare is a growth stock, no doubt about it, its revenues grew at a CAGR of 50% since 2016, reaching $975 million in 2022, and trying to project its revenues into the future I think we can expect them to surpass $6 billion by 2032, as the adoption of content delivery networks (CDN) spread among websites all over the world.

Cloudflare's revenues (Cloudflare)

Network and security services are the bread and butter for Cloudflare. Thanks to its proprietary servers deployed in co-located data centers in almost 300 cities all around the globe, Cloudflare offers CDN services which help companies deliver online content of any format in the fastest and most reliable way possible.

Cloudflare's servers are an essential tool for companies that operate on the internet, being spread across the globe, and containing a copy of the original content, they permit faster content delivery improving the user experience while helping the customer company to reduce the pressure on the original server during high traffic periods, avoiding website downtimes.

In addition to CDN services, Cloudflare generates revenues by offering security software solutions which help companies to secure both their website pages and internal employees' network from external malevolent attacks.

Market Overview

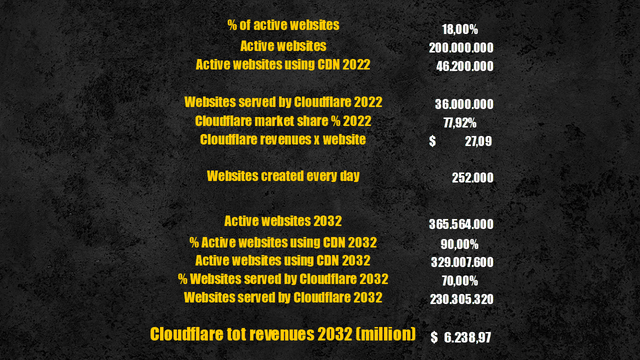

Cloudflare's future revenues are obtained by estimating the future CDN market. At the present day, there are around 200 million active websites in the world, a mere 18% of the 1.12 billion websites in existence worldwide. However, as of the beginning of 2023, only 23% of the active websites adopted CDN solutions, equal to roughly 46 million websites.

Cloudflare is the market leader in terms of the number of websites served by CDN solutions, with a whopping 78% market share, which accounts for 36 million websites. Dividing the 2022 total revenues by the number of websites served, we obtain $27 generated by each website.

With 252 thousand websites created each day, if we project this number into the next ten years, and we assume that the percentage of active websites remains equal to 18%, by 2032 we can expect to have 365 million active websites.

Given the terrific benefits and advantages that CDN solutions offer to websites, and the growing adoption rate of these solutions among web pages, which was only 5.5% in 2016 and grew to 23% in 2022, I assumed the percentage of websites which adopts CDN solutions to be equal to 90% of active websites by 2032.

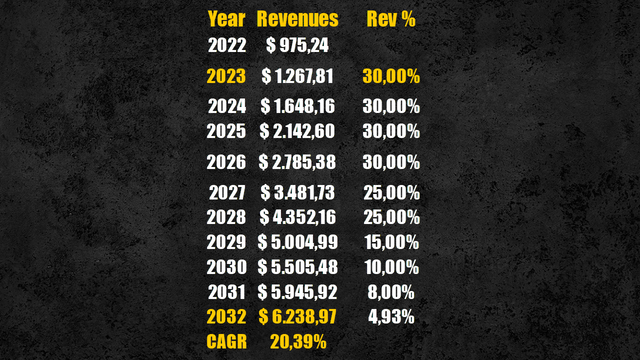

Revenues Projection

Assuming Cloudflare will maintain its dominant position, thanks to its vast network which accounts for the highest number of points of presence available among its competitors, I expect Cloudflare to maintain a market share of around 70%, meaning they will serve roughly 230 million websites with their network and security solutions. With the simplistic assumption of revenues per website remaining equal to $27 per web page, total revenues are expected to be around $6.2 billion by 2032.

This translates in revenues expected to increase more than six folds from current levels, growing at a CAGR of 20.4% in the next ten years.

Cloudflare's future revenues (Personal Data)

Future Efficiency and Profitability

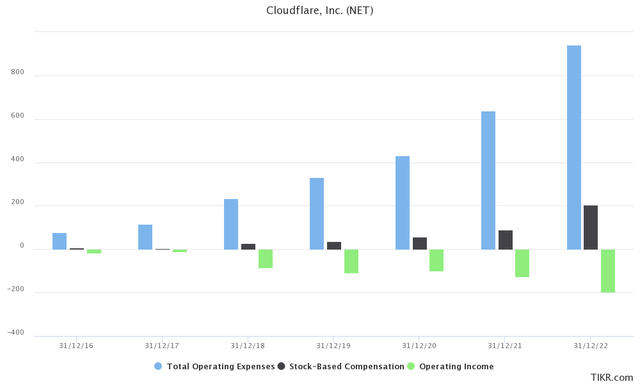

Moving on to Cloudflare's efficiency and profitability, it is immediately obvious that so far, growth alone has driven the company's market value. Cloudflare is still struggling to turn its business model profitable and hasn't achieved enough economies of scale to absorb the high operating expenses.

The operating loss for 2022 is equal to -$197 million, and over the past five years, Cloudflare averaged an operating margin of -23%. A big chunk of operating expenses is represented by stock-based compensation, which for the company doesn't represent a cash outflow, however, for us investors it represents a hidden cost reflected in ownership dilution when, and if, the stock options are exercised.

Cloudflare operating loss (Cloudflare)

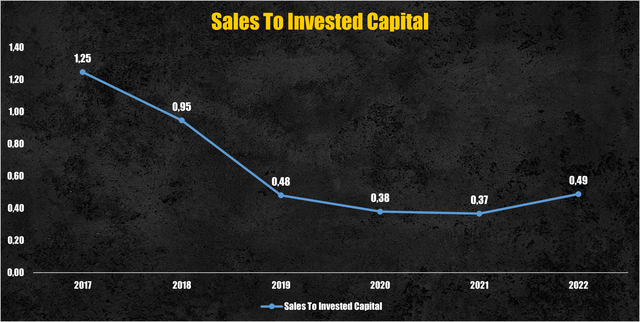

Using the sales to invested capital ratio instead, which shows how much revenue Cloudflare can generate given each dollar reinvested into the company, was equal to 0.49 in 2022.

Cloudflare sales to invested capital ratio (Cloudflare)

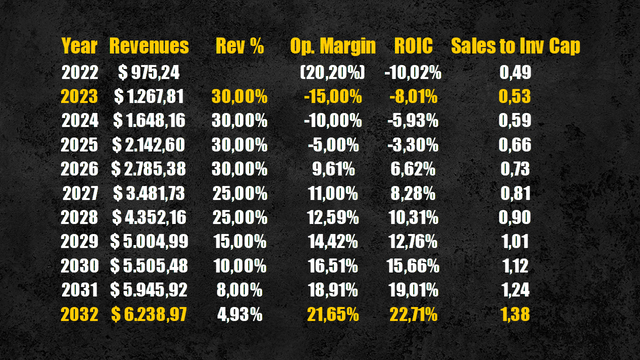

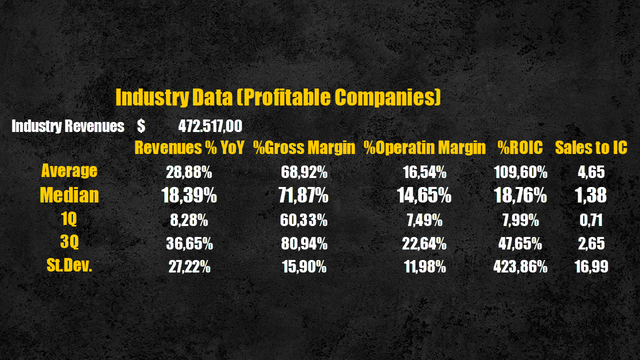

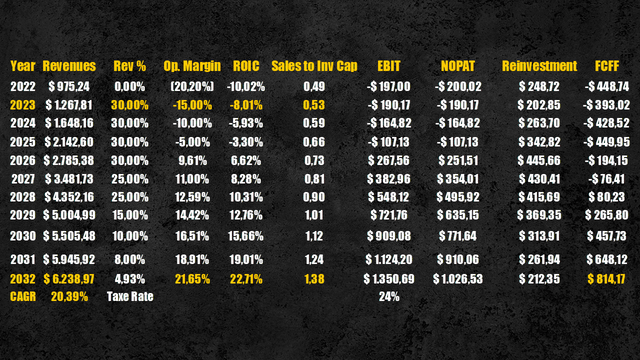

As regards the future, I assumed Cloudflare's business model to struggle to reach profitability for the next 3 years, as I expect the company to necessitate some more years to expand their economy of scale to properly absorb the operating costs. Once Cloudflare turns profitable, following the increasing adoption of CDN solutions, I expected the operating margin to scale up until reaching a value of 21.6%, slightly lower than the third quartile value for the software industry.

I then assumed Cloudflare's sales to invested capital ratio to improve from 0.49 to 1.38 by 2032, equal to the median value of the software industry. Again, as Cloudflare will scale up its operations, growing its revenues, and reducing the investments made in server infrastructure as the network gets bigger over time, we can expect the return, in terms of revenues generated, to increase significantly. Combined with the achievement of profitability, we obtain an expected return on invested capital (ROIC) of 22.7%, notably higher than the industry median value of 18.7%.

Cloudflare future efficiency and profitability (Personal data) Software industry data (Personal Data)

Cash Flow Projection

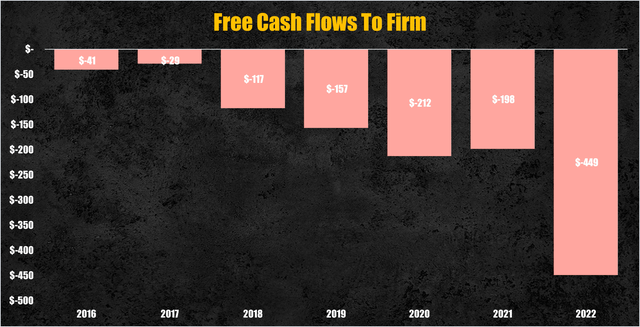

In the past, Cloudflare registered negative FCFF as the company had to invest heavily in capital expenditure, R&D, and acquisitions to support future growth.

Cloudflare FCFF (Personal Data)

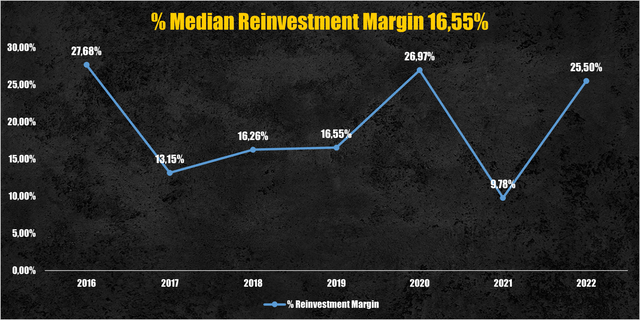

The median reinvestment margin for the past is equal to 16.55%, and I assumed the future reinvestment margin to remain around 16%, as far as the company grows at a sustained rate, to then gradually decrease as Cloudflare sets up its network. We can expect the reinvestment margin to decline as Cloudflare does not directly build and own the data centers, but rather places its servers in co-located data centers managed by third parties, significantly reducing the capital needs to set up its operations, especially as it grows its economies of scale.

Cloudflare reinvestment margin (Personal Data)

With these assumptions, Cloudflare is expected to deliver negative free cash flows to the firm (FCFF) for the next years, again as I expect the company to require some more years to reach full capacity, to then turn positive and reach $800 million by 2032.

Cloudflare cash flows projection (Personal Data)

Valuation

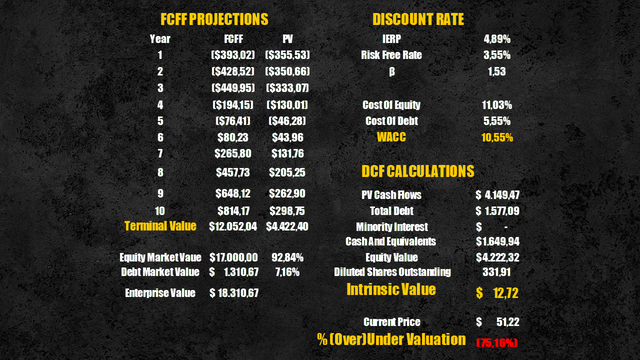

Applying a discount rate of 10.55%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $4.2 billion or $12.7 per share.

Compared to the current prices, Cloudflare's stock appears to be overvalued by 75%.

Cloudflare intrinsic value (Personal Data)

Risks

Despite Cloudflare currently having the dominant position in the CDN market in terms of websites served, it should be noted that the market is highly competitive, with the presence of players like Akamai Technologies (AKAM), which is a pure CDN provider, but most importantly, Cloudflare competes with giants like Google (GOOG) (GOOGL), which offers Google Cloud CDN, and Amazon Web Services (AWS), which offers Amazon CloudFront.

Despite Cloudflare's network still being the most advanced in the industry, available in 280 plus cities compared to Google and Amazon, which roughly serve 100 cities, the two cloud giants can represent a potential threat to the company given their scale of operations, brand awareness, and financial capabilities which can permit them to scale at an extraordinary pace, especially with regard to the most profitable enterprise segment which might require advance cloud capabilities. Worth mentioning is that while Cloudflare is the market leader in terms of the number of websites served, back in 2020 Amazon CloudFront served a greater number of enterprise clients than Cloudflare, which is mostly used by small and medium-sized businesses, and most of them access only free to use solutions.

However, while they do not generate any direct revenues, the immense base of free users represents a significant competitive advantage for Cloudflare thanks to the enormous amount of data they collect from them, which comes in handy in the continuous improvement and the addition of new features to its solutions which will, in turn, attract and retain a greater number of customers. Also, the small companies that nowadays are using free services, as they scale up their operations, will be more willing to start adopting Cloudflare's premium services as they are already used to the product.

Conclusion

So, in conclusion, despite Cloudflare being expected to keep growing strong in the coming years, maintaining the leading position in the CDN market, it still appears too expensive at today's prices to represent a good investment opportunity in my view.

Growth alone cannot justify the current market price for the company. What drives investors' gains in the long term is the ability of the company to generate cash flows, and based on my assumptions, Cloudflare's future cash flows are not enough to justify the current price.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.