Agnico Eagle Mines: Things Should Only Get Better

Summary

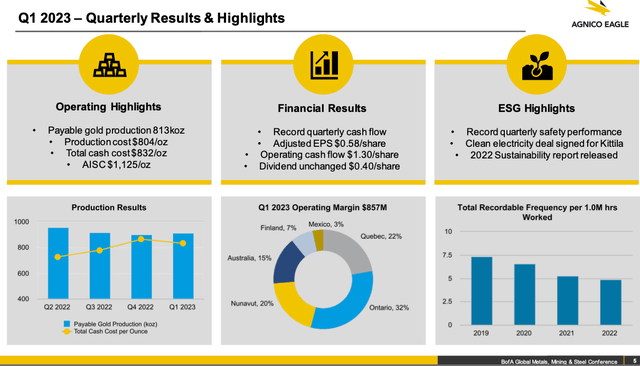

- Agnico Eagle Mines Limited reported strong Q1 2023 financial results.

- The company also completed the acquisition of an additional 50% interest in the Canadian Malartic mine.

- Is Agnico Eagle Mines still a buy after its strong stock price performance?

- This idea was discussed in more depth with members of my private investing community, The Gold Bull Portfolio. Learn More »

Agnico Eagle Mines: Updated Analysis

This update evaluates Agnico Eagle Mines Limited (NYSE:AEM), a stock I previously recommended as a BUY at $45 per share. In that prior coverage, I argued that the stock's selloff, largely due to increasing all-in-sustaining costs which had risen to $1,231 per ounce, was unwarranted. And I explained that the lower production at some of its operations impacted the quarterly unit costs, but said that was only temporary.

My previous coverage stated that Agnico had a great quarter overall, with robust gold production and strong exploration results, along with significant progress on its pipeline of organic growth projects. This BUY recommendation at the time has proved successful, with a total return of 19.67% since then, significantly outperforming the S&P 500 (SP500), which increased by just 2%.

However, what investors likely want to know now is this: Is Agnico Eagle Mines still an attractive investment opportunity right now, in light of its share price gains and its most recent quarterly results?

In this article, I provide an updated analysis of this leading gold miner.

Agnico Eagle Mines: Rising Production, Falling Costs

Agnico Eagle Mines had a strong rebound this quarter, and this was not too surprising if you've been following the miner.

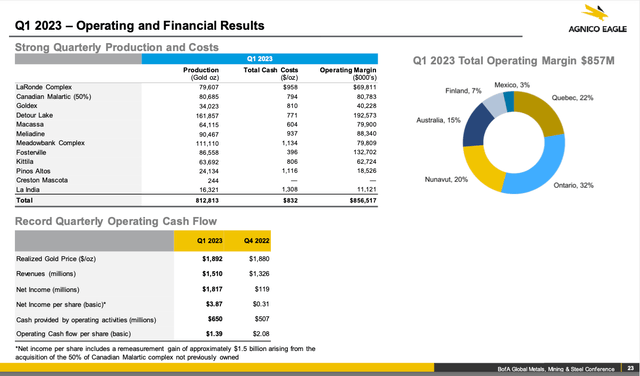

Investors should take note of the impressive production of 812,813 ounces of gold at decreasing costs. Total cash costs stood at $832/oz, and the all-in sustaining costs dropped to $1,125/oz, a decline of over $100 from the previous quarter and falling below the lower end of its annual guidance. This is among the lowest AISC in the industry.

Unsurprisingly, the combination of robust production, reduced cash costs, and high gold prices led to a great financial quarter. The company reported net income of $3.87 per share, which included the Canadian Malartic takeover, resulting in a remeasurement gain of $1.5 billion. On an adjusted basis, net income remained strong at $0.58 per share.

Agnico also reaffirmed its 2023 guidance. The company maintains its expected gold production for the year at 3.24 - 3.44 million ounces, with AISC projected to range between $1,140 - $1,190/oz.

Total capital expenditures for 2023 are estimated to be around $1.42 billion (unchanged), and this figure accounts for 50% ownership of Canadian Malartic for the first three months of 2023 and 100% ownership for the remaining nine months.

Canadian Malartic Update

Investors should take note that these financial results include only Agnico's 50% interest in Canadian Malartic, excluding the additional 50% it acquired from Yamana Gold in Q1. If the additional 50% had been factored in, the financial results would have been even better. The reason is that Canadian Malartic is one of the company's strongest performing assets. For example, in Q1, the mine produced 80,685 ounces of gold at total cash costs per ounce of $794 in Q1.

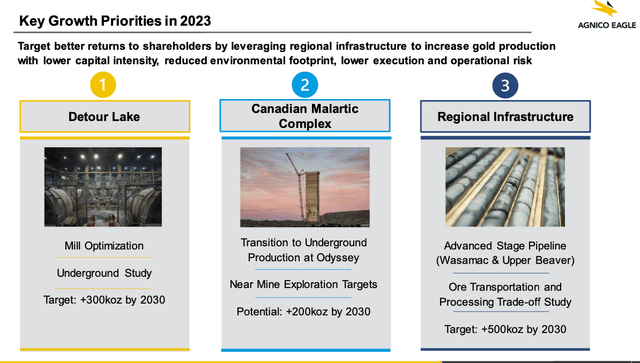

Looking out 5 years from now, the company's prospects at Canadian Malartic appear even brighter. Agnico anticipates up to 40,000 tons per day of excess mill capacity at Canadian Malartic starting in 2028. It plans to optimize mill throughput in the region, so it should be able to grow future production while also reducing capital costs.

Currently, Agnico is investigating potential production opportunities at its nearby Macassa and Amalgamated Kirkland deposits, along with Upper Beaver and Wasamac, which are nearby Canadian Malartic. A company update on these projects is expected before the year's end.

Other Key Projects On Schedule

Agnico also provided investors with important updates on several organic growth projects in its pipeline that bode well for future production.

Significant progress has been made on the Odyssey project (Canadian Malartic underground) in terms of underground development and construction activities. The initial production blast at Odyssey South happened in late March, and the drilling activities, primarily centered on infill drilling to confirm resources and reserves, have been ongoing, according to the company.

Odyssey is pivotal to the future mining operations at Canadian Malartic, with an estimated mine life stretching until 2039. According to the 2021 PEA study, the resource boasts more than 7 million ounces of gold in indicated and inferred resources.

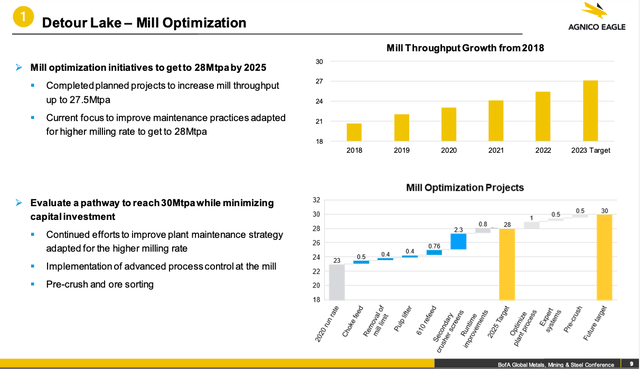

At Detour Lake, the mill continues to break production records. The mine produced 161,857 ounces of gold in Q1 at total cash costs of $771 per ounce. The company is focused on optimizing the mill process with the aim of potentially surpassing an annual throughput of 28 million tons, an increase from the current rate of approximately 26 million tons.

According to Agnico, Detour Lake's operation life has now been extended to 2052, with expected midpoint gold production of 690,000 ounces per year in 2023, rising to 740,000 ounces per year by 2025. Its acquisition of the mine from Detour Gold, at the cheap price of $5 billion, has been a fantastic move to date.

Furthermore, exploration results at Detour Lake continue to yield positive results. The company is in the process of updating the already substantial resource at Detour Lake, and the asset will likely bring shareholders more good news in the future.

Shareholder Returns Continue

Agnico is generating robust free cash flow and returning some of that cash to shareholders.

Share Buyback Update

Agnico announced that will renew its normal course issuer bid, aka share buyback program.

Under the program, Agnico has the right to repurchase and cancel up to 24.7 million common shares, or 5% of the issued and outstanding shares. As of writing, Agnico Eagle had 494 million issued and outstanding common shares.

Share buybacks are generally a good, shareholder-friendly move, but only when the company executes the buyback at favorable prices. In other words, it's only smart when the stock is undervalued or reasonably priced, as the buyback reduces its share count at those favorable prices. Buybacks can boost a company's financial metrics, such as price-to-earnings ratio, and therefore, boost its stock price.

High Dividends

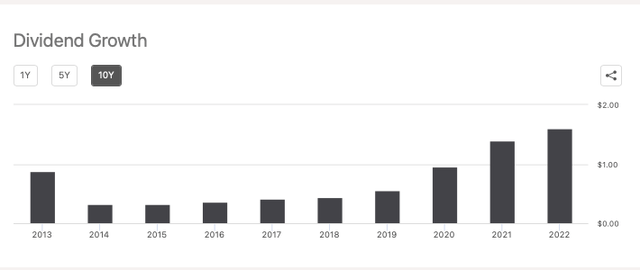

A quarterly dividend of $0.40 per share has been declared. At the current stock price of $54.84 as of writing, its shares yield 2.86%, giving its stock one of the highest yields in the gold mining sector.

Over the past 5 years, its dividend has increased by 30.67%, according to Seeking Alpha. The payout now exceeds the dividends paid during the 2013 year.

The company's payout ratio of 70%, and increased earnings power with gold prices north of $1,900/oz, indicate that Agnico has room to at least sustain this current dividend, and potentially increase it in the future.

Balance Sheet Flexibility

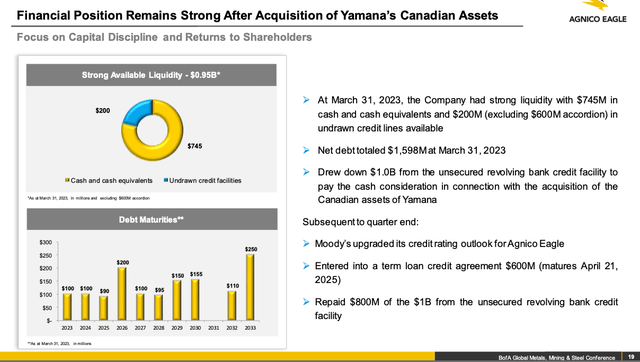

Agnico Eagle's financial position is strong even after its acquisition of Canadian Malartic from Yamana Gold (YRI:CA).

Its cash and cash equivalents stood at $744.6 million at quarter's end, an increase from $658.6 million at the end of 2022. This increase comes from its strong cash flow and reduced capital expenditures.

Another sign of Agnico's financial strength: Moody's has updated its credit rating outlook from "stable" to "positive" while maintaining the Baa2 credit rating. This indicates Agnico has been successful in maintaining a low leverage ratio, and it has strong cash flows to support debt repayment.

Agnico also took a move to further bolster its balance sheet. The company secured a $600 million unsecured term credit facility on April 20, which will be used to repay money drawn from another bank credit facility.

As of March 31, 2023, the company's net debt stands at $1.6 billion, which is pretty low for a company of its size (~$25 billion market cap and $500-$600 million operating cash flow per quarter). Also note that most of this debt doesn't mature until after 2026, so Agnico has plenty of time to repay or refinance the debt.

In conclusion, Agnico Eagle Mines' finances are quite robust, due to its healthy cash balance, manageable debt levels, and an improved credit rating outlook.

Agnico Eagle Mines: Is the stock a buy?

Agnico Eagle Mines Limited is outperforming its peers over the past year, and will likely continue to do so. Its strong start to the year is just the beginning. I think we're going to see even stronger performance out of its core mines in the future, including Detour Lake, Fosterville, and Canadian Malartic.

Agnico may not look like the cheapest gold stock in the sector if you study its valuation metrics. But the risk vs. reward for Agnico Eagle Mines Limited is very favorable, and you are paying for quality, production growth, low jurisdiction risk, and exploration upside.

plastic_buddha

Looking for more buying opportunities like Agnico? Join the exclusive community of smart investors who trust The Gold Bull Portfolio for expert analysis on all commodity stocks! Subscribe today and get immediate access to my top picks, personal portfolio insights, and in-depth analysis of over 140+ stocks. And, as a special welcome offer, new subscribers can try out our service risk-free with a free 2-week trial and receive a 10% discount on annual subscriptions. Don't miss this opportunity to take control of your investment strategy and grow your wealth – subscribe now!

This article was written by

With over a decade of experience in the investment industry, I am a highly skilled private investor with a proven track record of success in the commodities and hard assets sector. My areas of expertise include investing in gold and silver miners, royalty and streaming companies, pure exploration companies, as well as oil and gas producers and MLPs. My comprehensive understanding of these markets and my ability to identify and capitalize on profitable opportunities have enabled me to consistently deliver strong returns for my subscribers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.