i-80 Gold: High-Grade Ounces At An Attractive Price

Summary

- i-80 Gold Corp. was one of the top-performing precious metals names in 2021 and 2022, trouncing the performance of its developer peers.

- However, the stock has underperformed to start 2023 after ending the year near all-time highs, yet exploration success has continued, and the company is quietly adding ounces across its projects.

- Assuming i-80 can execute successfully on its growth plans, it will be a 400,000+ ounce producer on a gold-equivalent basis by 2028 with some of the highest-grade mines globally.

- A producer of this scale in the top-ranked mining jurisdiction should easily command a $2.2+ billion valuation, or triple its current fully diluted market cap, making i-80 Gold a steal at current levels.

raclro

While the gold price has continued to hang out near all-time highs to start the year, sector-wide performance has been quite bifurcated, with several producers marching towards 52-week highs while the developers have struggled to get up off the mat. This is evidenced by the VanEck Gold Miners ETF (GDX) being up 9% year-to-date while a sample of 30 gold developers I track with market caps above $150 million are down 8% year-to-date on average. However, while many of these companies have not seen much improvement in their investment thesis since the year began, i-80 Gold Corp. (NYSE:IAUX) has made considerable progress across its vast project portfolio.

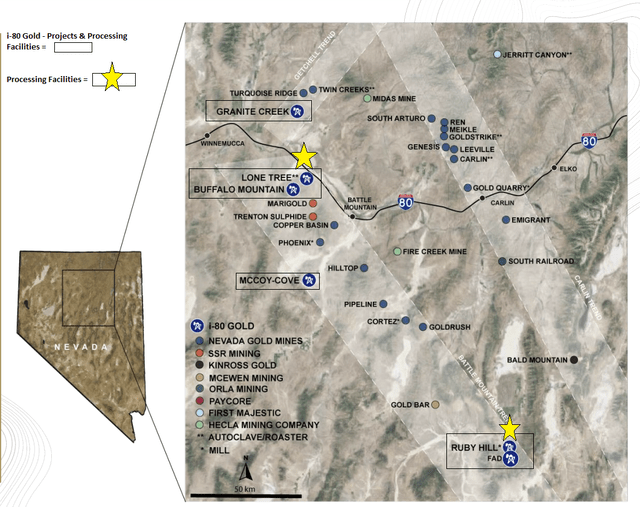

For starters, it has locked up an additional ~1,470 hectares of land directly south of its Ruby Hill Project with the acquisition of Paycore. Secondly, the company is successfully ramping up mining activities at Granite Creek Underground and is on schedule to blast first stope ore in the high-grade South Pacific Zone to help push mine production towards 800 tons per day. Lastly, it continues to make new polymetallic discoveries, with Hilltop's strike length now sitting at 750+ meters and East Hilltop and West Hilltop being added to the previously discovered Upper Hilltop and Lower Hilltop. Let's take a closer look at recent developments below:

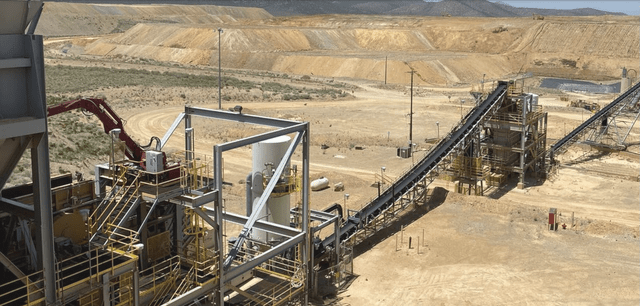

Ruby Hill Project (Company Presentation)

Paycore Acquisition

i-80 Gold closed its acquisition of Paycore Minerals Inc. earlier this month, a strategic deal that added ~1,470 hectares of land to its Ruby Hill Project in the Eureka District of Nevada. The acquisition was completed for ~$80 million, which is a steal in my view, given that the company adds a historic resource of ~3.9 million tons at ~13.0 grams per ton gold-equivalent, or 1.4+ million gold-equivalent ounces. Notably, this historic resource does not include drilling down-dip of the historic FAD resource completed by Paycore, with highlight intercepts that included the below intercepts. And even if we assume this deposit plus down-dip extensions translates to a resource of just 1.6 million GEOs, this would translate to an acquisition price of ~$50.00/oz, a massive discount to the ~$136.00/oz paid for ounces in Tier-1 jurisdictions in the past three years.

- 36.6 meters at ~13.0 grams per ton gold-equivalent

- 10.10 meters at ~21.0 grams per ton gold-equivalent

- 25.0 meters at ~11.0 grams per ton gold-equivalent

- 44.80 meters at ~10.0 grams per ton gold-equivalent

- 14.8 meters at ~20.0 grams per ton gold-equivalent

- 27.4 meters at ~15.0 grams per ton gold-equivalent

- 12.5 meters at ~16.0 grams per ton gold-equivalent

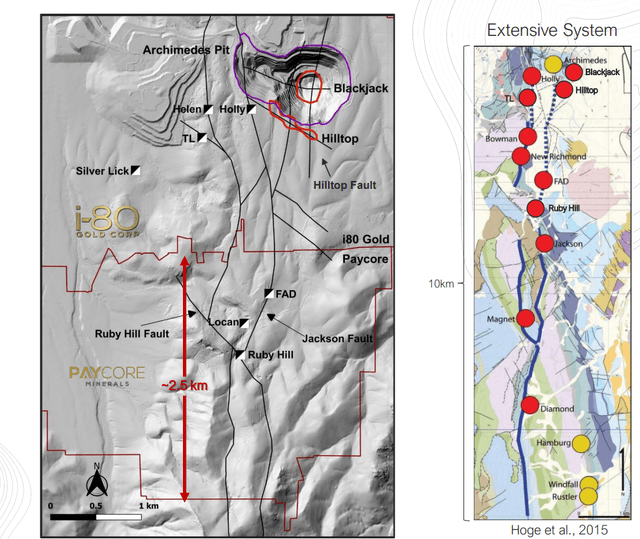

As discussed by i-80 Gold and shown in the below map, this acquisition adds key ground to extend the highly prospective Hilltop Corridor, a 2.0+ kilometer long trend that extends from south of the previously mined Archimedes Pit. As the image below shows, multiple polymetallic discoveries and gold discoveries have been made in the Eureka District which began production in the 1860s, and Paycore happens to have the historic Ruby Hill Mine on its ground, an asset with historically mined grades upwards of 42 grams per ton gold-equivalent, which would make it the highest-grade mine globally if it were in production today, with grades higher than that of Fosterville (2016-2019).

i-80 Gold - Consolidated Land Position with Paycore (Company Website)

Fortunately for i-80 Gold, Barrick Gold Corporation (GOLD) and Homestake Mining were interested in gold and mostly shallow oxide mineralization when they owned the Ruby Hill Project (not to be confused with the past-producing Ruby Hill Mine three kilometers to the south), meaning they passed over the polymetallic potential. Hence, the Paycore acquisition was logical and at a very attractive price given that it adds additional ground to potentially make a discovery immediately south of recent polymetallic discoveries made by i-80 Gold and just south of a key target for 2023 drilling, the 4H target, which lies between the Archimedes Pit and the FAD deposit.

In summary, I see this as a smart move by i-80 Gold and one that adds to resources almost immediately given that FAD is expected to be moved to NI 43-101 compliant resources by Q1 2024. And with Hilltop, Blackjack, new targets and FAD are being drilled currently, this should be a catalyst-rich year for the company with a decent probability of a new discovery being made following geophysical work to better pinpoints targets in the Hilltop Corridor and in proximity to recent discoveries. Of note in the most recent Investor Day Presentation is that drilling south of FAD has hit copper and molybdenum skarn mineralization associated with magnetite near the intersection of the Jackson and Ruby Hill faults, with i-80 Gold still working to see if it can identify the heat source for all of this high-grade mineralization and what it believes to be a high-grade porphyry somewhere in the district.

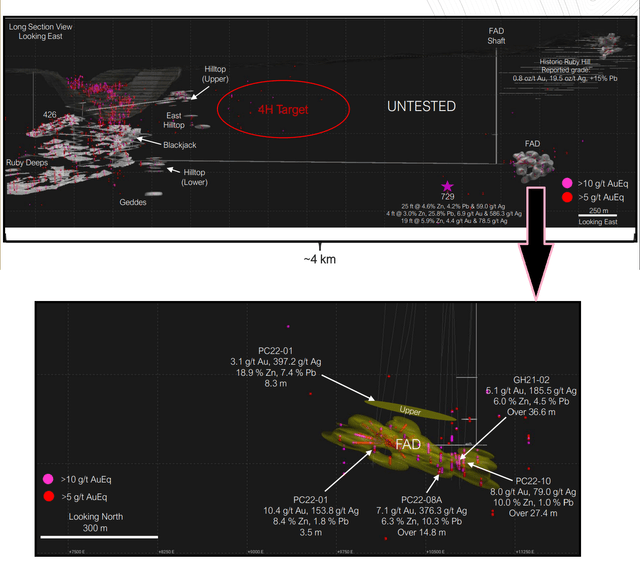

i-80 Gold - Planned Development + 4H Target + FAD Deposit (Company Website)

Recent Drill Results

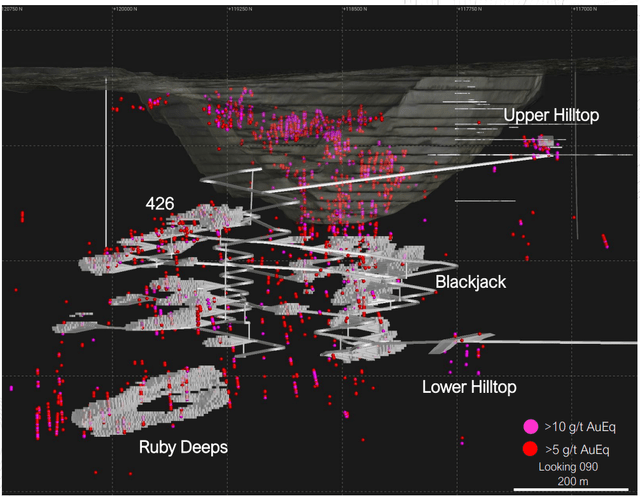

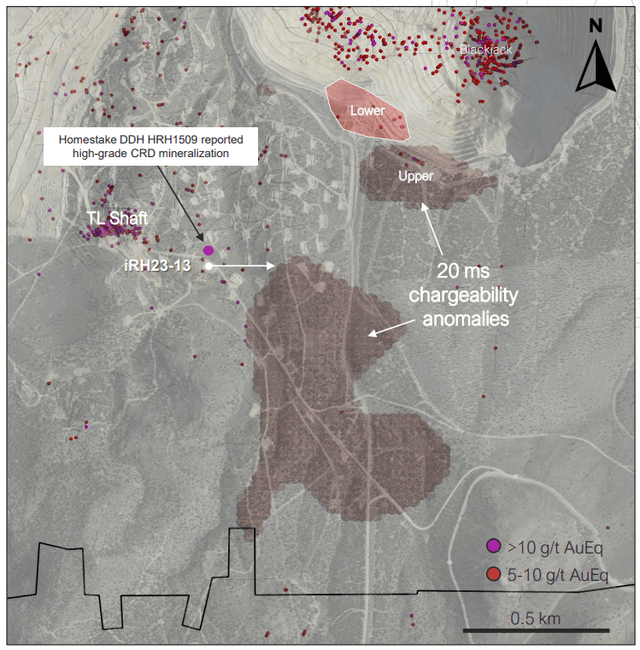

Moving over to i-80's recent drill results, the company released new drill results from drilling at Ruby Hill, with drill-hole iRH23-10 drilled between the ultra-high grade Upper Hilltop Zone and the East Hilltop Skarn Zone hitting 8.4 meters at ~11.0 grams per ton gold-equivalent, helping to confirm the rich zinc grades encountered just east in drill-hole iRH22-61 (39.6 meters at 12.3% zinc). Meanwhile, a hole drilled over 200 meters west of Lower Hilltop intersected a thick intercept of CRD breccia, with iRH23-09 hitting 18.3 meters of ~6.6 grams per ton gold-equivalent, and 5.8 meters of 9.9 grams per ton of gold in what's believed to be a meaningful extension to Ruby Deeps. This is quite exciting as Ruby Deeps continues to grow with an intercept drilled earlier this year that hit 10.7 meters at 12.3 grams per ton of gold right near an old Homestake hole (HC1428), 300 meters east off the southern portion of Ruby Deeps.

i-80 Gold - Recent Drill Results (Company Website)

Lastly, i-80 Gold intersected an impressive intercept of 13.1 meters at 11.6 grams per ton gold and 1.5% zinc in the Lowerjack Zone, pointing to further resource growth at the already well-defined Blackjack skarn deposit that is expected to make it to resource status by Q1 2024. Looking at the above map, the strike length at Hilltop has now been defined over 750 meters, and Ruby Deeps continues to grow at better grades than its current resource, suggesting the potential for the gold-only resource here (a future spoke for the Gold Hub & Spoke model) to increase to 2.0+ million ounces at grades closer to 8.5 grams per ton of gold.

Ruby Hill Development Plan (Company Website)

i-80 Gold is looking to design infrastructure that will allow the company to access its high-grade gold deposits (Ruby Deeps and 426 Zone) and polymetallic base metal deposits (Blackjack and Hilltop). Given that this mineralization is all in close proximity to an existing open-pit, this a much lower-capex opportunity than greenfield assets like Osisko Mining's (OTCPK:OBNNF) Windfall or SSR Mining's (SSRM) Hod Maden Project, but with similar gold-equivalent grades. In fact, while Windfall will likely cost $650 million to build and Hod Maden is likely to come in at closer to $380 million, i-80 Gold could put Hilltop and Blackjack into production for less than $150 million between mine development ($50+ million) and refurbishing its existing CIL plant to a floatation plant producing two concentrates (~$90 million), with a 1,500 ton per day processing rate (above the processing rate envisioned in the 2022 Scoping Study).

Today, i-80 Gold has significant liquidity to carry out these development plans, with a $100 million accordion option available from Orion Mine Finance from its 2021 financing, $55 million in cash, and up to $55 million in proceeds if warrants are exercised. In addition, once the company is able to upgrade resources to reserves, it could look at lower-cost bank debt, with the possibility of securing a $100+ million revolving credit facility to help with future growth. Hence, while we did see some share dilution recently from the Paycore acquisition, I would expect material growth in resources and reserves per share going forward with the company set to grow resources closer to the 19.0 million ounce mark on a gold-equivalent basis in the next 12 months with outstanding shares likely to remain at similar levels (~250 million shares outstanding), pointing to double-digit growth in resources per share.

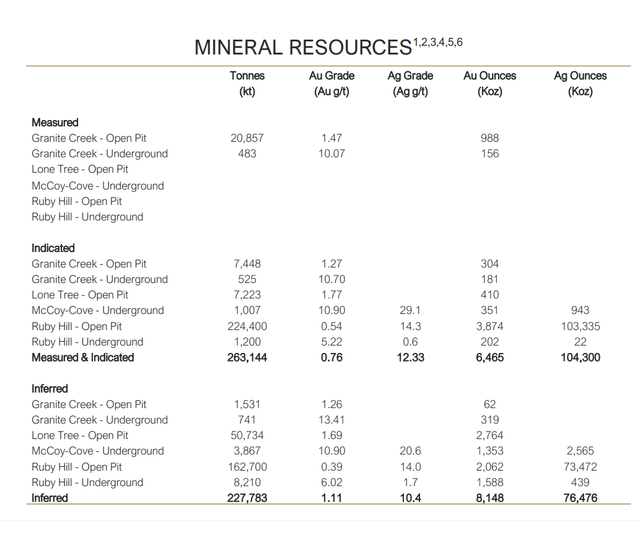

i-80 Gold's current resource stands at 14.6 million ounces of gold, and I expect resource growth at Granite Creek (South Pacific Zone) and Ruby Deeps, as well as maiden resources at Hilltop, Blackjack, and FAD by April 2024, with further growth looking out to April 2025 (year-end 2024 estimate) as deposits are drilled with tighter spacing, allowing more ounces to move into resource categories.

Valuation

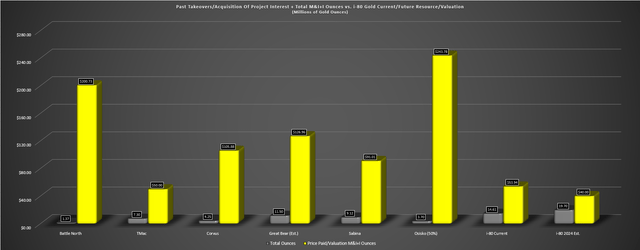

Based on an estimated ~350 million fully diluted shares and a share price of US$2.22, i-80 Gold trades at a market cap of ~$780 million. This leaves the stock trading at less than 0.50x P/NAV compared to an estimated net asset value of ~$1.60 billion (5% discount rate for gold assets and 8% discount rate for polymetallic assets). Meanwhile, on a per ounce basis, i-80 Gold trades at just ~$122.00/oz on measured & indicated [M&I] resources and ~$54.00/oz on total resource ounces. However, when we factor in expected resource growth at year-end from Blackjack, Ruby Deeps, FAD, Hilltop, and the South Pacific Zone, i-80 is trading closer to ~$109.00/oz on M&I ounces and just ~$40.00/oz on total resource ounces on a gold-equivalent basis.

i-80 Gold - Mineral Resources (Company Website)

If we compare these figures to acquisitions of developers and interest in projects (Windfall - 50%) over the past three years in Tier-1 jurisdictions, we can see that this is a massive discount to what suitors have paid for ounces in the past. This is especially true when we factor in that i-80 Gold has the most significant infrastructure relative to past acquisitions with an autoclave, CIL mill, floatation plant and assay lab/gold refinery at Lone Tree, heap leach pads at two sites, a CIL plant (expected to be refurbished to floatation) at Ruby Hill, a rail siding providing access to the Northern Nevada Railway. Plus, while not physical infrastructure, the company can process refractory material at NGM's sites (autoclave and roaster capacity until 2025 and 2032, respectively), a huge asset to have in a Nevada where many developers/producers ignore refractory material given that there's no way to process it.

TMac Resources was an unprofitable producer with operations put into care & maintenance shortly after the acquisition, so I have labeled it as a developer. I have assumed 8.5 million M&I ounces and 11.50 million total ounces are proven up at Dixie with the Great Bear acquisition to arrive at the price paid figures on a per ounce basis. Osisko Mining's 50% interest that acquired by Gold Fields for ~$900 million includes the payments due to Osisko Mining and Gold Fields' share of construction costs and regional drilling agreed upon in the transaction. Assuming i-80 Gold was to rebuild all of this infrastructure, it would likely cost upwards of $1.2 billion, translating to massive sunk costs that appear to be ignored by the market.

i-80 Gold - Price Paid/Valuation Per M&I Ounce (Company Filings, Author's Chart & Estimates)

Past Takeovers/Acquisitions Of Project Interest - Total M&I+I Ounces vs. i-80 Gold Current Resource/Valuation (Company Filings, Author's Chart & Estimates)

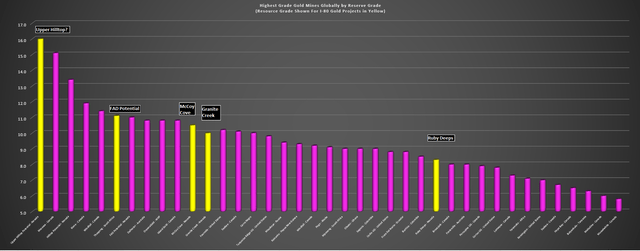

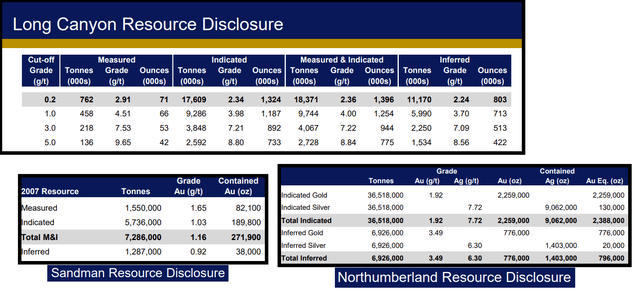

Finally, even if we take an ultra-conservative approach to valuation and exclude lower-grade ounces that aren't in i-80 Gold's immediate plans (Mineral Point, Granite Creek Open Pit), I believe the company has the potential to prove up 8.8 million gold-equivalent resource ounces by Q1 2025 (Ruby Deeps, Granite Creek Underground/South Pacific Zone, FAD, Hilltop Zones, Blackjack, McCoy Cove). Using a current market cap of $780 million, this leaves i-80 Gold trading at just ~$88.60/oz on solely high-grade ounces, well below the average price paid for other Tier-1 jurisdiction assets of ~$136.40/oz. However, as we can see below, i-80's projects are among the highest-grade globally and in the top-ranked mining jurisdiction, which should command a premium, not a discount, and this was certainly the case in the Fronteer Gold deal by Newmont (NEM), with NEM paying over $400.00 per ounce ($2.4 billion) to lock up Long Canyon, Sandman and Northumberland.

Highest Grade Gold Mines Globally by Reserve Grade - I-80 Gold Projects shown in Yellow by Resource Grade/Potential Resource Grade (Company Filings, Author's Chart & Estimates) Fronteer Gold Ounces - Newmont Acquisition 2011 (Newmont Presentation)

Based on an estimated net asset value of $1.65 billion for i-80 Gold's assets (5% discount rate for gold assets, 8% for polymetallic assets and subtractions for corporate G&A and autoclave refurbishment costs), I see a fair value of US$4.55 to its 18-month price target, translating to a 106% upside from current levels which assumes 350 million fully diluted shares to account for convertible debt, warrants, and shares issued in the Paycore deal. This makes i-80 Gold one of the most undervalued gold producers in the sector today, and a steal given that this assumes no upside from:

- the possibility of a high-grade porphyry deposit at depth or the heat source for this well-endowed Eureka District

- multiple CRD targets on the property, which have the possibility of yielding another Hilltop-like high-grade polymetallic discovery

- resource growth at Ruby Deeps, which looks like it could ultimately grow into a 2.5+ million ounce high-grade resource long-term

- resource growth at the South Pacific Zone at Granite Creek, which remains open along strike to the north towards the mammoth-sized Turquoise Ridge Complex (15+ million ounces of resources) and at depth

- resource growth at FAD, which has seen multiple step-outs from the historical resource and or at Gold Hill, a near-surface target.

A High-Grade Polymetallic Asset To Fund Future Growth

Some investors might believe that this is a complex story with a lot of moving parts, and that i-80 Gold has a very aggressive plan to grow production given that it's focused on bringing multiple mines online by 2028 to ultimately grow into a 400,000 ounce producer. However, as I've noted in previous updates, this is a multi-mine and dual-processing facility strategy, with three gold mines feeding a central autoclave (Lone Tree) of which one is already producing (Granite Creek), and polymetallic deposits feeding a future floatation plant at Ruby Hill. This is not unusual for Nevada and is a strategy currently employed by Nevada Gold Mines. Plus, I would expect i-80 Gold to sequence the polymetallic opportunity ahead of the autoclave.

The benefit of sequencing the polymetallic opportunity ahead of the Hub & Spoke gold model (three mines feeding Lone Tree) is that the company can balance capital spending and execution risk by focusing on one major project at once, and it should allow free cash flow from Upper Hilltop to help fund autoclave refurbishment at Lone Tree. Some investors might understandably be here for the gold and silver, not the polymetallic opportunity (lead, zinc), but it's important to note that the Carlin overprint is unique to carbonate replacement deposits, with this polymetallic opportunity quite rich in gold and gold and silver. This is evidenced by highlight intercepts that include:

- Upper Hilltop: 10 meters at 60.2 G/T of gold, 909 G/T of silver, 15.7% lead, and 1.1% zinc

- Upper Hilltop: 7.6 meters at 25.3 G/T of gold, 848 G/T of silver, and 7.9% lead

- Lower Hilltop: 28.3 meters at 0.90 G/T of gold, 515 G/T of silver, 28.9% lead, and 10.5% zinc

- FAD: 14.8 meters at 7.1 G/T of gold, 376 G/T of silver, 6.3% zinc, and 10.3% lead

- FAD: 27.4 meters at 8 G/T of gold, 79 G/T of silver, 10% zinc, and 1% lead.

As shown above, these intercepts would be incredible even without the additional zinc and lead credits, with gold-equivalent grades ranging from 7 to 72 grams per ton of gold. Hence, even if the polymetallic opportunity is sequenced ahead of the more significant gold opportunity, this is still a precious metals play with elevated gold/silver values at Upper Hilltop, which will likely be the first deposit to be mined given that it's above the water table. Besides, as discussed earlier, i-80 Gold is already mining high-grade gold at Granite Creek and doesn't need the autoclave to process this material, given that it has secured a toll-processing agreement to treat material at the nearby Sage Autoclave just northeast at Nevada Gold Mines' Turquoise Ridge Complex.

i-80 Gold - Projects/Mines & Processing Facilities (Company Website, Author's Notes)

Finally, it's worth pointing out that while putting a high-grade polymetallic mine into production to fund future growth in gold production might seem like a bold and foreign strategy relative to peers, this is the same model employed by Agnico Eagle Mines (AEM), the most respected gold miner in the sector with a glowing track record of growing reserves, net asset value, and production per share. In fact, Agnico Eagle and i-80 Gold share similarities, with both having a regional growth strategy and Agnico also had had ambitious plans two decades ago, with the company's high-grade polymetallic LaRonde Mine in Quebec being a cash cow which would fund acquisitions and future growth and propel the company into the 3.5+ million ounce gold producer that it is today.

AEM 25-Year Chart (TC2000.com)

For those that didn't get spooked by its aggressive growth plans, the rewards have been massive, with AEM investors enjoying an ~800% return from 2003-2010 and paying a 15% yield on cost for investors that bought the stock below $10.00 per share while it was out of favor. Let's take a look at some of the similarities:

The following excerpt is taken from Agnico Eagle's 2002 Annual Report, with the company laser-focused on growth but with the caveat that it had a clear mission to focus on regional growth in top mining jurisdictions to reduce its overall risk. At the time, Quebec was the #2 mining jurisdiction globally ranked by Fraser Institute, and today, i-80 Gold is working towards a similar model but in the #1 ranked mining jurisdiction globally: Nevada.

"Our regional growth strategy is relatively low risk, using existing resources in our own stable backyard. Part of this low risk is confirmed by the Fraser Institute in a survey published in December, which identified Quebec as one of the two most attractive areas in the world for mining, based on mineral potential and acceptance of the industry. While our peers emphasize quality and growth, we also deliver a third component: the stability of mining-friendly Quebec."

- Agnico Eagle 2002 Annual Report.

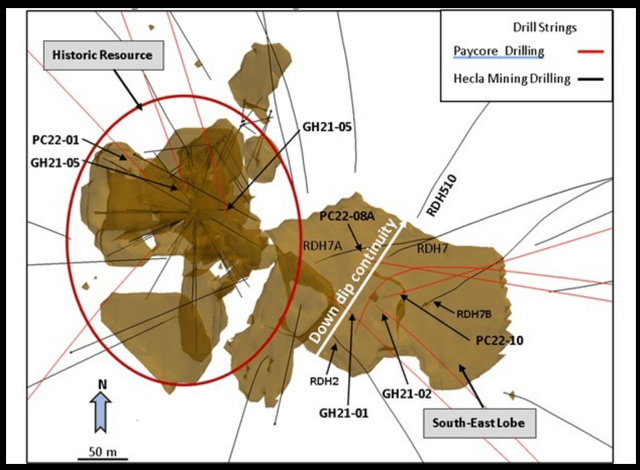

The other key similarity to a regional growth strategy focused on top-3 ranked mining jurisdictions is the ownership of a high-grade polymetallic asset, with Agnico Eagle's LaRonde Mine having ~59 million tons of total resources and reserves combined as of year-end 2000. This polymetallic resource that contained gold, silver, copper and zinc was home to ~7.8 million ounces of gold at an average grade of ~7.5 grams per ton gold-equivalent. While i-80 Gold is still in the early stages of proving up its polymetallic resource base at Ruby Hill, the company has a historic resource at FAD of ~3.9 million tons at an average grade of 13.0+ grams per ton gold-equivalent, significantly higher than that of LaRonde. Plus, drilling down-dip of the historic FAD resource (Southeast Lobe) suggests the possibility of material growth in this resource to 5.0+ million tons given the high-grade intercepts drilled in the past year.

FAD Deposit Drilling - Down-Dip of Historic Resource (3.9 Million Tons) (Paycore Presentation)

Meanwhile, i-80 Gold has made multiple polymetallic discoveries in close proximity to the previously-mined Archimedes Pit, including Upper Hilltop, Lower Hilltop, East Hilltop) and in addition to Blackjack, I would not be surprised to see i-80 Gold prove up 7.0+ million tons of resource material separate from FAD from the Hilltop zones and Blackjack. Assuming a resource base of 12.0 million tons (FAD, Blackjack, Hilltop zones) proven up by Q1 2026 (allowing time for adequate drilling to tighten up drill spacing) at an average grade of 11.0 grams per ton gold-equivalent, this would translate to a resource base of ~3.8 million gold-equivalent ounces, making this one of the largest and highest-grade deposits in North America owned by a junior, and similar in size/grade to Fourmile (arguably the most impressive discovery made in Nevada the past few years) owned by Barrick.

It's important to note that this would be entirely separate from ~5.0 million resource ounces at ~9.5 grams per ton gold on a blended basis at Ruby Deeps, Granite Creek Underground (including South Pacific) and McCoy Cove).

To summarize, while i-80 Gold's polymetallic resource potential may not rival LaRonde today and LaRonde's resource base as of year-end 2000 certainly dwarfs i-80's Hilltop/Blackjack/FAD in scale at ~59.0 million tons, the grades look to be much better at Ruby Hill. Plus, i-80 Gold is drilling on somewhat virgin ground (polymetallic potential ignored by Homestake and much of it missed by the old-timers due to being under alluvial cover) in a district famous for high-grade polymetallic mines with multiple historic mines in close vicinity to its recent discoveries. So, with multiple targets left to test which includes the 4H Target which is nearly quadruple the size of the Upper and Lower Hilltop zones and just southeast of the TL Shaft (the TL Mine had reported grades of 28.0 grams per ton gold-equivalent), resource ounces could add up very quickly given the historic and currently drilled grades on i-80 Gold's portion of the Eureka District.

Ruby Hill Project - 4H Target (Company Website)

Ultimately, Agnico's LaRonde Mine would help the company to acquire the high-grade Lapa deposit in 2000, acquire Riddarhyttan Resources AB to expand into Finland, acquire Pinos Altos to expand into Mexico, acquire Cumberland Resources to expand into Nunavut (now known as Meadowbank) and ultimately bring Goldex, Kittila (Riddardhyttan acquisition) and Meadowbank into production over the next decade. This was accomplished with modest share dilution due to growing production from LaRonde and was actually a far more aggressive plan than what i-80 Gold envisions building in Nevada. This is because these were all stand-alone assets, while i-80 Gold has the sunk costs in place already and only needs to refurbish two of its processing facilities and pay for underground mine development.

Plus, as noted in previous updates, i-80 Gold does not need to acquire or dilute shareholders to grow past the 400,000-ounce production mark, with a sleeping giant in Mineral Point (~5.9 million ounces of gold and ~180 million ounces of silver) that could produce ~170,000 ounces per annum at a 50,000 ton per day processing rate. So, while i-80 Gold's intermediate target is ~400,000 ounces per annum, there is the potential for 600,000+ ounces per annum long-term with Mineral Point, Granite Creek and or expansions to throughput capacity for the polymetallic opportunity if supported by new discoveries and resource/reserve growth.

Summary

i-80 Gold Corp. has underperformed its peers this year after digesting a recent acquisition, but the company continues to quietly add ounces across its properties and this should be a very busy year with a steady stream of drill results and resource estimates expected from multiple deposits over the next three to ten months. And assuming the company continues to see drill success and can execute on its plans, I see the potential for i-80 Gold to grow into a 400,000+ ounce producer on a gold-equivalent basis later this decade, which could command a valuation of $2.5+ billion, more than triple the company's current market cap, which would equate to north of US$6.00 per share.

However, the major upside to this story is that this is arguably a top-3 exploration story sector-wide within the sub $1.5 billion market cap space in the gold sector. And with all the ingredients in place for a possible porphyry at depth (distal zinc-lead rich skarns, CRD mineralization), and new high-grade polymetallic discoveries based on recently completed IP surveys, i-80 Gold has a very real possibility of making another major discovery at Ruby Hill.

So, with several high-grade assets in the #1 ranked mining jurisdiction being valued at a fraction of what suitors have paid for lower-grade projects, I see this pullback below US$2.25 as a gift, with i-80 Gold Corp. continuing to be one of my top-3 favorite ideas in the gold sector.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IAUX, GOLD, AEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.