LVHD's Big Price: Yield And Volatility Triumph, Growth And Profits Stumble

Summary

- LVHD selects profitable U.S. securities expected to pay relatively high and sustainable dividends. Companies are further screened based on the attractiveness of their price and earnings volatility.

- The result is high concentration in defensive sectors like Utilities and Consumer Staples. LVHD's 0.72 five-year beta will likely appeal to risk-averse investors.

- However, I caution against ETFs that combine the yield and volatility factors. Most, including LVHD, do so by sacrificing growth and profitability. SPHD, LVHD's closest peer, is no different.

- Instead, I recommend building your portfolio around more well-rounded ETFs like SCHD. As this article demonstrates, SCHD's expected yield isn't much less than LVHD's, and you get so much more peace of mind with its high-quality selections.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

BrianAJackson/iStock via Getty Images

Investment Thesis

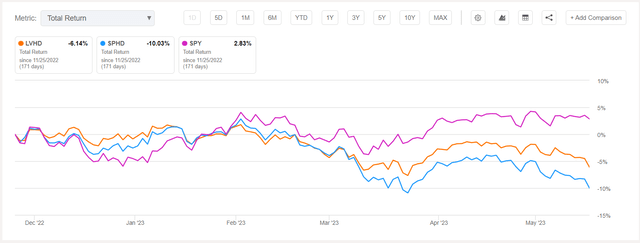

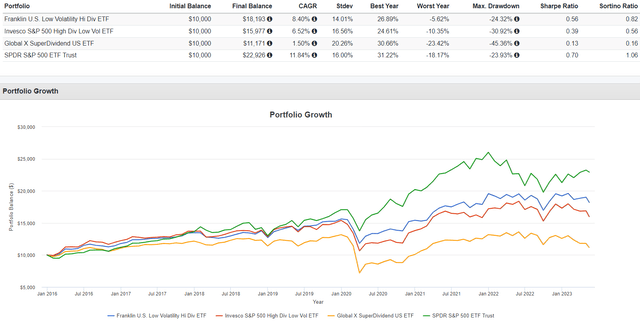

My colleague at the Hoya Capital Investing Group, Retired Investor, recently performed in-depth coverage of the Franklin U.S. Low Volatility High Dividend Index ETF (NASDAQ:LVHD), concluding that it was a better choice than its closest competitor, the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD). I don't dispute this conclusion because LVHD does better balancing the volatility and yield factors and has a better track record. However, we still can choose neither. That was my position in November 2022, and LVHD has underperformed the SPDR S&P 500 Trust ETF (SPY) by approximately 9% since. SPHD has done even worse.

Instead, today's article aims to evaluate whether LVHD is even needed in the first place. I believe it's not. As I will demonstrate, investors can select a well-rounded ETF like the Schwab U.S. Dividend Equity (SCHD), get much of the yield and downside protection LVHD offers without sacrificing growth and profitability, and then make slight adjustments with other factor ETFs to suit their preferences. This multi-factor, low-fee approach is more appropriate for long-term investors, and I look forward to taking you through my findings in more detail below.

LVHD Overview

Strategy Discussion

LVHD tracks the QS Low Volatility High Dividend Index, selecting 50-100 companies from the Solactive U.S. Broad Market Index that can pay relatively high and sustainable dividends. The methodology is proprietary, but additional points are below, sourced from LVHD's website.

- Selected constituents are scored based on the attractiveness of their price and earnings volatility

- Only the highest-scoring securities are selected, subject to limits, including a 2.5% and 25% security and sector cap (15% for REITs)

- The Index reconstitutes annually and rebalances quarterly

Note how both earnings and price stability are the key screens. As a result, stable businesses, particularly in the Utilities sector, are advantaged. In contrast, companies with less stable earnings patterns in the Technology sector are disadvantaged. This approach helps investors diversify away from broad-based market-cap-weighted ETFs like SPY, especially since high-yielding securities (with lower market caps) are preferred.

Sector Exposures and Top Ten Holdings

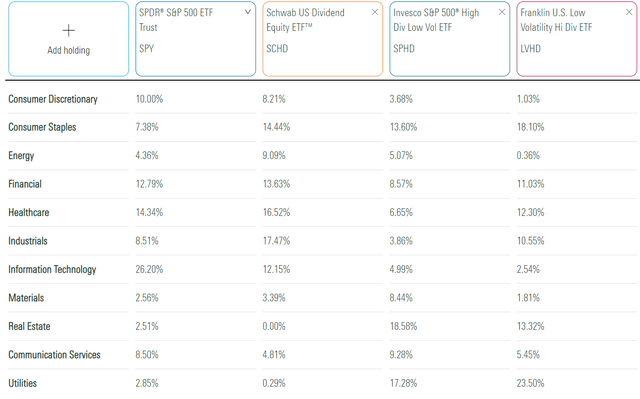

The following table highlights sector exposures for SPY, SPHD, and LVHD. I've also included the Schwab U.S. Dividend Equity ETF for comparison purposes. While you might consider SCHD in a different category, it has one thing going for it that helps it in market downturns: high profitability. We'll see that later in my fundamental analysis of the four ETFs.

As mentioned, LVHD overweights Utilities (23.50%) and underweights Technology (2.54%). It also leans into Consumer Staples (18.10%), resulting in a category-leading 0.72 five-year beta. SPHD is more balanced, with a much higher 0.82 beta. Meanwhile, SCHD is the outlier. It excludes REITs and virtually excludes Utilities, which is the key reason for LVHD's low beta. I've written recently about how I've changed my view on the sector lately. I predicted it would outperform in 2022, but there are good reasons to believe the opposite will occur moving forward. Feel free to read why in my Q1 2023 earnings season recap here.

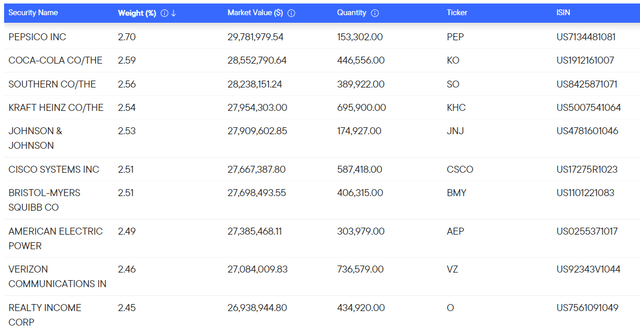

LVHD's top ten holdings are below. Due to the 2.5% cap on individual securities, it only covers 25% of the portfolio. PepsiCo (PEP), Coca-Cola (KO), and The Southern Company (SO) are above the limit because of relatively strong performance since the last rebalancing.

Performance Analysis

Only a handful of ETFs combine the low volatility and high yield factors, so it's understandable how investors can feel trapped with either LVHD or SPHD. Here are three others with trailing dividend yields above 3% and five-year betas below 0.85:

- Global X Super Dividend U.S. ETF (DIV)

- VanEck Morningstar Durable Dividend ETF (DURA)

- SPDR SSGA US Small Cap Low Volatility Index ETF (SMLV)

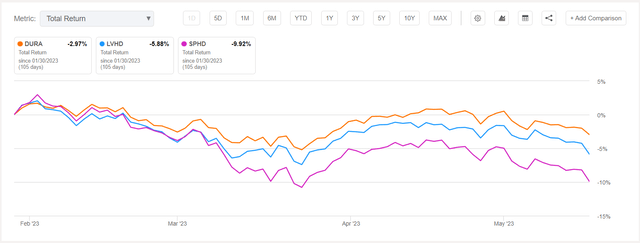

DURA is an exciting but little-known alternative. I covered it in January, recommending it over both LVHD and SPHD, and it's outperformed since. The reason is superior quality.

Since SMLV focuses only on small caps, DIV is the only other choice. Here is how it has performed against LVHD and SPHD since December 2015.

LVHD's 8.40% annualized return was superior to SPHD and DIV but still lagged SPY by 3.44%. LVHD's worst year was in 2018, losing 5.62%, but even that wasn't enough to make up for several underperforming years (2017, 2019, 2020, 2023). Unless you follow markets closely and can reasonably predict when you need low-volatility ETFs' downside protection, they aren't good buys.

LVHD Fundamentals

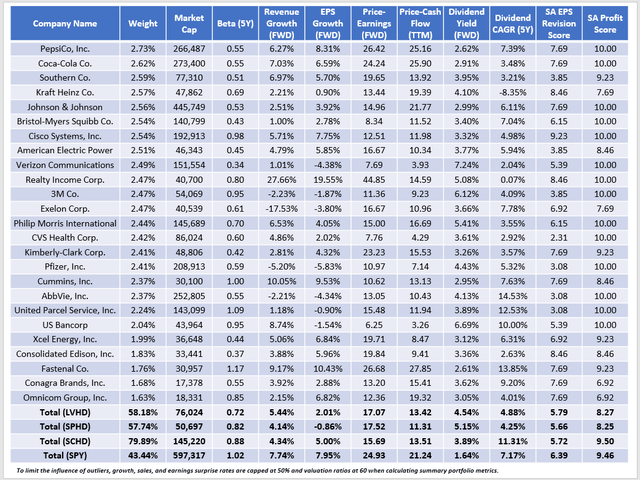

The following table highlights selected fundamental metrics for LVHD's top 25 holdings. I've also included summary metrics for SPHD, SCHD, and SPY in the final rows to illustrate the key differences between the four ETFs.

I mentioned earlier how LVHD does a better job balancing the volatility and yield factors than SPHD, and that's evident in this table. LVHD's five-year beta is the lowest at 0.72, and constituents yield 4.54% (4.27% after fees). Meanwhile, SPHD's 0.82 beta is hardly a differentiator anymore but has a 5.15% gross yield (4.85% net). The trailing yield figures for the two are different, but they don't reflect the latest reconstitutions and price declines, so these are the most accurate figures for today's buyer.

What's not advertised is LVHD's 2.01% weak estimated earnings growth rate. Although better than SPHD, whose holdings are declining, it's 6% and 3% less than SPY and SCHD. In addition, LVHD's 8.27/10 profitability score is only average for the category, a disappointing feature for long-term investors.

A commenter on my colleague's review questioned why an investor would choose LVHD over SCHD. Based on these fundamentals, I wonder the same. SCHD is also less volatile than the market, albeit not as much as LVHD. However, its low 0.06% expense ratio means its net 3.83% dividend yield is still strong. Furthermore, its constituents have grown dividends at a faster rate over the last five years (11.31% vs. 4.88%), its superior profitability score indicates it can handle market turbulence easier, and its higher growth rate suggests it has more capacity to raise dividends and produce more considerable capital gains moving forward. SCHD is the clear winner based on fundamentals alone.

Investment Recommendation

LVHD tracks an Index that selects stocks based on dividend yield and earnings volatility. It's one of a handful of funds combining these two factors, so given the limited choice, you may have already settled on LVHD. However, I think that's a mistake. These funds typically score well on these two factors by sacrificing other important metrics like growth, valuation, and profitability. Instead, I suggest a more well-rounded ETF like SCHD. If you need more downside protection, consider adding the iShares MSCI USA Min Vol Factor ETF (USMV), recommended here. If it's yield you're seeking, adding a small position in a covered-call fund or even risk-free U.S. Treasuries might be sufficient. Just don't assume you need a low-volatility/high-dividend ETF like LVHD. There are plenty of other choices in the ETF space, and if you're looking for recommendations based on the metrics discussed today, I hope you'll let me know in the comments section below. Thank you for reading.

The Sunday Investor Joins Income Builder

The Sunday Investor has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I perform independent fundamental analysis for over 850 U.S. Equity ETFs and aim to provide you with the most comprehensive ETF coverage on Seeking Alpha. My insights into how ETFs are constructed at the industry level are unique rather than surface-level reviews that’s standard on other investment platforms. My deep-dive articles always include a set of alternative funds, and I am active in the comments section and ready to answer your questions about the ETFs you own or are considering.

My qualifications include a Certificate in Advanced Investment Advice from the Canadian Securities Institute, the completion of all educational requirements for the Chartered Investment Manager (CIM) designation, and a Bachelor of Commerce degree with a major in Accounting. In addition, I passed the CFA Level 1 Exam and am on track to become licensed to advise on options and derivatives in 2023. In November 2021, I became a contributor for the Hoya Capital Income Builder Marketplace Service and manage the "Active Equity ETF Model Portfolio", which as a total return objective. Sign up for a free trial today! Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY, SCHD, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.