Reasons To Be Optimistic On American Markets

Summary

- For the past two years, we have been in a wall of worry. There has been a constant threat of a recession and other global headlines.

- These include the Covid pandemic, the Russian-Ukrainian conflict, inflation/rate hikes, and geopolitical risks with China.

- With so much to worry about, how can one be bullish on stocks? To do so, one has to somewhat ignore these global problems and look at US metrics specifically.

- This includes a focus on wage growth and labor participation, US dominance over other developed nations when it comes to economic growth, and the fact the country has diversified beyond China compared to year's past.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Tom Merton

Main Thesis & Background

The purpose of this article is to evaluate the state of the US economy and stock market, with a specific focus on reasons to be bullish. This is not meant to portray me as a cheerleader. I have written numerous pieces of late discussing why some caution and diversification here make a lot of sense. But I feel obliged to balance out some of those more cautious or negative reviews by spending some time talking about the good things America has going for it (in terms of the outlook for equities). While our daily headlines are filled with negative noise, there are indeed some reasons for optimism out there.

While they may not necessarily push the equity market higher in the short term, there is that potential. It is enough at least to justify remaining majority-long in my portfolio - as I pretty much always do. I will take some of the biggest positives, as I see them, in turn below.

The Envy Of The Developed World

When it comes to investing, we have to remember that everything is relative. While the US faces a host of challenges right now, many of those same issues are global too. These include inflation, an aggressive central bank, a continued tight labor market, and geopolitical risks with other world powers. Therefore, what may make the US seem uninvestable to some may actually make the entire developed world uninvestable! That just isn't realistic, so we need to put things in perspective.

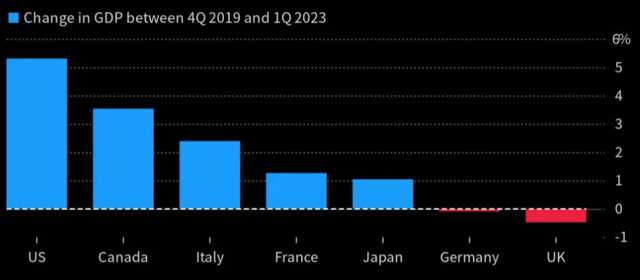

Case in point is economic growth. A lot of concern has been made over generally weak US economic growth and the potential for a recession. We have been hearing this for a long time now, and America keeps chugging along. Perhaps the reason is that US growth is actually stronger over time than most of its closest competitors.

When we look at growth between roughly when Covid started through Q1 this year for the Group of Seven (G7) nations, a clear winner emerges:

Change in GDP (Developed Nations) (Office for National Statistics (UK))

Again, I want to emphasize I am not saying "ignore the risks" at the moment. The US does face a very real threat of recession and the severity of that recession will greatly influence the magnitude of how stocks move. But the point I am making is these same issues are plaguing the G7 too - in a disproportionate way.

This does help to put the challenges the US is facing in perspective. Our country remains the top economy in the world and one of the fastest-growing among developed nations post-Covid. For me, this gives me confidence and reaffirms the "don't bet against the US" mantra.

Americans Are Getting Back To Work & Getting Paid

A second reason for some optimism is the state of the labor market. We have come a long way from people getting paid to sit at home and endless rows of "help wanted" signs that became a hallmark of many city centers. Fast forward to 2022, and employers couldn't find workers fast enough. Now, in 2023, the labor market is much more challenging with a wave of layoffs (especially in the Tech sector) dampening sentiment.

But I am not overly concerned - yet. First, many of these workers have transferable skills and are finding employment in other industries that are still understaffed. So we do not have a labor glut yet. In fact, it is more of a rebalancing that may actually be a positive for the economy in the long run.

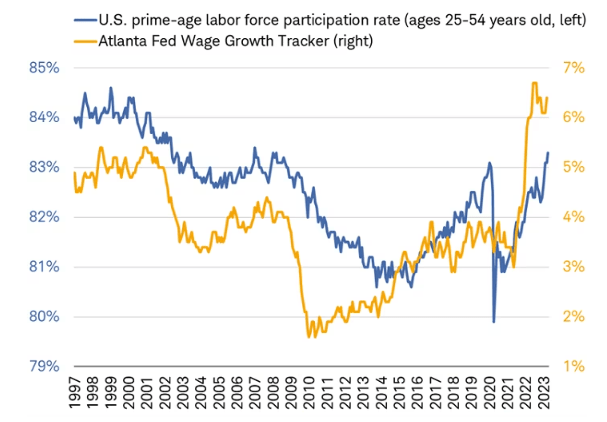

Second, labor force participation and wage growth have both continued on their upward trajectory even with these layoff announcements. This supports my first point on the sustainability of this labor market:

Wage Growth / Labor Force Participation (Charles Schwab)

This is fundamental to a bullish case. An economy can really only do well when people are working and - ideally - earning more each year. That is precisely what is happening in the US at the moment. While there are worrying recessionary trends that may derail this progress, for now, the facts are what they are. Those in their prime working years continue to return to the labor pool and are finding higher wages as a result. This supports the always-important consumer spending metric that is so critical to our economic growth.

US Economy Has Diversified From China

Another worrying trend over the past year has been a perceived (whether real or not) fragmentation of US-China relations on the political level. While the new administration in DC had previously pledged a more cooperative approach to China, the net result two years in has been mixed. While the nations had been cooperating, generally speaking, the short-term has been riddled with flare-ups. This includes back in February when a Chinese high-altitude balloon appeared in U.S. airspace. In response, U.S. Secretary of State Antony Blinken canceled a trip to Beijing that soured moods across the region. With issues ranging from trade, regional trade pacts, and Taiwan independence, among others, all points of contention, it is easy to forecast a scenario where the US and China remain suspicious of each other.

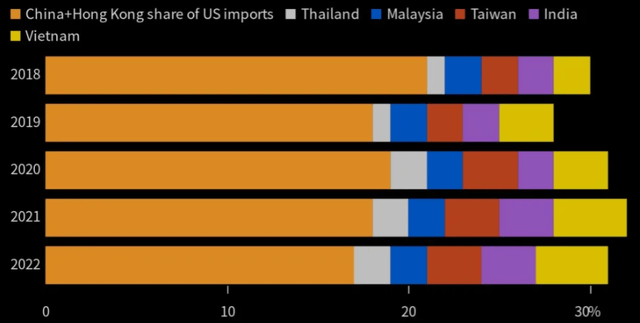

So, how can any of this be good news? An obvious question and I would answer that none of it is. But where the silver lining lies is how the U.S. has been diversifying away from China over the past few years. This has to do with a number of different factors. Geopolitical tension is one. Tariffs are another, as well as more production coming back within domestic borders. But an extension of this decoupling has been a heavier reliance on other Asian nations that have eaten away at China's share of US imports:

Import Breakdown (Into USA) (Yahoo Finance)

Of course, China is still a very important US trading partner and that will remain the case in the years ahead. There is no getting around that. With China on track to be the world's largest economy (albeit not the "best"), the US is going to have to figure out the best way to manage that relationship in a cooperative and beneficial way. But for now, we can take some comfort in knowing the negative headlines we see are not as detrimental to the US economy as they might have been previously. A greater reliance on other Asian nations improves diversification and minimized concentration risk. This is a net positive for the US economy and large-cap US companies in my view.

Bonds Will Do Well When Fed Pauses

My final point shifts away from equities and into bonds. This is an area that got hammered in 2022 as the Fed aggressively raised rates. This year has been different, with markets anticipating a "pause" in rate hikes and perhaps even rate cuts by year-end. To be clear, I do not personally expect any cuts this year, but prevailing sentiment in the market says this is a possibility.

This is important because if we are at, or near, the end of the rate hiking cycle, there is value in bonds across the board. Investors are given an opportunity to pick up the highest yields they are likely to see in the coming months and years if we are indeed at peak rates. That doesn't necessarily translate to positive returns over time, but it does give above-average income streams that help mitigate risks in other areas.

I bring this up because it is very likely we are at peak rates. In fact, just yesterday, the Atlanta Federal Reserve Bank President Raphael Bostic was discussing his outlook on rates and was quoted:

I think the appropriate policy is really to just wait and see how much the economy slows from the policy actions that we've done"

Source: CNBC

This is not "official" Fed policy at this juncture, simply one board member's opinion. But he has been known as one of the more hawkish individuals on the committee, so it goes a long way in my view. It is also guidance I personally agree with. We are at the highest rates we have seen in decades, so giving that time to flow through the economy and assess the impact before moving further makes a lot of sense to me.

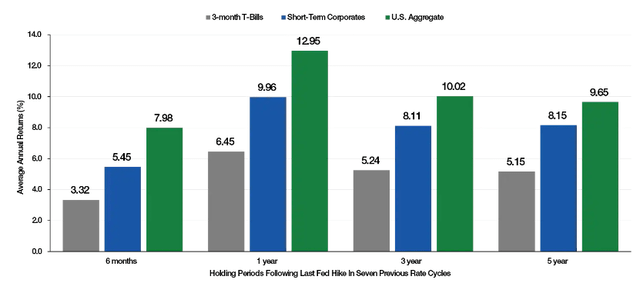

If we then assume we are at peak rates, what is next for bonds? The answer is that we will probably see strong returns. Using history as a guide, we see the bond sectors across the board often register strong gains following the "final" rate hike in a hawkish cycle:

Average Bond Returns (After last Fed rate hike) (Lord Abbett)

The natural disclaimer of "past performance does not guarantee future results" certainly applies here. There are always multiple catalysts that will impact bonds - Fed rate hikes are just one of many.

But this is still a comforting backdrop if the Fed is indeed done. It is hard for me to see a scenario where bonds do not attract investor interest if we have hit peak rates. Those who are income-oriented, more conservative, or are anticipating a recession are likely to scoop up these assets. Readers can front-run this now if they agree the Fed will pause and they want to get in before the rest of the market reaches that same conclusion.

Bottom-line

There are a number of worrying trends in today's market and I would not fault anyone for getting more selective with their investment approach as a result. This is something I have talked about in-depth in a number of reviews, so I am not trying to come off as a screaming bull.

But perspective is always needed. While media agencies make a living promoting the negative headlines, an equal amount of time should be spent discussing the positives. In the spirit of that balance, I highlighted a number of trends in the US that give me reason to be optimistic. While there very well may be trouble ahead, I don't anticipate a massive swoon in equity or bond markets due to a strong labor market, a likely Fed pause of rate hikes, and the fact the US has growth that dominates other developed economies. This continues to justify my predominately US-long approach, and I hope readers found this informative for the rest of the year ahead.

Consider the Income Lab

This article was written by

I've been in the Financial Services sector since 2008, which unsurprisingly gives me an invaluable insight in how markets can turn. I was a D1 athlete in college (men's tennis), where I studied Finance. I also have my MBA in Finance.

My readers/followers can trust that I won't pump any investment nor discuss a topic I don't genuinely follow and research. In that spirit, I list my portfolio here for transparency

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU, BUI; VDE, IXC, RYE; KBWB, VFH; XRT, CEF

Non-US: EWC; EWU; EIRL

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, PML, PDO, BBN

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, RSP, QQQ, DIA, EWU, EWC, EIRL, IEV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.