Palantir Technologies: Stock-Based Compensation At 26% Of Revenue Is Still Too Rich

Summary

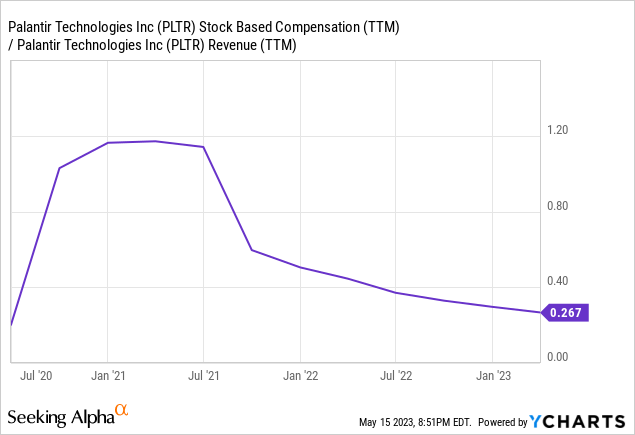

- Palantir has cut way back on its Stock-Based Compensation, which is down from 100%+ of revenues to 26%.

- After SBC, the company has reported its first quarterly net operating profit of $0.00 per share (actually it's $0.002 diluted rounded up).

- SBC/Revenue continues to be higher than revenue growth with more SBC expected in the years ahead.

- SBC as an expense is too rich for us given the actual performance so far.

Darieus

We like a little stock-based compensation (SBC). It helps to align incentives of management and employees with shareholder interest. But too much stock-based compensation is a major turn-off. Excessive SBC dilutes company shares which will result in under-performance if the value generated by SBC does not adequately compensate for the dilution. It can be difficult to capture the effect of SBC without examining the financial performance of a company in detail, because SBC is often omitted from non-GAAP measures of performance such as adjusted earnings.

SBC is an expense. We like to invest in growth at a reasonable price. In order to determine the "reasonable price" part of the equation we must understand the expense. The issue is of particular concern with high growth technology companies which tend to distribute SBC at a higher rate than other sectors.

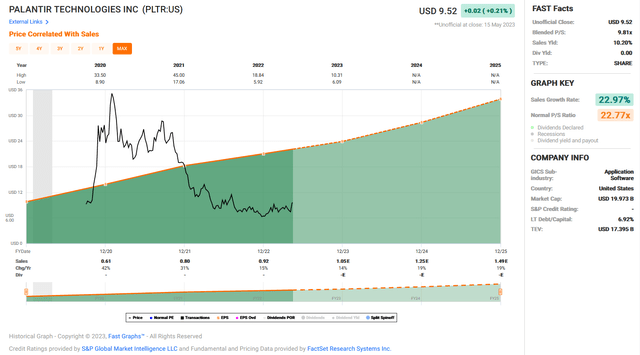

Among those companies with a controversial SBC rate is Palantir Technologies Inc. (NYSE:PLTR). The potential for Palantir's market is attractive from our perspective. It's intriguing to examine how the company will be able to leverage AI technology in future developments. The company's data analysis tools are valuable to large clients and the demand for data security is expected to continue growing. The company is trading at a price to sales ratio of 9.8x which is well below its average of 22.7x.

FAST Graphs

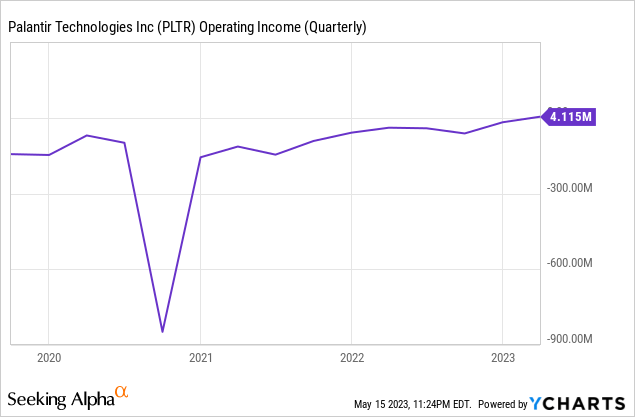

With the company posting its first quarterly operating profit in Q1 2023 of $4.1 million including SBC, it seems like the company could be turning a corner and worth establishing a position. PLTR has long been scrutinized for its SBC practices over the past few years. The company has been making improvements and acting with greater discipline. Unfortunately, it's still not enough to get us excited.

Stock-Based Dilution

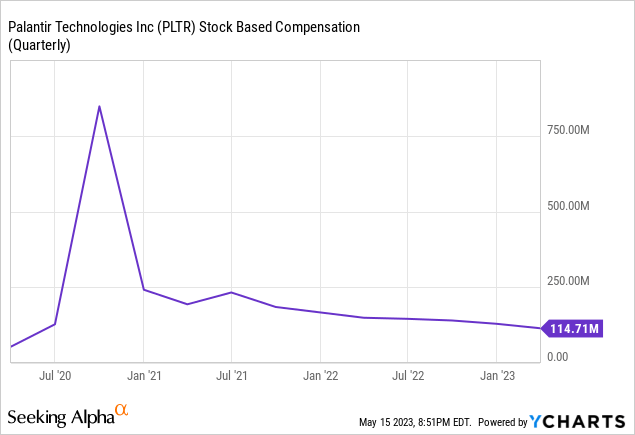

PLTR has issued a significant amount of SBC, including a surge above $750 million per quarter in 2020. Since 2021, the company has been reducing its quarterly SBC. Q1 2023 experienced only $114.714 million in SBC. This is down from $149.323 million in Q1 2022.

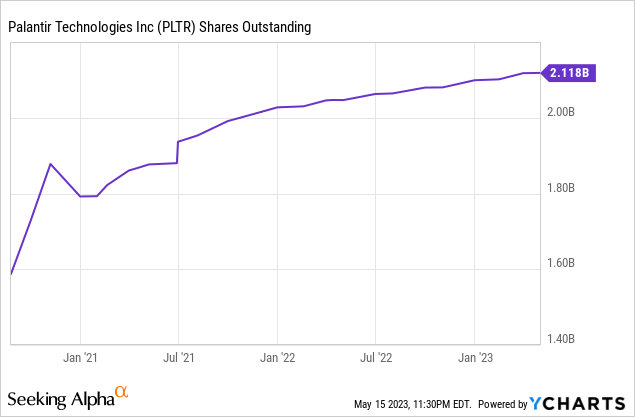

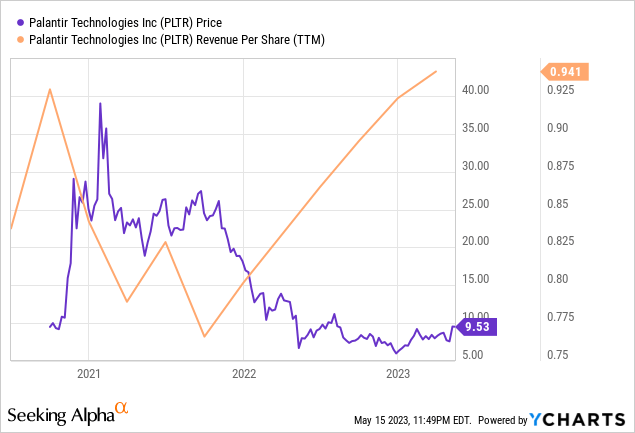

As a result, shares outstanding have ballooned from 1.6 billion in 2020 to 2.118 billion today. By itself, this isn't necessarily a problem if revenue growth exceeds share growth. Between 2020-2021 revenue per share was in decline, not a good indication. Since 2022, revenue per share has been on the rise. Unsurprisingly, this has corresponded with changes in share price momentum.

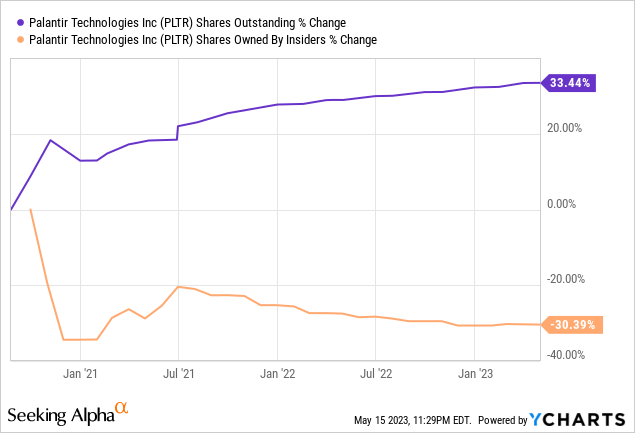

It is disconcerting to us that while shares outstanding has increased by 33.44% since 2021, largely a function of SBC, shares owned by insiders has declined by 30%. While some attrition should be expected, the degree of decline does not demonstrate that the SBC is creating the value that shareholders would expect for the dilution they pay.

SBC as a percent of revenue has improved significantly over the past two years. In 2021, the percentage was in excess of 100% which is a major concern for us. Today it stands just under 27%. As of March 31, 2023 the company had unrecognized stock-based compensation expenses related to options outstanding of $686.5 million and $703.2 million related to RSUs which the company expects to be realized over the coming years.

We believe this is too high. Normally, we look for SBC/revenue of 10% or less, although we have a conservative perspective on that. We recognize that some companies have the goal of attracting top talent and that requires solid compensation packages which will include sizeable SBC. Still, the current SBC rate appears to be in excess from our point of view. We're willing to pay for top talent, but not overpay for it.

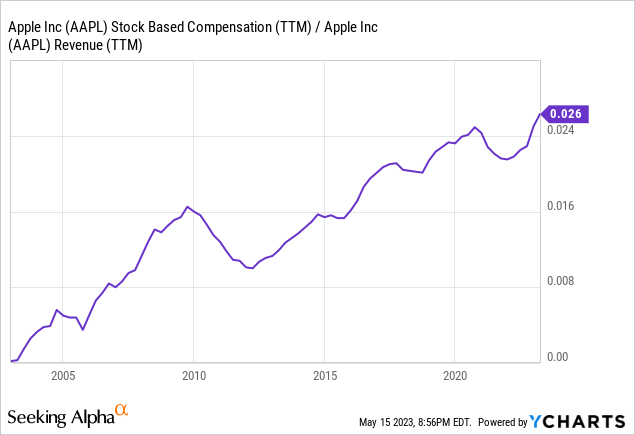

For reference, Apple (AAPL) is now paying its highest SBC/revenue in the last 20 years at 2.6%. While Apple and Palantir are very different technology companies, it demonstrates how wide the gap is between these two companies. It also demonstrates that a technology company does not need high SBC in order to grow into one of the most successful tech companies, as Apple did with SBC/revenue under 1% pre-2010.

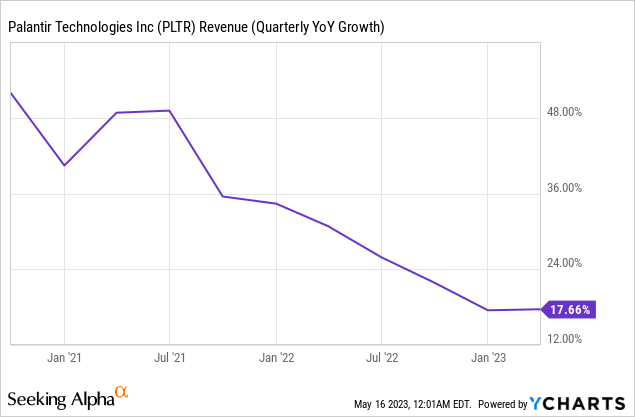

Naturally, as revenue growth slows the company will come under pressure to reduce SBC/revenue. When SBC/revenue was over 100% revenue growth was close to 50% YoY. Today, at SBC/revenue of 26.7% revenue growth is only 17.6% YoY. We are not attracted to revenue growth that is less than SBC/revenue. One way to think of this: all of the company's revenue growth is going to SBC, and then some. If SBC is supposed to help the company grow, it's not growing enough.

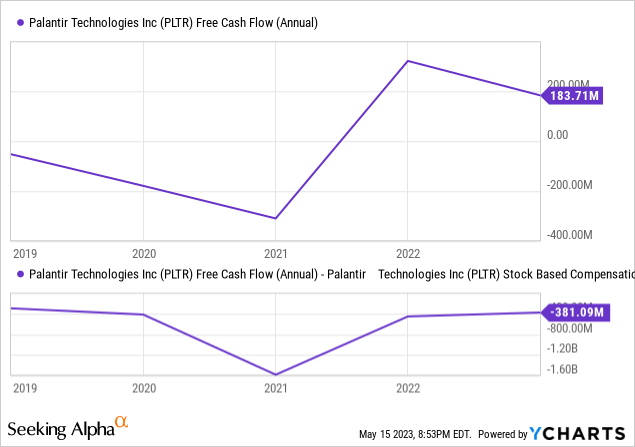

Cash flow is of particular importance to us. It is the basis for "reasonable price" in growth-at-a-reasonable-price. We're looking for solid free cash flow, free cash flow growth, or free cash flow potential. PLTR last reported free cash flow of $183.71 million and net operating cash flow per share of $0.09. By itself, this cannot determine much. For PLTR we need to add back the SBC to free cash flow to get a clearer picture of cash flow potential. When SBC is subtracted from FCF we see that the company actually lost $381 million. The trend has improved since 2021, when SBC was grossly excessive, but in-line with real/adjusted FCF in 2019. So with all the SBC over the last 4 years, real FCF hasn't improved much at all.

Summary

PLTR has a track record of loosely diluting its shares in an attempt to attract talent. Unfortunately, the results so far have been mediocre. The company has been tightening up its stock-based compensation structure but revenue growth has contracted simultaneously. There continues to be significant amounts of SBC that is expected to be realized in the near future.

Until the SBC structure becomes more conservative, it is difficult for us to get excited about Palantir. As a shareholder, we would not feel confident that we are getting the value we deserve from that share dilution. For these reasons, we continue to be on the sidelines.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not an investment advisor, is not registered as a financial advisor, and is not suggesting any investment recommendations. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and are subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.