Charles Schwab Is A Bargain

Summary

- Charles Schwab latest monthly activity report was very encouraging.

- About $13.6B in total net new assets flowed to the financial brokerage in April.

- Charles Schwab is a magnet for investor capital despite massive uncertainty in the financial system and investors may underestimate the firm's earnings potential.

- With a low P/E ratio of 11.9X, Charles Schwab is a bargain.

jetcityimage

In my recent work on Charles Schwab (NYSE:SCHW) -- Charles Schwab Q1 Earnings: A Top Recovery Bet For 2023 -- I indicated that the firm is seeing strong asset inflows which I felt contradicted negative investor sentiment about the brokerage company. In fact, assets continued to flow to Charles Schwab during the March craziness in the financial sector… indicating that investors saw (and still see) Charles Schwab as a destination for investment capital. According to Charles Schwab’s latest activity report for the month of April, the brokerage company has seen $13.6B in total net new assets last month. I believe this activity report strongly supports my bullish investment case for Charles Schwab and since shares of the financial brokerage company have failed to rebound (and are still cheap), I believe investors have even more reasons to buy SCHW stock!

Latest activity report indicates Charles Schwab remains a magnet for investor capital

One of the key concerns about Charles Schwab in the context of the financial crisis in March was that the broker was losing deposits. In the first-quarter, Charles Schwab did indeed lose deposits in the amount of $41B due to major cash sorting efforts in a higher-interest world. However, and this may not be fully understood, in my opinion, Charles Schwab also saw $53.9B in core net new assets flowing to the company in March. This was a 16% year over year increase and strongly indicated that investors are comfortable with handing over their assets to Charles Schwab.

According to Charles Schwab’s latest activity report, the brokerage saw total net new assets of $13.6B in the month of April. Core new assets declined $2.3B which, according to the company, was related chiefly to cash realignment activity in the context of the current tax season. The $13.6B in total new assets that have been moved to the platform by existing clients in April proves that Charles Schwab's remains a magnet for investors capital, despite a major crisis playing out in the U.S. regional banking market. Charles Schwab had $7.63T in total client assets at the end of April, showing a 1% increase year over year.

The market misprices Charles Schwab’s earnings potential

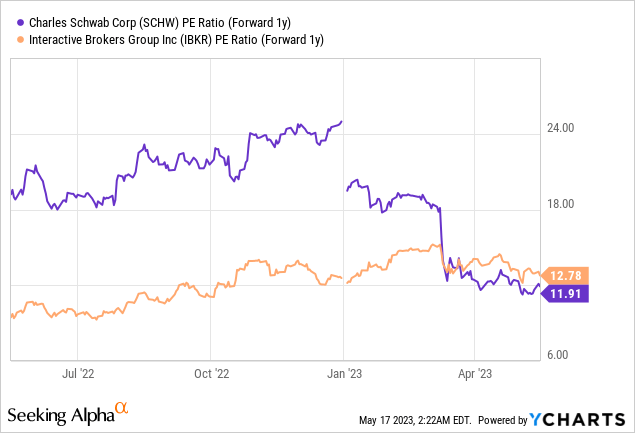

Charles Schwab’s valuation has failed to rebound from the March sell-off so far and shares are down about 7% since I last worked on Charles Schwab. Regional banks have also seen a continually high level of volatility and have not yet recovered from the industry turmoil which started back in March when Silicon Valley Bank failed. However, I believe that Charles Schwab's valuation is so attractive at this point, that the financial brokerage company has a very low risk profile, in my opinion. Charles Schwab is currently trading at a P/E ratio of 11.9X which is slightly lower than the P/E ratio of Interactive Brokers Group (IBKR)... which has a 12.8X multiplier sitting on its earnings potential.

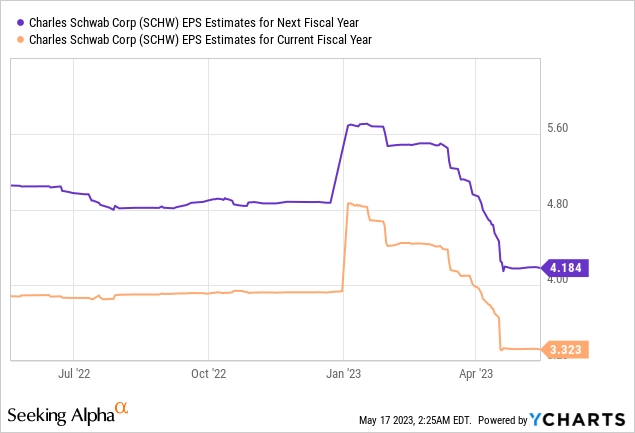

FY 2023 has so far been a challenging year for the financial sector and analysts expect a 15% decline in EPS for Charles Schwab this year as cash sorting efforts continue after the Fed has shown no signs of slowing down with its rate increases. However, the broad perception is that Charles Schwab will see a recovery of its earnings in FY 2024 with average consensus estimates implying a 26% rebound in EPS in next year and 27% growth in FY 2025.

EPS estimates have reset sharply lower this year in the wake of the financial crisis, but I believe estimates are now very bearish, especially if Charles Schwab's posts positive core net new asset growth again in the coming months. Even with lowered EPS estimates, Charles Schwab's shares are quite cheap, in my opinion, with a P/E ratio of 12X.

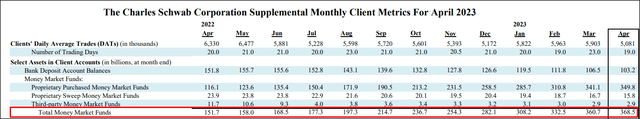

Risks with Charles Schwab

I must say, considering Charles Schwab’s strong weekly activity report for April, risks for the financial broker have decreased lately, not increased. The biggest risk for Charles Schwab is that the Fed continues to raise interest rates which adds pressure on the financial sector in general and likely forces investors to continue to withdraw bank deposits and invest them into higher-yielding money market funds, a trend that already had a huge effect on Charles Schwab: between April 2022 and April 2023, a total of $216.8B flowed into Charles Schwab's money market funds as investors chased higher yields.

What would change my mind about Charles Schwab is if the firm saw consistent declines in core net new assets going forward or saw a massive down-grade in EPS estimates.

Final thoughts

I believe the market overall does not get Charles Schwab and especially does not get the financial brokerage's strength in attracting investor capital despite uncertainty lingering in the U.S. financial system. Recent updates from U.S. regional banks show that the deposit situation has broadly stabilized which is solely the accomplishment of the Fed's emergency liquidity facility made available to the financial sector in March. Investor capital, however, is still gravitating to Charles Schwab… which makes, in my opinion, a strong case for the financial brokerage. Considering that Charles Schwab's earnings potential is likely undervalued at 11.9X (FY 2024) earnings, despite resetting EPS estimates, I believe the risk profile remains extraordinarily attractive here. Shares of Charles Schwab remain a strong buy!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SCHW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.