WesBanco: High Dividend Yield And Price Upside With Manageable Risks

Summary

- The margin will likely suffer from further deterioration of the funding mix.

- Deposits will likely restrain loan growth.

- The December 2023 target price suggests a high upside from the current market price.

- WSBC is offering a dividend yield of 6.5%. The dividend appears secure as the implied payout ratio seems sustainable.

Jacqueline Nix

Earnings of WesBanco, Inc. (NASDAQ:WSBC) will most probably fall this year due to pressure on the net interest margin and higher operating expenses. I’m expecting the company to report earnings of $2.89 per share for 2023, down 4% year-over-year. Compared to my last report on the company, I’ve reduced my earnings estimate because I’ve slashed my net interest margin estimate. The year-end target price suggests a high upside from the current market price. Further, WesBanco is offering a dividend yield that’s over 6%. Considering the attractive valuation and the moderate risk level, I’m upgrading WSBC stock to a buy rating.

Loan Growth Likely to Outpace Deposit Growth

The deposit book declined by 2.0% in the first quarter of 2023, in continuation of the trend witnessed since the second quarter of 2022. The magnitude of the contraction in the first quarter was in line with the magnitude seen in the last three quarters of 2022. As the deposit book had been contracting since long before the banking crisis started in March 2023, WesBanco’s deposit trend appears to be attributable to the Fed’s monetary tightening actions rather than a deposit run on the bank.

So far, the deposit book trend has not affected the loan portfolio’s growth. Loans grew at a decent rate of 1.7% during the first quarter, following a surge of 4.2% in the fourth quarter of 2022. WesBanco has funded additional loans through borrowings and a reduction of securities in the last few quarters. However, this cannot continue for long as funding loans through costly borrowings instead of cheaper deposits is detrimental to the margin. For the remainder of the year, I’m expecting deposit constraints to limit loan growth.

On the plus side, the continued team growth will likely support loan growth. The management mentioned in the conference call that it planned to hire additional commercial bankers this year like in the last couple of years.

Considering these factors, I’m expecting the loan portfolio to grow by 4.8% and the deposit book to grow by 0.3% in 2023. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 7,607 | 10,216 | 10,603 | 9,612 | 10,585 | 11,096 |

| Growth of Net Loans | 20.8% | 34.3% | 3.8% | (9.4)% | 10.1% | 4.8% |

| Other Earning Assets | 3,200 | 3,353 | 3,612 | 5,151 | 4,040 | 4,269 |

| Deposits | 8,832 | 11,004 | 12,429 | 13,566 | 13,131 | 13,165 |

| Borrowings and Sub-Debt | 1,535 | 1,898 | 983 | 459 | 1,121 | 1,723 |

| Common equity | 1,979 | 2,594 | 2,612 | 2,549 | 2,282 | 2,400 |

| Book Value Per Share ($) | 40.4 | 46.1 | 38.8 | 40.3 | 38.4 | 40.4 |

| Tangible BVPS ($) | 21.6 | 25.7 | 21.5 | 22.1 | 19.2 | 21.2 |

| Source: SEC Filings, Earnings Releases, Author's Estimates (In USD million unless otherwise specified) | ||||||

Margin Likely to Remain Under Pressure

WesBanco’s net interest margin shrank by 13 basis points in the first quarter of 2023 as the cost of funds almost doubled while asset yields increased by only a small amount. Most of the jump in the funding cost was attributable to a surge in costly borrowings. As discussed above, I’m expecting loan growth to continue to outpace deposit growth in the remainder of the year. Therefore, WesBanco will have to rely on further borrowings, which will hurt the margin going forward.

The securities portfolio, which makes up a quarter of total earning assets, will also hold back the margin. As mentioned in the earnings presentation, the portfolio’s average duration was 5.4 years at the end of March 2023, which is quite long. As a result, only a small portion of the securities portfolio can be expected to re-price in the year ahead.

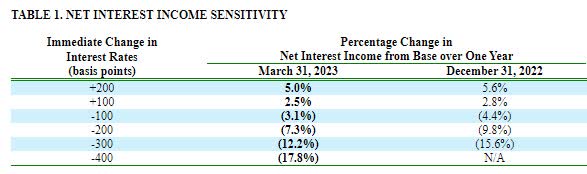

The results of the management's rate sensitivity analysis given in the 10-Q filing show that a 200-basis points hike in rates could increase the net interest income by 5% over twelve months.

1Q 2023 10-Q Filing

Overall, I’m expecting the margin to dip by five basis points in the second quarter of this year before stabilizing. Compared to my last report on the company, I’ve slashed my margin estimate partly because of the first quarter’s performance which missed my expectations. Further, my outlook on the funding mix is now worse than before.

Reducing the Earnings Estimate

Earnings of WesBanco will most probably decrease this year because of a decline in the net interest margin. Moreover, an inflation-driven rise in operating expenses will drag earnings. Overall, I’m expecting WesBanco to report earnings of $2.89 per share for 2023, down 4% year-over-year.

In my last report, I estimated earnings of $3.23 per share for 2023. I’ve slashed my earnings estimate mostly because I’ve decreased my net interest margin estimate.

The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 347 | 400 | 479 | 458 | 474 | 501 |

| Provision for loan losses | 8 | 11 | 108 | (64) | (2) | 13 |

| Non-interest income | 100 | 117 | 128 | 133 | 117 | 111 |

| Non-interest expense | 265 | 312 | 355 | 353 | 357 | 376 |

| Net income - Common Sh. | 143 | 159 | 119 | 232 | 182 | 172 |

| EPS - Diluted ($) | 2.92 | 2.83 | 1.77 | 3.53 | 3.02 | 2.89 |

| Source: SEC Filings, Earnings Releases, Author's Estimates (In USD million unless otherwise specified) | ||||||

Risk Appears Moderate

Unrealized mark-to-market losses on the Available-for-Sale securities portfolio amounted to $234 million at the end of March 2023, as mentioned in the presentation. To put this number in perspective, $234 million is 10% of the total equity balance at the end of the last quarter. WesBanco’s stock price has plunged by 37.5% since the start of the banking crisis on March 8, 2023, which is far higher than 10%. Therefore, I’m not worried about the unrealized losses as they already appear to be incorporated in the market price.

Further, uninsured and uncollateralized deposits totaled $3 billion, representing 24.7% of total deposits at the end of March 2023, as mentioned in the presentation. This level is also not worrisome because WesBanco has $4.5 billion in immediate liquidity, which can easily cover these deposits in the unlikely event of a deposit run on the bank.

Considering these two factors, I believe WesBanco’s risk level is only moderate in the current environment.

Upgrading to a Buy Rating

WesBanco is offering a high dividend yield of 6.5% at the current quarterly dividend rate of $0.35 per share. The earnings and dividend estimates suggest a payout ratio of 48% for 2023, which is the same as the average for the last five years. Therefore, the dividend appears secure despite the earnings outlook.

I’m using the peer average price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value WesBanco. Peers are trading at an average P/TB ratio of 1.29 and an average P/E ratio of 10.45, as shown below.

| WSBC | IBTX | CHCO | BKU | TRMK | NWBI | Peer Average | |

| P/E ("ttm") | 7.19 | 11.89 | 12.27 | 4.88 | 13.54 | 9.67 | 10.45 |

| P/E ("fwd") | 8.07 | 16.43 | 12.05 | 5.66 | 8.26 | 10.27 | 10.53 |

| P/B ("ttm") | 0.55 | 0.54 | 2.02 | 0.51 | 0.80 | 0.89 | 0.95 |

| P/TB (current) | 1.08 | 0.99 | 2.70 | 0.52 | 1.07 | 1.19 | 1.29 |

| Source: Seeking Alpha's Peer Page for P/E and P/B, Charting Page for P/TB | |||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $21.2 gives a target price of $27.5 for the end of 2023. This price target implies a 26.9% upside from the May 16 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.09x | 1.19x | 1.29x | 1.39x | 1.49x |

| TBVPS - Dec 2023 ($) | 21.2 | 21.2 | 21.2 | 21.2 | 21.2 |

| Target Price ($) | 23.2 | 25.4 | 27.5 | 29.6 | 31.7 |

| Market Price ($) | 21.7 | 21.7 | 21.7 | 21.7 | 21.7 |

| Upside/(Downside) | 7.3% | 17.1% | 26.9% | 36.7% | 46.5% |

| Source: Author's Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $2.89 gives a target price of $30.2 for the end of 2023. This price target implies a 39.5% upside from the May 16 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.5x | 9.5x | 10.5x | 11.5x | 12.5x |

| EPS - Dec 2023 ($) | 2.89 | 2.89 | 2.89 | 2.89 | 2.89 |

| Target Price ($) | 24.4 | 27.3 | 30.2 | 33.1 | 36.0 |

| Market Price ($) | 21.7 | 21.7 | 21.7 | 21.7 | 21.7 |

| Upside/(Downside) | 12.8% | 26.1% | 39.5% | 52.8% | 66.2% |

| Source: Author's Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $28.8, which implies a 33.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 39.7%.

In my last report, I adopted a hold rating with a target price of $34.4. Since then, the stock price has plunged because of the overall panic in the banking sector following the recent bank failures. In my opinion, the market has overreacted because the risk level is only moderate. Based on the total expected return and the riskiness, I’m upgrading WesBanco, Inc. to a buy rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.