Cognizant Technology: Growth And Margins To Remain Under Pressure

Summary

- Cognizant Technology's first-quarter results showed positive progress under CEO Ravi Kumar's leadership.

- CTSH aims to become an attractive employer and reduce attrition to enhance delivery capabilities.

- The company plans to improve efficiencies and reduce reliance on subcontractors to offset the margin dilution associated with larger deals.

svetikd

Investment Thesis

The first-quarter results provided an encouraging update on the progress made by Cognizant Technology Solutions Corporation's (NASDAQ:CTSH) new CEO, Ravi Kumar, who has been focused on specific goals: establishing CTSH as an attractive employer, enhancing the company's ability to secure large deals, and reinforcing operational discipline. CTSH made notable advancements in each area, particularly in securing significant deals, which contributed to stronger-than-expected overall bookings in the first quarter. However, this progress also resulted in higher-than-anticipated short-term margin challenges. To counterbalance this, the company plans to implement a cost-cutting program that is expected to generate a margin expansion of 20-40 basis points in the following year. Despite the expected lower margins, the revenue outlook appears favorable, and the growth projections are conservatively prudent, with anticipated quarterly growth ranging from -0.5% to 1% for the rest of the year.

Growth and Profitability Remains Challenged in the Near Term

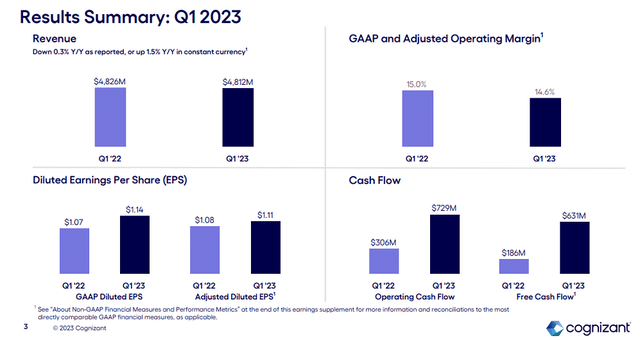

CTSH reported first-quarter 2023 revenues of $4,812 million, a slight decrease of 0.3% compared to the previous year but a 1.5% increase on a constant currency basis. The EPS of $1.11 exceeded expectations and guidance. However, the company's full-year 2023 guidance fell below consensus expectations, with projected revenue growth of -1% to +1%, operating margin guidance of 14.2-14.7%, and EPS of $4.11-$4.34.

On a positive note, CTSH experienced accelerated bookings growth in the first quarter, with a year-on-year increase of approximately 28%, leading to a record total trailing twelve-month bookings. This growth was driven by larger deals, particularly in the Financial Services sector. CTSH also introduced its "NextGen" program, which aims to simplify the company's operating model, optimize corporate functions, and consolidate office space. The program will incur restructuring charges of around $400 million, with severance costs accounting for half and the remaining half associated with real estate optimization.

With former INFY exec Ravi Kumar having taken the helm recently, investors are focused on details around new initiatives and strategy, giving CTSH a "hall pass" over the next few quarters as CTSH looks to reorient towards growth. In the near term, these efforts are swimming against the tide of a slowing IT services industry, a reduction in tech spending, lower volumes, a slowdown in discretionary projects and elongated decision-making. Combined with fundamental structural issues within the walls of CTSH, I believe that new CEO Ravi Kumar has his work cut out to build out a strategy to reinvigorate CTSH's growth.

Overall, while CTSH's revenue and EPS exceeded expectations, the company's guidance fell below consensus estimates. However, the accelerated bookings growth and the implementation of the NextGen program indicate a strategic shift toward future growth, providing some leeway for the new CEO in the coming quarters.

New Strategy Putting Pressure on Margins

An essential aspect of CTSH's revitalization strategy is to become an attractive employer, aiming to reduce attrition and enhance the company's delivery capabilities. In the first quarter of 2023, attrition saw a significant decline, and it is anticipated to remain at around 17%. The management has recently implemented measures such as providing bonuses in March and advancing the annual merit cycle to April to support this goal. However, as CTSH shifts focus towards larger deals, it may initially experience margin pressure before eventually reaching its full margin potential. The company intends to improve efficiencies and reduce reliance on subcontractors to offset this initial margin dilution. Additionally, near-term macroeconomic challenges are also expected to contribute to margin pressure. CTSH will experience a fall in the adjusted operating margins in FY23 as the company addresses weaker demand and volume while investing for future growth. CTSH also plans to leverage mergers and acquisitions (M&A) to reinvigorate growth, with the expectation of allocating half of its cash flow to M&A activities, particularly in rapidly growing digital markets.

Valuation

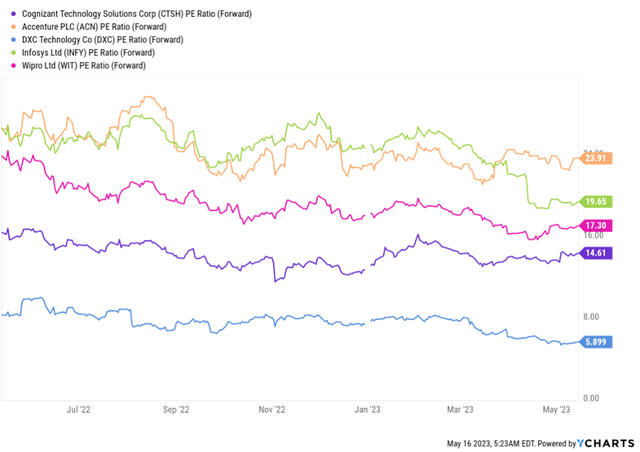

Cognizant is already trading at a valuation discount to peers near the low end of its two-year range, at 14x its CY23E EPS, while peers are trading at 18x. Cognizant's medium-term 8-11% constant-currency annual-growth target through 2024 was unveiled at an investor briefing in November 2021, with the current macro environment rendering that challenging. Moreover, that goal was predicated on a 2% annual inorganic contribution, yet slowed M&A was cited for the guidance cut after 1Q. Over the last year, CTSH has traded at a -22% discount relative to its peers on NTM P/E. I estimate CTSH earnings will grow at 5.7% over the next three years (2022-25) and recommend a hold rating on the stock.

CTSH comp group valuation comparison (Ycharts.com)

Conclusion

CTSH reported a slight decrease in Q1 revenues compared to the previous year but exceeded expectations for EPS. However, their full-year guidance fell below consensus estimates. New CEO Ravi Kumar has been focused on key objectives, including making CTSH an appealing employer, improving the ability to secure large deals, and enhancing operational discipline. The company made notable progress in these areas, particularly in winning significant deals, which resulted in better-than-expected overall bookings in Q1. However, near-term macroeconomic challenges are expected to continue to put pressure on margins. Hence, I view the stock as a hold at current levels.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.