U.S. Oil Demand Is Trending In The Right Direction, So It's Only A Matter Of Time

Summary

- U.S. oil demand continues to trend in the right direction, with the big 3 being higher y-o-y.

- Gasoline and jet fuel should continue to lead the recovery.

- An increase in refining capacity this year will keep margins rangebound.

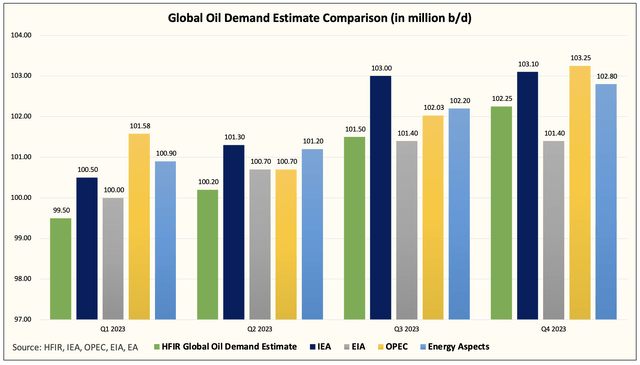

- With U.S. oil demand being higher y-o-y, our global oil supply and demand model is already conservative.

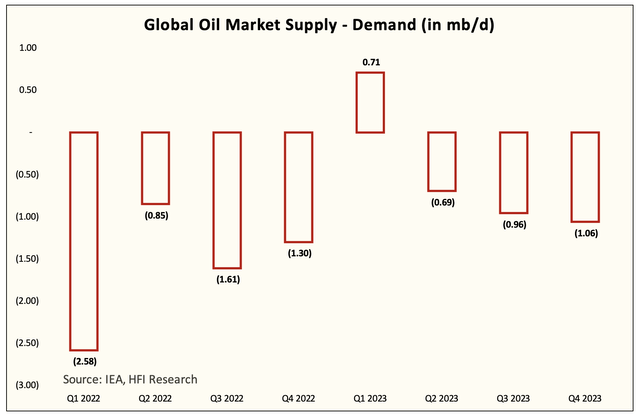

- But even with our depressed demand assumptions, we have the implied deficit at -1 million b/d for H2 2023.

- Looking for a helping hand in the market? Members of HFI Research get exclusive ideas and guidance to navigate any climate. Learn More »

artisteer

EIA reported a mixed oil inventory report today. Total implied oil demand trended lower following a material uptick last week. Crude saw a relatively large build as our modified adjustment jumped to ~1.7 million b/d. Product inventories were mixed with gasoline lower, distillate flat, and jet fuel higher. Total liquids saw a build of ~5.2 million bbls.

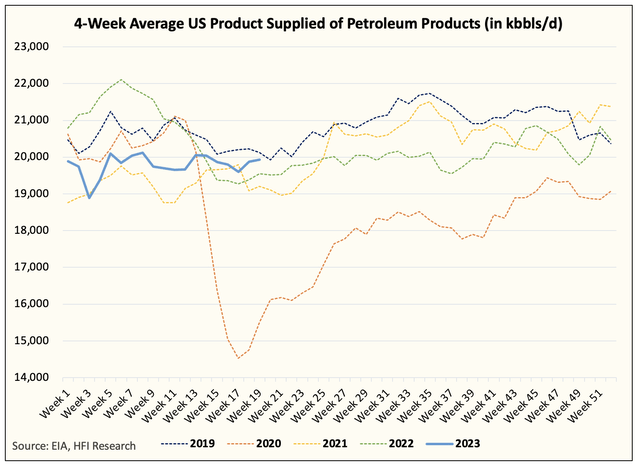

Taking aside the weekly noise/volatility, U.S. implied oil demand continues to trend in the right direction.

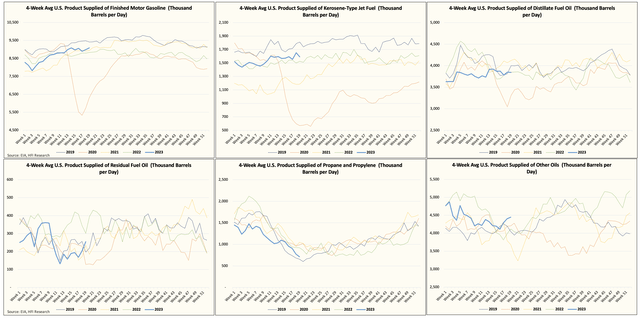

Relative to 2019, oil demand this year is much better than in the previous two years. The strength in demand this year is fueled by higher gasoline and jet fuel consumption.

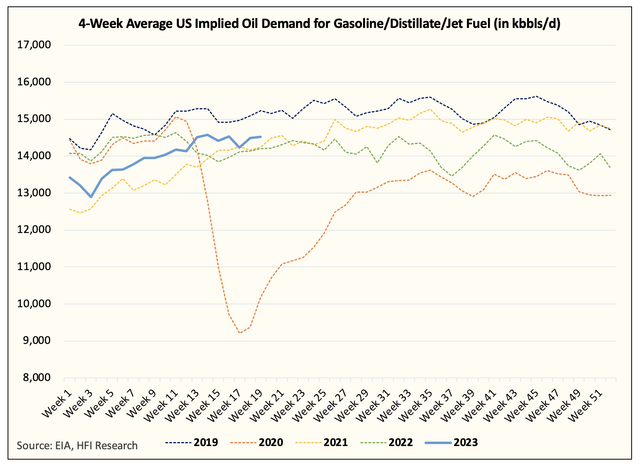

And in aggregate, we are seeing the big 3 trend in the right direction.

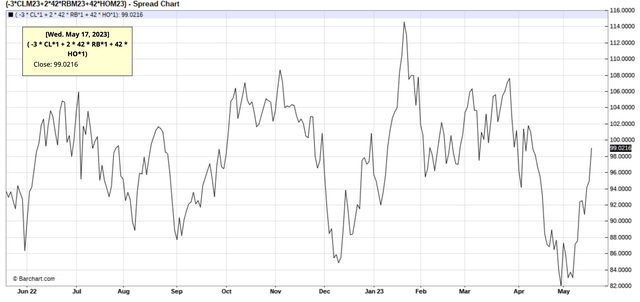

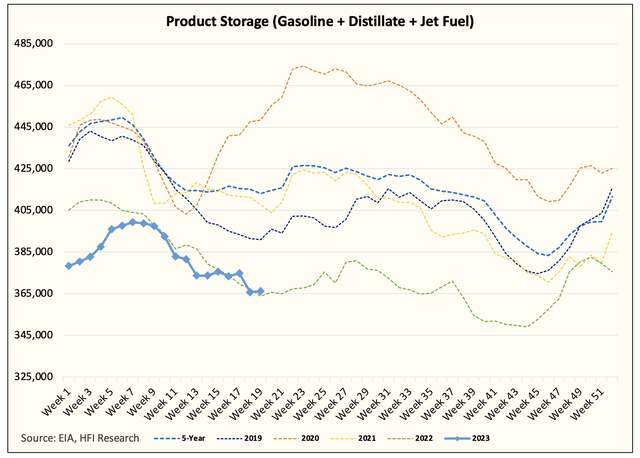

In our view, the key to this figure will be how we trend over the coming weeks. Given the recent performance in the 3-2-1 crack spread, I believe that product inventories should further decline as consumer demand continues to improve.

As a result, we could see product storage move into a steeper deficit going forward.

As of today, gasoline, distillate, and jet fuel are sitting right around 2022 levels. But remember that in 2022, we started to see much lower demand by the June timeframe. We think this year will be the opposite.

On the refining margin front, we don't expect refining margins to get anywhere close to what we witnessed last year. In H2 2023, we will see +2 million b/d of refining capacity come online, which would keep refining margins rangebound. In addition, Mexico's Pemex is starting up its refinery in June, which will take away some of the product export demand for the U.S. All-in-all, we see a rangebound scenario for refining margins, which should further aid consumer pricing.

This is why I believe that U.S. oil demand going into this summer could surpass an all-time high. Directionally speaking, we are moving in this direction, so it's only a matter of time.

Rangebound for now, but not for long...

We don't see how the oil market can remain in this tight range for long. There are three important reasons why we believe this:

- US oil demand is clearly performing better than what we saw going into the summer of 2022.

- China's oil demand recovery is real, and when it finishes draining its excess product inventories, crude buying will return.

- OPEC+ appears to be committed to reducing supplies to the market. Saudi's crude exports look to be lower by ~800k b/d m-o-m for May.

And if you circle these three points back to our global oil supply and demand model, you will note that we have one of the lowest oil demand assumptions, and yet, we still assume a draw in H2 2023.

S&D Model

In my view, the margin of safety is there for oil prices. The risk is asymmetrically positioned to the upside because I don't think the market is pricing in any scenario where demand surprises to the upside. In fact, we still assume OECD demand to be lower y-o-y (-0.29 million b/d), and this is despite the fact that US oil demand is already higher y-o-y.

This is why I believe, if global oil demand continues to trend the way it is, it is only a matter of time before oil breaks out of this range.

HFI Research, #1 Energy Service

For energy investors, the 2014-2020 bear market has been incredibly brutal. But as the old adage goes, "Low commodity prices cure low commodity prices." Our deep understanding of US shale and other oil market fundamentals leads us to believe that we are finally entering a multi-year bull market. Investors should take advantage of the incoming trend and be positioned in real assets like precious metals and energy stocks. If you are interested, we can help! Come and see for yourself!

This article was written by

#1 Energy Research Service on Seeking Alpha

----------

HFI Research specializes in contrarian investment analysis. We help you to find clarity in a world of uncertainty. We take contrarian thinking very seriously and believe that the only way to obtain a real edge in the market is to possess a contrarian investment thesis. We share our investment analysis with premium subscribers through daily and weekly reports.

----------

HFI Research Premium currently includes:

Oil Market Fundamentals - Our daily oil market report that discusses the current oil market fundamentals and the incoming price trend.

Natural Gas Fundamentals - Our daily natural gas market report that details current trader positioning, fundamentals, weather, and the incoming trade set-up.

Real-Time Trade Notifications - We actively trade oil and natural gas ETNs. In addition, we also issue real-time trade notifications on individual stocks.

Weekly EIA Crude Storage Forecasts - Every Saturday, we give the EIA crude storage estimate for the incoming week's report.

Weekly US Oil Production Forecasts - A weekly tracker for real-time US oil production so subscribers can understand what's happening to US shale growth.

What Research Reports We Read - A weekly report that covers all the research reports we read for the week, so subscribers can understand the market consensus and contrarian viewpoints better.

What Changed This Week - Our flagship weekly report.

For more info, please message us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.