DFRA: A New Real Asset ETF Off To Good Start

Summary

- The Donoghue Forlines Yield Enhanced Real Asset ETF invests based on the FCF Yield Enhanced Real Asset Index.

- This article reviews both the ETF and its index, plus it compares DFRA data with competing funds.

- While the start is good, that is only about sixteen months; longer existing real asset funds had good short-term returns too, but lag stocks in the long run. Hold rating.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

skodonnell

(This article was co-produced with Hoya Capital Real Estate)

Introduction

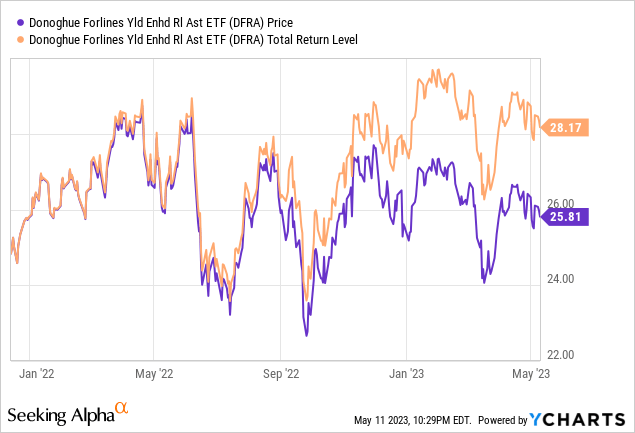

What does "real assets" mean? Later, when I compare several funds that use that term in their name, you will see what I mean; the assets held are not totally consistent. I have found over my many years of investing, one has to look "under the hood" to see what the fund holds, not just take the fund's name as "gospel". Here I review a ETF that is new to me and it is fairy new too, having started in late 2019: the Donoghue Forlines Yield Enhanced Real Asset ETF (BATS:DFRA). Compared to the other two ETFs and even the S&P 500 Index ETFs, DFRA is off to a good start.

Donoghue Forlines Yield Enhanced Real Asset ETF review

Seeking Alpha describes this ETF as:

The investment seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FCF Yield Enhanced Real Asset Index. The underlying index is designed to track the investment results of a rules-based strategy that aims to provide exposure to "real assets" equities based on the adviser's proprietary research.

Source: Seeking Alpha DFRA

DFRA has $51m in AUM, making them a "small-fry" in the ETF world. The managers are charging 69bps, about what seems standard for an actively managed ETF. Income investors will appreciate the 8+% yield, though that needs to be taken with the preverbal "grain of salt".

For those, like me, who are unfamiliar with this manger, this is how they define themselves:

Donoghue Forlines is a Boston-based tactical investment firm that has specialized in active risk-managed portfolios since 1986. In December 2017, W.E. Donoghue acquired JAForlines Global (JFG), an investment management company specializing in risk-managed global tactical strategies. The acquisition resulted in a unique firm in the investment management space.

Source: Donoghue Forlines

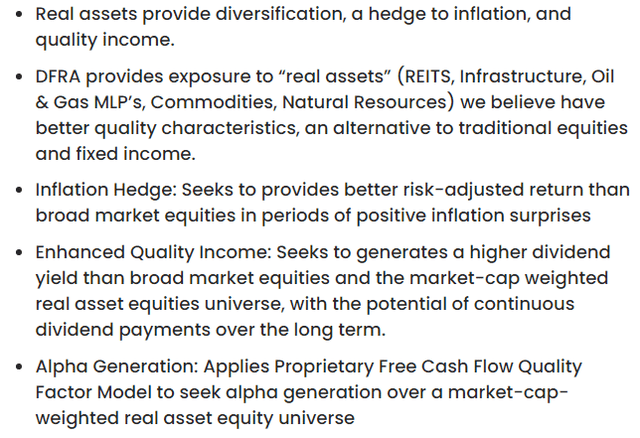

The fund managers list several reasons they believe investors should own their fund: note they list inflation hedge as the first reason.

Index review

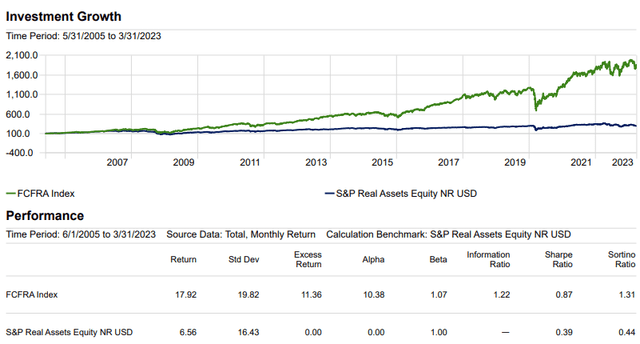

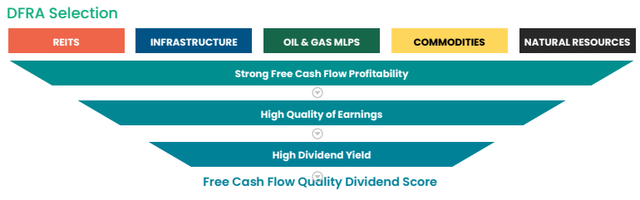

The FCF Yield Enhanced Real Asset Index (the "FCFRA Index") is designed to track the investment result of a rules-based strategy that aims to provide exposure to global "real assets" equities. The Index intends to reflect the performance of companies related to "real assets" (REITS, Infrastructure, Oil & Gas MLP's, Commodities, Natural Resources) with the following characteristics: High-Quality Alternative Exposure; Inflation Hedge; Enhanced Quality Income; Alpha Generation FCFRA TR Index reflects backtested performance from the period beginning 11/30/1998 to 08/31/2021, with a base value of 1,000. The index's live calculation began on 09/01/2020. Performance illustration starts 5/31/2005 when benchmark return was first available.

Source: indxx.com

They provided this chart and data for the index, including the backtested period.

The underlying index is sponsored and maintained by FCF Indexes LLC (the "index provider"), an affiliate of FCF Advisors LLC, the fund's investment adviser. I could not find a document explaining the index selection rules. The S&P Real Assets Equity Index is defined as:

A static weighted return of investable and liquid equity indexed components that measures the performance of real return strategies that invest in listed global property, infrastructure, natural resources, and timber and forestry companies.

Source: spglobal.com index

I mention this to point out the two indices are very different in that one is 70+% in fixed income assets, and the S&P index, as the name implies, is 100% equity, though it does include MLPs.

Holdings review

The next diagram shows how the portfolio is selected.

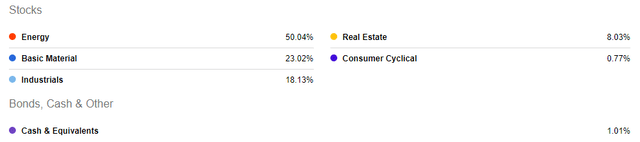

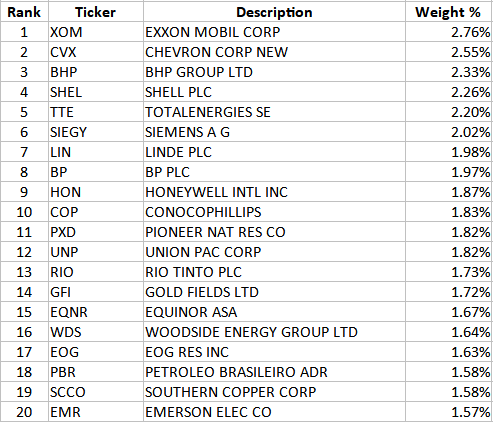

As the sector allocation shows, Energy stocks play a leading role for this ETF.

The entire portfolio is linked to how well the economy does, something to keep in mind as the FOMC continues to risk pushing the US into a recession.

Top 20 holdings

donoghueforlinesetfs.com; compiled by Author

DFRA own about 80 stocks, with the Top 20 comprising 38% of the portfolio's weight. Overall, the allocation is fairly weighted, with the bottom 20 stocks comprising 16% of the portfolio, a larger percentage than many equity ETFs. With no stock over 3%, concentration risk seems to be well controlled.

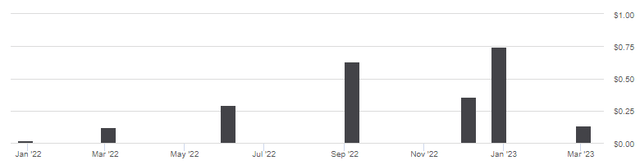

Distribution review

Payouts were on a steady climb until the most recent, which should give income investors a pause as to what DFRA really yields.

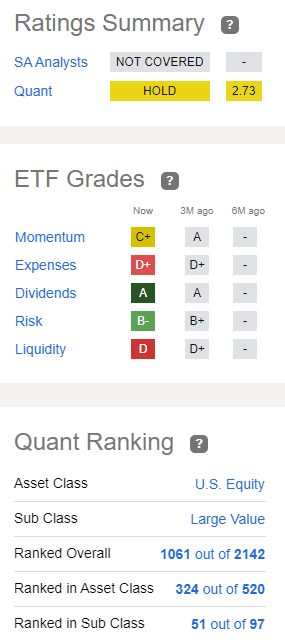

Seeking Alpha's analysis

Seeking Alpha grades and ranks each US ETF; here are the current values for DFRA.

seekingalpha.com DFRA homepage

Portfolio strategy

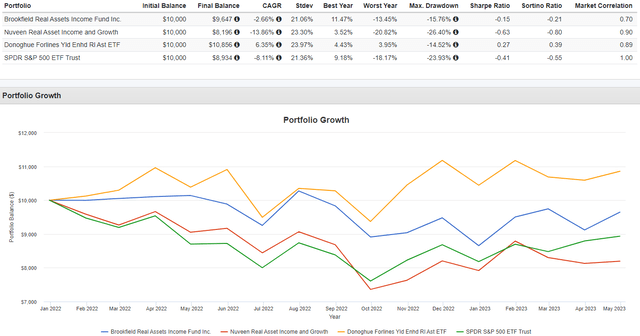

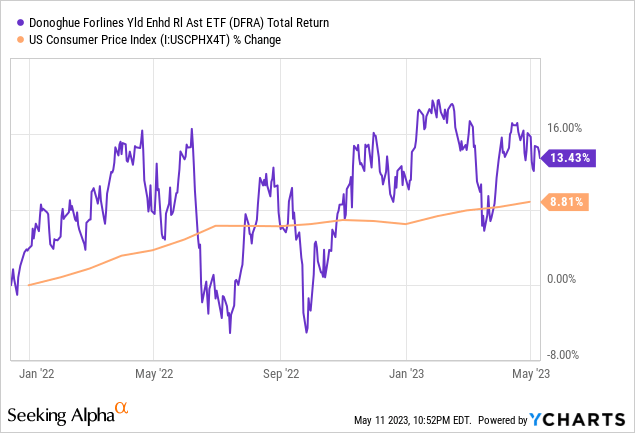

While DFRA is not consistently beating the US inflation rate, it has achieved its inflation-beating goal since inception. The next set of data compares DFRA against two other funds that include "Real Assets" in their name:

- Brookfield Real Assets Income Fund (RA), which I recently reviewed (article)

- Nuveen Real Asset Income & Growth Fund (JRI)

I also included the SPDR S&P 500 ETF (SPY) to see if investors did better just owning an standard index ETF: answer is no over this limited period.

So, while DFRA might be behind inflation since its start in December'21, it has done better than the other two real asset funds (both CEFs) and SPY. As for the CEFs, both are high-percentage fixed-income asset holders, so not a perfect apples-to-apples comparison to DFRA or SPY, but highlights the need to look beyond a fund's name and into what they actually invest in.

Final thought

While DFRA's start is good, that is only about sixteen months of results; longer existing real asset funds had good short returns too, but lag stocks in the long run. Fund's holdings appear highly correlated to the US economy so my best view at this point is a Hold rating.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.