ONEOK And Magellan Midstream Partners Make A Monumental Move

Summary

- ONEOK has agreed to acquire Magellan Midstream Partners in a transaction valued at $18.8 billion, causing ONEOK shares to plunge 9.1% and Magellan shares to surge 13%.

- The deal includes $5.1 billion in cash, $8.8 billion in ONEOK equity, and $5 billion in net debt, with ONEOK shareholders owning 77% of the combined company and Magellan shareholders owning 23%.

- Despite concerns about the lack of synergies between the two companies, management remains optimistic and the overall transaction looks promising.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

redtea

May 15th was a really big day for the energy midstream sector. After news broke that ONEOK (NYSE:OKE) had agreed to acquire Magellan Midstream Partners (NYSE:MMP) in a transaction valued at $18.8 billion, shares of the former plunged 9.1%, while shares of the latter surged 13%. This divergence in price may seem odd to some investors. But it's fairly common when the market believes that the acquirer might be overpaying for the business that's being acquired. Most of the concern, as highlighted by analysts, seems to be centered around the idea that, while other companies are very similar operationally, they also have some rather significant differences that might make attractive synergies unlikely to materialize. Digging deeper into the fundamentals, though, I do think that the market might be overreacting here. Generally, I am skeptical of acquisitions. But from all that I can see in the data provided, investors in both firms should be quite happy right now.

An interesting transaction

According to a press release issued by ONEOK on May 14th, the company has agreed to acquire Magellan Midstream Partners in a rather sizable financial transaction. The overall enterprise value of the deal is $18.8 billion. This is made-up of three separate numbers. First, there is the cash component of the deal. Upon closing of the transaction, shareholders of Magellan Midstream Partners will receive $25 per share in cash for each unit that they hold. They will also receive 0.667 of a share of ONEOK for each unit of Magellan Midstream Partners stock that they own. And finally, ONEOK is going to absorb the debt of the company it is acquiring.

Breaking these numbers out, we can see that ONEOK is paying $5.1 billion in cash, much of which it is getting from a bridge financing agreement. Using share prices of both companies prior to the deal being announced, it is also allocating $8.8 billion in its own equity toward the deal. And finally, the net debt associated with the transaction is roughly $5 billion. After the transaction closes, shareholders of ONEOK will own approximately 77% of the combined company, with investors in Magellan Midstream Partners accounting for the remaining 23%.

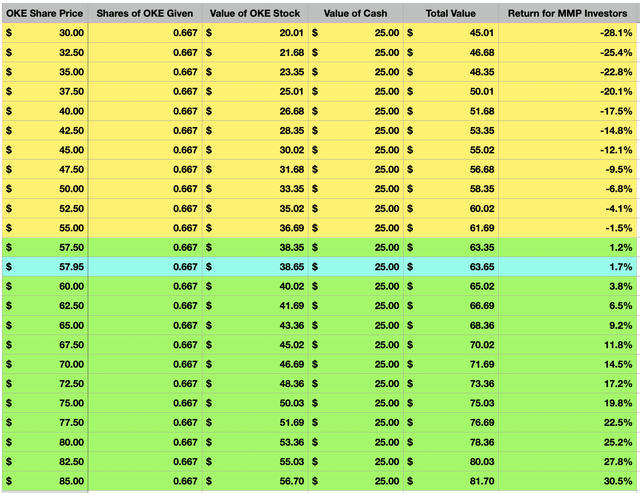

This deal translates to $67.50 per share, which would be 21.8% above the $55.41 that each share of Magellan Midstream Partners was worth immediately before the transaction was announced. But of course, because of volatility in the share price of ONEOK, the ultimate amount of the transaction could vary. As you can see in the table above, for instance, with shares of ONEOK at $57.95, investors in Magellan Midstream Partners should get total consideration of $63.65. That would imply a 1.7% increase over the $62.61 that shares were trading for as of the close of market on May 15th. If the price of ONEOK stock drops to $50, for instance, investors in Magellan Midstream Partners would experience downside of 6.8%. But if shares of ONEOK were to rocket higher to $85, upside for investors in Magellan Midstream Partners would total 30.5%.

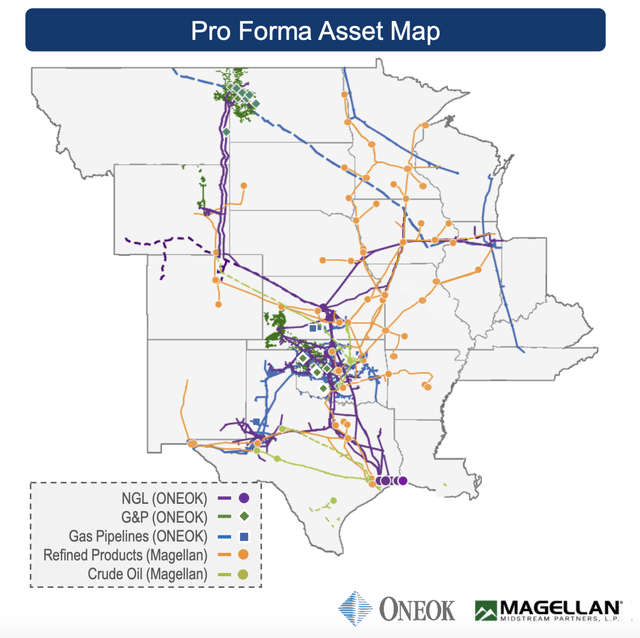

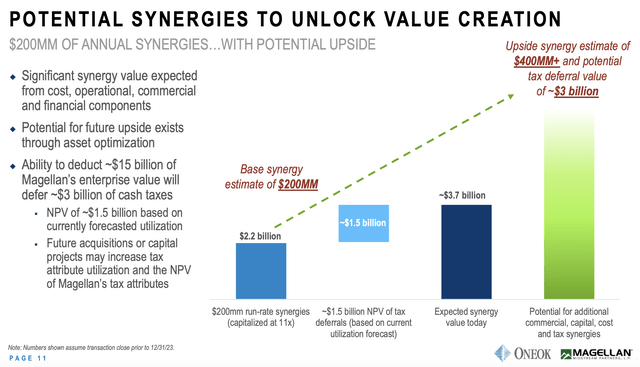

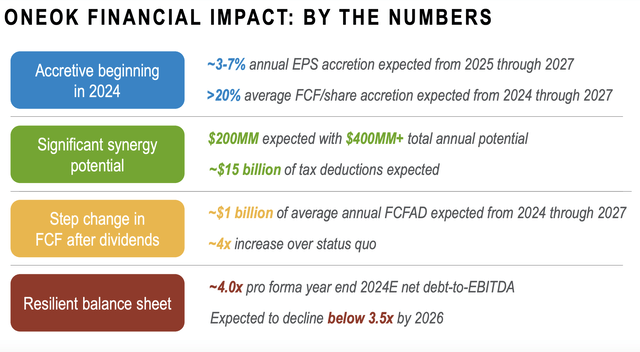

In many respects, this transaction makes a great deal of sense. For instance, if you look at the asset map of the combined entity, you can see that there is significant overlap between what each enterprise currently owns. This clustering of resources should help the company save a great deal of capital on certain operations. In fact, ONEOK expects this deal to result in at least $200 million worth of annual synergies. This number could grow to $400 million or more as time progresses. Thanks to these synergies, combined with the cash flows and earnings that Magellan Midstream Partners is expected to bring to the table, earnings per share accretion for investors in ONEOK should be between 3% and 7% higher than it otherwise would be for the 2025 through 2027 fiscal years. For free cash flow, that number is substantially higher for 2024 through 2027, coming in excess of 20% per annum.

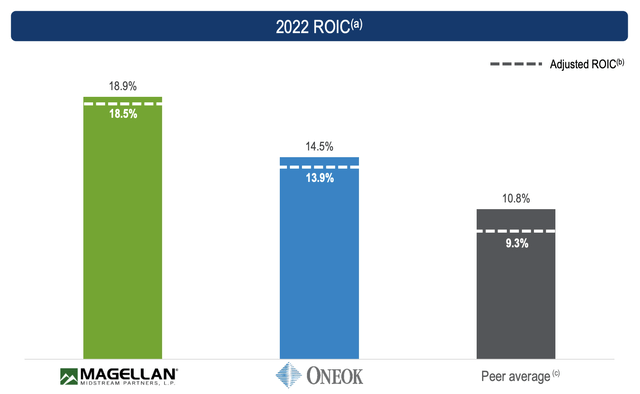

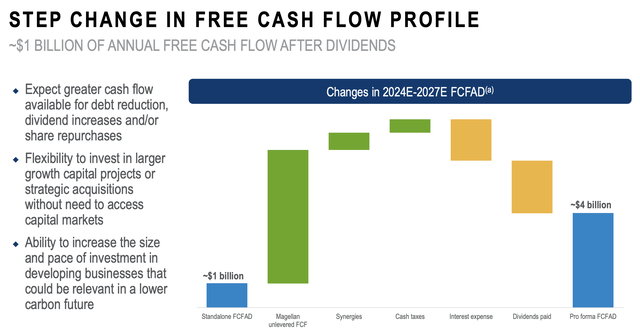

This improvement in profitability is aided by the fact that Magellan Midstream Partners has some rather high ROIC (return on invested capital). Using data from the 2022 fiscal year, this number came in at 18.5% on an adjusted basis. By comparison, ONEOK's was 13.9%, while the industry average seems to be around 9.3%. But it's important to keep in mind that there are other ways that ONEOK plans to derive value from this transaction. Because of the nature of the transaction, ONEOK will essentially be able to deduct $15 billion of Magellan's enterprise value as part of what is called a step-up in the tax basis. This will allow it to defer roughly $3 billion in cash taxes, which translates to a roughly $1.5 billion net present value. That number could increase based on future acquisitions or capital projects that could further increase the tax attribute utilization and the net present value for tax purposes. When added to the aforementioned synergies, ONEOK estimates that total synergies today should be worth around $3.7 billion. These changes, management said, should result in around $4 billion worth of free cash flow after dividends of $4 billion compared to $1 billion in free cash flow if ONEOK were to remain a standalone company.

All combined, the company will generate around $6 billion per year by 2024, without the aforementioned synergies, worth of EBITDA, with $4 billion or more of it coming from ONEOK's own operations and the remaining coming from Magellan Midstream Partners. But if we use data that is already come to pass, these numbers are a bit lower. In 2022, Magellan Midstream Partners generated EBITDA of $1.43 billion and adjusted operating cash flow of $1.23 billion. By comparison, these numbers for ONEOK were $3.62 billion and $2.90 billion, respectively. For context, adjusted operating cash flow is operating cash flow but adjusting for changes in working capital.

Using these numbers, we can see perhaps one of the reasons why the market punished ONEOK like it did. If we use that company's value prior to the deal being announced, it was trading at a price to adjusted operating cash flow multiple of 9.8 and at an EV to EBITDA multiple of 11.4. By comparison, the buyout price initially implied for Magellan Midstream Partners came out to 11.2 and 13.2, respectively. Even if we factor in the $1.5 billion in net present value associated with the tax side of the equation, the multiples only dropped slightly to 10.1 and 12.1, respectively. That does make it slightly more expensive than ONEOK.

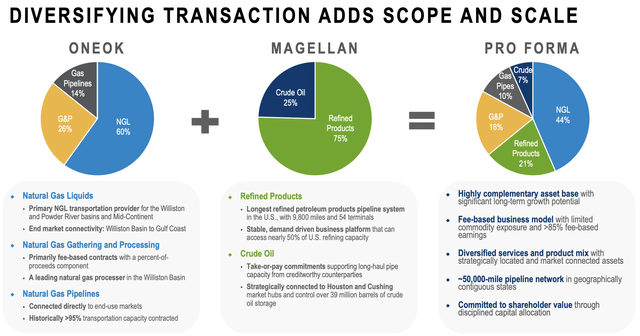

If you're wondering why I'm not factoring in the implied synergies, it's because analysts are concerned that synergies might not be all they are cracked up to be. In addition to this, many companies that make bold predictions of synergies end up falling short on delivering them. The reason why analysts are worried is that the companies, while operationally very similar, are also very different. If we look at the sum of operating income and equity earnings for the two companies, 60% of the value for ONEOK stems from NGLs. 26% is attributable to natural gas gathering and processing operations. And the remaining 14% comes from gas pipelines. For Magellan Midstream Partners, 75% it comes from refined products, while the remaining 25% comes from crude oil. There is no real overlap here. And in fact, a combination of the companies creates a really diversified player when investors in either one might have preferred the individual focus that the management teams have built the companies around.

It is worth noting that investors in Magellan Midstream Partners could face some rather unpleasant tax consequences from this transaction. Specifically, the ONEOK stock that investors in the company will receive will be considered a taxable event since partnerships are not capable of receiving stock in a deal like this without it being taxed. The amount of the stock received will work to reduce the basis that investors have in the shares of Magellan Midstream Partners. Once those shares are sold someday, investors will be on the hook for the extra tax incurred on that basis reduction. This should cause investors to weigh carefully their stake in Magellan Midstream if they elect to keep the shares on hand, especially when you consider that most or all of the gain realized by shareholders in the pipeline will be classified as ordinary income. Talking with a tax professional on the matter would be ideal.

Takeaway

Based on the totality of the picture, I do believe that ONEOK is in a pretty solid position with this transaction. Although the company is definitely paying a premium, it's picking up a great asset that should continue to perform well in the long run. I understand why analysts are concerned. But I do think this concern is overblown because, with the tax benefit but without the possible synergies, the prices of the two businesses are not terribly far apart. Even without the taxes or synergies, ONEOK is bringing 71.6% of the combined entity's EBITDA to the picture and 70.2% of its adjusted operating cash flow. And yet, shareholders in that business are receiving 77% of the combined business. This, to me, looks like a respectable deal and any benefit received from synergies should be considered a bonus.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.