Wingstop: Grossly Overvalued, Highly Leveraged And Many More

Summary

- Wingstop Inc.'s key multiples are jaw-dropping and much higher than its peers.

- Wingstop does not own any proprietary technology or any patents.

- Wingstop has not discovered the cure for cancer, either.

- There are about eleven reasons or catalysts where either one or a combination of them could lead to a big drop in Wingstop Inc. shares over the next months.

- In other words, I strongly believe that a sharp correction on Wingstop Inc. shares is just a matter of time.

- Looking for more investing ideas like this one? Get them exclusively at Value Investor's Stock Club. Learn More »

Alexandr Milodan

Saying that this stock has been priced for perfection is an understatement, in my opinion. I'm talking about Wingstop Inc. (NASDAQ:WING), a fast casual restaurant chain that sells classic chicken wings, boneless chicken wings, chicken tenders, and chicken sandwiches with 11 flavors. And there are about 11 reasons or catalysts where either one or a combination of them could push WING stock much lower than $207 in the next months, as presented in the next paragraphs.

The Low Bar Due To COVID-19 And More

WING announced its Q1 2023 results a few days ago. Among other things, domestic same store sales increased 20.1% and total revenue increased 42.7% to $108.7 million compared to prior year period. As a result, its stock went up, hitting $220, before falling to the current price of about $207.

However, WING opened 228 new restaurants in 2022 and 37 new openings in the fiscal first quarter 2023, which makes a total of 265 new restaurants since January 2022. In other words, restaurant count has increased about 16% since January 2022, when WING had about 1,700 restaurants, so revenue YoY growth in Q1 2023 was largely the result of the new openings.

I believe that the key parameter behind WING's rise to $220 was the same store sales growth metric that far exceeded expectations given that the consensus estimate was +8.6%. However, the market overplayed this metric while ignoring or downplaying these key facts and key negatives:

1) The bar in Q1 2022 was very low due to COVID-19: A key reason behind WING's domestic same store sales increase of 20.1% was the fact that the bar was very low in Q1 2022. And the bar was very low in Q1 2022 due to COVID-19. Specifically, according to statista.com (emphasis added):

The global restaurant industry was seriously impacted by the coronavirus (COVID-19) pandemic. Social distancing measures and general caution towards public places caused many consumers to dine out less. According to the source, the year-over-year change of seated diners in restaurants worldwide, compared to 2019, was 0.81 percent on August 1, 2022."

In other words, the seated diners largely remained flat on a YoY basis in 2020, 2021 and the first seven months of 2022. Due also to the fact that the bar was very low and the situation in the restaurant industry was bad in Q1 2022, the National Restaurant Association stated in February 2022 that (emphasis added):

The restaurant industry will likely never return to its pre-pandemic state. The trade group says 2022 will be a “new normal,” for the sector as it struggles to rebound and as competition for workers remains intense".

and: Restaurants and their patrons have found themselves in a ‘new normal.’ Given emergent technology, changing consumer behavior and dining preferences, and the extraordinary challenges of the last two years, the industry is unlikely to ever completely return to its pre-pandemic state”.

2) Outlook: Based on WING's guidance for 2023, domestic same store sales in 2023 is expected to be in the high-single digits, which means that same store sales growth will normalize and drop to low-single digits or mid-single digits in the next three quarters, as quoted below:

Based on fiscal first quarter results, the Company is providing updated guidance for 2023, which is a 52-week fiscal year: High-single digit domestic same store sales growth;"

3) High leverage: Adj. EBITDA in Q1 2023 was $34.6 million. Based also on the guidance for 2023, I estimate that adj. EBITDA in 2023 will be about $140 million. Given also that net debt is about $520 million (Q1 2023), WING is a highly leveraged company with its leverage ratio (Net debt-to-2023 adj. EBITDA) being about 3.7 times.

As a result of the high leverage, interest expense in Q1 2023 was approximately $4.6 million, up 10% compared to prior-year period. Meanwhile, the Fed recently increased the interest rates by 0.25% and more interest rate hikes are likely in the next months, so WING's interest expense in 2023 is estimated to be at least $23.5 million, up at least 10% compared to $21.2 million in 2022.

4) Sky high key multiples: Revenue and adj. EBITDA in Q1 2023 were $108.7 million and $34.6 million, respectively. Based also on the guidance for 2023, I estimate that revenue and adj. EBITDA in 2023 will be about $440 million and $140 million, respectively. Enterprise Value at $207 per share is approximately $6.7 billion including its net debt of approximately $510 million.

That said, WING's key multiples far exceed the peers', as illustrated below:

Company | EV-to-2023 adj. EBITDA (*) (**) |

WING | 48 |

CMG | 25.5 |

MCD | 20.6 |

YUM | 20.5 |

DPZ | 19.5 |

WEN | 15.5 |

QSR | 14 |

TXRH | 12.7 |

EAT | 12.5 |

DRI | 11.6 |

JACK | 8 |

CAKE | 7.8 |

PLAY | 4.9 |

(*): Estimates, based on the companies' Q1 2023 results, guidance for 2023 and closing prices as of 05/12/2023

(**): Enterprise Value (EV) includes the finance/capital lease liabilities, because they are considered debt, and does not include the operating lease liabilities, because they are not considered debt.

and below:

Company | EV-to-2023 Revenue (*) (**) |

WING | 15.2 |

MCD | 9.9 |

YUM | 7.1 |

QSR | 5.8 |

CMG | 5.9 |

DPZ | 3.9 |

WEN | 3.7 |

JACK | 1.9 |

DRI | 1.8 |

TXRH | 1.7 |

PLAY | 1.1 |

CAKE | 0.6 |

EAT | 0.6 |

(*): Estimates, based on the companies' Q1 2023 results, guidance for 2023 and closing prices as of 05/12/2023.

(**): Enterprise Value (EV) includes the finance/capital lease liabilities, because they are considered debt, and does not include the operating lease liabilities, because they are not considered debt.

The Sky High Key Multiples Aren't Sustainable

I have been a value investor over the last couple of decades, and my decades-long experience has showed to me that sky-high key multiples (i.e., EV-to-Revenue, EV-to-adj. EBITDA) do not last long. Fundamental analysis prevails at the end of the day, driving the stock price sooner or later. Some might say that WING is not an unprofitable cash incinerator, but instead it's profitable with revenue YoY growth, positive operating cash flow and positive free cash flow, so it could continue to trade for long with the sky high EV-to-Revenue and EV-to-adj. EBITDA that are presented in the previous paragraph.

I will tell them that numerous profitable companies from many sectors with revenue YoY growth, positive operating cash flow, positive free cash flow, and sky high key multiples have dropped a lot over the last years, so their valuation has come to more reasonable levels, based on absolute and relative valuation analysis. For instance, some of the most recent examples are Etsy (ETSY), Chewy (CHWY), YETI Holdings (YETI), CrowdStrike (CRWD), Okta (OKTA), Datadog (DDOG), Salesforce (CRM), The Trade Desk (TTD), Canada Goose (GOOS), Tesla (TSLA), Match Group (MTCH), PayPal (PYPL), Global Payments (GPN) etc.

And if you do not believe me, check their 2-year charts. The 2-year charts for the aforementioned companies say it all. Please also visit SA's valuation tab for all these tickers to confirm their sky high key multiples in 2021 and 2022.

Principal Shareholders

According to the most recent proxy statement, insiders own just 107,000 shares or just about 0.3% of the total outstanding shares, as illustrated below:

| Shares Beneficially Owned | ||||||||

Name and Address of Beneficial Owner | Number | % ofClass | ||||||

Non-Employee Directors: | ||||||||

Krishnan (Kandy) Anand | 3,639 | * | ||||||

Lynn Crump-Caine | 7,578 | * | ||||||

David L. Goebel | 5,873 | * | ||||||

Michael J. Hislop | 12,844 | * | ||||||

Kate S. Lavelle | 3,751 | * | ||||||

Kilandigalu (Kay) M. Madati | 6,356 | * | ||||||

Wesley S. McDonald | 6,810 | * | ||||||

Ania M. Smith | 1,164 | * | ||||||

Named Executive Officers: | ||||||||

Michael J. Skipworth | 28,755 | * | ||||||

Alex R. Kaleida | 4,001 | * | ||||||

Donnie S. Upshaw | 12,129 | * | ||||||

Albert G. McGrath | 11,779 | * | ||||||

Marisa J. Carona | 2,313 | * | ||||||

Charles R. Morrison | 0 | * | ||||||

Stacy Peterson | 2,004 | * | ||||||

All directors and current executive officers as a group (14 persons) | 106,992 | * | ||||||

| * | Less than one percent of Common Stock outstanding |

Therefore, WING is mainly owned by institutional investors. According also to this list, more than 150 institutions own WING, and the beneficial owners of more than 5% of the common stock are illustrated below:

| Shares Beneficially Owned | ||||||||

Name and Address of Beneficial Owner | Number | % ofClass | ||||||

| BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 3,532,122 | 11.79% | ||||||

| The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | 2,931,959 | 9.78% | ||||||

| Wellington Management Group LLP c/o Wellington Management Company LLP 280 Congress Street Boston, MA 02210 | 2,745,890 | 9.16% | ||||||

| T. Rowe Price Associates, Inc 100 E. Pratt Street Baltimore, MD 21202 | 2,318,081 | 7.74% | ||||||

| American Century Investment Management, Inc. 4500 Main Street 9th Floor Kansas City, Missouri 64111 | 2,036,381 | 6.80% | ||||||

Seven Additional Reasons And Catalysts

In my opinion, there are additional reasons and potential negative catalysts that could push WING much lower in the next months, bringing its valuation in line with peers', such as:

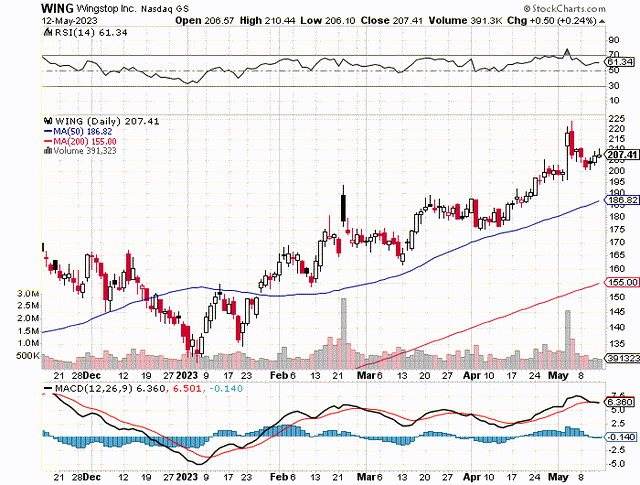

1) WING has become a momentum stock since last summer: WING has gone from $135 in January 2023 to $205 today, as illustrated below:

WING has also risen more than 200% since last summer, hitting an all-time high a few days ago, as illustrated below:

As a result of this strong uptrend over the last ten months, WING has been featured in many articles as a top momentum stock, with some of them in the last month alone, including here, here, here, here, and here.

In other words, WING has attracted many momentum funds (funds that use algorithmic trading) and momentum traders who invest based on the idea that the stock will continue moving in the same direction for a certain period of time. However, a direction does not last forever. And when the direction changes, the momentum funds and momentum traders dump the stock, so the drop is accelerated.

2) Institutional investors and portfolio rebalancing: As shown above, WING is owned by more than 150 institutional investors. Obviously, they are too many. And this is a big negative because all these fund managers do not think the same way and do not follow the same strategy, but they rebalance their portfolio with different criteria and at different timings. They do this rebalancing, because they have to control their portfolio risk, while also locking in profits from their winners and implementing a stop loss strategy for their losers.

To say it differently, they rebalance their portfolios, because they have to show results, as institutional investors compare their own returns to the returns of an index. This rebalancing happens regularly, and the more funds do it during the same period, the worse for the stock. And WING has been a big winner for all these funds over the last months, because it has risen more than 50% year-to-date and more than 200% since last summer, hitting all time high a few days ago.

3) Food safety issues: Food safety issues in the restaurant industry are real and happen out of the blue. For instance, Chipotle Mexican Grill, Inc.'s (CMG) reputation and stock suddenly took a big hit when a series of foodborne illness outbreaks due to norovirus, salmonella and E. coli sickened many people between 2015 and 2018. A few years ago, MCD and Fresh Del Monte Produce (FDP) suffered from cyclospora parasite issues. As also shown here and here, JACK, Burger King (QSR), Yum China's (YUMC), Taco Bell (YUM), and Chi Chi's are also some of the names in the list with food safety issues in the U.S. over the last years. That said, no restaurant chain including WING is immune to such incidents, so food safety issues could hit its reputation and its stock at any time. WING admits it in its annual report, as quoted below (emphasis added):

Food safety is a top priority, and we dedicate substantial resources so that our customers enjoy safe, high quality food products. However, food-borne illnesses, such as salmonella, E. coli infection, or hepatitis A, and food safety issues, including food tampering or contamination, have occurred in the food industry in the past, and could occur in the future. Any report or publicity linking our restaurants to instances of food-borne illness or food safety issues could materially adversely affect our brand and reputation as well as our revenue and profits. Even instances of food-borne illness or food safety issues occurring solely at our competitors' restaurants could result in negative publicity about the food service industry or fast casual restaurants generally and adversely impact our restaurants.

In addition, our reliance on third-party food suppliers and distributors increases the risk that food-borne illness incidents could be caused by factors outside of our control and that multiple restaurants could be affected rather than a single restaurant. We cannot ensure that all food items are properly maintained during transport throughout the supply chain or that our employees and our franchisees and their employees will identify all products that may be spoiled and should not be used. Our industry has also long been subject to the threat of food tampering by suppliers, employees, and others such as the addition of foreign objects in the food that we sell. Reports, whether or not true, of injuries caused by food tampering have in the past severely injured the reputations and brands of restaurant chains in the quick service restaurant segment and could affect us in the future as well. If our customers become ill from food-borne illnesses or injured from food tampering, we could also be forced to temporarily close some restaurants. Moreover, any instances of food contamination, whether or not at our restaurants, could subject our restaurants or our suppliers to a food recall pursuant to the Food and Drug Administration Food Safety Modernization Act."

4) Bird flu outbreaks: WING has exposure to many suppliers for its chicken, as quoted below (emphasis added):

The principal raw materials for a Wingstop restaurant operation are bone-in and boneless chicken wings, tenders, and chicken fillets. Therefore, chicken is our largest product cost item and represented approximately 60% of all purchases for the 2022 fiscal year. Company-owned and franchised restaurants purchase their bone-in and boneless chicken wings, chicken tenders, and chicken fillets from suppliers that we designate and approve. Our chicken supply is diversified both geographically and with a broad range of suppliers supporting the Wingstop system. We designate sources for potatoes to ensure that they are grown to our specifications. We also require franchisees to use our proprietary sauces, seasonings, and spice blends and to purchase them and other proprietary products only from designated sources."

However, the bird flu outbreaks have become a part of the recent history of the American poultry industry. As a reminder, the deadliest U.S. bird flu outbreak in history took place in 2022, when a highly contagious bird flu virus triggered the deaths of some 52.7 million animals. But last year's incident was not alone. There was another bird flu outbreak on the poultry industry in the U.S. in 2014-2015, when more than 50 million birds died. And a bird flu outbreak could impact WING negatively both through inflationary pressures along with supply-chain problems and by making its customers avoid its chicken dishes for some period of time. WING admits it in its annual report, as quoted below:

Additionally, avian influenza, or similar poultry-related diseases, may negatively affect the supply chain by increasing costs and limiting availability of chicken. As a result, we may not be able to anticipate or successfully react to changing food costs, including the price of bone-in chicken wings, by adjusting our purchasing practices, increasing our menu prices to pass along commodity price increases to our customers or making other operational adjustments, which could materially adversely affect our operating results."

5) WING and full dependence on PFGC: WING is dependent on only one distributor with all food items and packaging goods for Wingstop restaurants being currently sourced through one distributor with 17 geographically diverse distribution centers. This lack of distribution diversification is dangerous, because problems with the specific distributor could arise at any time and could result in interruptions or failures in the delivery services preventing the timely or successful delivery of products. WING's distributor is Performance Food Group Company (PFGC), as quoted below:

All food items and packaging goods for Wingstop restaurants are currently sourced through one distributor, Performance Food Group (“PFG”). Currently, there are 17 geographically diverse PFG distribution centers, which carry all products required for a Wingstop restaurant and service all of Wingstop’s domestic restaurants. PFG is contractually obligated to deliver products to our restaurants at least twice weekly. PFG provides consolidated deliveries with a tightly controlled and monitored cold chain. Its national distribution system has a documented recovery plan to handle any disruption. Wingstop contracts directly with manufacturers to sell products to PFG, who in turn receives a fee for delivering these items to our restaurants. The majority of Wingstop’s highest-spend items are formula or fixed-contract priced. Wingstop has also negotiated agreements with its soft drink suppliers to offer soft drink dispensing systems, along with associated branded products, in all Wingstop restaurants."

6) Fierce competition will become fiercer: WING has not discovered the cure for cancer. WING sells bone-in and boneless chicken wings, tenders, and chicken fillets with 11 flavors. WING does not own any proprietary technology or any patents including any patents for its 11 flavors, according to its annual report. Meanwhile, there are numerous chicken restaurant chains in the U.S. with the list including casual dining, fast casual and fast food restaurants. And the competition in the U.S. will become even more intense in the next couple of years, which will impact negatively WING's future performance of existing and new franchise restaurants, in my opinion.

On that front, many existing restaurant chains will build a lot of new restaurants including chicken restaurants while new players join the chicken restaurant list, as shown here and here.

For instance, YUM has opened a new restaurant every hour over the past two years and plans to continue on this path, while privately-held Dave’s Hot Chicken that has secured investments from famous backers such as hip-hop star Drake, Tom Werner, the Boston Red Sox chairman, and actor Samuel L. Jackson is on track to be the fastest growing chain ever with plans for additional openings in the next couple of years. Specifically, Dave's Hot Chicken plans to add at least another 70 locations this year alone and expects to open between 70 and 100 new chicken restaurants annually.

7) High inflation impacts negatively discretionary budgets: There is no question that high inflation weighs on consumers' purchasing power, so WING's customer base will be under pressure in the next months, which means that they could save on eating out or they could go to quick-service chicken restaurants that are cheaper than WING.

Risks

Are there any factors that can challenge this bearish thesis and can drive the stock price upwards? Frankly speaking, I can hardly find any.

First, it could be positive market sentiment. In other words, the stock market may climb higher, so the positive market sentiment could help WING's stock exceed $207 in the next months.

Second, it could be a company-specific factor. For instance, WING may announce that domestic same store sales would remain in high double digits for the remainder of 2023.

Takeaway

The market overplayed the domestic same store sales metric a few days ago, when Q1 2023 results were out, so Wingstop Inc. stock rose and currently stands at about $207 per share. But market participants ignored everything else, including the fact that the bar in Q1 2022 was very low due to COVID-19.

After all is said, I strongly believe that Wingstop Inc.'s current valuation is not justified. Actually, there are eleven reasons and catalysts where either one or a combination of them could lead WING stock much lower than $207 per share. In other words, I strongly believe that a sharp correction is a matter of time.

Value Digger is a former fund manager with more than 30 years of investment experience. Since 2016, he has consistently beaten the market thanks to select long ideas (high-yield dividend stocks & value stocks) and short ideas from many sectors. Since 2016, he has locked in profits from more than 170 picks making about 45% per pick (average return). As a result, Value Investor's Stock Club (VISC) is one of the most-subscribed services for value investors on Seeking Alpha. See the 5-star ratings and outstanding reviews here and sign up for a 2-week Free Trial here!

This article was written by

Additionally, he is a Seeking Alpha Author with one of the highest Followers per Article (F/A) rates. His F/A rate in Seeking Alpha far exceeds 30 followers per article. Also, he has created a big community of deep value investors and launched "Value Investor's Stock Club" (VISC) on Seeking Alpha in 2016. VISC is a value research service with select long and short ideas from different sectors.

His quarterly performance reviews illustrate his high returns and are available to his subscribers. For reference, when Value Digger was managing money in the early 2000s, his Portfolio's annual ROI consistently exceeded 50%. His research is based on a comprehensive review of company-specific and sector-related factors, macro conditions and competitors.

After 30+ years of investing experience, Value Digger has formulated a deep understanding of valuation analysis and his investment philosophy is firmly grounded in Ben Graham-style value-oriented opportunities that often have an asymmetric risk/reward profile. On that front, he has created a proprietary database with thousands of publicly-traded companies, which helps him discover big disconnects, spot the bargains (long ideas) and the bubbles (short ideas) before many investors find them.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of WING either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.