HDRO: Hydrogen Hits Peak Pessimism But A New Policy Regime Awaits

Summary

- Once a high-flying trading meme, the hydrogen sector has hit peak pessimism.

- With 300 hydrogen projects targeting heavy transport being developed worldwide, the Defiance Next Gen H2 ETF is well-diversified to capture this fifteen year secular trend across the developed world.

- 7 to 10 DOE-subsidized regional H2 hubs will be announced this September, offering more than $8 billion in subsidies.

- Anticipating the announcement and new base of public-private partnership support, expect to see this washed out sector industry to rally in the Fall.

Scharfsinn86

The Defiance Next Gen H2 ETF (NYSEARCA:HDRO) was launched two years ago, arguably five weeks after the peak of the Pandemic Mania, when Robinhood traders --idling in the dead of winter and kindling a stack of Covid checks-- bid up all things future-forward. Like fintech, EVs, and the metaverse, the hydrogen industry was one of those sites of core speculation, with Plug Power –its standard-bearer of excess-- reaching $73 on January 26, 2021.

Because of this broader market context, HDRO has arguably experienced a downdraft of underperformance since its inception, arriving too late to the party and now down a full 69% since its launch (March 9, 2021).

However, this summer might offer an inflection point for the industry. Technically, the sector feels washed out and more importantly, it should see substantial revenue growth in 2024 as major US subsidies start to roll in.

A Pure Play ETF:

Defiance Next Gen H2 ETF is a passive fund that mimics the BlueStar Global Hydrogen and Next Gen Fuel Cell Index. It tracks the performance of a wide group of globally listed equities, specifically those companies that generate at least 50% of their revenue from their involvement in the development of hydrogen-based energy sources, fuel cell technologies, and industrial gases.

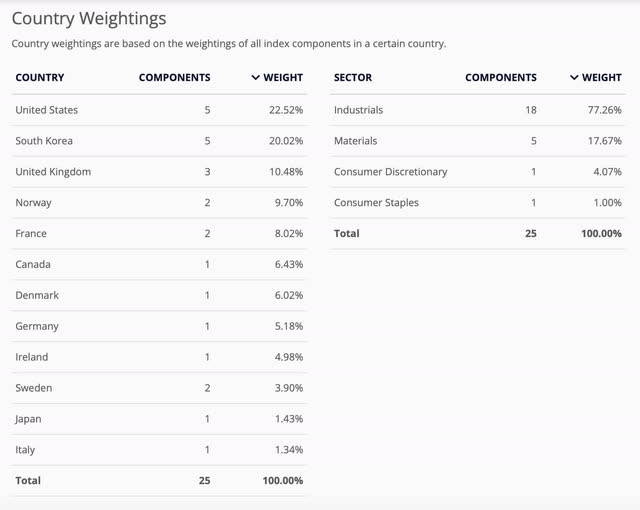

The ETF is quite diversified: the maximum weight of each holding is 10%, and it is very international in scope, with 77.5% of the portfolio non-US:

HDRO_Country Weightings (MarketVector.com)

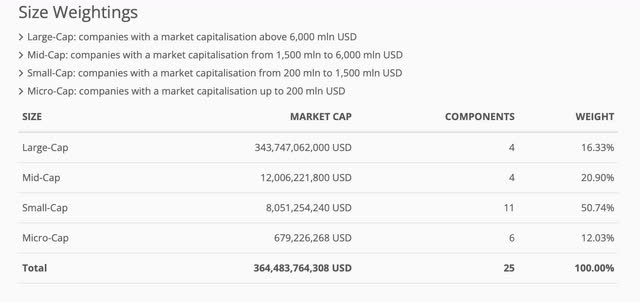

It is also very exposed to small cap companies, with 50% of its holdings being that category:

HDRO market Cap weightings (MarketVector.com)

With an expensive ratio of .30% and around $35 million AUM, it is comparable to its two pure play ETF competitors –HYDR and HJEN. Like HDRO, they are both passive funds, each following a distinct index, which most saliently predicates the percentage of hydrogen-specific revenue required of each holding as well as (less directly) its international weighting.

HYDR requires high hydrogen-specific revenue and is 69% non-US, perhaps as its index was formulated by Solactive, a German index provider. HJEN employs the Indxx Hydrogen Economy Index, which permits holding self-described “quasi-plays” and “marginal plays.” These are companies with less than 50% (or less than 20%) of revenues from hydrogen.

This loose approach allows HJEN to tap oil companies like Shell or BP, as well as its second-largest holding, Air Liquide, an industrial gas conglomerate which has spiked since the pandemic. This explains how HJEN has outpaced its competitors by 13-14% in a year-over-year comparison:

Pure Play Hydrogen ETFs: year-over-year performance (Seekingalpha.com)

International Holdings:

Unlike “grey hydrogen” which is typically derived by a fossil fuel like natural gas, “green hydrogen” is created using renewable energy --wind, solar, and hydroelectric—which then power the electrolyzers which will separate water into hydrogen and oxygen or generate electricity (from hydrogen) itself.

Many of the “pure play” firms held by HDRO typically create these electrolyzers, as well as the fuel cells, H2 distributions systems, or the vehicles that utilize the technology. Canada’s Ballard, South Korea’s Doosan, and Plug Power --second, third, and fifth in the ETF’s top holdings-- are all fuel cell makers.

HDRO is focused on industrial companies and offers a wide and balanced international exposure. Seven out of its top ten holdings are non-US companies, and often obscure to the American investor. For example, Green Hydrogen Systems is a Danish company that is at the crux of the transition from diesel to hydrogen, tapping that nation’s robust wind power investments. It is a go-to player with institutional knowledge for what are commonly known as "H2RES projects" on the continent, specifically those designed to create a large-scale conversion of renewable energy to hydrogen for heavy transport.

Its electrolyser tech is part of a pioneering wind-to-hydrogen project near Brande, Denmark that links to a Siemen’s wind turbine, porting carbon-neutral electricity into hydrogen production, which will be then stored for subsequent distribution and used as a fuel for hydrogen-powered buses and taxis. It operates in "island-mode" production, which means it is separate from the electrical grid offering a robust alternative network and avoiding curtailment issues.

NEL, HDRO’s top holding, is a century-old Norwegian firm with a lot of experience in Europe but one that is now taking a larger profile here in the US. On May 3, the company announced an agreement with Michigan to build a new $400 million automated gigawatt electrolyser manufacturing facility in the state.

Future Driver: The Buildout of Heavy Transport Infrastructure

There are now 300 green hydrogen projects under construction worldwide. Europe is certainly ahead, but what should be interesting to the potential investor is that US hydrogen industry is about to see a decade of major federal-level support, starting in 2024.

The Inflation Reduction Act will provide tax credits of up to $3 per kg of clean hydrogen. This development completely transforms the outlook for green hydrogen in the USA. The Department of Energy --with $8 billion to be disbursed via the Jobs Act—will be subsidizing hydrogen hubs nationwide.

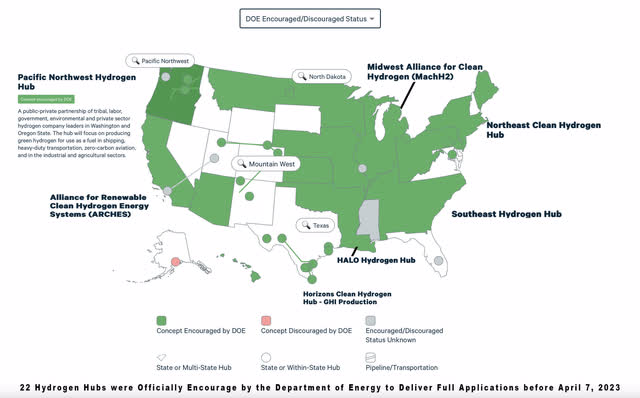

Of the original 79 bids for DOE-subsidized hydrogen hubs, 22 were tapped to send full applications before April 7th. The final “seven to ten” will be chosen this fall.

Here is a map of the states that have had bids accepted, with a few of the major hubs highlighted:

22 Hubs Encouraged / 7 to 10 to be Chosen (Author / Clean Air Task Force website)

Which hydrogen firms are partners in the run-off bids? Though some states are keeping their bids secret, a few are available to the public.

Nel Hydrogen is a partner in the Northeast Clean Hydrogen Hub submission, a proposal includes seven states --New York, Connecticut, Maine, Massachusetts, New Jersey, Rhode Island, and Vermont. It represents a $3.6 billion investment and includes more than one dozen projects across seven Northeast states that advance clean electrolytic hydrogen production, consumption, and infrastructure projects, for hard to decarbonize sectors, including transportation and heavy industry.

Like California, the Northeast hub appears to be a shoe-in. Politically, it is in mostly Democrat Party-controlled jurisdictions, and operationally it is a project with heft. (Scale appears to have mattered to DOE: the agency prioritized the larger endeavors for full application.)

Conclusion:

Green hydrogen remains a capital-intensive, money losing business. Profitability for most firms is far away --a late 2024 or 2025 hypothesis--and investor interest is at a justifiable nadir.

However, the hub partnerships to be issued this fall will give the industry major subsidies and a much clearer glide path to profitability. Whichever locations are chosen this September, these hubs will gradually re-circuit the energy distribution to industry, refining, and heavy transport in their respective regions over the next 30 years.

A pure play hydrogen ETF like HDRO is now at peak pessimism, but --if as an investor-- you give yourself a five-year horizon, it might be worth looking into this summer before the H2 Hubs announcement.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in HDRO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.