Plymouth Industrial Remains Among The Most Undervalued Industrial REITs

Summary

- Plymouth Industrial is a smaller industrial operator with a significant presence in the "Golden Triangle" region of the U.S.

- The company has similar operating metrics and performs on par with their peers in terms of total leasing activity.

- Shares still trade at a sizeable discount, at just over 11x forward funds from operations.

- At current trading levels, I continue to view shares as deeply undervalued in relation to their peer set.

Drazen_/E+ via Getty Images

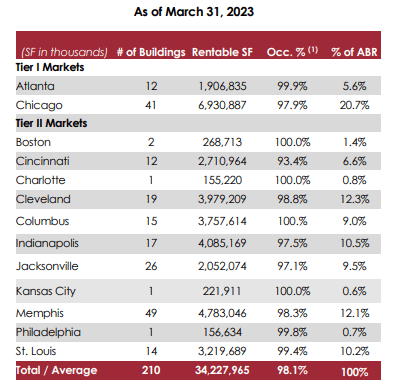

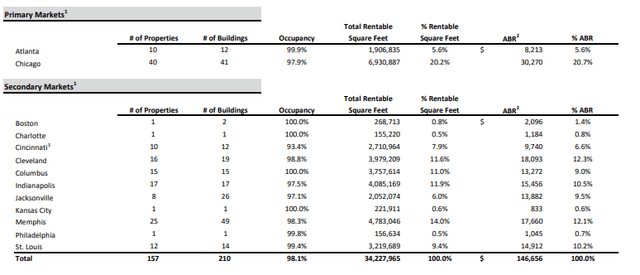

Plymouth Industrial (NYSE:PLYM) owns and operates single and multi-tenant industrial properties, located primarily in the "Golden Triangle" region of the U.S. in both Tier I and Tier II markets.

Among their top markets are Chicago, Cleveland, and Memphis. Together, the three markets represent about 45% of their annualized base rents ("ABR"). And Chicago, itself, accounts for 20% of the total.

Q1FY23 Investor Supplement - Summary Of Operating Regions By % Of ABR

It's also worth noting that Tier II markets account for approximately 75% of their ABR. This is notable since these markets provide key advantages compared to their Tier I counterparts.

These markets, for example, are more affordable for businesses, especially in terms of labor costs. In addition, the markets have a high availability of workers. This serves as a draw to those seeking to readily hire in a competitive labor market.

PLYM is one of the smallest industrials in the peer set, with an enterprise value of just under +$2.0B.

Seeking Alpha - Market Cap Of PLYM Compared To Peers

Shares also trade at the most attractive valuation, at just over 11x forward funds from operations ("FFO"). Similar peers trade in the upper teens and into the 20x range. The discount is due in part to their scale, as well as their debt load, which does track higher than sector averages.

Their results of operations, however, aren't significantly out of range from their competition. Their portfolio metrics, leasing statistics, and same-store growth are all comparable. And at current implied rates, I continue to view PLYM as overly discounted, given their fundamentals. For investors seeking a bargain industrial addition to their long-term portfolios, PLYM remains a worthy buy.

Recap Of Recent Results

At the end of Q1, PLYM's portfolio was 98.1% occupied. This is up 110 basis points ("bps") on a YOY basis but down 90bps sequentially.

The quarter/quarter decline was due primarily to one vacancy in excess of 100K SF during the quarter, as well as the inclusion of 155K SF of newly completed developments currently in lease-up. In the same-store pool, on the other hand, occupancy stood at 99.1%.

Q1FY23 Investor Supplement - Occupancy Summary By Operating Region

Leasing trends were also positive. For those leases commencing in Q1, PLYM experienced a blended 15.9% increase in cash basis rents. Separately stated, new leases were up 37.9%, while renewals realized a 11.7% increase.

It's also worth noting that 21% of their renewal activity was attributable to contractual renewals. While the higher degree of contractual activity did, to an extent, constrain their mark-to-market, they were still able to achieve a blended cash increase of 19.3% for all leases set to commence in 2023.

In addition to making significant headway in the space set to expire in 2023, PLYM also addressed 19% of their initial 2024 expirations. And for these commencements, PLYM will achieve a 14.4% cash increase on these rents. This is better than the 10.1% blended spreads they were able to achieve in the same period last year on their 2023 expirations.

PLYM also made strides in their development pipeline. Through the first quarter of the year, PLYM leased approximately 385K SF of their development pipeline.

This includes the full leasing of two properties in their Atlanta and Maine Markets, for which rent has already commenced and the full leasing one future development in their Jacksonville market, which is expected to be completed in the third/fourth quarters of 2023.

And of the +$61M total expected costs in the first phase of their developments, PLYM has already funded 88% of their total commitment. And looking ahead, the company appears to have the financial capacity to fund the remaining portion.

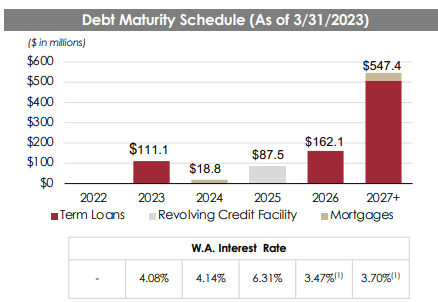

Aiding this capacity is their balance sheet, which has continued to exhibit improvement over prior periods. Their net debt multiple, for example, stood at 7.1x. This is down significantly from 8.8x in the same period last year.

In addition, the company has ample liquidity of about +$280M, comprised of cash on hand, operating expense escrows, and availability on their revolving facility. This level of liquidity is more than enough to satisfy their reoccurring obligations, which includes one maturity later this year.

Q1FY23 Investor Supplement - Debt Maturity Schedule

Why PLYM Remains A Buy

PLYM remains an attractive value addition to any long-term portfolio. Compared to their larger and more highly valued peers, their portfolio metrics and leasing performance is largely comparable. Current occupancy rates, for example, stand in the 98% range. That is on par with the sector average.

Leases are also being signed at significant cash spreads. For new leases commencing in the first quarter, the company realized cash spreads of 38%. And for new signings commencing later in the year, they achieved cash spreads of 31%. Moreover, for new signings set to commence in 2024, the company was able to lock in cash spreads of about 62%.

While the spreads on their renewals were lower, it's important to note that a larger share of their renewals in the current quarter were related to contractual renewals. But despite this, they're still achieving a blended rate of 19.3%, which is in line with their 18-20% mark-to-market opportunity.

Looking ahead, from April 2023 through December 2025, about 46% of base rents are set to expire. This provides clear visibility into continued earnings growth. As it is, the company is already posting sizeable same-store growth. In the current quarter, for example, same-store cash NOI was up 9.1%, and management sees this up 7.5% in 2023.

Given their continued earnings strength and the fundamentals of their portfolio, shares appear undervalued relative to their peers. One can point to their higher debt load as one reason for the discount. But LXP Industrial (LXP), one peer that carries a similar-sized debt load, currently commands a forward multiple of 14.7x. This is several turns above where PLYM currently trades.

In addition, PLYM currently trades at an implied cap rate of about 7%. Others within the sector trade between the 4% and 6% range. Taken together, I continue to view $28/share as a fair price for the stock. This would represent upside potential of over 30% from current trading levels. For investors seeking upside at a modest entry point, PLYM remains one industrial worth a second look.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.