PKW: Buyback Investors Beware, This High-Fee ETF Isn't Worth The Risk

Summary

- PKW selects U.S. companies that have reduced shares outstanding by 5% or more in the last year. Fees are 0.61%, and the ETF manages $920 million in assets.

- The 5% threshold, combined with only utilizing one year's worth of buybacks, leads to high turnover. There is also no mechanism to remove current constituents that pause their buyback programs.

- PKW's ten-year returns, as well as the results of the S&P 500 Buyback Index, suggest trailing buybacks are not a good leading performance indicator.

- While PKW trades at an attractive 13x forward earnings, constituents are only of average quality, a surprising find for a group of stocks that should be flush with cash. Low sales growth is common.

- I rate PKW a sell. While the ETF can outperform the market from time to time, there are alternatives. This article features a fundamental comparison with DIVB, SYLD, and SPY for your consideration.

- This idea was discussed in more depth with members of my private investing community, Hoya Capital Income Builder. Learn More »

PeopleImages/iStock via Getty Images

Investment Thesis

This article explains why the Invesco BuyBack Achievers ETF (NASDAQ:PKW) is not a good investment choice for dividend or total return investors. By setting a high 5% buyback yield threshold for constituents, the approach means substantial portfolio turnover is likely. Furthermore, there is no mechanism to remove companies that have paused their buyback programs, current components are only of average quality, and PKW's ten-year returns do not justify its unreasonable 0.61% expense ratio. I rate PKW a "sell," and I look forward to explaining why in further detail below.

PKW Overview

Strategy Discussion

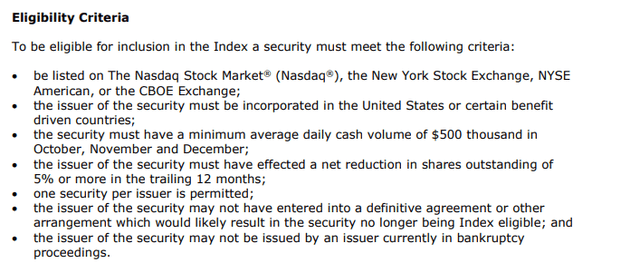

PKW tracks the Nasdaq Buyback Achievers Index, selecting U.S. securities that have reduced shares outstanding by at least 5% over the last year. Evaluations are at the end of January, and the Index is market-cap-weighted after selections meet the following criteria:

Previously, I compared PKW with the iShares Core Dividend ETF (DIVB). However, in December 2022, DIVB's Index underwent an "exceptional" reconstitution making it more dividend-yield focused rather than on buybacks. I believe these changes harmed the ETF fundamentally. However, I will still use DIVB as a comparator for this article alongside the actively-managed Cambria Shareholder Yield ETF (SYLD). Despite active management, SYLD's 0.59% expense ratio is competitive with PKW's 0.61%.

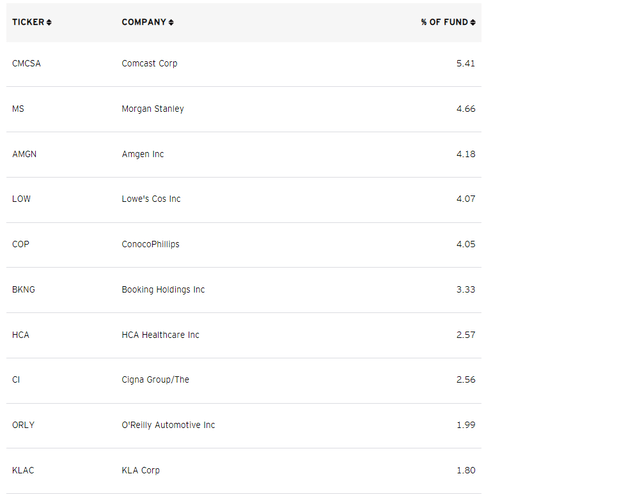

One distinction is that PKW evaluates securities based on one-year buybacks, while DIVB uses two years. This methodology difference can have enormous implications. For example, consider Amgen (AMGN), PKW's third-largest holding. It qualified because of $6.36 billion buybacks in Q1 2022 but has not repurchased shares since. HCA Healthcare (HCA) and The Cigna Group (CI) are PKW's other largest Health Care holdings.

It's a reminder that PKW is backward-looking. It won't necessarily select companies with strong future buyback programs, just ones that did previously. Furthermore, with a sensitive 5% buyback threshold, high turnover is likely. PKW's holdings more than doubled this year (313 vs. 152), with top names like Oracle (ORCL), Bank of America (BAC), and Dollar General (DG) removed. The Index added 221 companies, though many may be deleted next January after only a one-year stint.

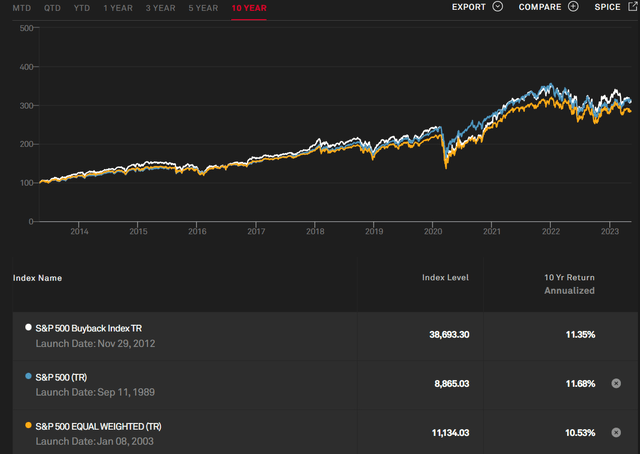

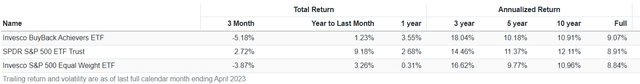

The evidence suggests buybacks are not a good indicator of future performance. Consider the ten-year results of the S&P 500 Buyback Index, an Index of the 100 S&P 500 stocks with the highest buyback ratios. The Index has underperformed the S&P 500 Index by 0.33% per year. It's not a perfect proxy since the Buyback Index is equal-weighted. Still, even if the S&P 500 Equal Weight Index is a better comparator, the Buyback Index's outperformance is mostly offset by PKW's 0.61% fees.

Sector Exposures and Top Ten Holdings

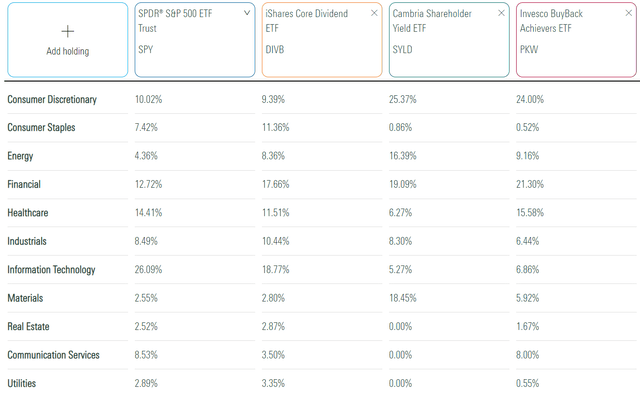

Sector exposures for PKW, DIVB, and SYLD are below, including the SPDR S&P 500 ETF (SPY) for reference purposes. SPY is a large-cap blend ETF, while the others are value-oriented and avoid most mega-cap stocks.

PKW and SYLD are similar: each overweight Consumer Discretionary but underweight Consumer Staples and Technology. However, PKW is 8% Communication Services, unusual for a value-oriented ETF. That's mostly Comcast (CMCSA), the top holding that recently expanded its share purchase authorization program to $20 billion. Morgan Stanley (MS) did the same in June 2022, while Amgen has paused its buyback program, as discussed earlier. These three companies comprise 14% of PKW.

Performance Analysis

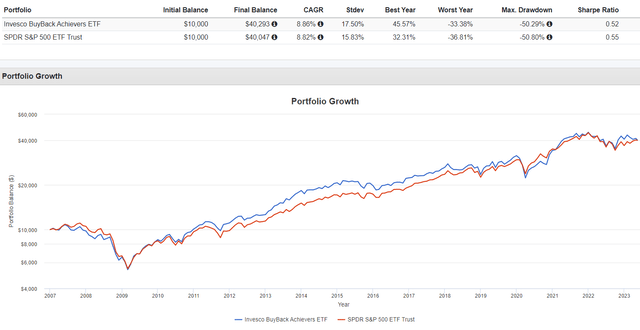

Since November 2006, PKW has outperformed SPY by 0.04% per year despite the higher expense ratio. However, due to higher volatility, SPY's risk-adjusted returns (Sharpe Ratio) were superior.

Three years contributed to PKW's outperformance:

- 2008: -33.38% vs. -36.81%

- 2009: 31.25% vs. 26.36%

- 2013: 45.57% vs. 32.31%

Since then, returns have been less strong, with PKW underperforming by 2.21% per year since January 2014. These results are reflected in the ten-year historical returns below, and as shown, PKW has also slightly lagged behind the Invesco S&P 500 Equal Weight ETF (RSP).

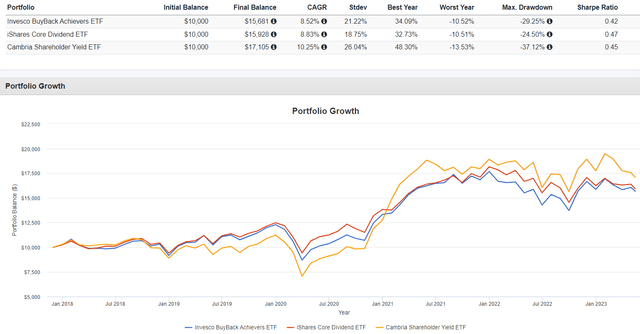

Long-term comparisons with DIVB and SYLD are misleading because their methodologies have recently changed. DIVB changed its screening process in December 2022, and SYLD switched to active management in June 2020. Nevertheless, here is a performance comparison since December 2017.

PKW's 8.52% annualized return was the lowest, but let's evaluate each ETF's current fundamentals to understand the risk/reward picture better.

PKW Fundamentals

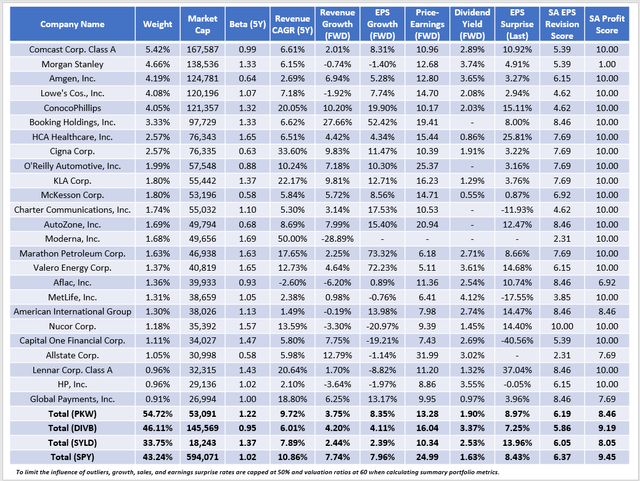

The following table highlights selected fundamentals for PKW's top 25 holdings, totaling 55% of the ETF. Summary metrics for PKW, DIVB, SYLD, and SPY are provided in the final rows.

PKW is the most concentrated, partially a result of its market-cap-weighting scheme. Its 1.22 five-year beta also indicates it's more volatile than DIVB and SPY because it avoids the mega-cap stocks that drive market returns. This feature could be beneficial from a diversification perspective, as there's only a 6% overlap between the funds. However, the downside to these deep-value funds is usually more risk. PKW trades at just 13.28x forward earnings, but few constituents have impressive expected sales growth rates. The weighted average for the portfolio is 3.75%, between DIVB and SYLD but less than half of SPY. I consider these weak and expect them to underperform in rising markets. Already in 2023, PKW has trailed SPY by almost 10%.

PKW has a much better 8.35% estimated EPS growth rate due to the buyback feature, which reduces outstanding shares and improves earnings per share. However, I'm concerned those estimates may not materialize if buybacks don't meet analyst expectations. Ironically, even prudent management decisions may be viewed negatively, like pausing a buyback program to conserve cash for a possible recession.

Finally, PKW has a 1.90% gross dividend yield (1.29% net). While dividends aren't the focus, I am disappointed at the portfolio's average 8.46/10 profitability score. It's surprising because companies capable of repurchasing shares should be more profitable than most. However, the average profitability score for diversified ETFs with market capitalizations between $25 and $75 billion is 8.23/10, so it's not much of an improvement. SPY's 9.45/10 score is ideal and likely why it typically bounces back strong after downturns.

Investment Recommendation and Conclusion

I don't recommend readers buy PKW. Despite more risk, the reward wasn't there, as PKW lagged SPY over the last ten years in a rising market. The 0.61% expense is unjustified, even though it improves portfolio diversification. In addition, I'm uneasy about using trailing buybacks as the primary input. This screen, combined with the high 5% threshold, leads to a high turnover that might not be beneficial. Furthermore, the timing of reconstitutions means that companies with no current buyback programs, like Amgen, may still have prominent weightings. Other considerations are a low 1.29% expected dividend yield and an average profitability score.

Readers may like SYLD more, especially since it's outperformed PKW since its June 2020 switch to active management. However, the category is a challenging one to pin down. Most are volatile, deep-value ETFs that will likely underperform in a downturn. Nevertheless, I hope you found this analysis helpful, and if you're interested in more detailed research on another similar ETF, please let me know in the comments section below.

The Sunday Investor Joins Income Builder

The Sunday Investor has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I perform independent fundamental analysis for over 850 U.S. Equity ETFs and aim to provide you with the most comprehensive ETF coverage on Seeking Alpha. My insights into how ETFs are constructed at the industry level are unique rather than surface-level reviews that’s standard on other investment platforms. My deep-dive articles always include a set of alternative funds, and I am active in the comments section and ready to answer your questions about the ETFs you own or are considering.

My qualifications include a Certificate in Advanced Investment Advice from the Canadian Securities Institute, the completion of all educational requirements for the Chartered Investment Manager (CIM) designation, and a Bachelor of Commerce degree with a major in Accounting. In addition, I passed the CFA Level 1 Exam and am on track to become licensed to advise on options and derivatives in 2023. In November 2021, I became a contributor for the Hoya Capital Income Builder Marketplace Service and manage the "Active Equity ETF Model Portfolio", which as a total return objective. Sign up for a free trial today! Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.