British American Tobacco: A Weak Outlook

Summary

- Combustibles matter most; don't let management distract you otherwise.

- Combustibles is seeing a broad-based volume and growth slowdown.

- Consumer sentiment indicates further weakness ahead.

- I adopt a 'Strong Sell' rating on British American Tobacco as I anticipate a further rating downgrade.

angel_nt/iStock via Getty Images

Thesis

I am bearish on British American Tobacco (NYSE:BTI) (OTCPK:BTAFF). Here's my 3-point thesis:

- Combustibles matter most; don't let management distract you otherwise

- Combustibles is seeing a broad-based volume and growth slowdown

- Consumer sentiment indicates further weakness ahead

Combustibles matter most; don't let management distract you otherwise

BTI's earnings calls and investor presentations focus a lot on business transition and ESG. However, investors should let this distract them from what the hard numbers show:

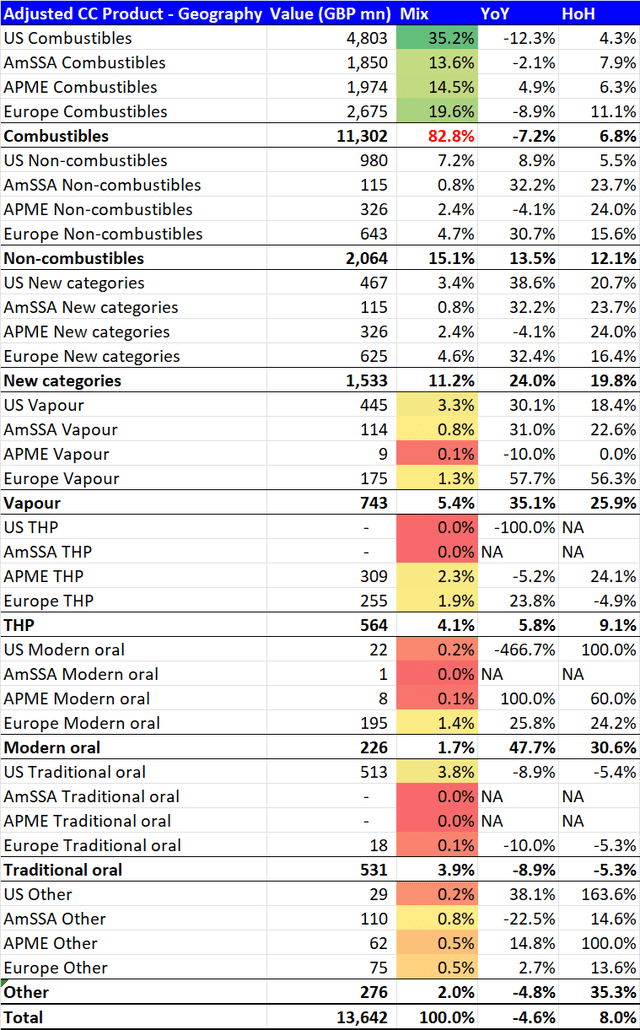

British American Tobacco H2 FY22 Revenue Split (Company Filings, Author's Analysis)

CC stands for constant currency; this is a better measure to assess performance as it excludes the impact of external forces outside management's control such as FX movements

As of H2 FY22, 82.8% of the entire business still comes from combustibles, of which the majority consists of regular cigarettes. It is true that the company is reducing the mix of this segment, however progress has been at a glacial pace:

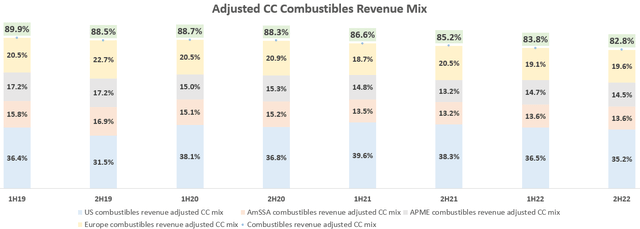

Adjusted CC Combustibles Revenue Mix (Company Filings, Author's Analysis)

Over the last 3.5 years, the combustibles' adjusted CC revenue mix has fallen from 89.9% to 82.8%; a mere 706bps decline. Annualized, this is about a 177bps reduction in the combustibles mix every year. And the growth rate during this time has been a paltry 1.3% CAGR. This is below the 2018 - 2022 industry growth rate of 2.6%.

So BTI is stuck with an underperforming combustibles segment as the primary driver of the stock. The transition to newer categories is not happening fast enough.

Combustibles is seeing a broad-based volume and growth slowdown

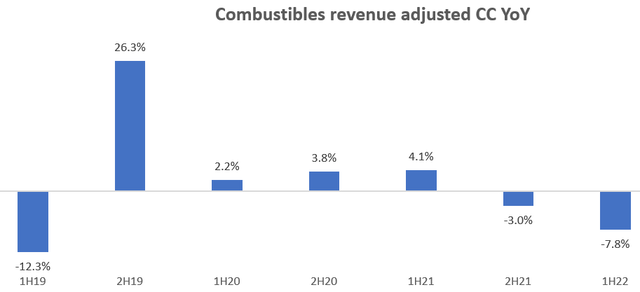

The overall combustibles segment is de-growing at more than 7% YoY for 2 consecutive quarters now:

Combustibles revenue adjusted CC YoY (Company Filings, Author's Analysis)

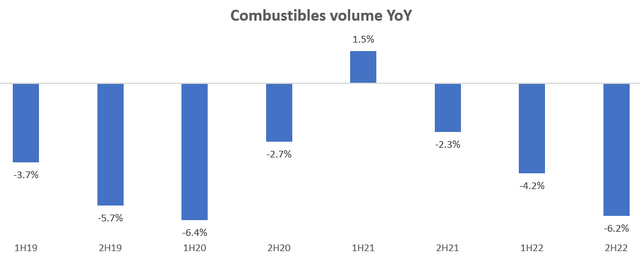

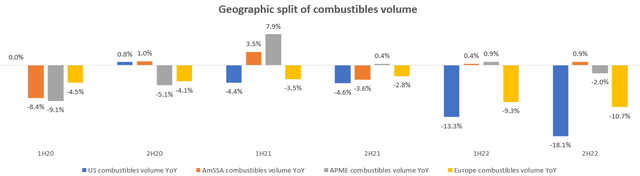

This de-growth is primarily due to an accelerating volume decline:

Combustibles volume growth YoY (Company Filings, Author's Analysis)

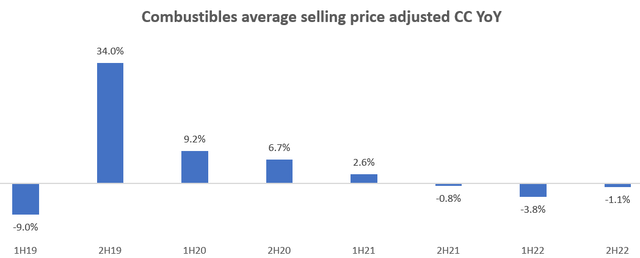

But also a marginal YoY fall in average selling prices:

Combustibles average selling price adjusted CC YoY (Company Filings, Author's Analysis)

This particular attribution for the overall de-growth in the combustibles business is not favorable since volume declines for an addictive product signify meaningful shifts in consumer behavior. It is also surprising that on an aggregate level, BTI has not been able to raise prices in 2022 despite worldwide high inflation during this period.

In the H2 FY22 earnings call, management highlighted a pivot toward value-focused selling strategies:

In the U.S., the market remains more at around 2.5% of total nicotine value and highly competitive. Revenue was up as we pivoted to drive value, reducing promotional support...

- Finance & Transformation Director Tadeu Marroco in the H2 FY22 earnings call, Author's bolded highlight

I believe this exposes BTI to even more intense competition since the value-segment is a prime target for the illegal tobacco trade, which has been gaining share globally.

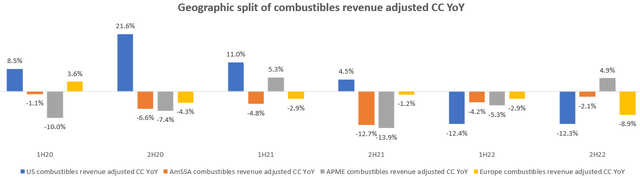

The overall slowdown in the combustibles segment is broad-based across geographies:

Geographic split of combustibles revenue adjusted CC YoY (Company Filings, Author's Analysis)

This is mostly due to a steep drop in volumes in the developed markets of the US and Europe, which make up 35.2% and 19.6% of H2 FY22 combustibles revenues respectively:

Geographic split of combustibles volume (Company Filings, Author's Analysis)

In the H2 FY22 earnings call, management admitted a loss in market share as BTI's volumes fell 500bps more than that of the industry. Pricing pressures as the mix shifts toward value is also leading to a 500bps YoY hit on margins:

Adjusted CC EBIT Margin (Company Filings, Author's Analysis)

Overall, BTI is losing combustible tobacco product market share on both volume and value terms across almost all geographies, which is dragging the margin profile as well. I am skeptical of management's claim of resiliency as I anticipate an increase in competitive intensity as the strategy pivots to focus on 'value', thus taking the formidable illegal tobacco market head-on.

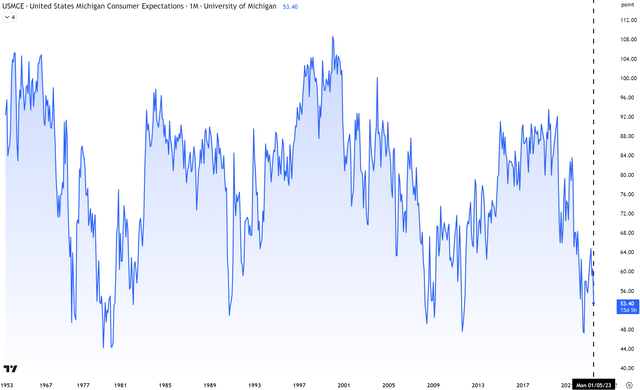

Consumer sentiment indicates further weakness ahead

In the H2 FY22 presentation, management highlighted consumer sentiment to be key macroeconomic indicators that affects BTI's business. A read of this indicators does not paint a rosy picture ahead:

University of Michigan Consumer Expectations (Trading View, Author's Analysis)

The University of Michigan Consumer Expectations index saw a sharp 11.7% fall from 60.5 in April 2023 to 53.4 in May 2023's preliminary release. These figures make me believe combustible volume growth is likely to remain tepid for BTI.

Takeaway

British American Tobacco's combustibles business is the key driver of stock performance as it contributes almost 83% to the overall business' revenues. The transition toward 'cleaner' nicotine products is happening at a rather slow pace.

The combustibles segment has been facing volume pressures across most geographies, which is a worrying sign especially for an addictive product such as cigarettes and other traditional nicotine-based combustible tobacco forms. The average selling price of consumables has also seen a marginal decline as the company has shifted focus toward the value segment. This has led to a YoY 500bps hit on margins. I believe with the value-focused strategy, the loss in volume and value market shares is likely to continue as the company faces increased competitive intensity with the illegal segment of the tobacco market, which operates at lower price points.

Finally, consumer sentiment indicators saw a sharp fall in May 2023, which I think bodes poorly for British American Tobacco. I rate the stock a 'Strong Sell' as I anticipate a further de-rating from the current 1-yr forward PE multiple of 8.90.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.