Investors Turn To ETFs In April While Giving A Cold Shoulder To Funds

Summary

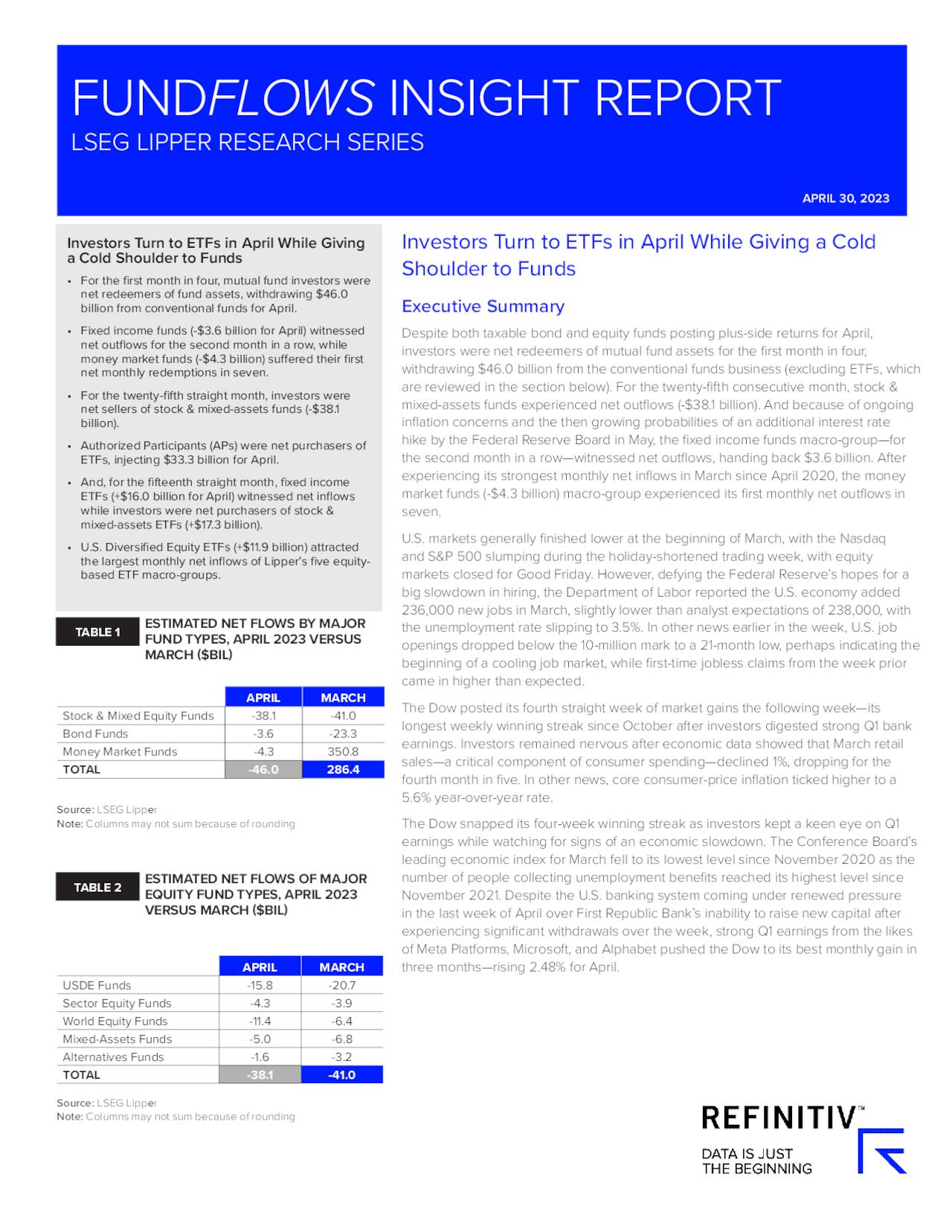

- For the first month in four, mutual fund investors were net redeemers of fund assets, withdrawing $46.0 billion from conventional funds for April.

- Fixed income funds (-$3.6 billion) witnessed net outflows for the second month in a row, while money market funds (-$4.3 billion) suffered their first net monthly redemptions in seven.

- For the twenty-fifth straight month, investors were net sellers of stock & mixed-assets funds (-$38.1 billion).

- APs were net purchasers of ETFs, injecting $33.3billion for April.

- And, for the fifteenth straight month, fixed income ETFs (+$16.0 billion for April) witnessed net inflows while investors were net purchasers of stock & mixed-assets ETFs (+$17.3 billion).

naphtalina/iStock via Getty Images

Despite both taxable bond and equity funds posting plus-side returns for April, investors were net redeemers of mutual fund assets for the first month in four, withdrawing $46.0 billion from the conventional funds business (excluding ETFs, which are reviewed in the section below).

For the twenty-fifth consecutive month, stock & mixed-assets funds experienced net outflows (-$38.1 billion). And because of ongoing inflation concerns and the then growing probabilities of an additional interest rate hike by the Federal Reserve Board in May, the fixed income funds macro-group—for the second month in a row—witnessed net outflows, handing back $3.6 billion. After experiencing its strongest monthly net inflows in March since April 2020, the money market funds (-$4.3 billion) macro-group experienced its first monthly net outflows in seven.

For the twelfth consecutive month, ETFs attracted net new money, taking in $33.3 billion for April. Authorized participants (APs—those investors who create and redeem ETF shares) were net purchasers of stock & mixed-assets ETFs—also for the twelfth month in a row—injecting $17.3 billion into equity ETF coffers. For the fifteenth month running, they were net purchasers of bond ETFs—injecting $16.0 billion for the month. APs were net purchasers of four of the five equity-based ETF macro-classifications, padding the coffers of U.S. Diversified Equity ETFs (+$11.9 billion), World Equity ETFs (+$3.8 billion), Alternatives ETFs (+$1.8 billion), and Sector Equity ETFs (+$18 million) while being net sellers of Mixed-Assets ETFs (-$133 million).

In this report, I highlight the April 2023 fund-flows results and trends for both ETFs and conventional mutual funds (including variable annuity underlying funds).

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.