Stem: The Software Premium Is Gone

Summary

- Stem is down 47% year-to-date, far outpacing the broader decline of clean energy stocks.

- The smart energy storage company saw the fiscal 2023 first quarter non-GAAP gross profit margin grow to 19%. However, net losses more than doubled.

- Stock market investors are increasingly valuing Stem as a hardware company with its historically buoyant sales multiple likely firmly in the past.

Pavel Babic

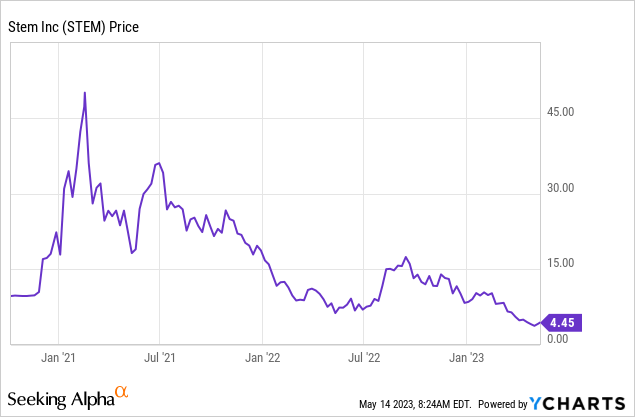

Stem (NYSE:STEM) is down by 47% year-to-date, far outpacing the 3% decline of clean energy ETFs like iShares Global Clean Energy (ICLN). The smart energy storage company has joined in with the broader market chaos that's been deepened by the angst around the health of the US regional banking system. Initial investor enthusiasm around the large opportunities posed by the 2022 Inflation Reduction Act has now been wholly replaced by uncertainty with Stem's large downward move coming against short interest at 20% of its shares outstanding. At risk here is the whole thesis that the transition to zero-carbon sources of energy would catalyze a generational boom in demand for energy storage. I previously covered Stem earlier this year in February.

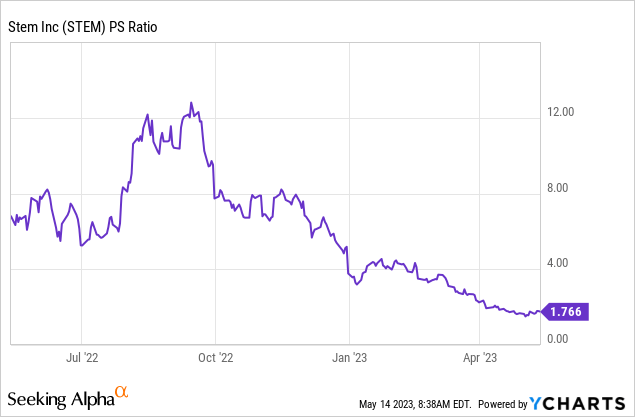

This year-to-date move has happened against what's now a more than 90% fall from early 2021 highs. This brief period in stock market history was defined by unfettered investor euphoria around ESG stocks built on cheap capital. Stem's current price-to-sales multiple stands at 1.77x and continues to trend lower as the old era of cheap liquidity has come to an end on the back of the Fed funds rate being hiked to a level not seen since 2008.

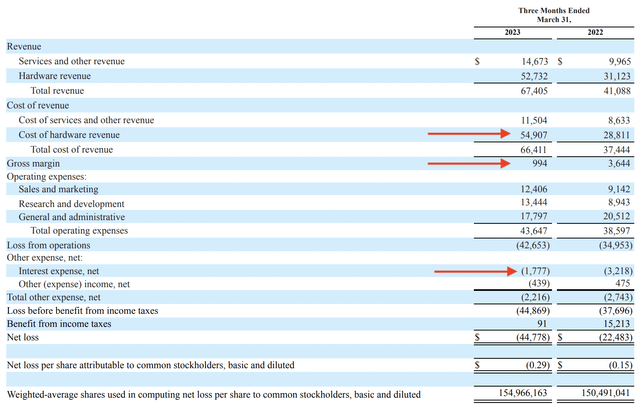

To be clear here, the market now values every $1 of revenue earned by Stem 90% less than it did in the summer of 2022. The company would have to do 10x as much revenue as it currently does to trade on the same market cap as it did in the summer 2022 peak. This is as revenue growth continues to come in strong. Fiscal 2023 first-quarter earnings saw Stem record a beat on revenue but with GAAP gross profit margins seeing some disruption.

Revenue Comes Ahead Of Consensus

Stem fiscal 2023 first-quarter revenue came in at $67 million, an increase of 63.1% over the year-ago comp and a beat by $3.68 million on consensus estimates. This was mostly driven by hardware revenue which jumped to $52.7 million from $31 million in the year-ago quarter. Higher margin service revenue grew by 47% year-over-year to reach $14.67 million. However, GAAP gross profit at $994,000 was a total collapse versus $3.6 million in the year-ago period. This was due to the cost of hardware revenue jumping 90.5% year-over-year to $54.9 million.

Non-GAAP gross profit margins actually increased in line with the company's guidance to reach 19%, up around 300 basis points versus the year-ago quarter. Stem's bullish story is highly dependent on the success of its services revenue as this drives significantly higher margins over low-margin battery sales. The stock market wants to value Stem as a software company and has historically done so but this is changing. Stem's price-to-sales multiple at 1.77x is meant to reflect not only the new risk-off paradigm of the stock market but revenue that is still wholly dominated by hardware sales. The company is behind its initial SPAC guidance that overall non-GAAP gross margins would have been driven to 26% by the end of its fiscal 2022, rising to 32% for fiscal 2023.

Outlook For Profit And Liquidity

Adjusted EBITDA was negative at $14 million and up around $1 million versus the year-ago comp. Net losses at $44.78 million grew by around 100% year-over-year with a net loss per share at $0.29 as the company's weighted-average shares outstanding increased by 2.9% year-over-year to 154.97 million. Whilst, net losses are expected at this stage, the company broadly failed to show progress on profitability during the quarter. Hence, whilst the broader secular growth story remains with its contracted backlog of $1.24 billion, up 119% from $565 million in the year-ago quarter, the market is simply less caring about growth. This switch from growth to profitability has been reflected across a number of different sectors from EVs to tech stocks.

Critically, cash burn from operations came in at $35.8 million during the first quarter, up by 38% year-over-year. This meant cash, cash equivalents, and short-term investments fell to $206 million from $250 million. The bullish story for Stem is being reset. In the long term, the intermittency of solar and wind energy will require a significant expansion of batteries to store and discharge energy. However, the short-term is set to be characterized by a viscous rerating of its multiple. It's important for current shareholders to know that this could go lower even as the long-term case continues to be built out by the decarbonization of the economy. Stem is still a long way away from generating free cash flow and its current liquidity position provides a cash runway of around 6 quarters against its current pace of quarterly cash burn. This opens up the specter of marked dilution with Stem likely requiring an equity raise to extend its runway before the summer of 2024. Against this, Stem is not a clear buy until it shows reduced cash burn in the coming quarters.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.