Clover Health: Strategic Refocus After Learning From Previous Missteps

Summary

- CLOV's revenue decline was expected as management embraced a strategic decision to axe unprofitable accounts.

- Despite the revenue decline, CLOV saw margins in both Medicare Advantage and Accountable Care Organization segments increase.

- The decision to offload unprofitable accounts will allow CLOV to focus on its core business and pursue a more measured but possibly more profitable growth.

- Concerns over the scalability of Clover Assistant persist.

Agustin Orduna/iStock via Getty Images

Author's Note: To fully grasp this article, consider reading previous analyses first. This piece expands on earlier discussions with new insights and developments.

Investment Thesis

In the frenzied landscape of healthcare insurance, Clover Health (NASDAQ:CLOV) is another player in a long line of Medicare Advantage "MA" startups vying for a piece of the pie. The company, like its competitors, is attempting to turn the Center of Medicare and Medicaid Services "CMS" cost-reduction initiatives into profitable ventures. Amid this bustling marketplace, each company is scrambling to find its unique selling point to outshine the rest. Drawing upon an example, Alignment Healthcare (ALHC) waves the flag of superior customer care, advocating a concierge-style approach as its primary selling point. Oscar Health (OSCR) chants the mantra of convenience, offering free telemedicine consultations to draw customers.

Then we have CLOV, championing its commitment to equality and an AI-powered platform to lower costs and better align its operations with the CMS's monetary incentives for quality and equality. Despite this lofty ambition and polished pitch, the reality has been somewhat sobering. The previous article highlighted CLOV's struggles to meet profitability targets and the subsequent axing of its ACO business, which cast doubt on the capabilities of its AI platform "Clover Assistant" and even the replicability of its business model outside of its core New Jersey market.

Despite these setbacks "and possibly drawbacks," there are compelling reasons to keep a watchful eye on CLOV in light of its valuation and recent results. Following its strategic decision to drop its unprofitable accounts, the company may be smaller but arguably also stronger and more focused. The rest of the case for cautious optimism is detailed in the following paragraphs.

First Quarter Earnings

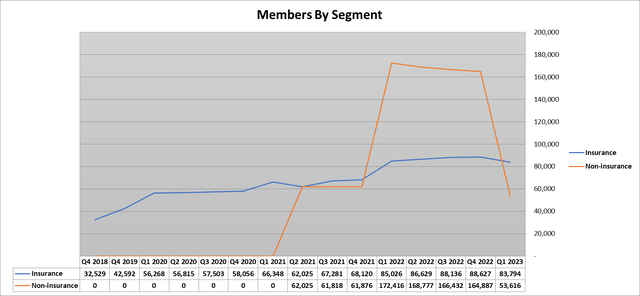

The latest financial results from CLOV reveal a mixed bag of developments. As expected, the company's revenue declined after strategically cutting a significant portion of its ACO business, now rebranded ACO REACH by the Biden administration. In November, I was among the first to report on this expected downturn, factoring in a projected 50% decrease in ACO revenue for 2023. Recent figures reveal a sharper decline in the business segment than I had initially forecasted, with a steeper drop of 65%, bringing the segment's quarterly sales to $205.8 million.

However, the bright spot in this scenario is the substantial increase in margins in both the Medicare Advantage "MA" and ACO segments. The company also benefited from the recent CMS star-rating upgrade for its flagship insurance plan, which took effect in January 2023. However, with a 3.5-star rating, CLOV is essentially on par with industry averages. For context, 90% of Alignment Healthcare (ALHC) members are under a 4-star plan, and to my knowledge, one can speak of comparable figures for Humana (HUM) and UnitedHealth Group (UNH).

Author's estimates based on CLOV filings

Interestingly, CLOV was cash flow positive for the quarter. However, it's essential to note that this is largely due to the timing of payments from the CMS. On a run-rate basis, management expects operating cash flow to normalize with historical averages, essentially returning to an operating cash outflow.

Similar to what happened in Q3 of last year, we received both the March and April MA payments from CMS during the month of March. This resulted in an unusual working capital effect, temporarily elevating Q1 cash by about $108 million at both the regulated entity level and on a consolidated basis. This effect would normalize in Q2. Scott Leffler, CFO, Q1 2023 earnings call

There is also a second anomaly. The decision to shed unprofitable operations naturally led to a decline in the ACO segment members. What was unexpected, however, was a decrease in the number of members in the MA segment. This is the first time that CLOV reported a decline in members after an enrolment season. This decrease is perhaps due to competition but also possibly due to the spill-over effect from axing relationships with ACO providers. Another possible explanation is the new CMS rules targeting aggressive marketing practices for Medicare Plans. The uncertainty created by the lack of growth in the number of MA members will linger until the next enrolment season in October-December. Unless CLOV announces new member additions by season-end via a press release, investors must wait until management reports Q4 results in late February or early March 2024.

Author's estimates based on CLOV filings

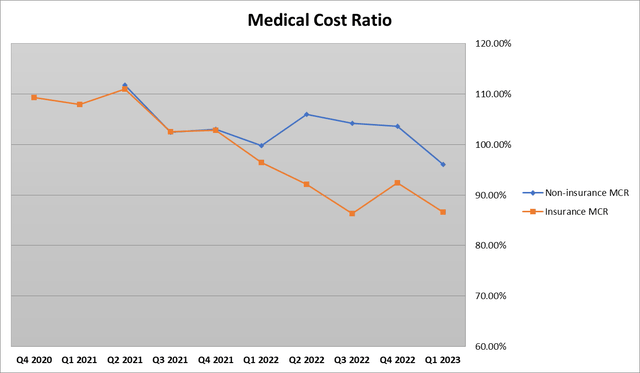

Looking ahead, CLOV management anticipates a decline in the ACO segment's margins to 100% MCR, essentially operating at a gross margin breakeven level. Management attributes this forecast to "events from the previous quarters," data lags, and benchmark decisions, although the exact reasons remain unclear to me. Management cited difficulties in evaluating performance due to uncertainties regarding CMS's rulings. Still, the company's CFO provided updated guidance for the year:

We are increasing our revenue guidance for the Insurance line of business to between $1.18 billion and $1.23 billion. We are also improving Insurance MCR guidance to a range of 87% to 89%. We are maintaining our previous Non-Insurance revenue guidance at a range of $750 million to $800 million and MCR of between 98% and 100%.

These metrics cannot yet be updated due to the previously mentioned lag on data and key benchmarks under the program. As mentioned, we will not realize the full effect of our recently announced transformation and cost savings initiatives until 2024. So, while we remain focused here, we are maintaining our previously issued guidance for adjusted SG&A of between $315 million and $325 million - Scott Leffler, Q1 2023 earnings call. Scott Leffler, CFO, Q1 2023 earnings call

The recent improvements in CLOV profitability metrics and the expected stabilization of the ACO segment have helped to alleviate some concerns over the company's rapid expansion in loss-making ACO ventures.

I believe that we now arrived at a pivotal juncture where the primary focus has shifted towards substantiating CLOV's business concept. This shift implies that by focusing on creating economies of scale, CLOV has the potential to pivot successfully into profitability.

While the ACO segment played a crucial part in this strategy, the decision to offload unprofitable accounts should allow the company to concentrate on pursuing profitable growth. I, however, still stand by my previous conclusion that axing the ACO business mirrors the limits of the much-touted capabilities of its Clover Assistant and the challenges CLOV faces in expanding its model into new markets.

Our strategy of prioritizing our core markets has also generated a greater portion of returning members in our population mix than in years past and has granted us a better line of sight into our members' care needs. In the near term, this intentional focus on member retention is one of the key levers for our path to profitability as it strongly affects MCR from both a revenue and a care management perspective. Andrew Toy, CEO, Q1 2023 earnings call

Growth is likely to proceed at a more measured pace as management has learned valuable lessons from its overly ambitious ACO expansion. Early signs of this more cautious growth mindset are evident in the launch of new initiatives, such as Clover Home Care, rolling out the service in its home market, New Jersey. Management believes that this more cautious approach promises to deliver steady advancements going forward.

So, with Clover Home Care, I'd remind that we're really excited about that particular initiative, and it is mainly serving in our New Jersey markets right now, which is where we launched the program. We've matured it there. We're excited by the results that we see. So, we have planned and thoughts about how we might bring it to other markets. Andrew Toy, CEO, Q1 2023 earnings call

Summary

While CLOV has faced struggles, including failure to meet profitability targets and the subsequent axing of thousands of members, its recent performance points to a smaller but potentially stronger company. Despite the revenue downturn, CLOV saw an increase in margins in both MA and ACO segments, thanks to a recent CMS star rating upgrade, which places it on par with industry averages. The improvements in profitability assuaged concerns over its rapid expansion into loss-making ACO ventures. CLOV now finds itself at a point where the focus has shifted towards leveraging operations through scale and adding new members. The decision to offload unprofitable accounts should allow the company to concentrate on pursuing profitable growth. This isn't going to be a walk in the park, and the company still needs to demonstrate the sustainability of its business model. Still, it is evident that lessons have been learned from its overly ambitious ACO expansion, and the company is now proceeding at a more measured pace with a focus on its core markets and member retention.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.