JD.com: A Buying Opportunity Emerges As Post-Earnings Rally Reversed

Summary

- Although JD's near-term revenue growth is weak due to slowed demand recovery, the company's margins remain resilient.

- The stock is down 40% YTD due to a significant downward revision of revenue at the beginning of the year.

- Despite geopolitical risks, the rebound of China's online retail sales is a key near-term catalyst for the expansion of JD's valuation (currently 12.3x P/E FY 2023).

- I'm bullish on the stock since the entire rally fueled by the impressive 1Q results was completely reversed last Friday.

mahiruysal

Investment Thesis (Delayed Recovery Play)

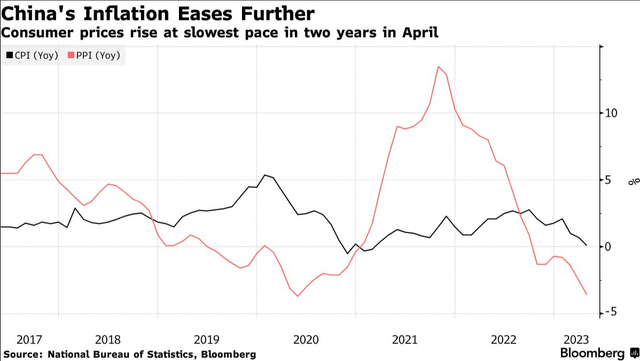

JD.com (NASDAQ:JD), like other Chinese retail giants, is vulnerable to a slowed macro recovery in China's online retail sales. The announcement of China reopening in November 2022 created a huge divergence in the recovery, with physical goods consumption remaining weak while service sectors such as travel and entertainment showed a significant rebound. The chart shows that China had only 0.1% increase in consumer inflation and a 3.6% YoY decrease in producer prices in April, indicating a weak demand for consumer goods.

JD's margin trend has been moving up despite many headwinds such as aggressive capex, weak demand, and competition, indicating the company's operating efficiency. While I admit the geopolitical risk is a long-term concern, I believe the key near-term catalyst is the demand recovery in online retail sales that can consistently drive up the stock price and its valuation multiples. The current cheap valuation also provides a floor for further downside, so I think it's prudent to gradually build up a position, particularly since the recent pullback wiped out the entire post-earnings gain last Friday.

1Q23 Takeaway

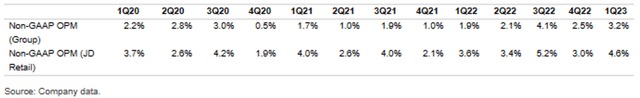

The company delivered impressive 1Q earnings results, with both revenue and non-GAAP EPS topped estimates. It's worth noting that its adjusted EBITDA rose 56.6% YoY, despite JD retail growth declining by 2.4%. Therefore, I believe JD's top-line growth remains a concern in the near term, as the company struggles to achieve even low-digit retail revenue growth. On the brighter side, the company has achieved incremental operating margin improvements. As we can see from the table, JD has achieved incremental improvements in operating margin, with its non-GAAP operating profit margin (JD Retail) reaching 4.6% in 1Q FY2023, the highest in the past three years. This margin was even higher than the pre-pandemic level of 3.7% in 1Q FY2020, indicating improving operational efficiency over the past three years despite a significant revenue growth slowdown.

During the earnings call, the management outlined their goal for FY 2023, which is to create a strong ecosystem that attracts more third-party merchants, particularly high-quality SMEs who make up a relatively small proportion of sellers on the platform. When an analyst raised a question about a potential headwind from the RMB 10 billion ($1.4 billion) discount campaign that had been launched for about two months, the CFO responded:

"As we mentioned in our last quarter call, we had a series of programs offering competitive prices and services that consumers truly appreciate and enjoy, including the 10 billion subsidy program, low cost and free shipping, flat sale and more formats. This is based on our continuous investment and accumulation in the supply chain which results in higher efficiency and lower costs."

Therefore, the company's focus on optimizing direct sales to SMEs is expected to impact its top-line growth, as sell-side analysts have already taken note of this headwind and started to reduce revenue estimates following the announcement. Further details will be discussed in the next section.

Consensus Revisions

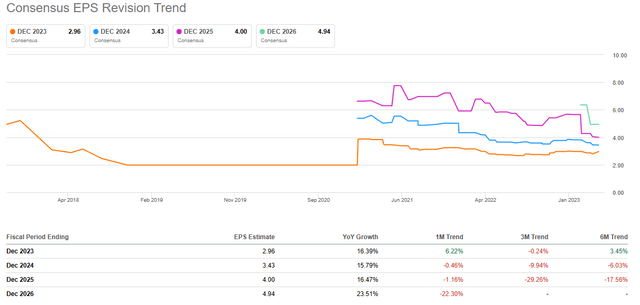

As mentioned earlier, I'm not particularly concerned about JD's bottom line growth and margins, as the 1Q results showed a strong rebound on a year-over-year basis. The Street has taken a cautiously optimistic stance, with FY 2023 earnings revisions showing some improvement. Over the last six months, sell-side analysts have slightly raised FY 2023 earnings estimates by 3.45%, indicating a potential upside for the company's bottom line. When it comes to JD's long-term estimates, I think analysts have taken a conservative approach of cutting estimates now and raising them later if the results turn out to be better than expected.

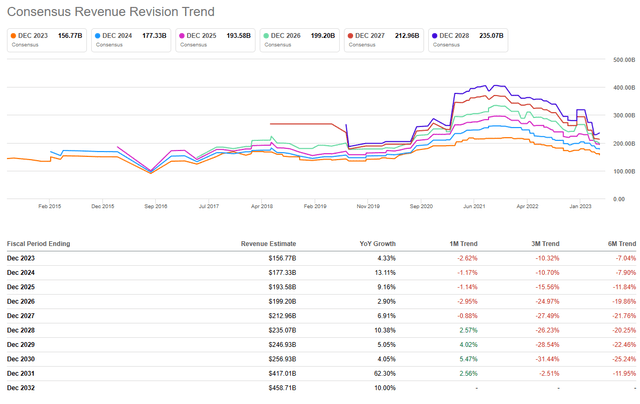

However, analysts have been lowering their revenue estimates for JD since the beginning of this year, indicating concerns about delayed recovery in the online retail industry and subsidies program. This is reflected in the significant downward revisions in JD's revenue projections for the next decade, as shown in the table, which explains the nearly 40% year-to-date drop in its stock price. Notably, the mid and long-term revenue consensus was reduced by more than 20%. Therefore, I believe investors should wait for an acceleration in revenue growth before we can expect a significant expansion in JD's valuation multiples in the near term.

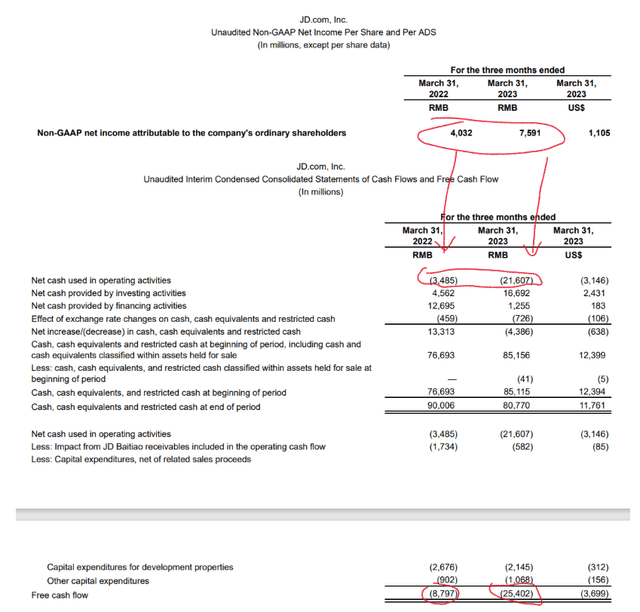

1Q Significant Cash Burn

While I'm optimistic about JD's earnings and margin trends, I'm cautious about some of the numbers on its cash flow statement. According to 1Q23 results, despite an 88.3% YoY growth in non-GAAP net income, from $4 million in 1Q FY2022 to $7.6 million in 1Q FY 2023, the company reported $-21.6 million of cash flow from operating activities (CFO) in 1Q FY2023, a significant decline from $-3.5 million YoY. The details of this discrepancy were omitted from the quarterly reports, and the company only provides these lines in its 20-F annual reports. As a result, it's difficult to determine the exact cause of the significant cash burn, despite the robust net income growth in 1Q. I leave it to the readers to make an educated guess.

Valuation

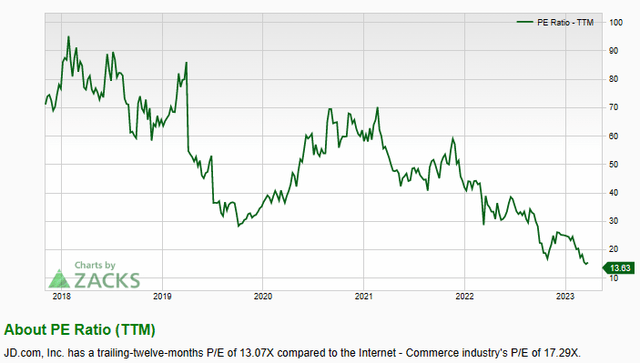

JD's current valuation is very attractive, with a low multiple of 13.6x P/E TTM and EV/adjusted EBITDA at 8.5x TTM, which is approaching Alibaba's (BABA) level. However, the valuation is facing pressure due to three main factors: A slowed demand recovery in the near term, a 10 billion subsidy program, and mid-to-long-term geopolitical risks. Despite these challenges, my investment thesis is heavily focused on the upside potential for a recovery in retail demand. I believe this recovery could materialize in the fourth quarter of FY2023 or the first quarter of FY2024. Investors need to be patient, but the risk and reward profile appears to be very appealing at this level.

Conclusion

In sum, JD's near-term revenue growth is facing many headwinds, including a subsidy program and a slowed demand recovery. This has led to sell-side analysts cutting revenue estimates and a decline in the stock price. However, there are some positive signs, such as the improvement in operating margins and near-term demand recovery. I admit the exact timing of the recovery is hard to predict. Additionally, the company's valuation multiples are currently at historic lows, which presents an opportunity for investors who are willing to be patient and wait for a potential demand recovery. Lastly, it's important to keep in mind the potential risks, such as geopolitical factors, but overall, I believe the risk-reward profile is appealing.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.