Carnival Stock: Why 2023 Could Be Another Disappointing Year

Summary

- As investors, we expect the stock prices of companies in our universe to follow corporate earnings, however, there are many other factors involved in determining stock prices.

- As a close follower of Carnival Corporation, it's hard to miss the positive developments from a financial performance perspective.

- In this analysis, I highlight the 3 major reasons behind Carnival's recent losses despite comparable revenue to pre-pandemic levels.

- I also highlight the main conditions that need to be met for Carnival stock to break through to new highs.

- Looking for a helping hand in the market? Members of Beat Billions get exclusive ideas and guidance to navigate any climate. Learn More »

Lorraine Boogich

As investors, we expect the stock prices of companies in our universe to follow corporate earnings. There is nothing wrong with this, however, there are many other factors involved in determining stock prices. Because of this, undervalued companies can remain undervalued for a long period of time while overvalued companies may remain overvalued for an extended period. Carnival Corporation (NYSE:CCL), the largest cruise company in the world, seemed well-positioned to benefit from the surging demand for travel in 2022, which it did. The company, however, has lost more than a quarter of its market value in the last 12 months despite making steady progress to recover from the pandemic lows. After revisiting the company and the cruise industry, I am forced to believe that CCL's stock will have another disappointing year in 2023 before long-term investors can enjoy some gains.

The Path Toward Pre-Pandemic Highs

Looking at historical stock prices, it is easy to conclude that Carnival stock is nowhere near its pre-pandemic levels. To get a better picture, I believe investors should consider the market capitalization of the company as Carnival issued new shares aggressively at the height of pandemic fears in 2020 to raise much-needed cash to remain afloat. Carnival ended 2019 as a company valued at close to $35 billion in the market. In contrast, Carnival is valued at just over $12 billion today. As the below chart illustrates, Carnival's market value reached pre-pandemic levels in 2021, but the party did not last long.

Exhibit 1: Carnival's market capitalization

All else equal, one could argue that for Carnival's market value to reach pre-pandemic levels, its financial performance needs to catch up with pre-pandemic highs. Since this sounds like a valid argument, let's compare how Carnival's recent financial performance compares with its pre-pandemic performance.

Financial Metric | Q1 2023 | Q1 2019 |

Revenue | $4.43 billion | $4.67 billion |

Net income (loss) | ($693 million) | $336 million |

Occupancy | 91% | 104.8% |

Passengers carried | 2.7 million | 2.9 million |

Long-term debt | $32.67 billion | $9.13 billion |

Customer deposits | $5.5 billion | $4.7 billion |

Source: Company filings

Carnival has almost fully recovered from a revenue perspective, but the company still has a long way to go to be as profitable as it was four years ago. The company's profitability has deteriorated primarily because of three reasons.

- Surging inflation

- High energy costs

- The massive debt burden

Building on our understanding that Carnival's revenue has almost fully recovered, let's compare some line items from the company's income statement to get a better understanding of why Carnival is making massive losses on comparable revenue.

Item | Q1 2023 | Q1 2019 |

Fuel cost | $535 million | $381 million |

Food | $311 million | $268 million |

Interest expense net of capitalized interest | $539 million | $51 million |

Source: Company filings

Rising inflation and elevated energy prices explain the first two entries in the above table. The massive debt pile the company accumulated ever since the start of the pandemic explains the substantial growth in interest expenses. The increase in fuel and food costs has played a major role in deteriorating Carnival's operating performance from an income of $386 million in Q1 2019 to a loss of $172 million in Q1 2023. At the net profit level, interest costs have played the main role in pushing Carnival from a profitable business in Q1 2019 to a loss-making one in Q1 2023.

Higher ticket prices will partially offset rising operating costs resulting from higher energy and food prices. With guest operations returning to normal, I believe we will see continued improvements on this front this year. However, the massive debt pile will continue to hurt the company's financial performance, although the $8 billion liquidity will help Carnival survive the challenging times this year. Because of the recovery of business and the $8 billion liquidity, I believe Carnival will not face a credit crunch this year, but avoiding a credit crunch will not be sufficient to impress Mr. Market.

Carnival stock is up more than 24% this year, but for the rally to continue, I believe all the below conditions will need to be met.

- A notable reduction in total debt

- Strong free cash flows

- Positive earnings revisions

During the first-quarter earnings call, Carnival CFO David Bernstein revealed that the company turned free cash flow positive in Q1 on an adjusted basis and projected total debt to decline from a high of $35 billion to $33.5 billion by the end of the year. These are encouraging developments and projections. The only way Carnival can impress market participants is by bringing in sufficient free cash flows to service its debt and fund capital investments. By the first quarter of 2024, I believe Carnival will benefit from easing inflation, paving the way for margin expansion. Free cash flows, therefore, are likely to grow from here with its business now on the right track, free from Covid fears. However, because of the massive debt pile, I do not believe CCL stock will benefit from an improvement in investor sentiment this year unless the company can notably improve its cash flow profile, which is something I do not expect to happen this year.

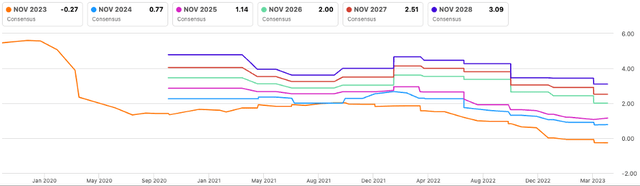

At Beat Billions, we believe there is a quantifiable relationship between earnings revisions and stock prices. For this reason, I believe the expected improvements in Carnival's financial performance will need to be reflected in Wall Street earnings estimates for CCL stock to maintain momentum this year. Unfortunately, fiscal 2023 and 2024 estimates have declined sharply in the last 12 months.

Exhibit 2: EPS revisions

In the last three months, there have been no positive revisions to fiscal 2023 EPS estimates but 12 negative revisions. In the absence of a favorable change in EPS revision trends, I believe CCL stock will fail to head higher from here.

Carnival is on the right track, but I believe 2023 will be another disappointing year for investors as I believe the company's financial performance will continue to lag its 2019 performance through the end of this year.

Takeaway

Carnival Corporation had no option but to raise capital aggressively to remain afloat in 2020. With a no-sail order banning Carnival from taking its ships to the sea, the company had no other way to bring in the required cash to survive. The company, in my opinion, did what it had to do in order to survive. Today, the massive debt pile accumulated in recent years has come to haunt Carnival's future, and I believe CCL's stock will trade sideways at best until the company establishes that its business operations will bring sufficient cash flows to survive and thrive without having to tap capital markets yet again. Until this happens, I believe Carnival investors will have little to write home about.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don't miss out on our launch discount - act now to secure your subscription and start supercharging your portfolio!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.