Valero: Another Strong Quarter But Crack Spreads Less Favorable, Downgrading To Hold

Summary

- The Energy sector has been the worst-performing area of the stock market this year as oil prices have sagged.

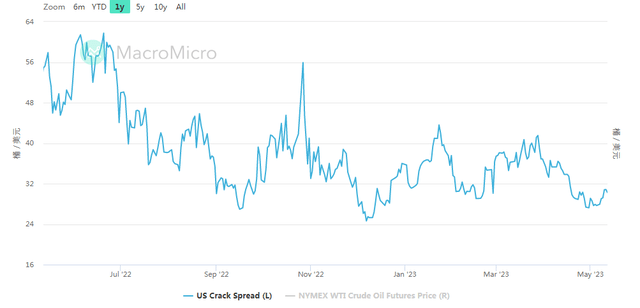

- With still-decent gasoline demand, crack spreads have wavered lower, hurting profitability of refiners.

- I still see Valero's intrinsic value above the current stock price, but macro headwinds, weaker cracks, and a technical breakdown are concerning.

Justin Sullivan

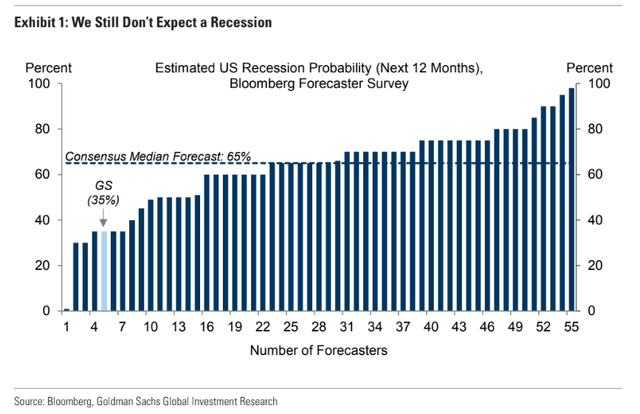

Is a recession on the horizon? Most economists think so. According to Goldman Sachs, a 65% majority of those surveyed see two quarters of negative real U.S. GDP growth happening before long. That would have negative implications for energy demand. And we have already seen WTI Crude Oil prices tumble to the low $70s. If folks lose their jobs, then gasoline demand could also see a downtick, pressuring refiners.

I am downgrading Valero (NYSE:VLO) to a hold. While I still find the valuation and total yield attractive, macro risks have increased, and the stock’s momentum has turned south.

Recession In the On-Deck Circle?

According to Bank of America Global Research and Seeking Alpha, VLO is one of the largest independent petroleum refining and marketing companies in the United States. The company manufactures, markets, and sells transportation fuels and petrochemical products in the US, Canada, the United Kingdom, Ireland, Latin America, and internationally. VLO owns 13 refineries in the US, Canada, and Europe, and has total throughput capacity of around 2.5 million barrels per day. Operations include three segments: Refining, Renewable Diesel, and Ethanol.

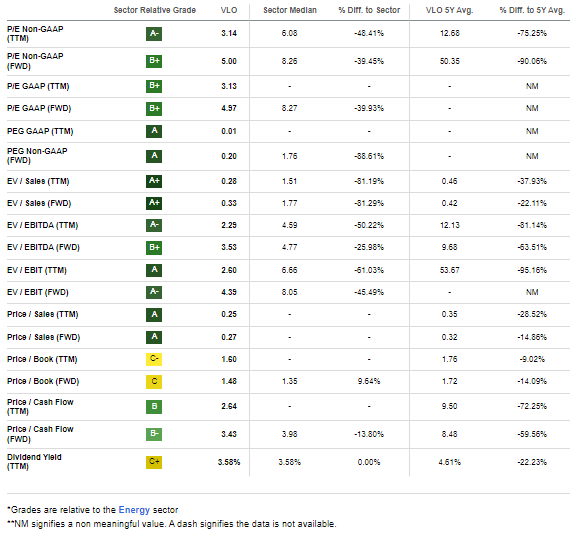

The $40.0 billion market cap Oil and Gas Refining and Marketing industry company within the Energy sector trades at a low 3.1 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.7% dividend yield, according to The Wall Street Journal.

On April 27, VLO reported an earnings beat, but missed on the top line. $8.27 of per-share profits topped analysts’ estimates of $7.21 while revenue fell 5.4% year-on-year to $36.44 billion, a large $1.06 billion miss versus consensus. Shares had already been trending lower ahead of the Q1 release, and downside momentum continued through the first week of May. While adjusted EPS beat on strong throughput metrics, cash flow was robust once again for this free cash flow generator.

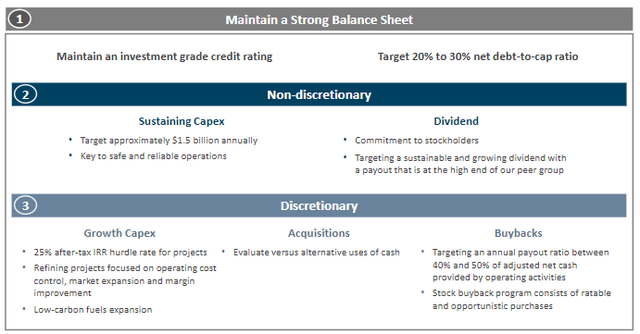

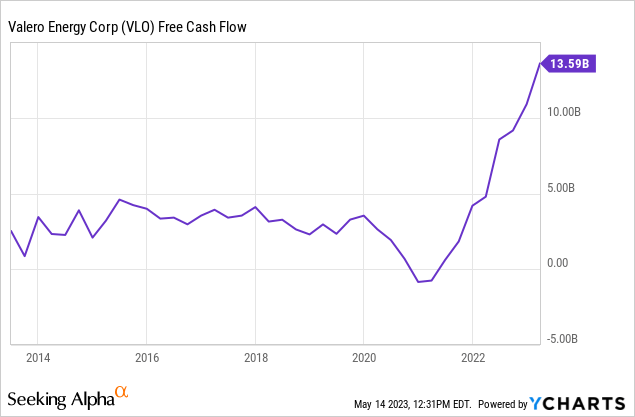

With $467 million of capex in the quarter, total free cash flow verified at $3.3 billion, more than enough for the company to cover its $1.5 buyback activities and roughly $400 million of dividends. VLO is a rare stock that has reduced its share count significantly over the last 12 months while also improving its balance sheet through debt reduction. The management team remains focused on a disciplined capital management policy during this volatile period in the refining industry.

VLO: Strengthening Balance Sheet, Flexible Capex & Buybacks

Unfortunately, the domestic crack spread, a key profitability gauge for refiners, has been trending lower lately. While U.S. gasoline demand appears robust heading into the summer driving season, reduced cracks from a year ago could lead to a softer profit outlook for VLO versus what was expected as of earlier this year. After reporting decent margins last quarter, there’s risk that a margin correction could occur in the coming months.

U.S. Crack Spreads Trending Lower

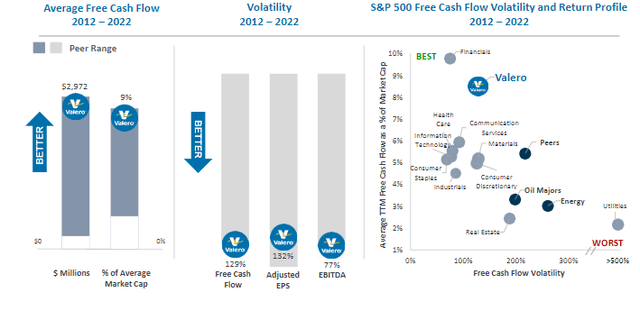

VLO: Relatively Durable FCF and Lower EPS Volatility Versus Competitors

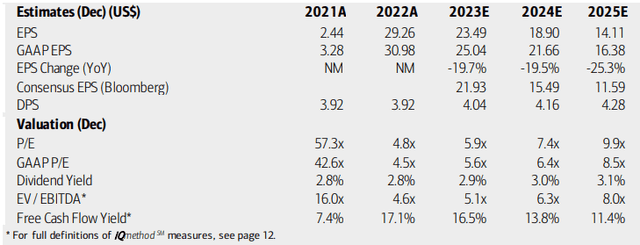

On valuation, analysts at BofA see earnings falling from last year’s abnormally strong period. Per-share profits are expected to gradually decline into the mid-teens ($/share) by 2025 while the Bloomberg consensus estimate is even less optimistic. Given the earnings correction that is ongoing, a low P/E is warranted. Still, with ample free cash flow and shareholder-friendly activities, I still see a proper valuation of the stock being in the mid-$100s.

Reduced crack spreads may imply a forward P/E of 10 on $14 of normalized earnings, placing the stock’s intrinsic value closer to $140 than $170 that I previously outlined. If the stock falls to a level I think could be in play later this year based on the chart, then that would imply a forward dividend yield near 5% which should draw amply demand from value investors.

Valero: Earnings, Valuation, Free Cash Flow Forecasts

Dividend investors are likely growing increasingly attracted to VLO’s yield. While below its 5-year average, the rate is higher than what was seen earlier this year. Dividends are expected to continue higher given the double-digit free cash flow yield even with impressive capex plans. After a 10% drop in shares outstanding, buybacks should also support the stock on a further decline.

VLO: Rising Dividend Yield Couples With A Strong Buyback Yield

Seeking Alpha

VLO's FCF Equates To 34% of Its Market Cap

YCharts

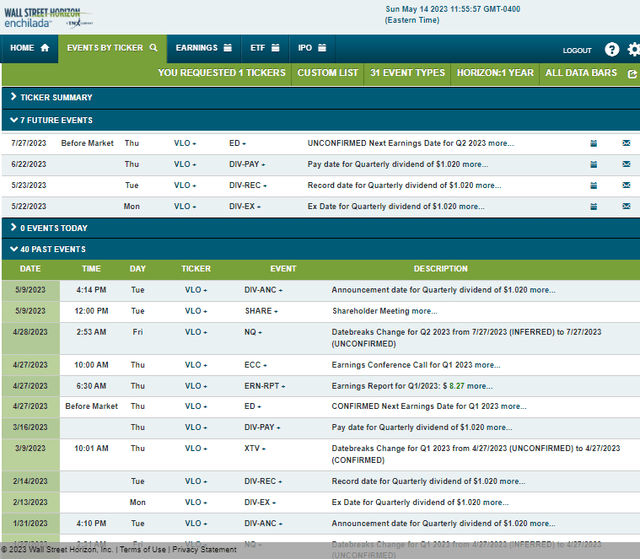

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Thursday, July 27 BMO. The stock trades ex-div on Monday, May 22.

Corporate Event Risk Calendar

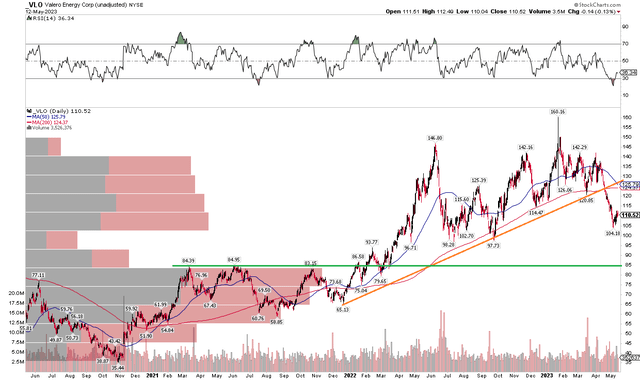

The Technical Take

I still like the valuation and free cash flow story with VLO, but the uptrend has clearly broken down. Notice in the chart below that shares fell under the key $120 level I described back in Q1. Now, the bears may be gaining a grip on the chart. I see support at the 2021 range highs in the low to mid-$80s - that would be an ideal spot to back up the truck and go long. For now, though, the chart suggests investors be cautious.

With a now flattening 200-day moving average after a protracted uptrend, and what is soon to be a death cross (whereby the 50-day crosses below the 200-day), it’s yet another warning sign. There could be a layer of near-term support in the $94 to $98 range, but ample volume does not come into play until the low $80s. Moreover, there is now a high amount of overhead supply up to $140. Overall, the technical situation has deteriorated.

VLO: Uptrend Broken, Eyeing Mid-$80s Support

The Bottom Line

I am downgrading VLO stock to a hold. I continue to like the valuation, but with a looming technical recession in the second half and price action that has turned bearish, I see momentum favoring the bears right in the near term.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.