DSU: This Fully-Covered Debt Fund Is Worth Your Consideration

Summary

- Investors are in desperate need of income as portfolios have shrunk over the past eighteen months while prices of goods and services have gone up.

- DSU invests in a portfolio of fixed-rate and floating-rate debt in an attempt to provide its investors with an incredibly high level of income.

- The fund invests mostly in junk-grade debt, but it is very well diversified and losses due to defaults should have negligible impact on the portfolio.

- The fund yields 10.91% which is fully covered by net investment income.

- The fund is trading at a very attractive discount to the net asset value right now.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

Marat Musabirov

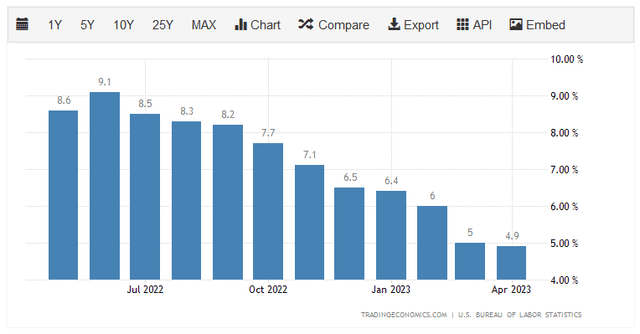

Undoubtedly, one of the biggest challenges facing the average American today is the incredibly high inflation that has been dominating the economy. Although it has come down in recent months, it still remains uncomfortably high and the consumer price index has posted a year-over-year increase of at least 6% in ten of the past twelve months:

This is the highest rate of inflation that the United States has experienced in forty years, and it has been causing a great deal of hardship throughout the nation. As the drivers of this inflation have been necessities such as food and energy, people cannot just stop using the items that are going up in price so it has had a particularly devastating effect on those of lesser economic means. As I discussed in a blog post, many households have been forced to drain their savings or max out their credit cards just to tread water. In fact, revolving credit card balances set a new record in March, and it is very hard to believe that people are spending all their money on the newest gadget or electronic toy. In short, people are desperate for additional sources of money, which probably explains why 81% of Generation Z and 77% of Millennials are taking on part-time work or entering the gig economy just to obtain the money that they need to get by.

As investors, we are certainly not immune to this. After all, we need money to pay our bills and finance our own lifestyles, and with the devastation that we saw in the stock market last year, our portfolios are smaller and need to go farther as prices continue to rise. Fortunately, we do not have to resort to things such as taking on part-time jobs. This is because we have the ability to put our money to work for us earning an income. One of the best ways to accomplish this is to purchase shares of a closed-end fund that specializes in producing income for its investors. These funds are, unfortunately, not particularly well-followed in the media and few investment advisors are familiar with them, so it can be difficult to find the information that we would like to make an informed decision about adding one to our portfolios. This is a shame because closed-end funds offer a number of advantages over familiar open-ended and exchange-traded funds. In particular, closed-end funds are able to use a variety of strategies that boost their yields beyond that of any of the underlying assets and, indeed, pretty much anything else in the market.

In this article, we will discuss the BlackRock Debt Strategies Fund (NYSE:DSU), which currently yields a very impressive 10.91%. That is certainly a high enough yield to satisfy just about any income-seeking investor! I have discussed this fund before, but a considerable amount of time has passed since then so obviously several things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund's finances. Therefore, let us investigate and determine if this fund could be a good addition to your portfolio.

About The Fund

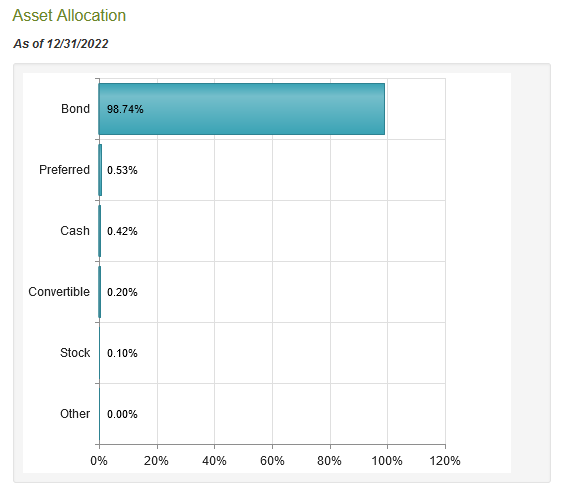

According to the fund's webpage, the BlackRock Debt Strategies Fund has the stated objective of providing its investors with a high level of current income. This is not surprising considering the name of the fund implies that it invests in debt securities. This conclusion is reinforced by the portfolio composition, which currently consists entirely of bonds and other fixed-income securities:

CEF Connect

This is in line with the webpage's description of the fund's strategy:

BlackRock Debt Strategies Fund's primary investment objective is to provide current income by investing primarily in a diversified portfolio of US companies' debt instruments, including corporate loans, which are rated in the lower rating categories of the established rating services (BBB or lower by S&P's or Baa or lower by Moody's) or unrated debt instruments, which are in the judgment of the investment advisor of equivalent quality.

In other words, this is essentially a junk bond fund, although it can also include other things such as floating-rate senior loans. As such, the focus on current income is not especially surprising because that is how these instruments primarily deliver investment returns. An investor purchases a bond at face value, it makes regular interest payments to the investor, and at maturity, it returns the investor's original capital. Thus, the interest payments will be the only realized returns that an investor who holds a bond for its entire life will receive. Ultimately, there is no potential for capital gains in this scenario.

With that said, funds like this rarely hold bonds to maturity. In fact, the fund especially states that it has a secondary objective of capital appreciation. As we have just seen though, that is not possible to achieve by purchasing bonds at issuance and holding them to maturity. Despite this, it is possible to obtain capital gains by trading bonds. This comes from the fact that bond prices vary with interest rates. It is an inverse relationship, so when interest rates go up, bond prices go down and vice versa. This has particular relevance today because the Federal Reserve has been aggressively raising interest rates over the past year as part of an effort to combat the incredibly high inflation that the economy has been experiencing. As we can see here, the effective federal funds rate was 0.33% a year ago but it is 4.83% today:

Federal Reserve Bank of St. Louis

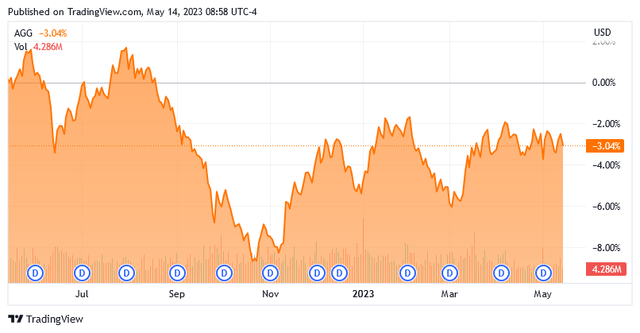

This has had a negative effect on most bonds due to the relationship that was just discussed. Over the past year, the Bloomberg US Aggregate Bond Index (AGG) has declined by 3.04%:

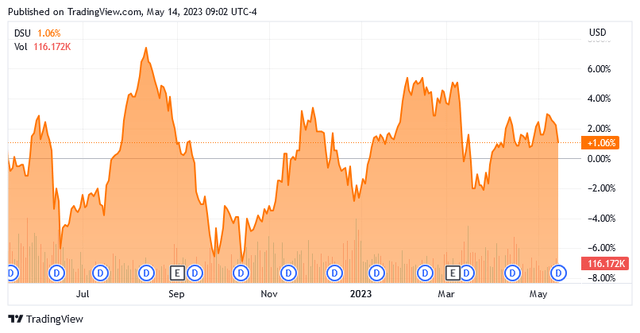

We can see that the bond index has increased since the end of last year. This is mostly due to the market's expectations that the United States will soon fall into a recession and the Federal Reserve will be forced to reduce interest rates. There has also been a flight to safety pushing up the value of U.S. Treasury securities due to things such as the regional banking crisis. These securities account for 44.84% of the index, so strong performance here will obviously have a significant effect on the index. However, as already mentioned, the BlackRock Debt Strategies Fund is a junk bond fund and will not invest in highly-creditworthy securities like U.S. Treasuries. This has not stopped it from performing surprisingly well despite the rising rates, though. In fact, the fund's shares are actually up 1.06% over the past year:

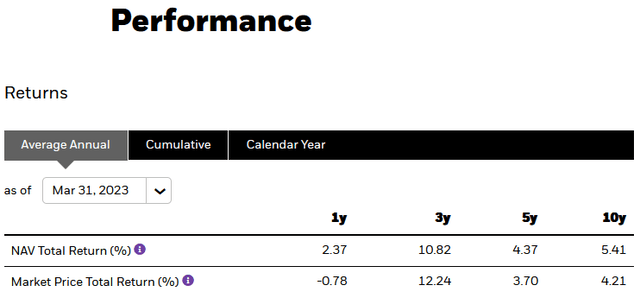

This is not only significantly better than the index, but it is significantly better than just about any other bond fund in the market. As I have pointed out in various previous articles though, it is not uncommon for a closed-end fund's market price to exhibit different performance than the actual underlying portfolio. This did happen here, but it is not exactly what might be expected. In fact, as of March 2023, the fund's portfolio outperformed the share price over the trailing one-year period:

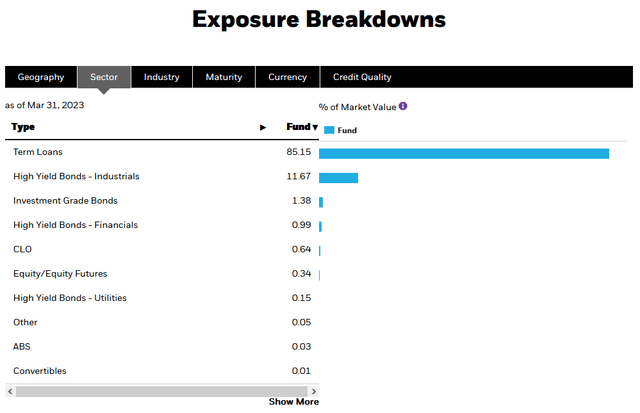

One possible reason for this is that the fund can hold bank loans, as it states in the description on its webpage that was quoted earlier. In fact, these securities currently account for 85.15% of the portfolio:

The defining characteristic of these securities is that they have floating interest rates. Thus, the interest rates paid by the securities increase with the federal funds rate so they should hold their value much better than ordinary bonds as rates increase. Thus, this fund should not have suffered the same losses as many other bond funds that resulted from the Federal Reserve's rate-hiking regime over the past year. These securities will also provide the fund with growing income as rates continue to increase. This is a very good thing to see in this environment and it is why corporate loan funds have generally outperformed traditional bond funds over the past year. As I pointed out in a recent article though, the interest rate-driven carnage in the traditional bond market is probably over at this point as the Federal Reserve is unlikely to raise rates further as a near-term recession is much more likely than inflation taking off again. Thus, the advantage of floating rate securities over traditional bonds is no longer as strong as it has been over the past several months.

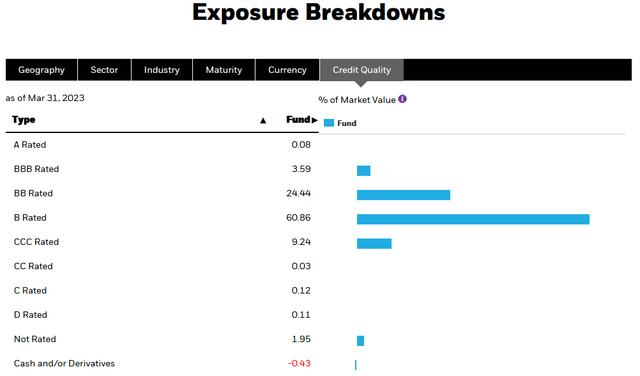

As mentioned earlier in this article, the BlackRock Debt Strategies Fund invests mostly in junk debt. This is something that may concern risk-averse investors due to all that we have heard about these securities possessing a very high default rate. We may be able to derive some comfort though by looking at the credit ratings of the securities that comprise the fund's portfolio. Here is a summary:

Anything rated BB or below is considered to be "junk debt." As we can see, that is fully 96.76% of the portfolio. This is certainly enough to concern most investors that place a very high priority on the preservation of principal. However, we can see that the overwhelming majority of these securities (85.3% of the fund's total assets) are rated BB or B by the major rating agencies. These are the two highest possible ratings for junk bonds, and according to the official bond rating scale, companies whose bonds have these ratings have sufficient financial capacity to carry their current debt obligations and should be able to weather a short-term economic shock without adverse consequences. Thus, the overwhelming majority of the fund's holdings should be reasonably safe from default risk. When we combine this with the fact that the fund has positions in 1,299 unique securities, we can see that a default is pretty unlikely during most times, and even when one occurs, it should not have a noticeable impact on the entire fund. Thus, we should not really have to worry too much here.

Leverage

As mentioned in the introduction, closed-end funds like the BlackRock Debt Strategies Fund have the ability to use certain strategies that boost the effective yield of the fund's portfolio well beyond that of any of the underlying assets. One of these strategies is the use of leverage. In short, the fund borrows money and then uses this borrowed money to purchase various corporate debt securities. As long as the purchased securities have a higher yield than the interest rate that the fund needs to pay on the borrowed money, the strategy works pretty well to boost the overall yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage, as that would expose us to too much risk. I generally like to see a fund's leverage remain under a third as a percentage of its assets for this reason. This fund is currently satisfying this requirement as its levered assets comprise 24.99% of the total portfolio as of the time of writing. Thus, the BlackRock Debt Strategies Fund appears to be striking a reasonable balance between risk and reward.

Distribution Analysis

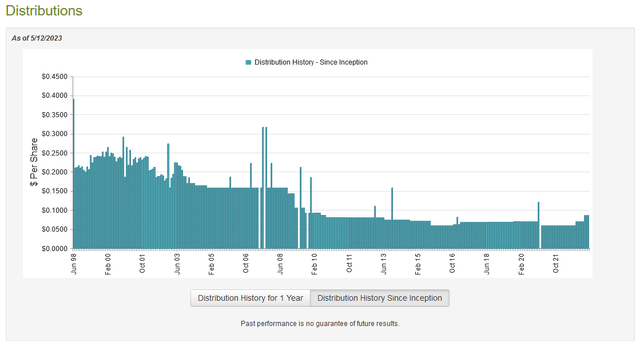

As stated earlier in this article, the primary objective of the BlackRock Debt Strategies Fund is to provide its investors with a high level of current income. In order to achieve this objective, the fund invests in junk bonds and other speculative-grade debt, which tend to have fairly high yields. The fund then applies a layer of leverage to boost the effective yield of this asset portfolio. As such, we might assume that the fund has a very high yield itself. This is certainly the case as the fund pays out a monthly distribution of $0.0868 per share ($1.0416 per share annually), which gives it a very attractive 10.91% yield at the current price. The fund has, unfortunately, not been very consistent about its distribution over its history:

The fact that the distribution has varied so significantly over the fund's lifetime will likely be something of a turn-off for those investors that are seeking a safe and secure source of income with which to pay their bills or finance their lifestyles. However, the fund has raised its distribution twice in the past year, which adds somewhat to its appeal. Indeed, there are some signs that debt is more attractive as an investment than equities for the first time in fifteen years, which is evidenced by the fact that the fund has been able to grow its distribution even as numerous economic indicators are showing signs of weakness. As I have pointed out in various previous articles, the fund's past is not exactly the most important thing for new investors though since anyone purchasing today will receive the current distribution at the current yield. Thus, the most important thing for anyone today is the fund's ability to maintain its current distribution so let us investigate that.

Fortunately, we do have a reasonably recent document that we can consult for this purpose. The fund's most recent financial report corresponds to the full-year period that ended on December 31, 2022. Although this report will not include any information about the fund's performance over the past few months, it is a much newer report than we had available to us the last time that we discussed this fund and will give us a great idea of how the fund handled the challenging conditions in the debt market last year. During the full-year period, the BlackRock Debt Strategies Fund received $78,358 in dividends and $42,508,039 in interest from the assets in its portfolio. When we combine this with a small amount of income from other sources, the fund achieved a total investment income of $43,085,781 over the course of the year. It paid its expenses out of this amount, which left it with $33,524,702 available for shareholders. This was actually enough to cover the $32,417,479 that the fund paid out in distributions during the period. That is very nice to see, particularly as the fund reported both net realized and net unrealized losses during the period. However, it appears that this fund is just paying out its net investment income, so we should not have to worry too much about losses since this is a bond fund, so losses correlate with higher interest rates, and income increases when the fund experiences losses. The only concern would be if the fund is depending on capital gains to finance its distributions as some of its peers do, but this one is not doing that.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Debt Strategies Fund, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can obtain them at a price that is less than net asset value. This is because this scenario implies that we are purchasing the fund's assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of May 11, 2023, the BlackRock Debt Strategies Fund had a net asset value of $10.65 per share but the shares currently trade for $9.55 each. This works out to a 10.33% discount on the net asset value. That is a very reasonable price that is quite a bit better than the 9.64% discount that the shares have had over the past month. Thus, the fund certainly seems to be offering an attractive value proposition right now.

Conclusion

In conclusion, the BlackRock Debt Strategies Fund looks like a pretty good way to obtain a sizable level of income right now. The fund's focus on speculative-grade debt may be concerning to risk-averse investors, but it appears to have this risk managed well and we should not have to worry about too much here. The fact that the fund holds more than just fixed-rate bonds is also nice, just in case the Federal Reserve does raise rates further. The fund can also easily sustain its distribution and is trading at a very attractive price. Overall, it could be worth purchasing today.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.