Mueller Industries Is A Hold With Upside Potential

Summary

- Our bullish opinion about the company is tempered momentarily by its close ties to the global and national economy, about which talk of a crash prevails.

- There are other risks that can stymie the growth and earnings of Mueller Industries, including insider and funds selling as the share price touches its 52-week-high.

- The company numbers and balance sheet improved tremendously in the last few years and portend a good future if construction and industrial manufacturing are stable.

Vesnaandjic/iStock via Getty Images

Backbone Industry

Stocks of companies that manufacture and sell industrial machinery, supplies, and components are telltale investment opportunities for how America's economy is functioning. Mueller Industries, Inc. (NYSE:MLI) is a basic industrial manufacturer; it got our attention last fall. We advised our retail value investors that the shares are a potential opportunity when they were selling at ~$60 each. Mid-May '23, the shares top $75 each.

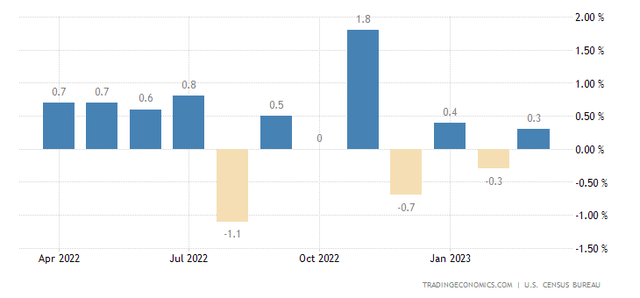

We are still bullish but less so in our opinion of Mueller Industries. Our enthusiasm is waning for the stock, tempered by the price touching the 52-week high and the selling of shares by funds and corporate insiders. Moreover, inflation persists, increasing the chance for higher interest rates. We see dropping consumer confidence in the economy and decision-makers. A direct risk is the less-than-impressive spending on construction that can affect Mueller's growth.

Construction Spending (tradingeconomics.com)

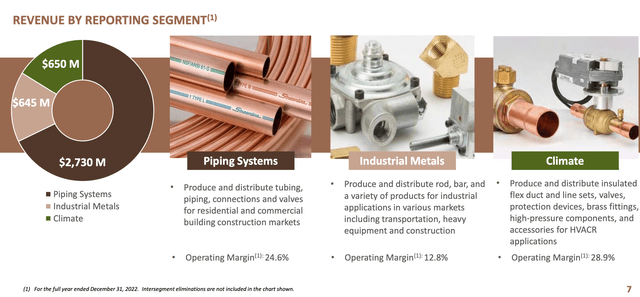

106 years old Mueller Industries, Inc. manufactures and sells copper, brass, aluminum, and plastic products through 3 segments. The company targets OEMs and commercial contractors in transportation and equipment construction (5%), industrial manufacturing (6%), plumbing and gas delivery construction (46%), and refrigeration and HVAC systems (41%).

We think of the company as one of the key players in manufacturing and distributing the pieces and parts when assembled to make the industrial infrastructure supporting the national economy. Mueller's numbers and balance sheets reflect the economic recovery of America since the dreadful pandemic years.

Mueller's Performance

Product Segment Sales (d1io3yog0oux5.cloudfront.net)

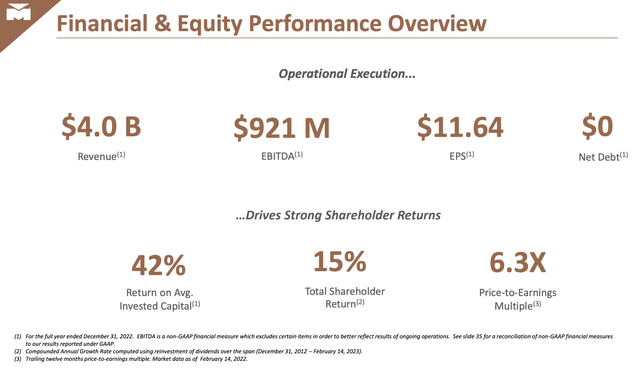

The company is rather small. It sports a $4.35B market cap. Shares are lightly traded, on average ~500K/day, and the stock is followed by a few analysts. Nevertheless, Mueller Industries is building revenue and earnings, a strong balance sheet, and getting enviable ratings and grades. In April '23, the company reported the following numbers to shareholders:

Q1 '23 Report (d1io3yog0oux5.cloudfront.net)

The highlights the CEO noted in his presentation on Q1 '23 include:

- Operating Income + 7.7% Y/Y.

- Net Income of $173.2M increased 9.4% Y/Y.

- Q1 '23 EPS of $3.07 is 10.4% higher than Q1 '22 of $2.78. EPS is up in the last 3 years.

- Net Sales of $971.2M in Q1 '23 is - 3.8% Y/Y. The decrease in net sales relates to copper prices and lower unit volume in the international mill businesses. Concomitantly, EBIT margins are +6% to 22% Y/Y.

- A $5.5M gain on property Mueller disposed of in 2022 built cash while operating income increased 10.6% Y/Y.

- Cash from operations was $111.6M, resulting in quarter-end cash and short-term investments totaling $782.4M.

- The Company has no net debt and a current ratio of 4.3 to 1.

- Increased the quarterly dividend by 20% to $.30 per share.

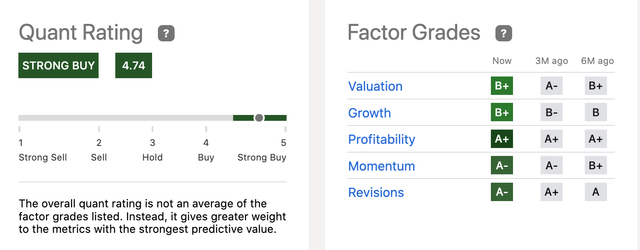

The strong Mueller numbers outstrip the broader ETFs of industrial stocks. For instance, Mueller Industries shares are +41% over the last year and +28% YTD. The PE is 10.17; that is a ratio far below the industrial machinery and components industry average PE of 24.04. Mueller is trading at a cheaper price relative to its peers, suggesting the potential for the stock to go higher with the right stimulus. First Trust RBA American Industrial RenaissanceTM ETF (AIRR) shares are up 25.7% over the last 12 months and 6.77% YTD. Seeking Alpha assesses both stocks at a Strong Buy Quant Rating.

Quant Rating & Factor Grades (seekingalpha.com)

The Mueller dividend offers a slightly better-than-average return of 1.6% compared with the industrial stocks' average return of 1.38%. The dividend gets As and Bs for safety, growth, yield, and consistency. But the yield is not attractive to retail value investors who are longer-term investors.

The company valuation metrics are rife with A and B grades. Only Price/Sales and Price/Book get C+ from SA. Some of the revenue growth, over the last 5 years, can be attributed to the acquisition of 4 companies; they were in the manufacturing and building materials sectors.

Risks

Investors need to be cautious. Headwinds abound with talk about the inevitability of the economy crashing. The event might setback the industrial machinery, supplies, and components industry and hog-tie the construction industry. The pandemic stymied Mueller's revenue and earnings in 2019 and 2020. The company recovered over the next two years. Mueller is a survivor. It survived the Great Depression and multiple recessions. Earnings flourished during this latest round of inflation.

Mueller's management and analysts expect revenue to decline on average by 5.8% over 2023 and into '24. EPS estimates are Q2 '23 will be under $2 compared to last year's Q2 EPS of $3.65. The next earnings report is tentatively scheduled for July 17 '23.

We expect the company will be impacted by weakness in construction, and, according to the CEO:

Economic activity as a whole began to temper during the second half of 2022 amidst rising interest rates, inflationary pressures, and global instability. Beyond that, the destocking of inventories and normalization of supply chains exerted downward impacts.

Other risks stem from the machinery industry's sustainability. The PE ratio is falling, though higher than for Mueller Industries. MLI shares did better than AIRR shares. Mueller's shares are doing better than The Industrial Select Sector SPDR Fund ETF (XLI) shares, too. XLI shares are more erratic than Mueller's: down about ½ of 1% for the last 6 months and up just 7% over the previous 12 months. MLI shares trend toward high volatility (0.91 Beta). The short interest rate stands at a high of over 10%.

Two more risks are evident. Corporate insiders sold nearly $650K worth of shares in the last 3 months. NASDAQ reports insiders bought 33K shares over the last 3 months and sold 62.6K. The trend is more positive among institutional owners and hedge funds. 91% of Mueller Industries shares are owned by institutions. 162 institutional owners cut their holdings last quarter while 180 increased positions. 57 institutional owners took new positions, and 32 sold out. The number of hedge funds holding shares increased over the last 5 quarters,

Takeaway

Mueller Industries, Inc has had a remarkable improvement in its revenue and earnings growth over the last several years. It is the kind of company that will successfully navigate global and national economic headwinds. It weathered storms for over a century. Its products are knitted to the larger economy. Doubts and worries about the economy temper our bullishness for Mueller Industries. We are more neutral at the present time. The strong numbers and healthy balance sheet may not hold if the market and economy crash. The dividend yield is unattractive for retail value investors. The stock is worth watching for dips and holding if owned.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.