Ziff Davis Aims For Slight Growth In Best Case For 2023

Summary

- Ziff Davis recently reported its Q1 2023 financial results.

- The firm operates a wide variety of brands in digital media and subscription software industries.

- ZD guided to 1% revenue growth in 2023 as a best-case scenario but faces a softening advertising market and greater budget scrutiny by customers.

- I'm Neutral [Hold] on ZD in the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

PeopleImages/iStock via Getty Images

A Quick Take On Ziff Davis

Ziff Davis (NASDAQ:ZD) reported its Q1 2023 financial results on May 9, 2023, beating revenue and EPS consensus estimates.

The firm provides media and software products and services worldwide.

Most of ZD’s brands are struggling to produce growth as the advertising market continues to soften and software sales cycles lengthen due to advertising and software budgets being under increasing scrutiny.

My outlook for ZD in the near term is Neutral [Hold].

Ziff Davis Overview

Ziff Davis operates a growing collection of digital media properties and various subscription software industry entities.

The firm is headed by president and CEO Vivek Shah, who has previously held management positions in the media industry, including at Time Warner.

The company’s primary offerings include the following verticals:

Technology

Connectivity

Shopping

Gaming & Entertainment

Health

Cybersecurity

Martech

ZD acquires customers via online methods as well as through direct sales and marketing efforts at each of its brands.

Ziff Davis’ Markets

ZD operates in a variety of markets, some of which are unrelated to each other.

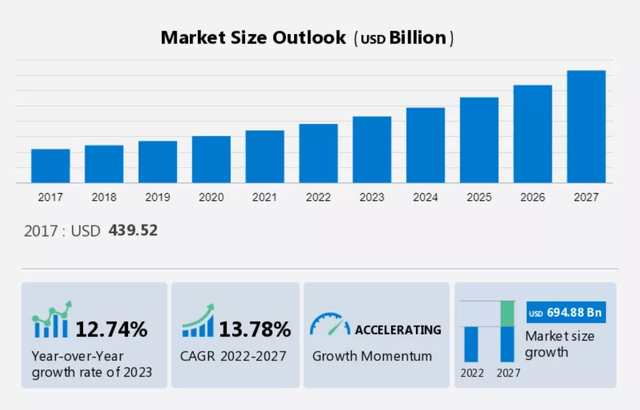

According to a 2022 market research report by Technavio, the global market for digital media, a major market category for Ziff Davis, was estimated to increase in value by nearly $700 billion from 2022 to 2027.

This represents a forecast CAGR (Compound Annual Growth Rate) of 13.78% from 2022 to 2027.

The main drivers for this expected growth are the continued transformation of media into digital form, broader and faster internet connectivity and greater consumption of all forms of digital media by consumers.

Also, the chart below summarizes the historical and projected future growth trajectory of the market through 2027:

Global Digital Media Market (Technavio)

The firm also operates in connectivity and cybersecurity software markets, which are substantial markets in their own right. However, its technology vertical has noticed the greatest amount of shrinkage over the past year, likely a result of the retrenchment in the greater technology industry.

Ziff Davis’ Recent Financial Trends

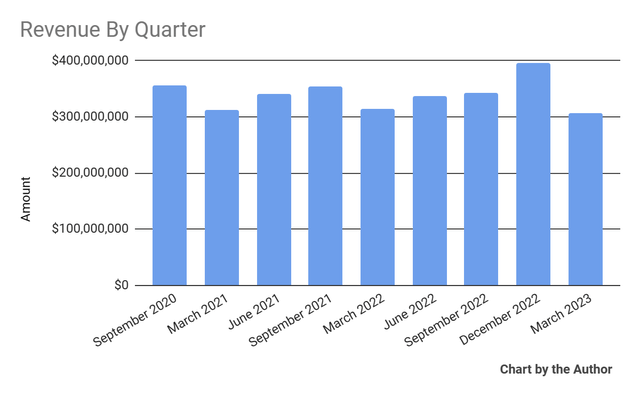

Total revenue by quarter has produced the following trajectory:

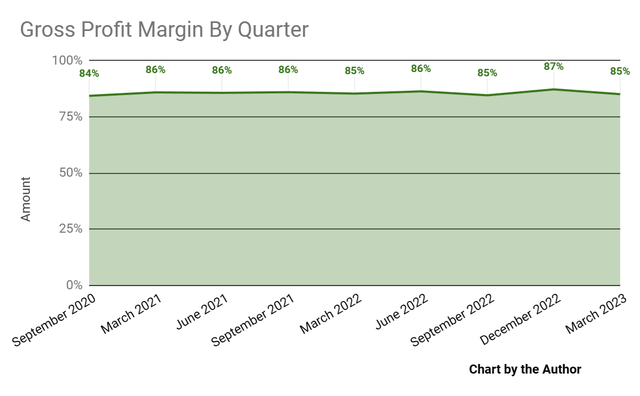

Gross profit margin by quarter has fluctuated within a narrow range:

Gross Profit Margin (Seeking Alpha)

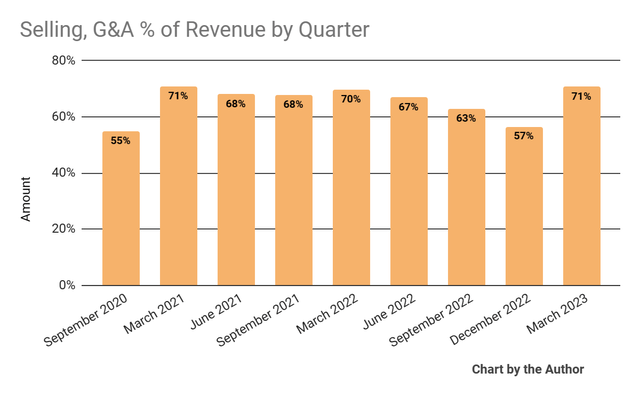

Selling, G&A expenses as a percentage of total revenue by quarter have jumped in the most recent quarter:

Selling, G&A % Of Revenue (Seeking Alpha)

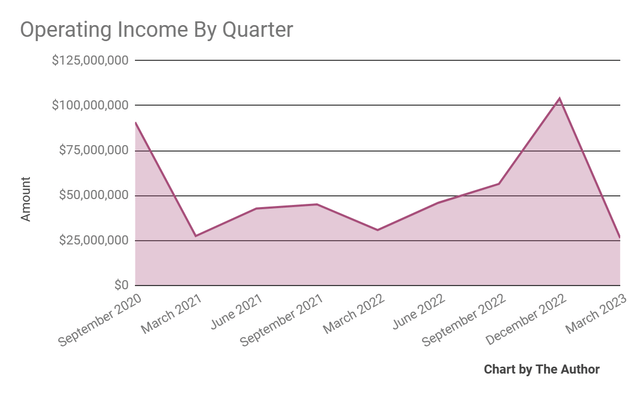

Operating income by quarter has dropped sequentially for Q1 2023, as shown here:

Operating Income (Seeking Alpha)

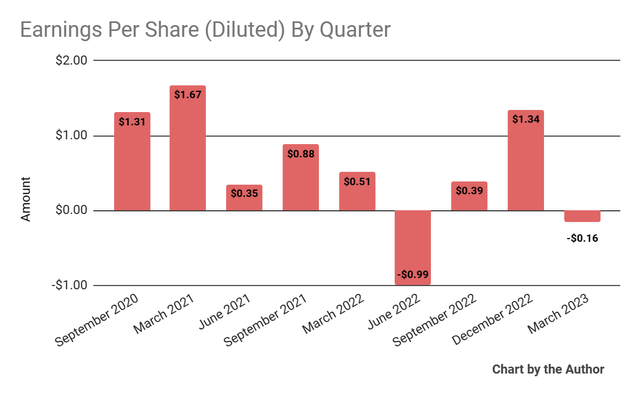

Earnings per share (Diluted) have turned negative recently:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

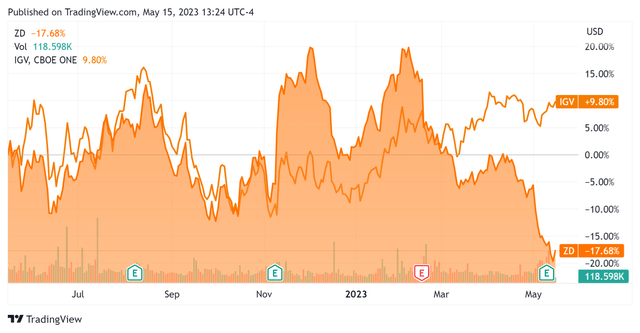

In the past 12 months, ZD’s stock price has fallen 17.68% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) rise of 9.8%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $760.5 million in cash, equivalents and short-term investments and $1.0 billion in total debt, none of which was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was an impressive $229.5 million, of which capital expenditures accounted for $105.7 million. The company paid $28.3 million in stock-based compensation in the last four quarters, the highest amount in the past eleven quarters.

Valuation And Other Metrics For Ziff Davis

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 2.4 |

Enterprise Value / EBITDA | 7.4 |

Price / Sales | 2.2 |

Revenue Growth Rate | -2.6% |

Net Income Margin | 2.3% |

EBITDA % | 32.4% |

Market Capitalization | $3,100,000,000 |

Enterprise Value | $3,340,000,000 |

Operating Cash Flow | $335,240,000 |

Earnings Per Share (Fully Diluted) | $0.58 |

(Source - Seeking Alpha)

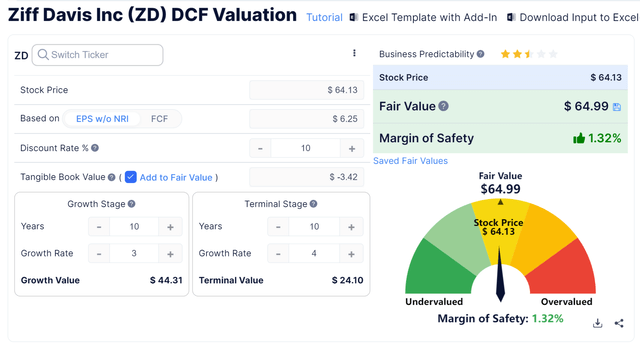

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow Calculation - Ziff Davis (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $64.99 versus the current price of $64.13, indicating they are potentially currently fully valued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On Ziff Davis

In its last earnings call (Source - Seeking Alpha), covering Q1 2023’s results, management highlighted the challenging environment for its advertising businesses, especially in the technology vertical.

The firm is seeing some potential growth in its consumer and pharmaceutical digital ad spending verticals, with the pharma vertical returning to its pre-pandemic activity and cadence.

Leadership has ample resources to continue its M&A strategy but noted a slower-than-expected acquisition pace, likely the result of sellers having two-high valuation expectations despite a changed environment.

One aspect of a potential macroeconomic downturn is the potential for acquiring properties at a discount to their previous valuation levels.

Total revenue for the quarter dropped 2.5% year-over-year and gross profit margin also dropped by 0.3 percentage points.

The company’s net advertising revenue retention rate was 91% for the quarter. Subscription revenue rose 4.5% and was hurt by the stronger US dollar.

SG&A as a percentage of revenue rose by 0.9 percentage points and operating income dropped 14.3% year-over-year.

Looking ahead, management reaffirmed its previous full-year 2023 guidance of revenue growth of 1% at the top end and adjusted diluted EPS of negative 2% as the best-case scenario.

The company's financial position is relatively strong, with ample liquidity against $1 billion in long-term debt and very strong free cash flow.

Regarding valuation, my discounted cash flow calculation estimates that ZD is fully valued at its present price, given the revenue growth assumptions that the firm will have a difficult time achieving in the near term.

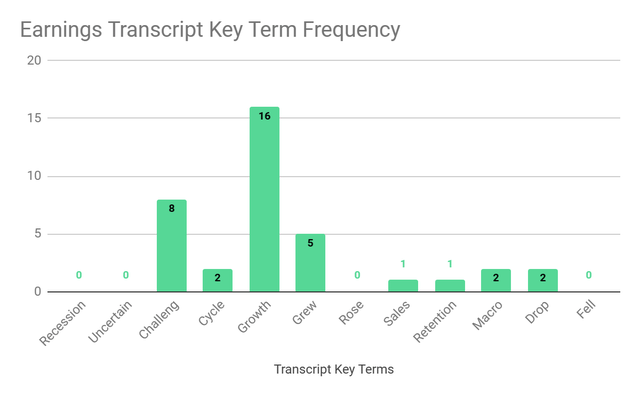

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Term Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management cited ‘Challeng[es][ing]’ eight times, ‘Macro’ twice and ‘Drop’ twice.

The negative terms referred to the difficult operating environment for advertising-based businesses currently as they face reduced advertising budgets from companies in an uncertain macroeconomic environment.

In the past twelve months, the firm's EV/EBITDA valuation multiple has dropped nearly 21%, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

The primary risk to the company’s outlook is a continued macroeconomic slowdown reducing customer advertising spending and slowing its subscription software sales cycles.

Given the likelihood of a further slowing U.S. economy throughout the rest of 2023 and possibly into 2024, my outlook for ZD is Neutral [Hold].

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.