Coupang: Demonstrating Tremendous Operating Leverage

Summary

- I rate Coupang a "strong buy" as the business has continued to post stellar results, all while the share price has remained largely flat and trailed the broader market in 2023.

- Coupang has posted 20%+ revenue growth rates (in constant currency) each quarter since its IPO in 2021.

- In Q1, Coupang reported an all-time high adjusted EBITDA margin of 4.2%.

- Coupang trades on an attractive free cash flow yield of 6.6%.

- Coupang has a long runway for growth ahead, both in its core e-commerce and grocery delivery businesses, as well as international expansion and adjacent business segments.

Michael Vi

Introduction

Coupang (NYSE:CPNG) is the largest e-commerce business in South Korea with a broad range of business segments, including:

- First-party (1P) e-commerce.

- Third-party (3P) e-commerce.

- Grocery delivery (Rocket Fresh).

- Food delivery (Coupang Eats).

- Advertising.

- Video streaming (Coupang Play).

- Fintech (payments).

- WOW subscription membership service, similar to Amazon Prime (NASDAQ:AMZN).

While the above list implies that Coupang is broadly diversified across verticals, the vast majority of net revenues are derived from e-commerce and grocery delivery.

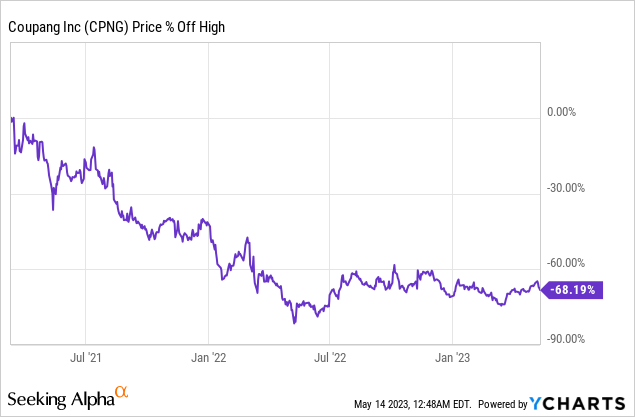

I've written about Coupang several times on Seeking Alpha since their IPO, opting for a "buy" rating each time. However, I've decided to upgrade this rating to a "strong buy" as the business has continued to post stellar results in recent quarters, all while the share price has remained largely flat and trailed the broader market so far in 2023.

Indeed, investors are able to purchase Coupang shares at a 68% discount to their IPO price from March 2021, near the peak of the bull market.

Let's dig into why I think Coupang offers such an attractive risk-reward at the current share price.

Top-line growth remains strong, even in a tough macroeconomic environment

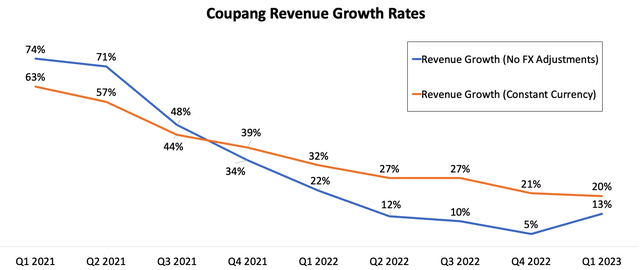

News headlines calling for an imminent recession in the US and elsewhere have become more common with each passing month in 2023. Despite the obvious weakening global macroeconomic environment, Coupang has continued to post 20%+ YoY revenue growth rates (in constant currency) each quarter since their IPO in 2021.

Coupang Quarterly Revenue Growth Rates (Author Generated from Company Filings)

While revenue growth has decelerated as macroeconomic conditions have worsened and consumer spending has decreased, Coupang's growth has remained incredibly resilient and sits above e-commerce peers like Amazon, Etsy (NASDAQ:ETSY), and Alibaba (NYSE:BABA).

Coupang's Q1 2023 revenue growth of 20% (in constant currency) was driven by a 5% YoY growth in active customers to 19.0m and 14% YoY growth (in constant currency) in total net revenues per active customer to $323. Coupang's market share in South Korea also continued to increase, cementing their dominant leadership position in e-commerce.

What makes Coupang's resilient top-line growth even more impressive is that it has occurred as they have cut back substantially on growth investments in their "developing offerings" segment, consisting of newer business units like food delivery, video streaming, and e-commerce in international markets (e.g., Japan and Taiwan). Net revenues for their "developing offerings" segment decreased 17% YoY (in constant currency) to $142.2m.

Given Coupang's "Amazon-esque" obsession with low prices and scale economies shared, growth should remain fairly resilient in a recession as cost-conscious shoppers flock from higher priced in-person and e-commerce offerings to cheaper alternatives, like Coupang.

We continue to defy the broader slowdown in the retail market because we offer customers something very different to the limited assortment and high prices they see in offline retail.

- Coupang CEO Bom Kim, Q1 2023 Earnings Call

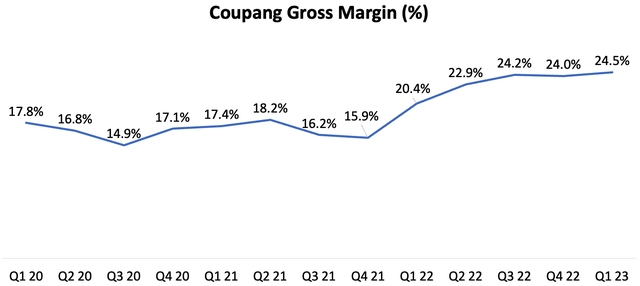

Gross margins continue to expand

Coupang's gross margins have expanded considerably over the past 12 months, coinciding with the market's transition from prioritising "growth at all costs" to capital-efficient growth and profitability. Indeed, there are two core drivers of Coupang's continued gross margin expansion:

- Coupang has completed their major CapEx cycle which took place from 2020-2021 as they massively expanded their logistics/fulfilment infrastructure to support higher e-commerce volumes.

- Coupang has become more focused on unit economics within their "developing offerings" segment and pulled back on growth investments in business units which were not seeing a satisfactory return on investment, such as international e-commerce expansion to Japan.

Continued operational improvements should see Coupang's gross margins rise to the 25-30% range over the coming years; however, this may take longer than expected if the cost of capital decreases due to interest rate cuts and Coupang begins to increase growth investments in newer business divisions.

Coupang Quarterly Gross Margin (Author Generated from Company Filings)

Profitability is no longer a concern for Coupang

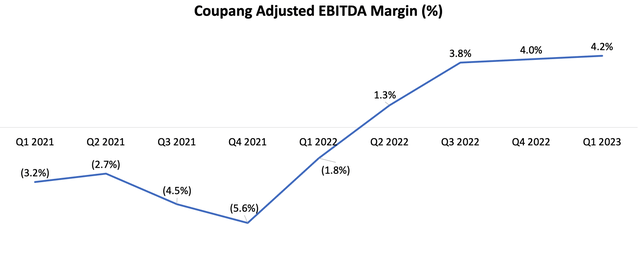

Throughout 2020-2021 when Coupang was investing aggressively in their logistics/fulfilment capabilities and newer growth areas, adjusted EBITDA and net income margins were negative, deterring investors focused on profitability. However, Coupang is now consistently generating positive adjusted EBITDA (note: a dubious metric given their large PP&E balance) and net income.

In Q1, Coupang reported an all-time high adjusted EBITDA margin of 4.2%, showing sequential improvement each quarter since Q4 2021.

Coupang Quarterly Adjusted EBITDA Margin (Author Generated from Company Filings)

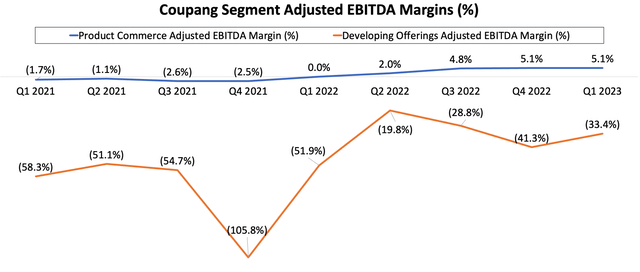

As can be seen below, adjusted EBITDA margins have continued to improve across Coupang's core "product commerce" segment (to 5.1% in Q1) and, to a lesser extent, their "developing offerings" segment.

Coupang Quarterly Segment Adjusted EBITDA Margins (Author Generated from Company Filings)

Coupang's CEO Bom Kim has guided previously towards a long-term target of "10% or higher" adjusted EBITDA margins and, given his track-record of underpromising and overdelivering, I wouldn't be surprised if their internal goal was for a 12-15% margin.

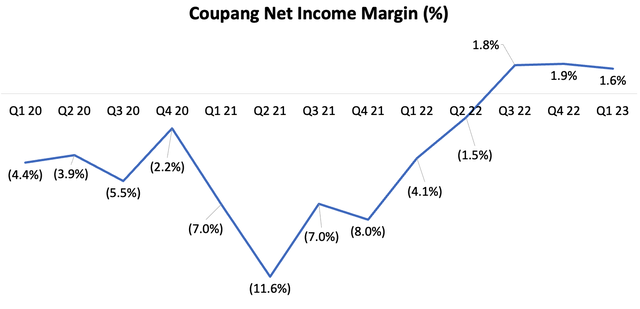

A more appropriate profitability metric - net income - also demonstrates Coupang's significant operational improvements since their IPO. In recent quarters, net income margin has remained steady at 1.6-1.9%, with fluctuations largely due to the relative balance of interest expenses and income.

In Q1, Coupang's LTM net income was positive for the first time since their IPO, meaning that Coupang can now be valued using a classic P/E multiple.

Coupang Quarterly Net Income Margin (Author Generated from Company Filings)

What is most pleasing to me is that Coupang's recent margin improvements are not the result of one-off cost cutting measures (e.g., mass layoffs), but rather sustainable operational improvements:

The majority of the nearly 600 bps improvement in profit margin this quarter came from operational improvements in product commerce, not benefits from advertising, Eats, or WOW membership. It was also not driven by onetime cost-cutting measures like layoffs. And more importantly, we achieved these profit improvements without sacrificing the customer experience.

- Coupang CEO Bom Kim, Q1 2023 Earnings Call

Coupang is beginning to print free cash flow

As recently as Q3 2022, Coupang's CEO Bom Kim re-iterated that Coupang's "next milestone" was to generate positive free cash flow (operating cash flow minus CapEx). Indeed, in the next quarter (Q4 2022), Coupang delivered a whopping $462m in free cash flow, followed by another $407m in this latest quarter. If we take the average of these last two quarters, Coupang is generating around $1.74b in annualised free cash flow.

Coupang trades at an attractive free cash flow yield

If we divide Coupang's enterprise value of $26.2b ($29.4b market cap as of 14th May 2023 minus $3.2b in net cash) by their annualised free cash flow ($1.74b), Coupang trades on an EV/FCF multiple of 15.1x. This is equivalent to a 6.6% free cash flow yield, well ahead of what investors can receive in low-risk US treasury bills. Keep in mind that Coupang's free cash flow should also continue to grow steadily over the coming years.

A strong balance sheet

I actively look for companies with "antifragile" balance sheets (i.e., strong net cash positions) that can use their excess cash to: 1) invest aggressively to gain market share during periods of macroeconomic weakness as competitors are forced to retreat and pull back on marketing spend, and 2) engage in opportunistic M&A transactions when strategically relevant companies trade at deep discounts to their intrinsic value.

In Q1, Coupang reported $3.79b of cash and cash equivalents and $330m in short-term restricted cash, resulting in a total cash balance of $4.12b. Against total debt of $895m, Coupang boasts a very strong net cash position of $3.22b. Coupang is also generating healthy free cash flow, so I would expect this cash position to increase in the coming quarters, further strengthening their balance sheet.

There's also no goodwill on the balance sheet vulnerable to write-downs in the current market conditions.

Minimal shareholder dilution

Coupang's shareholder dilution from stock-based compensation is also minimal. Common shares outstanding increased 1.2% YoY from 1.81m to 1.83m, a negligible amount of dilution for shareholders. I get concerned when annual shareholder dilution exceeds 5% and I don't imagine this will be a concern for Coupang for a long time to come (if ever!).

Conclusion

Coupang has unashamedly copied the Amazon and Costco (NYSE:COST) playbook of relentless customer obsession and scale economies shared to become the largest e-commerce business in South Korea.

While the operating leverage inherent within Coupang's business model was always clear to investors willing to dig beneath the surface, it's only become evident in headline profitability metrics in recent quarters. I expect Coupang to continue to inch towards their long-term target of "10% or higher" adjusted EBITDA margins while continuing to increase e-commerce market share in South Korea.

Patient long-term investors should strongly consider picking up shares in Coupang, a founder-led and fast-growing e-commerce business with a dominant market position and a long runway for growth ahead, both in their core e-commerce and grocery delivery businesses, as well as international expansion and adjacent business segments. A 6.6% free cash flow yield only sweetens the deal.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CPNG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.