Chimera Investment: The 19% Yield Will Likely Be Cut Soon

Summary

- Chimera just reported a big miss on net interest income for its fiscal 2023 first quarter.

- GAAP book value at $7.41 per share fell from $10.15 in the year-ago comp.

- Earnings available for distribution fell year-over-year by 67% and was not sufficient to cover the quarterly dividend payout.

Johnrob/iStock via Getty Images

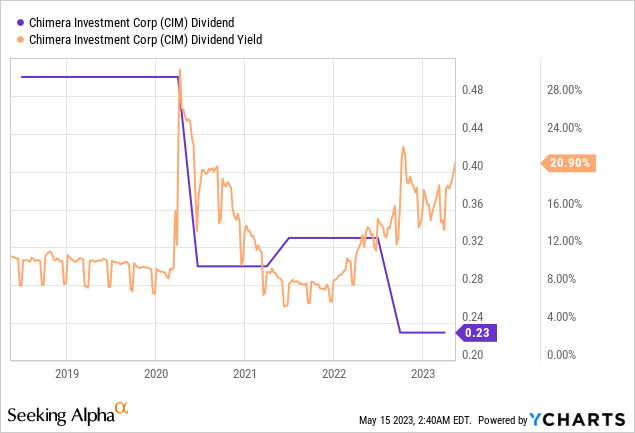

Chimera Investment (NYSE:CIM) last declared a quarterly cash dividend of $0.23 per share, in line with the prior payment and for a 19% forward dividend yield. The mREIT has fallen around 22% since I last covered it earlier this year, joining a broader REIT selloff that was deepened by a series of banking failures and subsequent regional banking crisis that has not come to a conclusive end. The yield has moved close to highs previously only seen in the height of the pandemic crash, but the quarterly payouts have fallen precipitously since then. The dividend is down around 22.7% over the last 12 months and will likely see continued pressure as Chimera continues to realize marked year-over-year falls in net interest income.

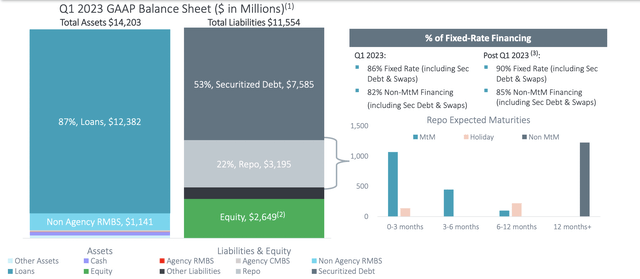

The broader macroeconomic backdrop is dire and residential real estate loan investors have been exposed to the same carnage as office REITs. Chimera's capital is mainly invested in residential mortgage loans and non-agency RMBS, financed with non-recourse and repo financing. Total assets as of the end of its fiscal 2023 first quarter stood at $14.20 billion with liabilities at $11.55 billion. The mREIT held $2.5 billion in floating rate exposure on its outstanding repo facilities with 86% of its financing being fixed as of the end of the first quarter, rising around 400 basis points to 90% post-period end.

Chimera Investment Corporation

The mREIT purchased $1.25 billion of residential mortgage loans during the quarter with seasoned re-performing loans forming the bulk of this at $707 million and with non-qualified mortgage DSCR loans forming another $487 million of purchases. Chimera's GAAP book value as of the end of the first quarter stood at $7.41 per share, down around $0.08 sequentially from $7.49 in the prior fourth quarter and from $10.15 in the year-ago comp. Hence, whilst the mREIT trades at a 27% discount to book, this has not fully stabilized. The risk here is that book value continues to fall to render the current discount a reasonable predictor of the direction of travel.

The Uncovered Dividend

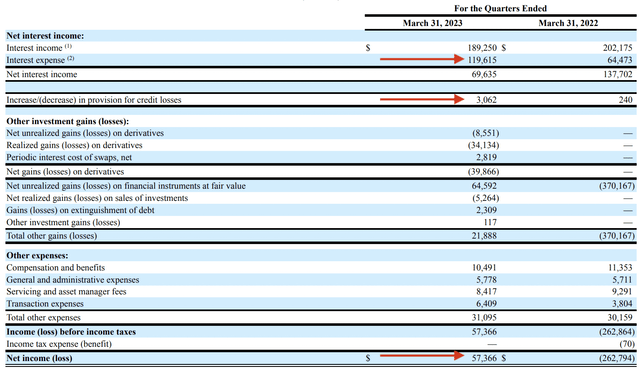

Chimera recorded a miss on net interest income for its fiscal 2023 first quarter. Net interest income of $69.6 million was a 49.4% decline versus $137.7 million in the year-ago comp and significantly below consensus estimates for net income of $84.3 million. This was driven by interest expense that jumped by 85.5% year-over-year to $119.6 million versus a corresponding 6.4% fall in gross interest income. However, whilst the Fed funds rate was just hiked 25 basis points to a 5% to 5.25% range, the mREIT has made some incremental progress with making more of its financing fixed.

Provision for credit losses has also increased by 12.75x to $3.06 billion from $240 million in the prior year-ago quarter. Chimera's management spent quite some time during the first quarter earnings call spelling out the broader macroeconomic context they're operating in. To state it's disruptive would be an understatement with the stock market seesawing between reacting negatively and then positively to strong economic figures on what's expected to be a dovish Fed pivot in the June FOMC meeting. Whilst a loss of $262.8 million in the year-ago quarter made the first quarter look positive, actual distributable earnings were markedly different between the two quarters due to the impact of non-cash items.

The Outlook For The Dividend

Chimera's first quarter earnings available for distribution was $0.13 per share, around $0.03 below consensus estimates and down 67% from $0.39 in the year-ago quarter. It was however an 18.2% increase sequentially from $0.11 in the fourth quarter. EAD at $0.13 for the first quarter meant a payout ratio of 177%. Hence, the current dividend is extremely unsustainable and another cut might be due in the near term. Management acknowledged this during their earnings call and did not rule out another cut but stated that they're positive the portfolio and EAD will recover.

Chimera, like most REITs, faces one of the most disruptive environments for investing in well over a decade. Inflation is still well above the Fed's 2% target while the US is moving dangerously close to a sovereign default. This has not helped sentiment against the broader fears about stagflation. Chimera's 8.00% Series B Fixed to Floating Rate Cumulative Preferred Stock (NYSE:CIM.PB) continues to offer a better way to play the mREIT. These have only moved down around 5.6% year-to-date and are set to float next year at three-month LIBOR plus a 5.791% spread. Critically, it's the income that matters and the current yield on the commons is extremely unsustainable against a 177% payout ratio. A dividend cut is likely coming and could be as large as 50% to reduce the payout ratio below 100%. Hence, this is to be avoided for now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.