Disney: Forget Disney Plus, The Magic Kingdom Hit My Magic Number

Summary

- The risk-free rate is still pitiful for a 10-year investment in a US Treasury. Investors should be looking for future cash flow discounts.

- I'd much rather buy The Walt Disney Company in anticipation of the company returning to its 2018 performance and valuation.

- The assets are some of the most valuable in the world as is the intellectual property.

- Buying it below 2 X book value may still be cheaper than the actual market value of The Walt Disney Company's collective assets.

Jerod Harris

The Magic Kingdom is back

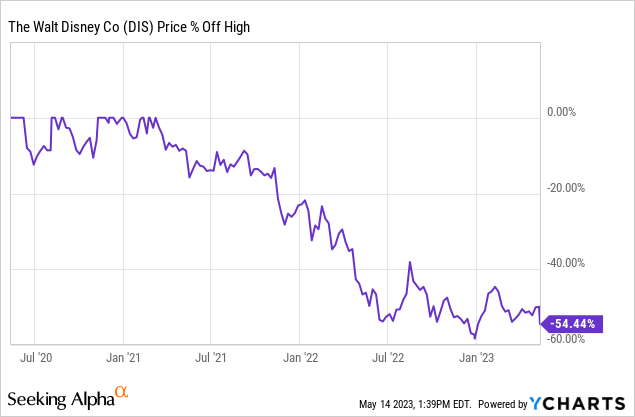

When I say back, I mean back to my price target. I published an article on The Walt Disney Company (NYSE:DIS), after visiting the Anaheim park in October 2022. The article was published after a downturn in the stock price, similar to the one we are seeing now. When I published, it was in the mid to low $90s, after posting the "hold" article, it hit my number of $89 and I proceeded to buy. My price target didn't last long unfortunately and I only got my hands on a limited amount of shares which I still hold now.

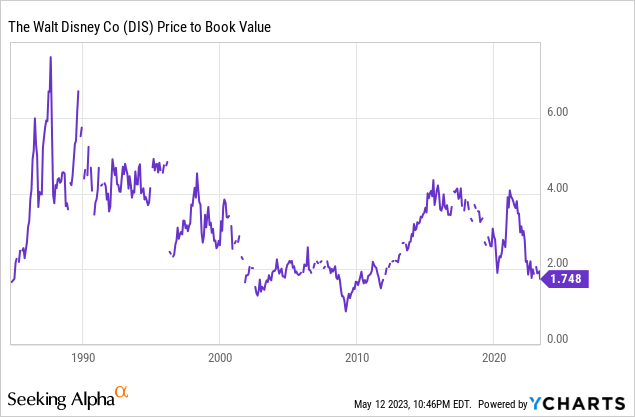

The price target I used for The Walt Disney Company incorporated a modified Graham Number using EBITDA per share and the book value. I couldn't value it on growth due to the Covid disruption, but I noticed it was trading under 2 X book value for the first time in a long time. Since the Graham Number incorporates both the value of the assets and the earnings or cash flow, I lumped it in that bucket. Since then, EBITDA has increased, as has book value.

The company has also bought back shares. I am using EBITDA here because of the turnaround The Walt Disney Company is going through, enduring excess expenses. If you believe in the turnaround under CEO Robert Iger, then today's EBITDA per share might be next year's EPS. The Walt Disney Company is a buy here with a price target of $93. Let's take a look.

The chart

For those that follow me, first thank you very much and second, you know I love fishing at the bottom of the sea. When Mohnish Pabrai was once asked where he starts first in searching for values, the 52-week low list was his answer. Off 54% from its Covid high, which I think was an unwarranted price in the first place, the stock has now gotten a dose of reality.

What they do

From the most recent 10K:

The Walt Disney Company, together with its subsidiaries, is a diversified worldwide entertainment company with operations in two segments: Disney Media and Entertainment Distribution [DMED] and Disney Parks, Experiences and Products [DPEP].

At this point, you have a negative headwind and a positive tailwind. The headwind is the burning of capital as it relates to expenses regarding the media and entertainment business, while the tailwinds are the wide open world and expanding TAM for the DPEP segment to go after. Getting them both humming at the same time is the only thing that will make investors happy at this point in my opinion.

Valuation model

I'll be taking a look at the price using a modified Graham Number substituting EBITDA per share for EPS. The Graham Number taught in the original Intelligent Investor is simply the SQRT of 22.5 × (Earnings Per Share) × (Book Value Per Share). This is the price at which the price-to-book X the price-to-earnings does not cross Ben Graham's magic number line of 22.5 Substituting $7.03 in EBITDA per share for EPS and using the current book value per share of $54.95, we have SQRT: 22.5 X 7.03 X 54.95 = $93.25.

Of note here, my last model ended up at $89.00 a share, which it quickly bounced off of. They have now added $3 per share in book value with a slight increase in EBITDA, especially on a per-share basis since some shares were repurchased since then.

What could be

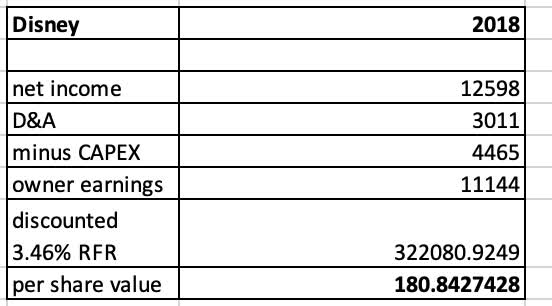

Let's take a look back at The Walt Disney Company's best year in the last 5 years: 2018. The company had $12.598 Billion in GAAP net income, roughly the same as the EBITDA that I am incorporating in my adjusted Graham Number model. Now let's use Warren Buffett's discounted "owner earnings" as outlined in Robert Hagstrom's The Warren Buffett Way, a book so good, Warren Buffett even congratulated Hagstrom on its accuracy.

The discounting method Warren Buffett uses according to the book is the following, net income + depreciation and amortization - capital expenditures discounted at the 10-year treasury risk-free rate. The discounting method adds depreciation and amortization while subtracting CAPEX to look at the stability of the cash flow. In this case for 2018 we have:

- Net income $12.598 Billion

- Plus D&A $3.011 Billion

- Minus Capex $4.465 Billion

- Owner Earnings= $11.143 Billion

Numbers in millions USD except per share numbers:

My own excel, data from Seeking Alpha

Adjusting this model, discounting it to the current risk-free rate of the 10-year Treasury of 3.46% we get a business value of $322 Billion. Divided by the current shares outstanding would give us a per-share value of $180.84. That is my bull case price target should Bob Iger execute the turnaround. With this in mind, I'd say the business was more valuable under Iger, even though the stock got to a higher price under Bob Chapek.

Balance sheet trends

Shares outstanding

Glad to see buybacks starting up again. The float increased during 2020 and 2021, as did debt. The buybacks are welcome and increase the valuation models of both discounted owner earnings and the Graham Number.

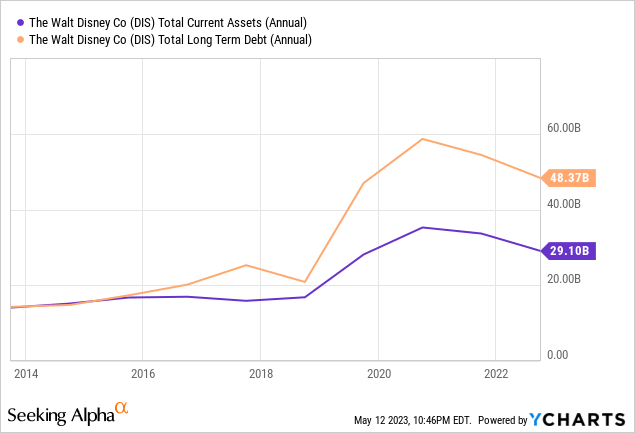

Current assets vs LT debt

In most articles, I like to look at the trend line of current assets versus long-term debt. This is a Peter Lynch basic must when looking at the balance sheet. We see LT debt on the downtrend with current assets flatter, but also decreasing. The company is still burning cash but also keeping debt reduction as a priority. This is not the best balance sheet, but the LT debt is going in the right direction after all the Covid-era borrowing. The debt pay-down and higher cost of capital will likely keep growth initiatives at bay in the near term.

Most recent quarter call

Here are the highlights from the most recent earnings call:

Revenues for the quarter and six months grew 13% and 10%, respectively.

Diluted earnings per share [EPS] from continuing operations for the quarter increased to $0.69 from $0.26 in the prior-year quarter.

Excluding certain items(1), diluted EPS for the quarter decreased to $0.93 from $1.08 in the prior-year quarter.

EPS from continuing operations for the six months ended April 1, 2023 increased to $1.39 from $0.89 in the prior-year period.

Excluding certain items(1), diluted EPS for the six months ended April 1, 2023 decreased to $1.91 from $2.14 in the prior-year period.

Most of these items looked positive, until we got to the DMED, Linear Networks and DTC numbers:

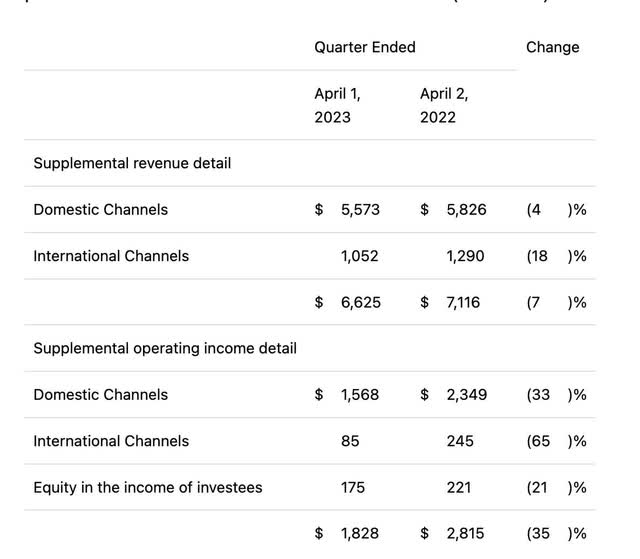

Linear Networks revenues for the quarter decreased 7% to $6.6 billion, and operating income decreased 35% to $1.8 billion. The following table provides further detail of Linear Networks results (in millions):

Long story short, investors did not want to see the linear numbers drop, regardless of the increases in revenue from the physical properties.

Then there was the direct to consumer results:

- Direct-to-Consumer revenues for the quarter increased 12% to $5.5 billion and operating loss decreased $0.2 billion to $0.7 billion. The decrease in operating loss was due to improved results at Disney+ and ESPN+, partially offset by lower operating income at Hulu.

- The improvement at Disney+ was due to higher subscription revenue and a decrease in marketing costs, partially offset by higher programming and production costs and, to a lesser extent, increased technology costs. Higher subscription revenue was attributable to subscriber growth and increases in retail pricing, partially offset by an unfavorable foreign exchange impact. The increase in programming and production costs was due to more content provided on the service.

- Improved results at ESPN+ were attributable to growth in subscription revenue due to an increase in retail pricing and subscriber growth.

- The decrease in operating income at Hulu was due to higher programming and production costs and lower advertising revenue, partially offset by subscription revenue growth and, to a lesser extent, lower marketing costs.

With competition in the DMED segment from the likes of Netflix (NFLX), Comcast (CMCSA), Paramount (PARA), Amazon (AMZN) Apple (AAPL) and Warner Bros. Discovery (WBD), this is a formidable group. All have amazing content and streaming doesn't have to be a zero sum game. However, that's how the market sees it. Truth is, subscribers will pay for multiple services. In the end, all these companies will reap the rewards but linear non DTC channels will suffer.

A relatively flat but slightly negative Disney+ subscriber growth soured investors. It was even more negative at Hulu with -2%. Even though the monthly revenue per subscriber was largely positive, the market didn't like the slowdown in subscriptions at all. Thank you, Mr. Market!

Book Value History

As you can see, this stock doesn't trade below 2 X book value very often. There was a period in the late 80s, early and late 2000s. It's been a while since we've been here, but we're back. Even more than the earnings of The Walt Disney Company, I value the assets. I feel not only do they have the most valuable brand in the world, but also some of the most amazing properties.

Think about it, they own massive properties in the heart of Anaheim, California, near Paris, Shanghai, Hong Kong, and in the heart of Tokyo Japan. I'm not even mentioning Orlando, but those first 5 cities have some of the most valuable land in the world. We're talking 100 acres of prime land on average at each theme park. Similar argument with REITS on NAV versus book value, who knows what the actual value of The Walt Disney Company's properties is. While they don't own all those properties outright, there's no way the equity stakes in those properties and equipment don't outstrip depreciation and amortization by a long shot in my view.

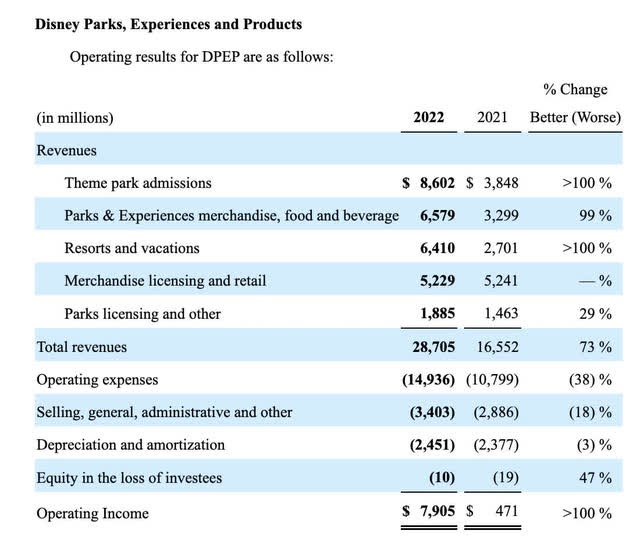

The revenues on all physical entertainment properties and theme parks did much better last year than in 2021 and 2023 should see that prosperity continue:

On top of all this, they operate resorts in the following locations either in whole or as a branded equity stake. From the company website:

There are currently more than 25 Disney Resort hotels to choose from in the Disney Resorts Collection, from budget-conscious accommodations to our luxurious deluxe Resort hotels, including:

- Bay Lake Tower at Disney's Contemporary Resort

- Boulder Ridge Villas at Disney's Wilderness Lodge

- Copper Creek Villas & Cabins at Disney's Wilderness Lodge

- Disney's All-Star Movies Resort

- Disney's All-Star Music Resort

- Disney's All-Star Sports Resort

- Disney's Animal Kingdom Lodge

- Disney's Animal Kingdom Villas - Jambo House

- Disney's Animal Kingdom Villas - Kidani Village

- Disney's Art of Animation Resort

- Disney's Beach Club Resort

- Disney's Beach Club Villas

- Disney's BoardWalk Inn

- Disney's BoardWalk Villas

- Disney's Caribbean Beach Resort

- Disney's Contemporary Resort

- Disney's Coronado Springs Resort

- Disney's Grand Floridian Resort & Spa

- Disney's Old Key West Resort

- Disney's Polynesian Village Resort

- Disney's Polynesian Villas & Bungalows

- Disney's Pop Century Resort

- Disney's Port Orleans Resort - French Quarter

- Disney's Port Orleans Resort - Riverside

- Disney's Saratoga Springs Resort & Spa

- Disney's Wilderness Lodge

- Disney's Yacht Club Resort

- Disney's Riviera Resort

- The Cabins at Disney's Fort Wilderness Resort

- The Campsites at Disney's Fort Wilderness Resort

- The Villas at Disney's Grand Floridian Resort & Spa

This list doesn't include the cruise line business. The resort business being comprised of valuable assets, has a lot of upside earnings potential versus the last 3 years with all countries now wide open for business.

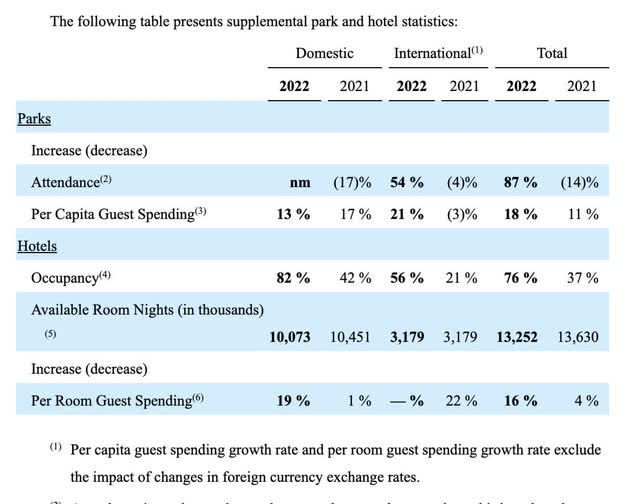

The resort business is seeing a resurgence similar to the theme-parks:

2023 could see domestic hotel capacities exceeding 90% if trends continue. International hotel attendance has a lot of room to grow and add to the top and bottom lines.

Catalysts

The market wants to see The Walt Disney Company dominate the streaming space. So much so that the parks, experience, and resorts are rarely touched upon in stock related news. Subscriber upticks and possibly parting ways with the Hulu stake would make this bounce. I am personally more focused on the physical assets, but that's not the market's forte at the moment.

Company specific risks from the 10Q

Some company specific risks from The Walt Disney Company's most recent 10Q:

Further deterioration in domestic and global economic conditions;

• deterioration in or pressures from competitive conditions, including competition to create or acquire content and competition for talent;

• consumer preferences and acceptance of our content, offerings, pricing model and price increases and the market for advertising sales on our direct-to consumer services and linear networks;

• health concerns and their impact on our businesses and productions;

• international, political or military developments;

• regulatory and legal developments;

• technological developments;

• labor markets and activities, including work stoppages;

• adverse weather conditions or natural disasters; and

- availability of content.

I found it interesting that The Walt Disney Company listed international military and political developments as a risk. With properties in Shanghai, Hong Kong and Tokyo, the Asia Pacific Region is a vital source of revenue recovery to get back to the 2018 numbers. In my opinion, this and expenses that far outstrip revenue in the DMED segment are my big two concerns. Either or both could derail Iger's efforts going forward.

Conclusion

As long as The Walt Disney Company remains under $93 a share, I will continue to allot a larger chunk of my DCA investments to the stock as I feel the current price level may be fleeting. My last modified Graham write-up was good at finding a bottom. The assets are some of the most valuable in the world as is the intellectual property. Buying it below 2 X book value may still be cheaper than the actual market value of The Walt Disney Company's collective assets.

I'm buying the stock and most of all I feel I'm buying the assets at a discount. The risk-free rate is still pitiful for a 10-year investment in the US Treasury. I'd much rather buy The Walt Disney Company in anticipation of the company returning to its 2018 valuation. I believe my $180.84 assessment of the business returning to 2018 profitability is fair if the long end of the yield curve continues to drop.

Don't forget, Disney + didn't even launch until 2019 and 2018 was very profitable without it. Buy the real estate assets and worry about the DMED later. For context, a turnaround returning to 2018 income levels would have the company currently trading under the long term market average at 12.9 X 2018 earnings. Even if DMED were jettisoned, I think this company is irreplaceable.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS, AMZN, CMCSA, PARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.