Pioneer Natural Resources: Closer Look At Financial Health Amid Market Price Fluctuations

Summary

- Assuming an $80 WTI oil price, Pioneer plans to allocate 75% of free cash flow to dividends and buybacks while using the remaining 25% for balance sheet and debt reduction.

- PXD’s crude oil land total production in the following quarters can be higher than in the first quarter of 2023.

- The company’s increasing crude oil and natural gas production is in line with the increasing production levels in the United States.

- However, the company’s average realized prices in the second quarter of 2023 are expected to be lower than in 1Q 2023.

grandriver

Introduction

Pioneer Natural Resources (NYSE:PXD) is a leading independent oil and gas exploration and production company in the United States. Their focus is on developing and producing oil, gas, and NLG while maintaining a strong balance sheet and returning shareholder value. In 2022, they successfully reduced their debt and devoted 95% of their free cash flow to shareholders' returns. Looking ahead to 2023, they aim to increase production while allocating 75% of their free cash flow to shareholders' returns. However, given the anticipated weaker energy prices this year, it is crucial to assess PXD's financial structure and ability to navigate industry fluctuations.

Financial Outlook

As an oil and gas producer, PXD is constantly exposed to industry fluctuations. In addition to facing competition from major integrated oil and gas companies, they also face competition from producers of alternative sources of energy such as renewable energies. This intense competition requires management to focus on effective operation and cost management. For example, the company's major sales of oil, gas, and NGL are driven by Energy Transfer Crude Marketing LLC, a subsidiary of Energy Transfer (ET) , Shell Trading, a subsidiary of Shell plc (SHEL), Occidental Petroleum Corporation (OXY), and Plans Marketing Inc. In 2022, revenues from sales of purchased oil to Occidental accounted for 14% of the company's total revenues from sales. Therefore, the loss of any of these significant customers would have a negative impact on PXD's operations and production efficiency. The oil and gas industry experienced severe volatility from 2020 to 2022 due to both demand-side and supply-side factors. In early 2020, COVID-19-induced circumstances led to a severe worldwide economic downturn that reduced the demand for oil due to global quarantines and travel restrictions. As a result, oil prices plummeted into negative territory. However, post-pandemic circumstances combined with Russia's intervention greatly affected the supply side and caused oil and gas prices to reach their highest levels in a decade in 2022. Despite losses due to war, companies related to oil and gas generated significant cash flow during the previous year. As time passed, warmer-than-expected winters in Europe and other factors have brought some stability in prices. It is anticipated that oil prices will remain relatively flat throughout 2023.

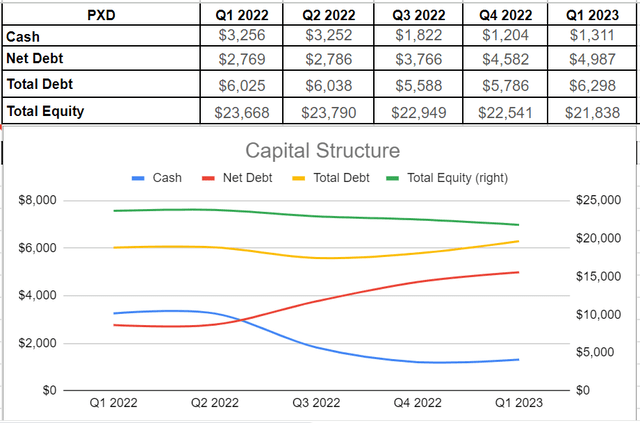

Thanks to the high energy prices, Pioneer was able to generate a significant amount of cash in the first half of 2022. However, as shown in Figure 1, their cash balance decreased by 44% to $1.8 billion in the third quarter of 2022 compared to over $3.2 billion in 2Q 2022 due to lower energy prices during the second half of the year. Meanwhile, by the first quarter of 2023, their cash balance increased slightly to $1.3 billion. Additionally, their debt level increased roughly to circa $6.3 billion. Although there was a significant drop in net debt levels during 1H 2022, they have since rebounded and currently stand at approximately $5 billion. Fortunately, PXD's debt level is still well below its equity level of $21.8 billion in 1Q 2023, indicating that they are well-positioned to weather any potential market volatility in the coming year.

Figure 1 – PXD’s capital structure (in millions)

Author

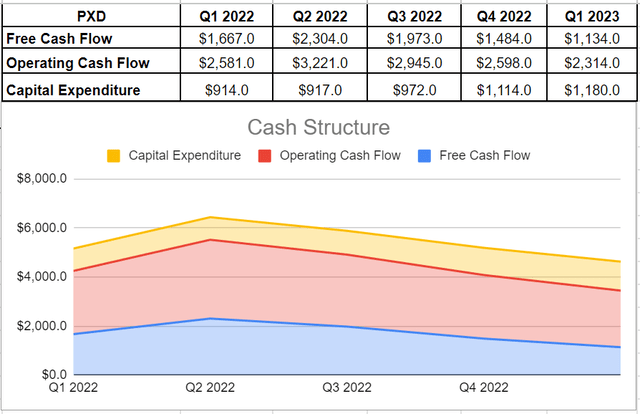

In the first quarter, Pioneer increased its total production and this was mainly driven by the placement of 128 horizontal wells in the Midland Basin, resulting in approximately $950 million in free cash flow by 1Q 2023. With a strong capital structure and this free cash flow, Pioneer plans to return $1.3 billion to shareholders, including a dividend of $3.34 per share in 2Q 2023 and a 14% increase in the base dividend. This marks Pioneer's sixth consecutive year of increasing its base dividend and demonstrates their solid financial structure even before the oil boom. Assuming an $80 WTI oil price, Pioneer plans to allocate 75% of free cash flow to dividends and buybacks while using the remaining 25% for balance sheet and debt reduction. Deleveraging will improve their financial flexibility for the rest of the year as energy prices are not expected to remain as strong as they were in 2022.Although their FCF is lower year over year compared to 1Q 2022, generating $2.3 billion in cash operations during 1Q 2023 translates into $950 million in free cash flow after adjusting for changes in operating assets and liabilities. This FCF is sufficient to support Pioneer's capital return plan (see Figure 2).

Figure 2 – PXD’s cash structure (in millions)

Author

The market outlook

In its 4Q 2022 guidance, PXD announced it expects its Q1 2023 oil production and total production to be between 349 to 364 thousand barrels per day and between 659 to 687 thousand barrels of oil equivalent per day, respectively. In reality, the company’s oil production and total production in the first quarter of 2023 were 361 thousand barrels of oil per day and 680 thousand barrels of oil equivalent per day, respectively, meaning that the company was able to produce near the high points of its guidance. For the second quarter of 2023, the company expects to produce between 357 to 372 thousand barrels of oil per day. Also, PXD expects its total production in 2Q 2023 to be between 674 to 702 thousand barrels of oil equivalent per day. PXD’s increasing production is in line with the higher production of oil, NGL, and natural gas in the United States.

Due to higher crude oil demand from China and India, EIA estimates the global liquid fuels consumption to increase by 1.6 million barrels per day in 2023 and 1.7 million barrels per day in 2024, positively affecting crude oil prices to be between $75 per barrel and $80 per barrel. While the Russian and OPEC crude oil production may decline further (following their production cuts in the past few months), as a result of higher production in North America, the world crude oil and liquid fuels production is expected to increase in 2023 and 2024 (see Figure 3). U.S. crude oil production is expected to increase from 11.89 million barrels per day in 2022 to 12.53 million barrels per day and 12.69 million barrels per day in 2023 and 2024, respectively.

Furthermore, PXD’s natural gas production in 2023 can be higher than in 2022. EIA expects U.S. natural gas total marketed production to increase from 106.67 billion cubic feet per day in 2022 to 109.59 billion cubic feet per day in 2023. However, as natural gas prices decreased significantly, I expect PXD’s natural gas average realized prices to decrease further in the second quarter of 2023. As a result of higher-than-normal temperatures during the past winter, At the end of April 2023, U.S. natural gas storage inventories were 19% more than the five-year average. EIA expects Henry Hub's natural gas price to decrease from $2.76 per thousand cubic feet in 1Q 2023 to $2.49 in 2Q 2022. However, in the second half of 2023, due to higher natural gas exports and higher domestic demand. U.S. natural gas prices can increase to more than $3.00 per thousand cubic feet.

Figure 3 – World crude oil and liquid fuels production and the components of annual change

EIA

Conclusion

Pioneer's strategy for increasing production and delivering returns to shareholders is in line with the projected growth of the US production market in 2023. The company has demonstrated strong financial performance and stability. However, given their vulnerability to fluctuations in commodity prices, their profitability may not be as robust as in previous years. Therefore, I recommend a hold rating for PXD stock as its current market price is fair. Investors may want to consider adding this stock to their portfolio when its market price experiences a slight dip.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I recommend a hold rating for PXD as its current market price is fair. Investors may want to consider adding this stock to their portfolio when its market price experiences a slight dip.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.