Upstart: A Turnaround AI Lending Play

Summary

- Upstart’s stock skyrocketed 35% after 1Q-23 results were announced.

- Higher interest rates are hurting Upstart’s lending business, but 2024 could be a strong recovery year for the AI startup.

- Current price surge may be driven by a closing of short positions.

ArtistGNDphotography

Upstart Holdings, Inc. (NASDAQ:UPST) saw its stock price rise 35% Wednesday, May 10 after the AI lending startup announced its most recent quarter's results.

Upstart surprised investors when it announced that the artificial lending startup had secured $2 billion in long-term funding, which would help the company weather a lending market downturn.

The funding announcement has altered Upstart's narrative, particularly because the lending company's stock has been heavily shorted ahead of earnings.

Considering the financing agreement and the possibility of a sales rebound in a lower-interest environment, I believe the stock is a good buy.

Short-Term Interest Headwinds Hurt Originations And All Of Upstart’s Major Key Performance Metrics

Upstart uses artificial intelligence to support personal loan decisions, and as interest rates have risen sharply, the company has seen a significant drop in sales and other KPIs. Last year, the central bank began an aggressive rate-hiking cycle in order to control inflation, and the rise in short-term interest rates has profoundly and negatively impacted Upstart's origination business, which is heavily reliant on selling new loans to investors.

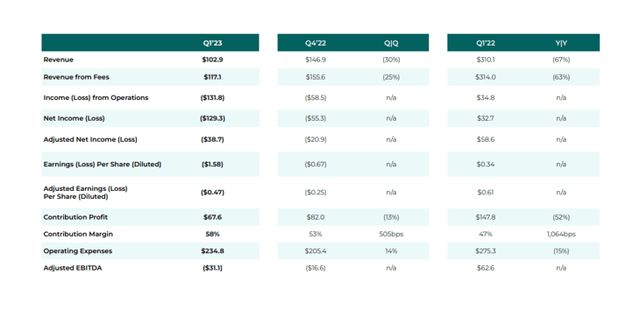

The trend in key performance metrics deteriorated significantly in 2022, and this trend continued in the first quarter. With floating rates continuing to rise, Upstart's sales took a significant hit in the first quarter, falling 67% YoY to $102.9 million.

Unfortunately, the shift in the interest rate landscape has resulted in a significant widening of operating and net income losses. Upstart's net loss in the first quarter was a whopping $129.3 million, compared to a profit of $32.7 million the previous year.

Key Performance Highlights (Upstart Holdings)

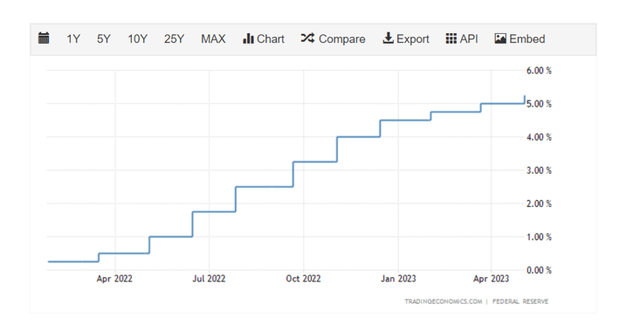

The reason for the sharp drop in sales is the change in interest rates over the last year, which has resulted in less demand for loans from investors. Following the most recent increase, interest rates now range from 5.00% to 5.25%.

Interest Rates (Tradingeconomics.com)

However, as risks to the U.S. economy grow, interest rates may fall in the second half of the year. The failure of Silicon Valley Bank and other banks, as well as easing inflation, are two good reasons for the central bank to ease up on interest rate hikes and reverse some of the rate hikes initiated during the current rate-hiking cycle.

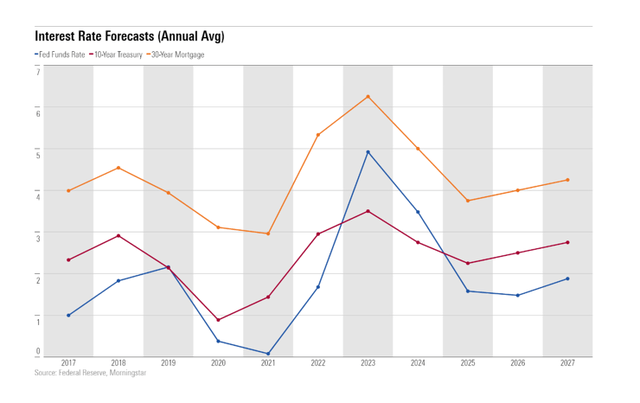

Morningstar analysts, for example, predict that interest rates will return to 2.00% by the end of 2024, reviving Upstart's lending business.

Interest Rate Forecasts (Federal Reserve, Morningstar)

$2 Billion In Secured Long-Term Funding

The real gem in Upstart's 1Q-23 earnings results was the announcement of a $2 billion funding package from new and existing partners, which will allow the company to scale its product offering, invest more heavily in AI capabilities of its lending platform, and, most importantly, weather a potential downturn in the U.S. economy. Upstart did not provide many details about the funding agreement, but the market was clearly aware of it.

Short Squeeze Potential

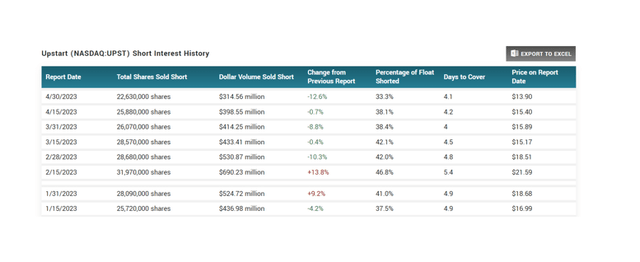

Upstart has been heavily shorted as investors anticipated that interest rate headwinds would result in a significant drop in originations and sales for the company.

Upstart's short interest ratio was approximately 33% of the company's float at the end of April, and the AI lending startup was likely heavily shorted ahead of the 1Q-23 earnings release as well.

The 35% increase in the stock price appears to have been caused by short sellers closing out their short positions.

Short Interest History (Upstart Holdings)

Sales Estimates Indicate Recovery Potential In 2024

The market is currently forecasting $540.16 million in sales, a 35.9% decrease YoY. However, with interest rates expected to fall again later this year and especially next year, I am optimistic that Upstart will see a sales turnaround, even if the company will not fully return to its 2022 sales volume of $842.4 million in 2024.

Having said that, a rebound in Upstart's sales growth next year could help the company present itself to investors as a growing AI lending startup once more.

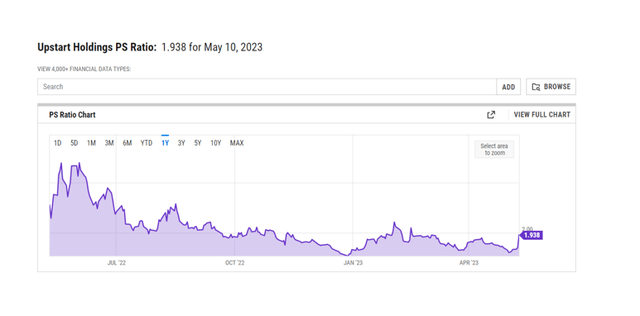

Upstart is currently valued at 1.9x sales, and the days of investors willing to pay high sales multiples in 2021 and 2022 are long gone. Upstart is clearly not a bargain at 1.9x sales (based on this year's sales), but the prospect of a larger short squeeze, a sales recovery in a lower-rate interest environment, and the fact that the company secured a $2 billion long-term funding deal make UPST more appealing.

Upside/Downside Risks With Upstart Holdings

Upstart is a cyclical investment in the market of artificial lending. When short-term interest rates are low and demand for personal loans is high, the startup can be expected to perform well.

That being said, I believe that only investors with a strong stomach could and should own Upstart. Higher floating rate interest rates are weighing on personal loan originations as well as the mortgage market, threatening the short-term sales picture. While Upstart is primarily focused on personal loans, high-interest rates have an impact on both consumer and investor demand for new loans.

Unless Upstart begins to report increased loan demand, the road ahead is likely to be bumpy.

My Conclusion

Overall, Upstart's 1Q-23 earnings results impressed both me and the market. Though sales are down sharply YoY, the AI lending startup's financial results could improve if interest rates return to a lower level.

Furthermore, I believe the $2 billion long-term funding agreement is very good news for investors because it reduces uncertainty and allows the company to invest more in its AI capabilities while financially tying the business over during a potential recession.

Because Upstart has significant short squeeze potential, I believe the stock is a buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UPST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.