Efficiency Gains - Blessing Or Curse For QQQ?

Summary

- Widespread layoffs are being applauded by market prices.

- I am less certain the margin growth is permanent.

- History teaches lessons on how efficiency measures have fared.

- Looking for a portfolio of ideas like this one? Members of Portfolio Income Solutions get exclusive access to our subscriber-only portfolios. Learn More »

Andrii Yalanskyi

The tech index as measured by Invesco QQQ Trust ETF (NASDAQ:QQQ) is up 23% year to date, primarily driven by 2 factors:

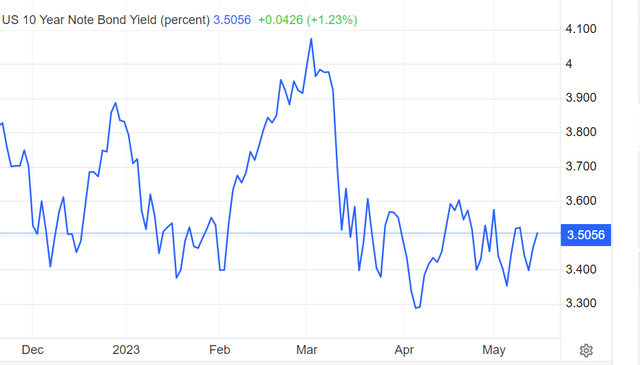

- Ten year treasury yield is down.

- Efficiency improvements are driving earnings.

The first reason is legitimate and financially correct. The 10-year treasury began the year right around 4% and now sits at about 3.5%.

Most of the index runs light on debt, so the QQQ doesn't care that short term interest rates are still very high. Instead, the main driver here is discount rates.

Since this is among the growthier indices with relatively low earnings yield today, it has a higher duration than most other equities. Thus, the weighted average cashflow is further into the future which means more years of discounting to get to present value.

In academic theory, higher interest rates hurt all equities because it means the discount rate is higher so the present value of everything is less. Higher rates disproportionately hurt the QQQ because of its longer duration. Discount rates tend to be driven by the 10 year treasury yield with some risk premium added on top, so the 10 year yield moving from 4 to 3.50 so far in 2023 is a huge boon to tech and explains at least a portion of QQQ's year to date outperformance.

As far as I can tell, that portion of the move is correct.

The rest of the outperformance seems to be driven by rather substantial earnings growth driven by efficiency gains. So far this is taking the form of mass white collar layoffs. The idea is that with improved technology the companies can fulfill all the same functions with fewer people. The most pointed to factors seem to be:

- Greater processing power

- AI

- A population that is much better versed in coding than it used to be

Simply put, most things in the information services industry can be done faster and cheaper than previously.

These layoffs and similar cost cutting measures have already significantly improved earnings across much of the index. On the surface, that would seem like a fundamentally rational reason for the index to rise in price.

However, I would caution in considering these cost savings to be a permanent increase to earnings.

Efficiency - a blessing or a curse?

History has taught us that efficiency gains do not always translate to durable earnings growth. There are thousands of examples one could use, but I want to look at one where efficiency results in greater productivity and one in which efficiency is of the cost saving nature.

The greater productivity effect On Farmland

When the weather hits just right in a given year, farms will operate more efficiently resulting in well above normal crop yields. Without any additional cost, the farmers produce significantly more so it seems like a good thing at first, but when it happens, commodity prices tend to crater.

Farmer revenue is the product of yield X price, so while yields are up price is down and it is unclear if that is actually better. Efficiency gains are often akin to a supply surge. In the case of weather, the supply surge is temporary resulting in a temporary glut of supply, but if it is more technological in nature, say better plant genetics or superior fertilizer, the supply glut is more secular in nature.

Cost savings style of efficiency

There have been many efficiency improvements in personal computing. Back in 1981, a computer looked like this.

It was an IBM Personal Computer 5150 and according to USA Today this one would have cost $1,565 which adjusted for inflation would be about $4,332 today.

Over the years, technology improved significantly. Chip makers automated production making better chips faster and cheaper to produce. The cost savings once an automated chip factory was up and running were huge.

This probably seemed like it would be good news for PC makers, but once again the efficiency gains went to consumer surplus instead of producer surplus.

Today's computers are 100X better and 1/10th the price. The consumer won and many of the major desktop computer makers went out of business.

Thus, my initial read is that the market is being far too hasty in pricing in the efficiency associated with the tech job cuts as a permanent gain to earnings. Much like the employee who trains a robot to do his job winds up unemployed, not all efficiency winds up being good for the industry.

Profit increasing efficiency versus profit reducing efficiency

I believe the key differentiator here is whether the efficiency is unique to a business or if it is industry wide. Industry wide efficiency gains have one or more of the following effects:

- Price reductions on sold goods or services

- Supply increases

- Reduced barrier to entry

- Reduced replacement cost

None of these are good for incumbent businesses.

In contrast, when a company has its own unique source of efficiency, it gets the cost savings or production increase without its competition observing the same. That sort of efficiency truly does lead to sustainable earnings growth.

Consider the early days of Walmart (WMT) in which it built out a hub and spoke logistics model. At that time, it was the only company with such efficient distribution and it outcompeted everyone. Huge gains from the company specific efficiency advantage.

What does this mean for the QQQ?

Well it depends on whether one believes the efficiency gains seen in 2023 are company specific or industry wide.

I am of the belief that they are industry wide. It wasn't just one company that used a newfound efficiency to lay off 10% of its employees. It seems to be across the board.

According to Forbes, already by February 24th, 2023:

"400 tech companies have laid off over 110,000 white-collar professionals."

That, in my opinion, is not a specific company finding a unique source of efficiency gain. That is an entire industry that has found a way to do things more efficiently.

So what happens?

Well, the cost savings are immediate. They are already showing up in 1Q23 earnings reports and full year 2023 guidance. It is this earnings rise that has caused the aforementioned outperformance of the QQQ.

Over time, however, the negative effects of industry wide efficiency will start to kick in.

For the subsectors that sell goods or services, I would expect the supply of those to increase which will in turn reduce the prices companies can charge.

It is a bit trickier for companies that already charge $0 for their product but instead sell customer information to advertisers. I don't see the increased efficiency leading to advertisers paying less for ad space.

Instead, I think the industry wide efficiency gains will manifest as reduced replacement cost. It is rapidly becoming cheaper and faster to create a competing platform. As such, competition is a greater risk and I think there will have to be increased spending to maintain market share.

- Can Google (GOOG) maintain 90% of search market share with open source programs providing deeper answers to certain types of questions?

- Can Apple (AAPL) maintain 2 billion ecosystem users if competitors can produce increasingly equivalent phones at a much lower price point?

I don't know the answers to these questions, but I do think the market should be a bit more cautious about pricing in the widespread layoffs as permanent earnings growth.

That which can be produced cheaply, tends to be sold cheaply.

So far, Portfolio Income Solutions subscribers consist largely of investment professionals, whether current or retired. That’s great, I love having an educated readership as they ask questions that challenge me to dig deeper. At the same time, I believe financial information should be available to all and that financial education is foundational to success in life. As such, I have launched REIT University, a new branch within Portfolio Income Solutions and am offering a large discount to those who want to learn. It contains a crash course in fundamental investment and goes deep into REIT specific analysis.

Grab a free trial and start learning today!

This article was written by

2nd Market Capital Advisory specializes in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation.

Our Portfolio Income Solutions Marketplace service provides stock picks, extensive analysis and data sheets to help enhance the returns of do-it-yourself investors.

Investment Advisory Services

We now offer a variety of ways to invest with us. Our focus is on maximizing client returns while staying within risk their risk parameters. To learn more about our advisory services you may schedule a 15 minute intro meeting here: https://calendly.com/2mc/intro

Dane Bowler, along with fellow SA contributors Simon Bowler and Ross Bowler, is an investment advisory representative of 2nd Market Capital Advisory Corporation (2MCAC). As a state registered investment advisor, 2MCAC is a fiduciary to our advisory clients.

Full Disclosure. All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of the specific person. Please see our SA Disclosure Statement for our Full Disclaimer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles. It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article. 2MC does not provide tax advice. The material contained herein is for informational purposes only and is not intended to replace the advice of a qualified tax advisor. S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P 2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.