Timberland Bancorp: A 4% Dividend Yield While Trading At 0.9 Times Tangible Book Value

Summary

- Timberland Bancorp is a small regional bank focusing on some counties in Washington State.

- The balance sheet shrank while the total amount of equity increased, which boosted the quality.

- The ratio of non-performing assets decreased, while Timberland added to its loan loss provisions.

- The majority of the deposits are insured (which reduces the risks of a run on the bank) while it has access to an unused line of credit of $647M from the FHLB and Federal Reserve.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

Kirk Fisher/iStock via Getty Images

Introduction

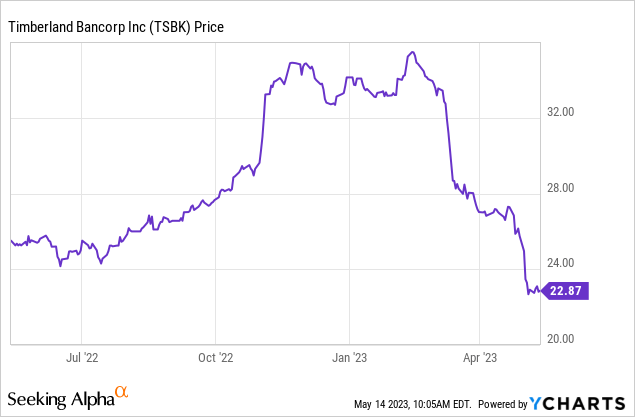

I have always had a weak spot for Timberland Bancorp (NASDAQ:TSBK), a small regional bank in Washington State. The bank runs a robust balance sheet with very low loan loss provisions while its quarterly earnings are usually very robust. Of course, the bank was also hit by the worries hitting the US regional bank sector and the share price has lost in excess of 30% since March and is down about 34% since my previous article on Timberland was published.

The second quarter of the financial year confirmed the strong underlying earnings

The bank's financial year ends in September, which means the most recent quarter the company reported on was the second quarter of its financial year, which ended in March. During the quarter, the bank's net income remained very robust and that's important as it will ultimately help to boost the liquidity on the balance sheet (the bank does pay a dividend, but it retains the majority of its earnings) while the increasing book value and tangible book value per share are making the stock more attractive. The bank is focusing on some counties in the western part of Washington State, and I think this specific focus helps the bank to reduce the risks in its loan book.

Timberland Bancorp Investor Relations

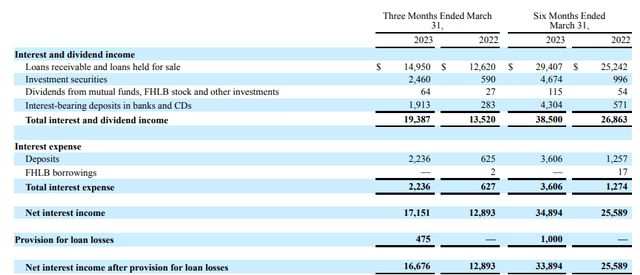

In the second quarter of the current financial year, Timberland saw a small increase in its total interest and dividend income which increased to $19.4M (from $19.1M in the first quarter) Unfortunately, the interest expenses increased at a faster pace and this has put the net interest income under pressure.

Timberland Bancorp Investor Relations

While the $17.2M net interest income is obviously much better than the $12.9M the bank reported for the second quarter of last year, it is a small decrease from the $17.7M it recorded in the first quarter of the current financial year. The decrease is mainly due to the smaller balance sheet as the net interest margin came in at 4.02% in the second quarter.

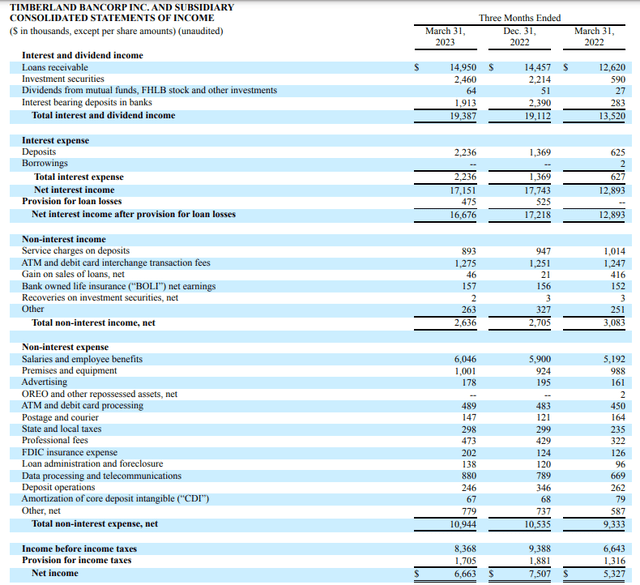

Unfortunately, the net non-interest expenses also increased and this resulted in a lower net profit compared to the first quarter of the year. As you can see below, the bottom line shows a net profit of $6.66M, which is about 10% lower than the $7.5M the bank generated in the first quarter of the year as the net interest margin is shrinking as the bank needs time for interest rates on its loan book to reset. That being said, the Q2 EPS is still about 25% higher than the net income about a year ago. The EPS came in at $0.81 in the second quarter of the year, which brings the H1 2023 EPS to $1.72.

Timberland Bancorp Investor Relations

A good result, but given the mounting pressure on the net interest margin, we should definitely prepare for a lower EPS in the second half of the year.

The bank currently pays a quarterly dividend of $0.23 per share, which is costing about $1.9M per quarter. This means Timberland Bancorp retained about $10-10.4M in earnings, of which about $1.4M was spent ($0.9M on a net basis after taking the cash proceeds from option exercises into account) on a share buyback program.

Access to liquidity remains important

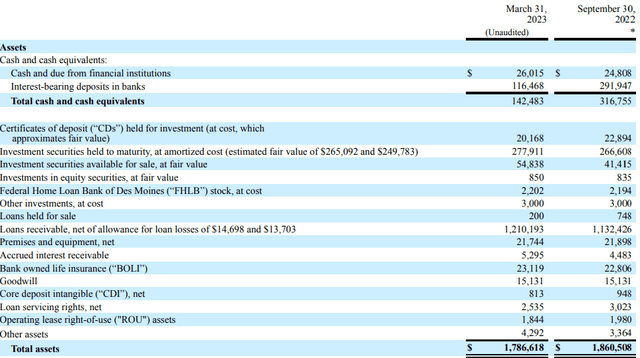

Banks that are retaining a large portion of their earnings should be able to withstand the current crisis in the US regional banking space a bit better. Timberland also runs a relatively small balance sheet of just $1.8B (down from $1.86B at the beginning of the financial year) and its equity portion of the balance sheet has increased. At the end of FY 2022, equity accounted for 11.75% of the balance sheet total, and this increased to 12.75% as of the end of the first semester.

That being said, the issue in the banking sector wasn't always a solvency issue but also a liquidity issue. I was a bit surprised to see Timberland's total amount of cash and cash equivalents decreased from $317M as of the end of FY 2022 to just over $124M at the end of H1, but it looks like the bank has stepped up its efforts in its loan portfolio. The total loan portfolio increased from $1.13B to $1.21B. Additionally, as you can see below, there was an increase in the total amount of investment securities held to maturity, which increased to $278M. It's important to note the fair value disclosed by Timberland: according to the bank, the fair value was $265M. Although that is indeed $13M lower than the book value, it really is a non-issue as even if Timberland would have to dispose of some of the securities, it likely would not have to take a large haircut.

Timberland Bancorp Investor Relations

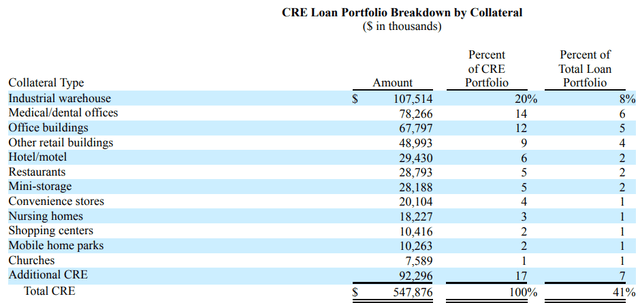

Looking at the breakdown of the loan book, you indeed see that about 45% of the total amount of loans receivable are classified as commercial real estate loans.

Timberland Bancorp Investor Relations

While that could potentially be an issue if it was commercial real estate like malls or restaurants, the majority of the commercial real estate portfolio actually appears to focus on lower-risk investments. As you can see below, 20% of the CRE portfolio consists of loans for warehouses, with an additional 14% of the CRE loan book focusing on medical and dental offices.

Timberland Bancorp Investor Relations

And with just 0.12% of the assets classified as non-performing while the total amount of loan loss provisions is approximately 750% of the total amount of non-performing loans, it looks like Timberland has the situation under control.

Investment thesis

Liquidity shouldn't be an issue for Timberland. As of the end of the second quarter, its cash and cash-equivalent position represented 14% of the liabilities while the bank also has $647M available through the Federal Home Loan Bank and the Federal Reserve using the secured borrowings line. Additionally, as 88% of the deposits are insured, there are very few depositors that would get nervous.

This leads me to believe Timberland Bancorp will get through the current crisis and despite the anticipated lower EPS in the second half of the year, I think the EPS will still exceed $3 and even going forward, this will likely be the lower end of the earnings range (excluding any sudden need for loan loss provisions). This means the bank is trading at just around 7 times earnings and at a discount of 11% to the tangible book value. Combined with a CET1 capital ratio of 18.20%, Timberland appears to be in a good shape.

I haven't bought any additional shares yet as I wanted to dig into the Q2 financial results, but I am pretty satisfied with what I see. I will likely increase my small long position in the next few weeks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSBK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may add to my small position but I am in no rush.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.