Increased Market Efficiency, Safer Market Structure Could Subdue VIX

Summary

- 2022 was one of the worst years for stocks in decades, yet the VIX topped early in the year despite significant June and October swoons.

- Recently, acute concerns about a banking crisis have barely gotten the infamous fear index above the important psychological level of 20.

- Several explanations have been advanced for VIX behavior over the last couple of years, with some even postulating the Fear Index is broken.

- I am advancing an argument for why the VIX has been relatively subdued that I haven't seen elsewhere.

Salameh dibaei/iStock via Getty Images

Volatility is often a curious thing. When volatility is elevated in markets, outcomes are inherently more unpredictable. The potential for extreme outcomes is elevated. Often, a panic mentality grips our decision-making that negates the higher impulses and rationality of the pre-frontal cortex. Fight or flight takes over, and panic ensues.

There is financial volatility, and then there is real-world volatility, like the California wildfire pictured above. We are lucky in financial markets. We can control the effects of financial volatility more than, say if your house is in the path of a fire. Volatility has the property of being very mean reverting as well.

Fundstrat and Bloomberg

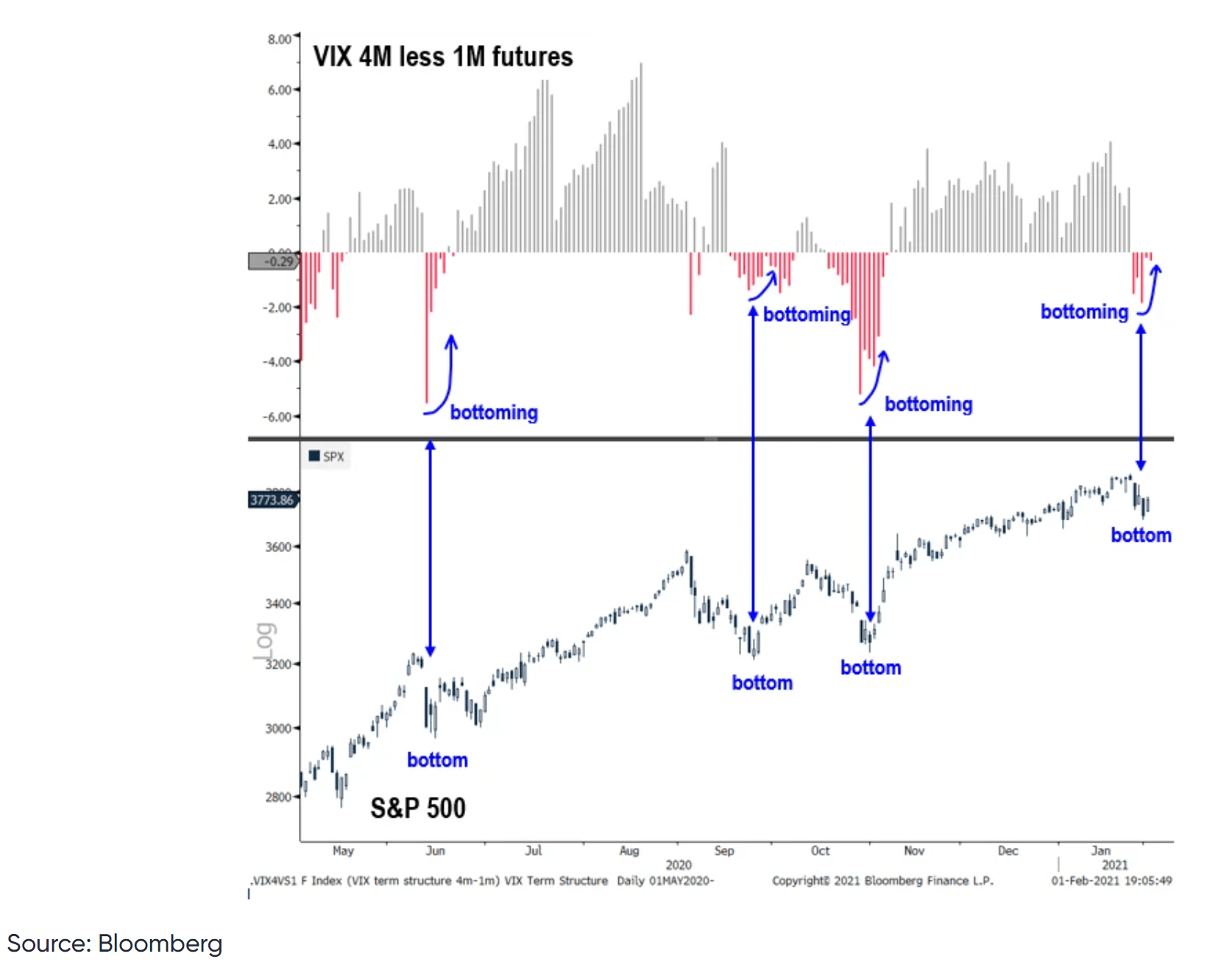

So, when the VIX futures curve is inverted, the market suggests that there is more chance for unpredictable outcomes over one month than over four months. This reflects extreme fear and a condition that is normally reversed in short order.

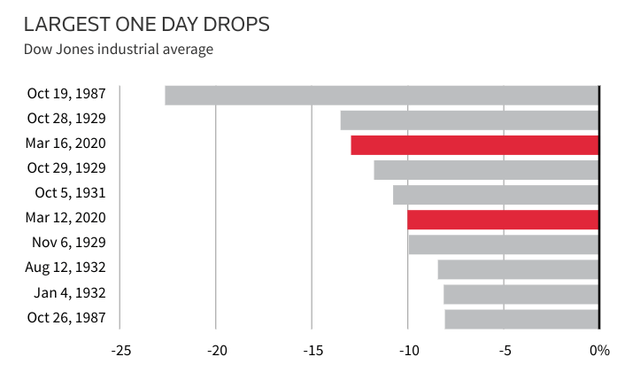

But one dominant feature of the VIX since 1987 has been the emergence of the skew to the left, and this has been a dominant feature of the appeal for the index for use as insurance. The nature of the left-tail risk is often more sudden and extreme than the right-hand. Therefore, downside protection is more expensive than upside protection. Of course, the premium may also reflect the importance of avoiding drawdowns to outperform benchmarks and peers.

Given developments in markets since 1987, including the growing sophistication and efficiency of markets and more effective regulatory guardrails to prevent cascading, panicked sell-offs, it seems intuitive to me that what might be occurring is a partial reversal of the effect of 1987 in defining the volatility smirk of implied volatility on SPX options. In other words, March 2020 shifted the conceptual skew somewhere between the two lines below.

If a coordinated global economic shutdown, cessation of earnings for whole sectors, and the prospect of tens or hundreds of millions of deaths can't bring the market down as much as 1987 did, then perhaps it was either a structural fluke or a one-hundred-year flood. Furthermore, the type of uncertainty and earnings volatility is better managed through single-stock derivatives than index-level tools for several reasons.

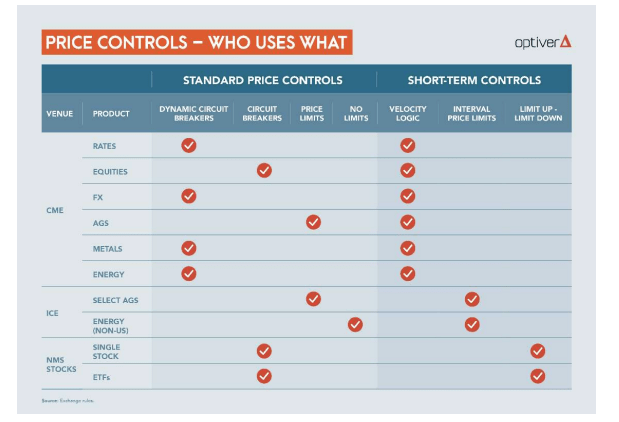

Optiver

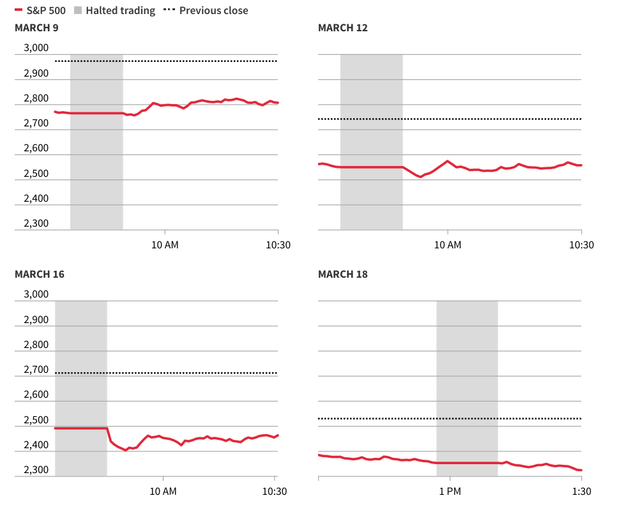

One main reason though is that you can get a lot more bang for your buck before the Limit-Up, Limit-Down rules stop the upside than when the circuit breaker kicks in at the index level. It seems that more customized volatility strategies create more potential for alpha. Remember, all the violations have been at 7% since, and we've never come close to the daily losses of October 1987 and we've never had a 13% drop set off the breaker either.

It's obviously a limited data set and any major volatility event that results in the type of all-correlations go to one sell-offs we've largely avoided in the wake of COVID could reverse it, but I think the steepness of the leftside skew of SPX options has, and conceptually should have, flattened relative to its shape prior to March 2020.

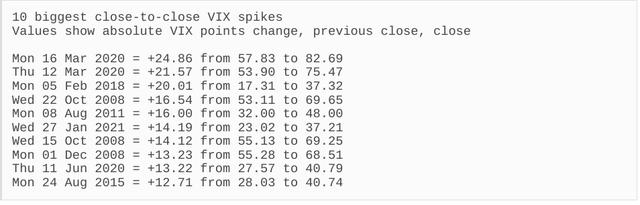

The VIX hasn't see a jump the size of 1987 in the nearly 40 years since. It's safe to say the probability of one that large is less than in its aftermath because of the aforementioned factors. Therefore, the skew to the left of SPX should be less steep, and this is a factor in why those hoping for major VIX spikes are often disappointed.

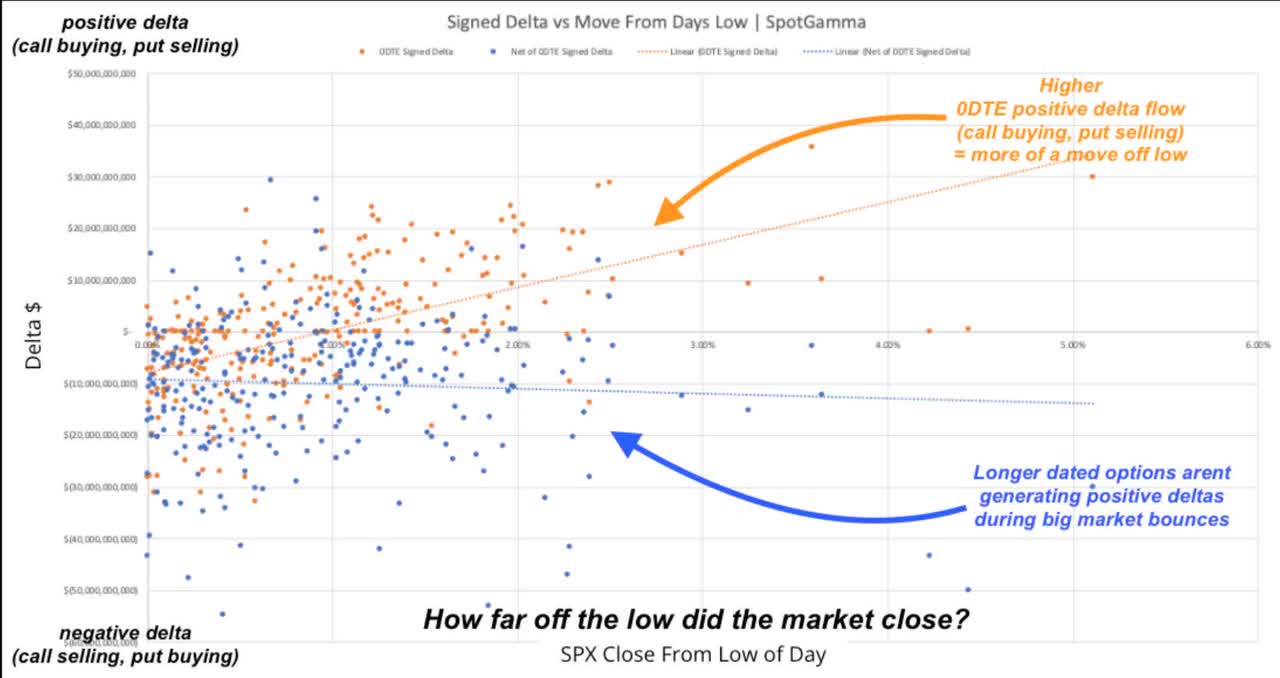

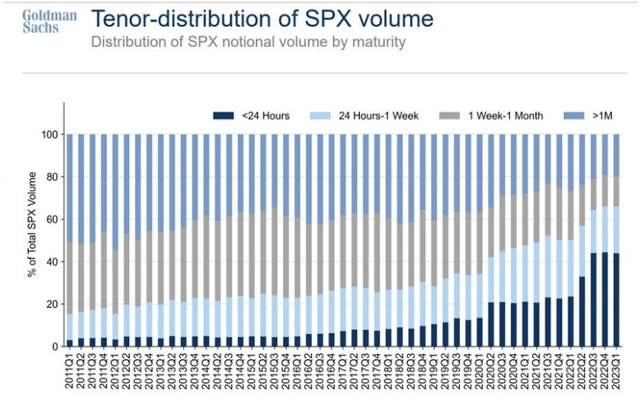

Another piece of evidence supporting this assertion is how many 0DTE options are being used to benefit from upside moves. Traders are taking advantage of volatility on the right side of the curve that only has recently been able to be captured and wasn't always easy to isolate using the SPX futures (or instruments derived from their value) with expirations from 23-37 days. The founder of Spot Gamma, Brett Kochuba, has found that 0DTE options have acted as a positive force on the market.

He found that the delta was positive for the extreme contracts suggested they are actually being used to effectively bank on rebounds after sell-offs, rather than causing or contributing to the sell-offs themselves. This suggests the market is using these tools more efficiently, as does the use by high frequency traders where the match of needs and risk profile is obvious.

Strong Guardrails Help Mitigate Volatility

One of the more underappreciated market reforms that appears to have significantly changed how volatility affects markets, and prices at troughs, is the humble market circuit-breakers passed out of an intuitive sense that gives market participants a few moments to let passions cool in the wake of 87. This is an effort to avoid cascading losses and forced liquidations that can cause economic scarring and persistent uncertainty.

One of the trendy conversation starters in financial discourse has been whether or not the VIX is 'broken,' or not. Most of these arguments revolve around the demand side. Still, I think I may have isolated a major set of occurrences that changed our knowledge and perception of how markets operate when 'the bottom is out of the tub,' so to speak.

- The circuit breakers have been found to successfully mitigate volatility that would likely result in higher VIX spikes.

- There was debate prior to March 2020 whether the circuit breakers would make volatility worse (magnet theory) or whether it would be effective.

- A recent research paper suggests Circuit Breakers work to mitigate cascading selling and extreme outcomes, therefore, the implied volatility of SPX options should be reduced by them, meaning this could be a source of downward pressure on VIX levels.

- If this is true (and more qualified minds than me should debate that) I think it lends support to the assertion that the VIX, while doing what it was designed to do, may be a less useful practical hedge in many instances both because of the proliferation of other more tailored products, and because the skew (to the right for the VIX reflecting the leftward SPX skew) was one of its most attractive features as a hedge or insurance against rare market outcomes.

I think the unlikely culprit for why the VIX has been relatively suppressed compared to previous volatility episodes is at least partially influenced by the unintended consequences of the successful circuit breaker experiences during the dog days of COVID. Though they were implemented after the 1987 crash, they had been tripped only once since then, and then they were tripped four times in less than two weeks during March 2020.

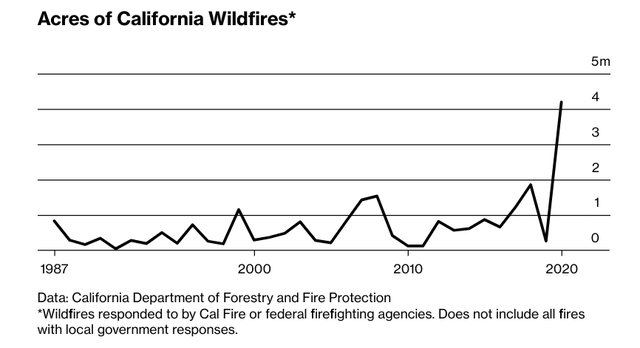

I'll explain why, conceptually, this should have a relatively weak but nonetheless inverse effect on the upward skew, or smirk, of the VIX. All else equal, this means that prior to markets knowing the breakers would have their desired effect, the upside for the VIX would have been relatively more. I want to use an example of the rapidly changing risk of California wildfires to illustrate some of what I think is happening with the notorious fear index.

CA Market Changes are Analogous to Changes in Demand for Volatility Products

In California, nonrenewals of home insurance policies climbed 31% from 2018 to 2019, with ZIP codes that had a "moderate to very high fire risk" seeing a 61% uptick, according to a recent report from the California Department of Insurance. This change caused more residents to turn to the FAIR Plan, a Los Angeles-based association of insurers that provides fire insurance as a "last resort." The number of policies issued under FAIR climbed 36% last year and more than doubled in higher-risk areas, according to state insurance regulators.- Bloomberg, Leslie Kaufman and Eric Rostman.

California wildfire risk has gone up dramatically and very quickly. Many very valuable homes are unable to be insured without the addition of provisions for private firefighters. While some critics have chided private firefighters, the insurance premiums of many people have sometimes been spiking up to four digits. The antiquated, more expensive insurance has been replaced largely in high-risk areas with cheaper premiums being prized over full protection.

This reflects a change in the risk that previous solutions for its mitigation couldn't keep up with. For some expensive homes, it is virtually impossible to insure them without this added protection. Like the 2010s California insurance products, it's less accurate to say the VIX is broken and more accurate to say it's becoming more obsolete as fundamental catalysts change and competing products adapt.

In our digital age of blame-oriented content, many seized upon the rich having private firefighters as fodder for clickable class warfare-laden narratives. But wealth distribution is not my topic today. There's a more profound lesson from this real-world effort to mitigate the effects of physically volatile events.

The evolution of the California insurance market to protect against wildfire is actually a useful metaphor for what I believe explains the behavior of the VIX since March 2020. In high-risk areas, available policies cannot provide enough coverage to cover the cost of the structure anymore, despite a largely responsive market. Thus, the private firefighter solution proliferated, much like the proliferation of more advanced and effective tools to manage and benefit from volatility.

RAND Corporation

The risk got more acute, while a prevailing solution simultaneously became less effective. This led to more customized private alternatives, including the private firefighters often required to insure high-value homes in high-risk areas.

The market share of existing insurers is falling faster in high-risk areas than in low-risk ones. I suspect this is analogous to the diminished demand for 23-37 DTE SPX futures, the prices of which directly result in the headline VIX level. Remember, anything that causes the average price of these futures to drop will cause the VIX to drop.

The proliferation of more sophisticated and precise volatility tools, lower equity exposures, and increased institutional comfort with single-stock derivative strategies all displace demand that might have otherwise gone to the contracts needed for the VIX calculation or, of course, VIX options themselves. Still, the need for other tools seems to have been accelerated by the extreme volatility of March 2020.

However, I believe something that we failed to notice in the dog days of COVID had a great bearing on the rapid evolution of how price and trade volatility over the last few decades. It all has to do with the market circuit breakers.

0DTE May Be a Symptom, Not a Cause, of the Reduced Lefthand Skew

There has been much criticism of 0DTE options as reckless. However, the behavior of customers in high-risk areas may have sacrificed elements of fire insurance protection; they were opting for cheaper options as affordability became a concern. Those who are risk managers or general managers know that affordability is always a concern in hedging.

QuantStackExchange.com

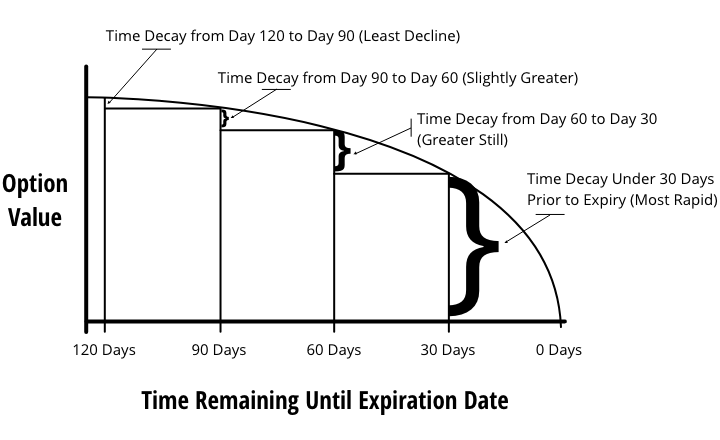

The use of 0DTE VIX positions is a lot more rational, and the trend toward diminishing maturities for more precise hedging with greater opportunity for alpha is a lot more established and almost perennial. It's been the natural progression of derivatives markets as they've expanded, and it's likely largely benefited diligent risk managers.

You get cheap exposure basically purely to the price movement as any extrinsic value has nearly completely decayed by the time there are only 24 hours left to expiration. Remember, every single option will be a 0DTE option right before it expires...

As Interactive Brokers Chief Strategist Steven Sosnick astutely points out, the main reason for the rise of 0DTE use is probably the mere fact that it's only been recently available. And remember, every option is eventually a 0DTE option. The way pricing behaves when the extrinsic value has nearly exhausted gives a profile of cheapness in terms of price and an asymmetric upside reward which can be appealing to both sophisticated and novice investors. As he says, The Games Haven't Changed, The Casinos Have Opened More Tables.

The point we are now at, where there are expirations of options every day, has been a process that played out over the last few decades, but as it has, their use has risen far before our contemporary discussion of the issue. This started picking up as folks became more and more adept at wielding volatility to their advantage over the years. Still, it really expanded in 2020 at the peak of COVID concerns and then in the back half of 2022.

These two spikes look to me like the market responding to new information, given the relative jumps. I suspect the move toward 0DTE options was accelerated by new information about the interplay between regulatory guardrails and the behavior of investors in response to them.

My general hypothesis is that the VIX is generally still working correctly and as it was designed. However, the secular rise of a riskier and more uncertain environment along multiple planes, as well as a regulatory framework that is designed to smooth volatile moments in markets, has led to an evolution of which types of hedges best serve an investor's goal of insuring against the drawdowns that can cripple returns and make recoveries difficult.

Volatility is Often Counterintuitive, Market Hedges Lost Relative Appeal to Direct Hedges

So what seems like a paradox of more risk, lower VIX actually makes perfect sense given the relatively blunt and inconsistent nature of using the VIX as a practical hedge and the added stakes of hedging correctly. The bluntness is only exacerbated by the necessary limitation of upside created by market circuit breakers, which historical observations now suggest are successful in their aim to reduce the exact cascading sell-offs that result in the largest upside for the fear index.

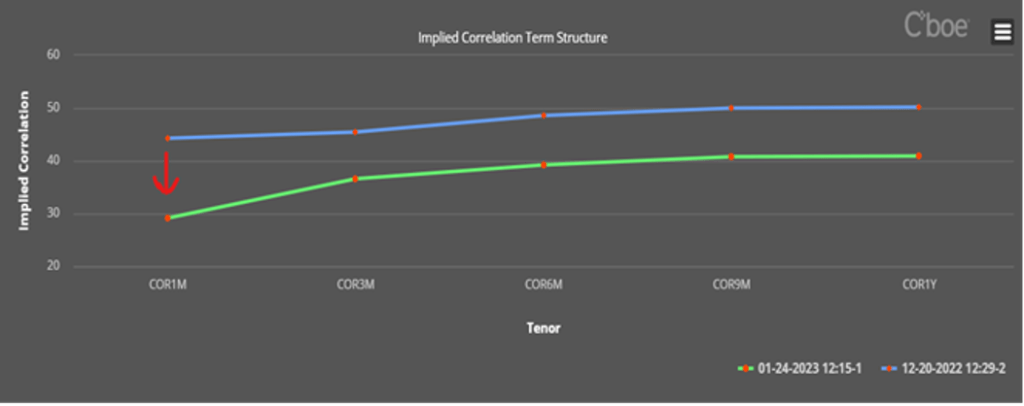

Several of the best pieces by the most prominent authors in institutional derivatives highlight several factors that are reducing demand for the VIX, both seasonally and secularly. A great piece by Don Dale illustrated to me how the Volatility Index could often behave differently than what we would expect in the face of the unprecedented earnings uncertainty over the past years.

When you see stocks dropping 25% or even 50% after big earnings miss, particularly if you own them, you might feel like the VIX should be at $70 like during the GFC. But the effect of pairwise correlations going down means the VIX, reflecting index volatility, actually declines in response to upcoming earnings reports when uncertainty around those reports is way higher than in recent times.

Alphacution Guest Post by Don Dale

Post-COVID volatility has been far more pronounced at the single-stock level in many cases, particularly for companies who couldn't forecast correctly when they had to pass "the puppy through the python" of COVID demand through their reports and rapidly change forecasts in the face of demand volatility. Naturally, some management teams credited themselves for major revenue influxes rather than extraordinary circumstances that would largely normalize, albeit slowly.

So, when there are companies losing 50% after a record earnings miss, largely driven by the difficulty of forecasting in such extraordinary times, it makes a lot more sense to have a direct hedge on assets than a market-level hedge.

Risks and Where I Could be Wrong

Firstly, to be clear, while this article is bearish on the Volatility Index it is by no means saying to expect less volatility over the next few years. Indeed, I expect the contrary given the flock of black swans stalking markets. However, let's remember that exogenous risk factors often don't have as pernicious effects on price as say, financial crises. Nonetheless, any of the below crises could create just the type of sell-off that proves my thesis wrong, painfully wrong:

- Escalation in Ukraine or Taiwan

- Fed Policy Error

- Banking Crisis Worsens

- Return of Inflation

- CRE meltdown

- Write-downs of Private Assets

The crux of my argument pertains to the VIX potentially not being as an effective form of insurance in this environment as it has been during previous risky environments. I think if there is any takeaway from this article, it should not be to not hedge yourself from the effects of volatility, but to be more thoughtful and creative about how you accomplish that as the tools available evolve.

There's a number of great products that can get your exposure to different sections of the curve than afforded by the famous fear index. Managing the risks with 0DTE options, rational as their use can be, is not something that novice investors should consider. It's like flying a plane in the wall of a hurricane your first time. You're just not setting yourself up for success.

Conclusion

In 1987 market participants were shocked by how far markets could go down. It was not really considered possible before that event. In March 2020 and its aftermath, investors largely learned a contrary lesson: even in the face of the most significant risk to commerce in history, markets can rally significantly. Upside volatility was underpriced. Developments in market structure and the increased depth of capital markets since 1987 have also made the type of drop that occurred then less likely.

There was only one observation of them being implemented prior to COVID. But circuit breakers proved their mettle in March 2020. But that fact in itself limits the crescendo of panic that would likely occur in their absence, which is, of course, when the VIX price would spike to its highest theoretical level- the singularity of when there is no call demand at all for SPX, a put/call of 1:0. Staying further away from that theoretical point limits the VIX's efficacy as an insurance tool and instead steers volatility hounds toward newer tools.

It simply is rational to use more precise and efficient instruments to benefit from volatility; the VIX no longer has the same level of upside it did prior to the activation of the circuit breakers around the pandemic. Many have blamed 0DTE options for a suppressed VIX, but I view their increased use as a symptom of the shifting skew of SPX options caused by lessons that COVID-19 taught collective market participants about the nature of financial volatility.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am advancing what I think is a pretty important insight into the interplay between market guardrails and one of the market's most vital indicators of volatility, the CBOE Volatility Index (VIX). So, I know there are a lot of stakeholders on the topic, and I want to confess immediately that there are a great many who have a much more thorough understanding and pedigree on the subject I will be discussing than I do. For those folks, I not only welcome but insist upon thorough consideration, and if a better alternative hypothesis supplants mine, I will feel gratified to have initiated that process. I thus am draped in humility while making this hypothesis. However, I've also checked with supremely smart people (much smarter than I) whose opinions I value, and they think there could be something to my argument. I'm not a quantitative analyst, and just like George Akerloff when he wrote his paper, I'm advancing a conceptual argument primarily. Still, one that I think is of consequence and that will strike you as intuitive if you're a degenerate volatility hound like me.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.