ARS Pharmaceuticals: Potential Revolution In Allergy Treatment With Neffy

Summary

- ARS Pharmaceuticals' Neffy, a nasal spray for emergency Type I allergic reactions, received a favorable FDA committee vote, increasing approval chances and boosting ARS stock by 75%.

- Neffy offers a potential breakthrough in allergy treatment, as it would be the first non-injectable option, addressing issues like needle fear and device complexity that come with current epinephrine autoinjectors.

- The company's solid financial standing, with a cash balance of $274.4 million, is expected to support the development and potential commercialization of Neffy for at least three years.

- Clinical trials for the 2.0 mg Neffy dose have shown promising results, with comparable efficacy to existing injectable epinephrine products, excellent tolerability, and minimal adverse events, suggesting its potential success in the market.

- ARS Pharma's $750 million market capitalization might be undervalued considering the size of the potential market for Neffy if approved by the FDA, making SPRY stock an enticing investment opportunity.

Tashatuvango/iStock via Getty Images

Introduction

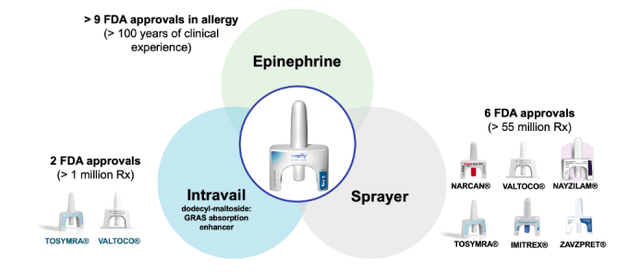

ARS Pharmaceuticals (NASDAQ:SPRY), a clinical stage biotechnology company, is actively developing a product called Neffy (formerly known as ARS-1) to address the pressing need for emergency treatment of Type I allergic reactions, particularly anaphylaxis. Neffy employs a specialized epinephrine composition combined with an absorption enhancer called Intravail, enabling efficient absorption of a low dosage through a convenient nasal spray delivery method.

Recent events: On May 12th, the Pulmonary-Allergy Drug Advisory Committee (PADAC) of the U.S. Food and Drug Administration (FDA) voted in favor of ARS Pharmaceuticals' Neffy for the treatment of severe Type 1 allergic reactions, including anaphylaxis, in adults and children over 30kg. While these recommendations are not binding, they will influence the FDA's review of Neffy's pending New Drug Application (NDA). The FDA is expected to reach a decision by mid-2023. If approved, Neffy will be the first non-injectable treatment for such allergic reactions.

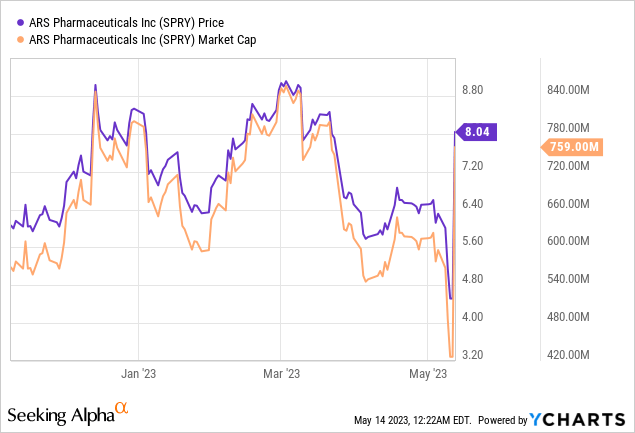

As a result of the positive PADAC recommendation, the stock of ARS Pharmaceuticals experienced a significant increase of over 75%.

ARS Pharmaceuticals' Financials

In the financial results for the fourth quarter and full year of 2022, ARS Pharmaceuticals reported a cash position of $274.4 million, which is anticipated to fund operations for a minimum of three years. Research and development (R&D) expenses for the last quarter were $4.7 million, totaling $18.4 million for the year. General and administrative (G&A) expenses were higher in the last quarter at $10.7 million due to costs associated with the merger with Silverback Therapeutics, Inc. and the initiation of preparations for Neffy's potential commercialization, totaling $18.5 million for the year. The company recorded a net loss of $14.4 million for the quarter and $34.7 million for the year ended December 31, 2022.

Promising Clinical Trial Results and Ease of Use Make Neffy Nasal Spray a Game-Changer

ARS Pharmaceuticals has reached a significant milestone with the successful completion of three pivotal clinical trials for its innovative 2.0 mg Neffy dose. These trials were meticulously designed with the purpose of generating comprehensive data on bioavailability, pharmacodynamics, and safety. The selection of participants was diverse and intentional, including healthy subjects, individuals suffering from severe Type I allergies, and individuals whose allergies were triggered by a nasal allergen challenge. Such a diverse participant group allowed for a thorough investigation of the drug's efficacy across varying health conditions. An additional single-arm pharmacokinetic study was undertaken on pediatric subjects aged 4 to 18 years, a key move in supporting pediatric labeling for the product.

The company also conducted two early-stage proof of concept studies to assess the bioavailability of the 2.0 mg Neffy dose. These studies were another testament to ARS Pharmaceuticals' thoroughness, as they included both healthy individuals and those battling ongoing Type I allergies. These studies further provided a valuable insight into the drug's potential.

ARS Pharmaceuticals' 2.0 mg Neffy dose is being developed to be equivalent to the approved 0.3 mg epinephrine intra-muscular injection products for individuals over 30 kg. This strategic dosage targets approximately 80% of the prescription market in the U.S. Meanwhile, the 1.0 mg Neffy dose is catered towards individuals weighing between 15 to 30 kg, demonstrating ARS Pharmaceuticals' commitment to providing solutions for a wide range of patients. The NDA for the 2.0 mg dose was accepted for review by the FDA in 2022, a significant step forward, with a decision anticipated by mid-2023.

The clinical trials have brought to light the effectiveness of the 2.0 mg Neffy dose. It demonstrated comparable epinephrine exposures to approved injection products, proving its equivalence. Notably, in terms of hemodynamic response, Neffy matched the performance of certain injection products, including the widely-used EpiPen. The overall safety profile of Neffy was further validated as over 600 subjects were exposed to the drug across all clinical trials, showing excellent tolerability with minimal pain upon administration and no serious treatment-related adverse events.

In comparison, about 14% of subjects who received an EpiPen dose and 2% with Symjepi experienced potential blood vessel injection, which could lead to serious side effects. This adverse effect was not observed with Neffy due to its nasal administration route, further reinforcing the safety and convenience of this new drug.

Moreover, Neffy has the unique advantage of reducing the risk of critical dosing errors. This showcases its user-friendliness, making it a potentially preferable choice for adults, children, and untrained individuals. This feature not only enhances its commercial viability but also underlines its potential for large-scale adoption due to its ease of use.

My Analysis & Recommendation on SPRY Stock

In sum, ARS Pharmaceuticals emerges as a potentially lucrative investment opportunity, considering its unique market position, robust financial health, and the innovative potential of its product, Neffy. As an innovative solution for the emergency treatment of anaphylaxis—a severe and life-threatening condition—Neffy could revolutionize the administration of allergy treatments, offering a more accessible, less intimidating approach, thereby reducing treatment errors.

The company's successful clinical trials, coupled with positive feedback from the FDA's PADAC, point towards a promising likelihood for Neffy's approval. ARS Pharmaceuticals' sound financial strategy is evident in its substantial cash reserves and judicious R&D spending.

Furthermore, ARS Pharmaceuticals' strategic dosage decisions for Neffy have the potential to capture a significant market share. The 2.0 mg Neffy dose, designed to be equivalent to the 0.3 mg epinephrine injection commonly prescribed, could serve around 80% of U.S. prescription holders. The company's plans to submit a supplemental NDA for the 1.0 mg dose demonstrate its commitment to a wider patient demographic, thereby potentially broadening its market reach.

ARS Pharmaceuticals asserts that in the U.S., there are 25 to 40 million Type I allergy sufferers, with about 16 million experiencing severe reactions. However, only 3.3 million of these individuals filled an epinephrine injection device prescription in 2021. This group, often fearful of needle-related injuries and discomfort, regularly neglects to carry these life-saving devices, according to the company. Given the size of the existing epinephrine treatment market (estimated at $2 billion worldwide), Neffy's market potential is considerable. If it manages to secure even a fraction of this market, it could significantly boost ARS Pharmaceuticals' revenue. Thus, the current market capitalization of $750 million may seem undervalued against the prospective revenue from Neffy post-approval, indicating potential investor gains.

Though inherent risks come with biotech investments—especially those hinging on FDA approval of a flagship product—the potential returns in this case seem significant. Therefore, investors are recommended to consider adding ARS Pharmaceuticals to their diversified portfolios ("Buy"), with the prospect of substantial long-term growth potential.

Risks to Thesis

When the facts change, I change my mind.

While there are several compelling reasons to consider ARS Pharmaceuticals as a promising investment, it is crucial to highlight several potential risks that could affect my buy thesis.

- Regulatory Risk: Despite the favorable vote from the FDA's PADAC, the FDA's final approval is not guaranteed. The FDA may require additional data or trials before granting approval. A delay or rejection in approval could lead to a significant drop in the company's stock price.

- Market Acceptance: While Neffy presents a unique approach to treating severe allergic reactions, its success ultimately depends on market acceptance. Doctors, patients, and insurers must be willing to adopt this new treatment approach over traditional epinephrine autoinjectors.

- Competition: The pharmaceutical industry is highly competitive, and other companies may be developing or could develop alternative non-injectable treatments for severe allergies. Any such competition could limit Neffy's market share and revenue potential.

- Manufacturing and Supply Chain Risks: ARS Pharmaceuticals needs to ensure it can produce Neffy at scale and maintain an efficient supply chain. Any disruptions could impact the company's ability to meet demand and hurt its reputation.

- Financial Risk: Despite its current healthy financial position, ARS Pharmaceuticals is still operating at a net loss. The company will need to manage its cash reserves carefully, particularly in light of potential unexpected costs or delays associated with bringing Neffy to market.

- Legal and Patent Risk: If ARS Pharmaceuticals fails to secure or maintain exclusive rights to the technology used in Neffy, it may face legal challenges or lose its competitive advantage.

- Dependence on a Single Product: As a clinical stage biotech company, ARS's potential success is heavily reliant on Neffy. If Neffy fails to achieve approval or meet market expectations, the company's future growth could be severely impacted.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.