H&E Equipment Services: A Good Buying Opportunity

Summary

- H&E Equipment Services posted solid financial results amid tough market conditions.

- They are planning to open six new branches in Q2 FY23.

- They are trading at a discounted price with a low valuation providing a great buying opportunity.

- I assign a buy rating on HEES stock.

vm/E+ via Getty Images

H&E Equipment Services (NASDAQ:HEES) works as an integrated equipment services firm. It operates through five segments: used equipment sales, parts sales, new equipment sales, repair and maintenance services, and equipment rentals. In the used equipment sales segment, they sell used equipment and inventoried equipment. In the parts sales segment, they sell parts for equipment customers and offer their rental fleet. In the new equipment sales segment, they sell new construction equipment. In the repair and maintenance services segment, they offer repair and maintenance services to their equipment customers and rental fleet. Finally, in the equipment rentals segment, they offer industrial and construction equipment for rent on a weekly and monthly basis. HEES recently announced great Q1 FY23 results amid tough market conditions. I think they are trading at a discounted price, providing a great buying opportunity. I will analyze its financial performance and talk about its growth potential in this report. I assign a buy rating on HEES.

Financial Analysis

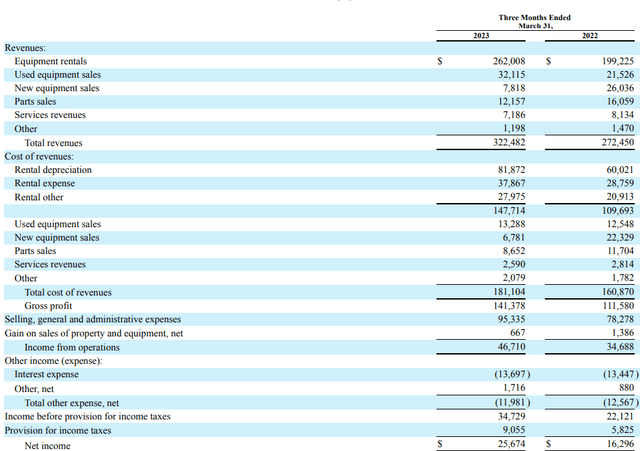

HEES recently posted its Q1 FY23 results. The total revenues for Q1 FY23 were $322.4 million, a rise of 18.3% compared to Q1 FY22. I think increased revenues from equipment rentals and the used equipment sales segment was the major reason behind the revenue increase. The revenues from equipment rentals rose by 31.5% in Q1 FY23 compared to Q1 FY22. I believe the increase in rental rates was the main reason behind the rise. The rates were up by 9.5% in Q1 FY23 compared to Q1 FY22. The revenues from the used equipment sales were up by 49.2% in Q1 FY23 compared to Q1 FY22. I believe an effective and better fleet management strategy was the main reason behind the revenue growth in the used equipment sales.

The gross margin for the first quarter of 2023 was 43.8% which was 40.9% in Q1 FY22. I think higher gross margins on used equipment sales and improved revenue mix were the main reason behind the rise. The net income for Q1 FY23 was $25.6 million, a rise of 57.5% compared to Q1 FY22. In my opinion, the financial performance of HEES was excellent substantial fleet growth and better fleet management, and increased rental rates were the main reasons behind its financial success in Q1 FY23. As a result, their revenues, net income, and gross margins increased, which is quite impressive and a positive sign.

Technical Analysis

HEES is trading at the level of $35. Despite good financial results, the share price has fallen more than 35% since the month of March. But this correction can be a good buying opportunity because the stock is taking support from its 200 ema, which is at $34.9. In addition, the price has been following a trendline since 2020. The stock has taken the support of the trendline three times in the last three years. The last time when it touched the trendline was in October 2022; it went up by 100%, and now the stock is near the trendline. So I believe one can make a fresh buying position in the stock due to the strong support of 200 ema and the trendline. As a result, I think the stock has the potential to move up by 30% from current levels.

Should One Invest In HEES?

I believe their diversified business is their strength. They aren't dependent on a single business to survive if we look at the Q1 FY23, their three segments were struggling, but due to their multiple businesses, they were able to grow their revenues, which is quite impressive and looking at the current adverse market conditions their financial performance becomes even more attractive. In addition, their gross margins and cash & cash equivalents increased in Q1 FY23. As of Q1 FY23, they had cash and cash equivalents of $89.9 million, a rise of 10.6% compared to Q4 FY22. Their balance sheet looks strong, which is a great sign.

Talking about the growth potential. I like its expansion and acquisition strategy to grow its business and boost revenue growth. Like the acquisition of One Source equipment rentals which they completed in October 2022, through this acquisition, they added ten equipment rental locations strengthening their presence in locations like Illinois and Kentucky. In addition, the management is looking to open six new branches in the second quarter of 2023, and they target opening new branches in possibly fifteen new locations. So I think its expansion and acquisition strategy might boost its revenue in the long term.

Talking about its valuation. HEES has a P/E (FWD) ratio of 8.34x compared to the sector ratio of 16.24x and has a PEG (FWD) ratio of 0.34x compared to the sector ratio of 1.51x. So after looking at both ratios, I believe HEES is undervalued. I think the valuation is justified by its current revenue growth rate and future growth potential.

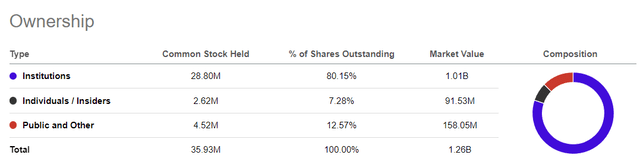

Their shareholding pattern is also perfect. The institutions own 80% shares of HEES which is healthy. Where institutions own maximum company shares, we see less volatility in share price fluctuations.

Risk

The capacity of its main suppliers to provide it with the equipment and other supplies it needs for its operation on reasonable terms or at all could be affected by supply chain disruptions. They have had only mild supply chain delays so far. Still, they could eventually encounter more severe disruptions or the unavailability of one or more suppliers to produce or transport equipment or parts. Their capacity to meet customer demand could be impaired by any suspension or delay in any of their suppliers' ability to provide adequate equipment or supplies or by its capacity to obtain equipment or supplies from other sources on time or at all. As a result, this could materially negatively impact its operations, financial condition, or business. In addition, as of 31 December 2022, they purchased 50% of their equipment from just five manufacturers. So a termination of the relationship with any of its suppliers might adversely affect its business operations.

Bottom Line

In adverse market conditions, they performed very well, and their growth trajectory looks solid. In addition, they are trading at a discounted price with low valuations. Therefore, I believe it might provide excellent returns to its investors in the coming times. Hence I assign a buy rating on HEES.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.