Shopify Q1: GAAP Profitability

Summary

- Shopify reported significantly better than expected results for Q1’23. The e-Commerce company reported a GAAP profit as well.

- The company is selling its logistics and fulfillment business.

- Shopify announced it was cutting 20% of its workforce, and cost cuts could drive GAAP profitability in FY 2023.

- While shares are not cheap, the market seems to be warming up again to SHOP's growth potential.

Sean Gallup

Shopify (NYSE:SHOP) presented better than expected results for the first fiscal quarter in May which caused shares of Shopify to soar by 25%. Shopify continued to see traction in Merchant Solutions revenue growth, the company's growth engine. Shopify further announced that it was selling Deliverr as well as its logistics business although the e-Commerce company only last year acquired the start-up in order to boost its fulfillment capacity. The e-Commerce company further said that it was cutting its workforce by 20% which could improve Shopify's GAAP profitability this year while continual streamlining efforts could drive a further upward revaluation of Shopify's shares!

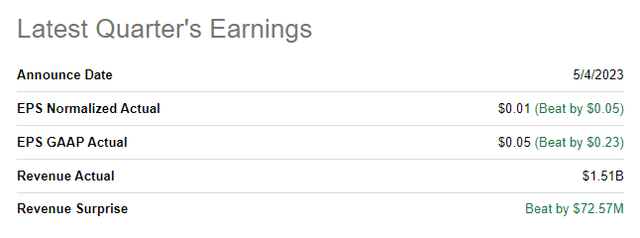

Shopify beats earnings

Shopify beat earnings predictions easily on both the top and the bottom line earlier in May: the e-Commerce presented revenues of $1.51B which beat the consensus estimate by $73M. Shopify also delivered better than expected EPS with actual EPS coming in at $0.01 compared to a prediction of $(0.04), on an adjusted basis.

Solid business momentum in both core business segments

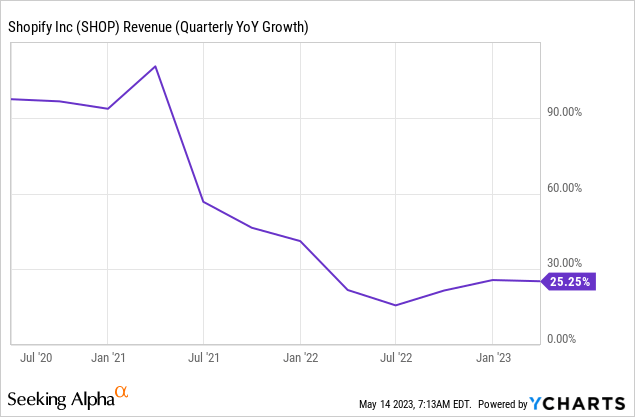

Shopify reported $1.51B in revenues for its first-quarter, showing 26% year over year growth which was once again driven chiefly by Shopify's Merchant Solutions segment. This segment consolidates all those services that online entrepreneurs are willing to pay extra cash for and that supplements Shopify's income from selling monthly or annual subscription plans.

Merchant Solutions revenues soared 31% year over year to a record $1.13B driven by strong product adoption and a growing merchant base that is using Shopify's value-added merchant products and services, such as Shopify Capital or Shopify Shipping, to drive online sales. Merchant Solutions revenues are increasingly important for Shopify as they represented 75% of total revenues in the first-quarter compared to a revenue share of 71% in the year-earlier period.

Subscription Solutions, which represent revenues recognized from the sale of monthly or annual subscription plans to run online stores, increased only 11% year over year in Q1'23 to $382M, meaning Merchant Solutions continued to grow about three times faster than subscription-related revenues. The subscription business represents more or less a stable revenue stream for Shopify while Merchant Solutions dips into the broader revenue potential of the e-Commerce market by offering online merchants products and services that depend on transaction volume.

While Shopify's growth has slowed, post-pandemic, the company is still growing its top line in the double-digits, annually.

Sale of Deliverr and Shopify's logistics business, cost cuts

Almost exactly one year ago, in May 2022, Shopify acquired Deliverr, a California-based fulfillment start-up, for $2B in order to boost Shopify's fulfillment capabilities. The acquisition was part of Shopify's strategic plan to offer its merchant base better inventory capabilities and faster shipping times.

By selling the majority of its logistics business to Flexport, Shopify can focus on its core products while its strategic partner will continue to build out the logistics back-end. The market clearly liked the move as the focus is shifting more and more towards Shopify achieving sustainable GAAP profitability. What also helped Shopify's shares last week was that the e-Commerce company announced that it was cutting 20% of its staff in order to lower its operating expenses. Since Shopify just achieved GAAP profitability, cost savings could result in bigger profits for the e-Commerce firm this year.

GAAP profitability marks an inflection point for Shopify

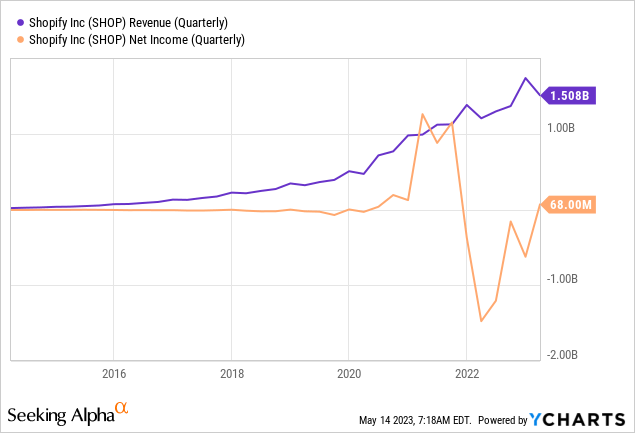

Shopify is now a profitable e-Commerce business on a net income basis which is an important milestone achievement for the company now that top line growth rates have reset from pandemic highs. Shopify's first-quarter net income was $68M which is a serious improvement over last year's $1.47B loss.

Shopify's valuation

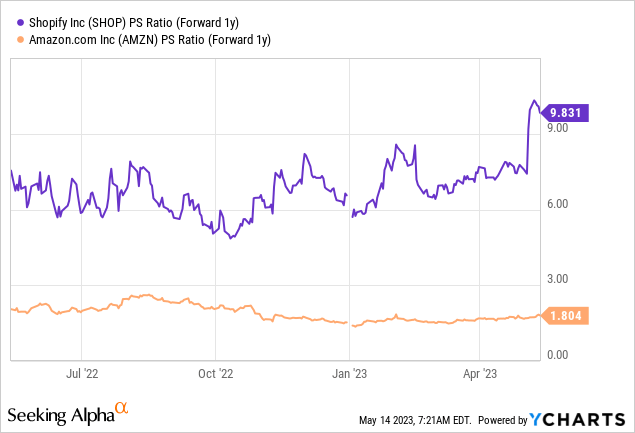

Shopify is a highly-valued e-Commerce company… and this is largely due to the fact that the firm is still growing its top line at double digit rates each year. Shopify is expected to grow revenues 20% this year and 19% next year which translates to a forward price-to-revenue multiplier factor of 9.8X. Amazon (AMZN), on the other hand, is selling at a much lower P/S ratio (1.8X) because the e-Commerce giant is growing at a much lower rate: Shopify grew its top line 2.9X faster than Amazon did in the first-quarter (26% vs. 9%).

Risks with Shopify

The big risk for Shopify, as I see it, is a potential slowdown in both Subscription and Merchant Solutions segment growth if the economy gets hit by a recession. However, I still believe that Shopify is an excellent bet on the long term prospects of e-Commerce economy as the company has successfully created a large, merchant-centric e-Commerce platform in the world. What would change my mind about Shopify is if the company saw merchants leaving its platform for other rival companies offering online store services.

Final thoughts

Shopify delivered a solid earnings card for the first-quarter that showed continual momentum in Subscription and Merchant Solutions revenue growth. The sale of Deliverr, which the e-Commerce company only acquired a year ago, and Shopify's logistics business is a sign that Shopify prioritizes profitability now a bit more than in previous years. The Q1'23 GAAP profit is also a hugely positive sign that the business is developing in the right direction, with job cuts potentially boosting Shopify's income prospects in FY 2023.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHOP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.