DFJ: Spotting Strength And Yield In Japanese Small Caps

Summary

- Multiple expansion has driven the S&P 500's concentrated climb this year.

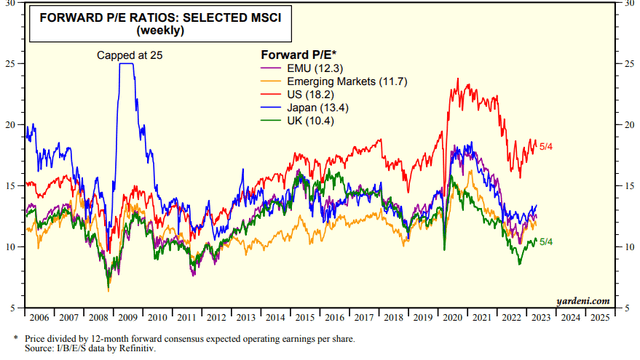

- With an elevated domestic P/E and tepid yield, investors should consider looking overseas and within cyclical small caps in Japan.

- DFJ has a low earnings multiple and strong yield, but the chart has mixed signals.

StockByM

Foreign valuations have only become more attractive compared to the domestic P/E this year. With the S&P 500 higher by more than 7% this year and 2023 earnings estimates that are lower today versus on December 31 last year, multiple expansion has been the primary driver of SPX returns. Go overseas, though, and you will find lower earnings multiples with a recent trend of upward EPS estimates.

I have a buy rating on the WisdomTree Japan SmallCap Dividend Fund ETF (NYSEARCA:DFJ) for its attractive valuation, diversified sector allocation, and relative strength. I do highlight risks including seasonality that is not exactly sanguine right now and a concerning chart pattern.

Where's Value? Don't Forget About Japan.

According to the issuer, the ETF seeks to track the investment results of dividend-paying small-cap companies in the Japanese equity market. It is a unique product that does not come at a very high cost considering how niche it is. Its annual expense ratio is 0.58% while the 30-day average volume is about 16,000 shares, so using limit order during illiquid times is prudent – DFJ’s 30-day median bid/ask spread is 12 basis points. WisdomTree has a useful feature called “Implied Liquidity” that estimates the maximum number of shares that could be traded in a session, and that figure stands at 731,000.

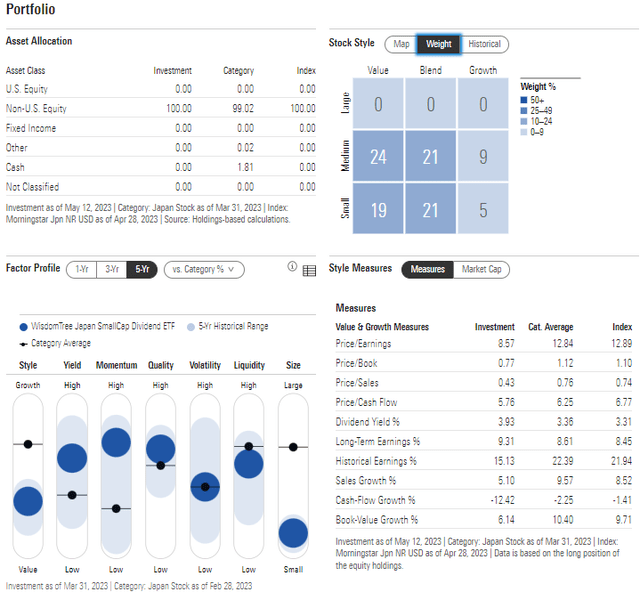

It’s a small fund as you would expect with total assets under management of just $189 million, but its inception is back in 2006. Yield-hungry investors may be attracted to the ETF’s high 4.65% distribution yield. Additionally, value investors should like the fund’s low 10.8 trailing 12-month price-to-earnings ratio while the forward P/E is just 11.3.

Digging into the portfolio, data from Morningstar show that DFJ is value-oriented in the small and mid-cap space. There is no large-cap exposure and scant growth holdings. Momentum is somewhat high with the fund, but negative cash flow growth is a concern.

DFJ: Portfolio X-Ray and Factor Profile

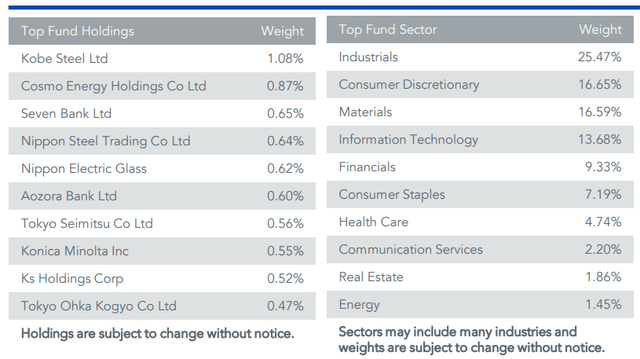

Sector-wise, there is interesting diversification. Notice in the image below from WisdomTree that cyclical Industrials and Materials make up more than 40% of the ETF, but more growth-oriented Consumer Discretionary and Information Technology sector stocks comprise nearly one-third of the allocation. Being a SMID-cap fund, no single position commands an exceedingly high percentage of the portfolio, too.

DFJ: Top Holdings, Sector Weights

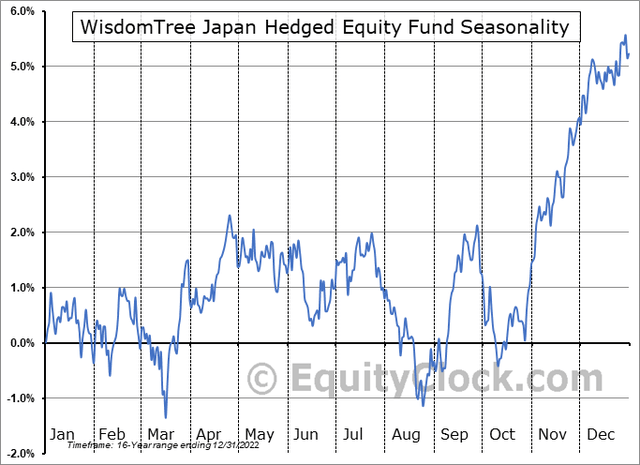

For the seasonal view, I took a look at the WisdomTree Japan Hedged Equity Fund (DXJ). According to data from Equity Clock, currency-hedge Japanese equities tend to be volatile with some downside action now through early Q4, so it is not an opportune time to own the space if history is a guide.

DFJ: Bullish Seasonal Trends Commence in October

The Technical Take

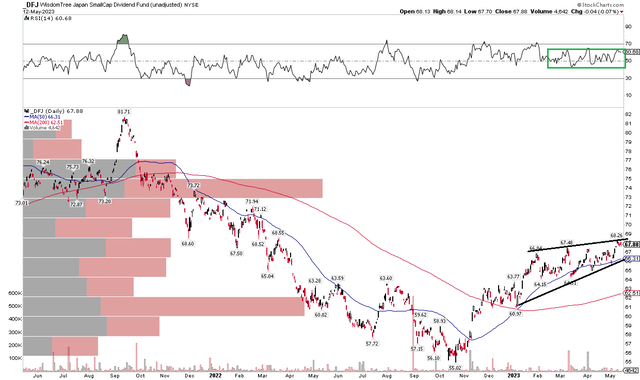

DFJ rests near 52-week highs, which is bullish considering global stocks have pulled back modestly in recent days. What’s more, the trend for domestic equities since the start of the quarter has been non-existent. The S&P 500 has ranged less than 4% in that span, and back out the mega caps, and performance has been negative. So, there’s relative strength with Japanese small caps. Notice in the chart below that the fund has modestly risen this year, putting in a series of higher highs and higher lows.

But the negative aspect is that it’s a rising wedge – a reversal pattern. Bulls want to see stronger price action coupled with confirming volume and RSI momentum. In this instance, DFJ has little in the way of rising volume while the RSI indicator at the top of the chart is simply rangebound. The bottom line technically is that while the uptrend is good to see, conviction is not strong. I rate the chart neutral.

DFJ: Bullish Relative Strength, But Bearish Rising Wedge

The Bottom Line

I am a buy on DFJ. I like the valuation and relative strength, while diversification across sectors and a high yield make it an attractive targeted play right now despite the mixed technical signals.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.