IWF: Rate Pivot Less Likely Than A Staying Of Rates

Summary

- Our view on things is that a rate-stay is more likely than an actual pivot, even if banking issues continue.

- Persistent consumer buying signals expectations that there will be inflation, and the Fed will want to stomp that out even though inflation is easing slightly.

- The IWF has a lot to gain on a rate pivot because of technical effects around tech stocks, but we don't think it's coming.

- IWF mainly has the AI factor to gain from for now with at least 20% allocated to stocks with an AI proposition, but that's possibly already priced in.

- Nothing clearly compelling about IWF.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

imaginima

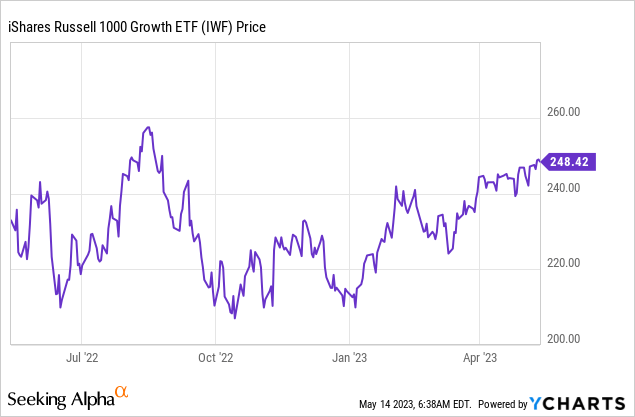

The iShares Russell 1000 Growth ETF (NYSEARCA:IWF) is a tech basket of stocks from the US. It's gaining from the AI factor, and it's unclear how long that will last, which is probably for the benefit of the IWF. However, the matter of the rate pivot, which is implied by the yield curve, is not one we'd bet on yet, and IWF has quite a lot to gain from that. Absent that catalyst, which for technical reasons has an outsized impact on tech stocks, we'd either focus on more explicit AI stocks or avoid speculating on AI at all. IWF doesn't really offer enough of an edge to be worth considering over more specific AI plays or instruments that are more rate-agnostic.

IWF Breakdown

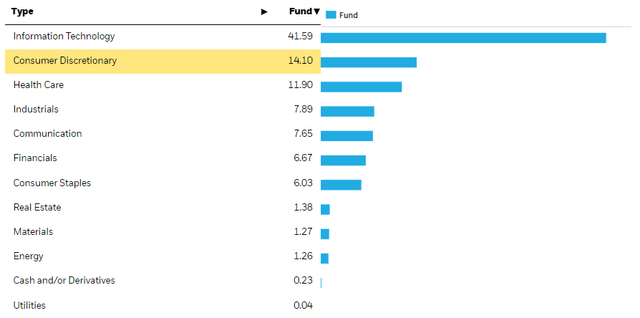

The skew towards tech is immediately evident with the sectoral exposures:

Sectoral Exposures (iShares.com)

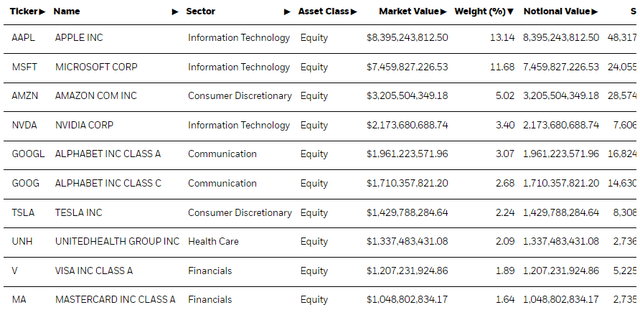

The top holdings show that it is rather skewed towards large-cap holdings, with Apple (AAPL) and Microsoft (MSFT) dominating the top.

Expense ratios are rather low at 0.18%, and PEs are unsurprisingly high hovering just below 30x.

Bottom Line

These high multiples spell out valuations subject to intense gravity from interest rates. With high PEs, much of the valuation is deferred into horizon values, with long horizons for forecast secular growth. This also means sensitivity to rates, since longer horizons mean more compounding on the changes in costs of capital for these companies. Worsened financing environments due to strains on financiers as well as the explicitly higher Fed funds rates have resulted in general declines in these valuations. Further rate hikes, or longer-than-expected periods of higher rates, could continue to put upward pressure on cost of capital assumptions being applied in these horizon values. While there is easing inflation, especially in wholesale figures which are fast approaching allowable policy limits, the CPI figures are still very high and markets may be surprised yet again by either a rate hike, or at least not sign of a rate pivot, which is what even the smart money bond markets expect based on the yield curve.

There is another consideration, which is the debt ceiling impasse. US stocks will be heavily impacted if the impasse goes on for much longer, and divisiveness in US politics begins to be a factor for a premium on treasury rates. Since divisiveness is a secular consideration, coupling it with the financing situation of the US is a major issue, and high multiple tech stocks are going to see outsized downsides.

What has allowed for some optimism in the IWF is that there's a 20% allocation to high AI specific stocks with NVIDIA (NVDA) and Google (GOOG) featuring prominently in the top holdings.

However, for every winner like Microsoft recently, there is also a highly-weighted Google that could be a loser. There are winner-take-all dynamics when it comes to building competent AI. Google is suddenly behind now.

The real force for the recent recovery, which hasn't boomed nearly as much as some select AI winners, has after all been the rate expectations. We think that the intelligent equity investor should be wary, and try take positions that are as rate agnostic as possible, because the market has only ever misread the rate situation since the Fed rate hikes began, and seems to be doing so again given how consistent the Fed rhetoric has been and how likely it is that the Fed may actually purposefully disappoint markets to break any habits and expectations around the Fed Put, which has been a problem for their independence and credibility for a long time now. If rates stay high for longer than expected it'll erode IWF value.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.