Vulcan Materials: Good Growth Prospects But Already Priced In

Summary

- Price increases, a significant backlog in non-residential, and the Federal infrastructure funding should benefit the company’s revenue.

- Margin should also get benefit from pricing increase and reducing diesel costs.

- Valuation is in line with historical levels.

sturti

Investment Thesis

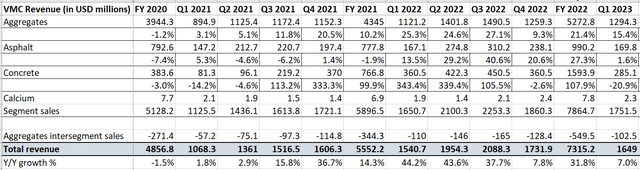

Vulcan Materials Company (NYSE:VMC) reported positive revenue growth in the first quarter, despite lower shipment levels. This growth was primarily attributed to successful pricing actions, which are expected to continue benefiting the company's revenue throughout 2023. Management has guided for a 15% price increase for the full year, contributing to this positive outlook. Additionally, the company has a backlog of 8.5 million tons, including some multiyear projects, in the private non-residential sector. This backlog is expected to help offset the negative impact of the softening residential housing end market and further boost revenue in 2023.

In terms of margin, Vulcan Materials Company is expected to benefit from the upcoming price increases. Combined with disciplined cost management in selling, general, and administrative (SGA) expenses, as well as moderating diesel price inflation, the company's margin is anticipated to improve in the coming quarters.

As for the stock's valuation, it is currently trading at 29.82x FY23 consensus EPS estimates, which is a slight premium to its historical 5-year average P/E (FWD) of 29.50x. The company’s valuation is also at a premium to its peer Martin Marietta Materials (MLM), which is trading at 25.42x current-year consensus EPS estimates. Although I like the company’s growth prospects, I believe they are already getting priced in at the current levels. Hence, I have a neutral rating on the stock.

VMC Q1 2023 Earnings

Recently, VMC reported better-than-expected results in the first quarter of FY 2023. Sales for the quarter reached $1.65 billion, marking a 7% year-over-year increase and surpassing the consensus estimates of $1.57 billion. The earnings per share (EPS) also experienced significant growth, rising by 30.1% year-over-year to $0.95, exceeding the consensus estimate of $0.62.

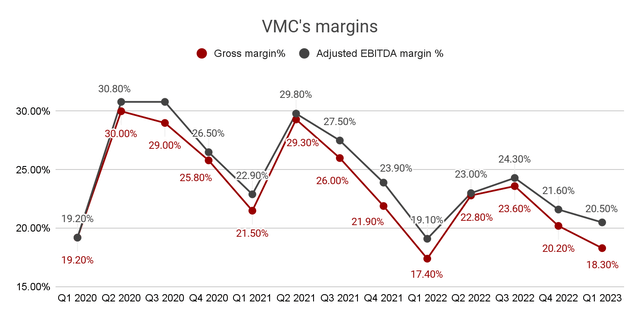

The revenue growth in the quarter was primarily driven by strong pricing momentum across all product lines, which more than compensated for the decline in shipments during the period. Despite facing persistent inflation related to natural gas and liquid asphalt, the adjusted EBITDA margin expanded by 140 basis points year-over-year to 20.5%. This margin improvement played a key role in boosting the EPS for the quarter.

Revenue Analysis and Outlook

The company continued to benefit from strong pricing across all product lines, with aggregates prices (adjusted for mix) improving by 19% year-over-year in the first quarter of 2023. However, the aggregates shipment in Q1 2023 declined by 2.4% to 51.7 million tons compared to the previous year. Additionally, shipments of other products, such as asphalt and ready-mixed concrete, also experienced significant declines in the quarter. The pricing increases more than offset the volume decline, resulting in revenue growth of 7% year-over-year.

VMC's revenues (Company data, GS Analytics Research)

Looking ahead, management has guided for a 15% Y/Y pricing increase for the full year 2023 which should support revenue growth. Moreover, the pipeline of private non-residential projects remains strong, providing support for near-term demand. The company has 12 major industrial projects in its backlog, totaling 8.5 million tons. These projects include battery plants, electric vehicle manufacturing facilities, LNG facilities, and large warehouse parks, which align well with the company's geography and service capabilities. Capitalizing on these opportunities should help offset the negative impact of the softening residential market and drive revenue growth in 2023.

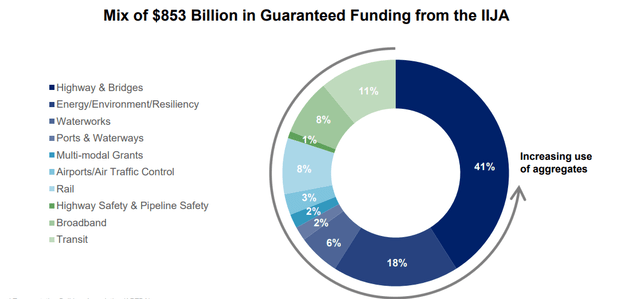

On the public side, there is growing momentum, with new highway starts exceeding $100 billion in the trailing 12 months. The highway sector is poised for robust growth as it is backed by $853 billion of new federal funding from the Infrastructure Investment and Jobs Act (IIJA), with 41% of that allocated to aggregate-intensive highways and bridges. Other infrastructure sectors such as water, energy, ports, and airports are also expected to benefit from significant funding from IIJA and the Department of Transportation (DOT). The allocation of these funds is anticipated to be deployed in the coming years.

Federal Infrastructure Funding Mix (VMC’s Investor Presentation)

Overall, I maintain an optimistic outlook on the company's long-term revenue growth prospects, given its leading position in the majority of the markets it operates in and benefits from future projects fueled by government funding.

Margin Analysis and Outlook

The company's adjusted EBITDA expanded by 140 basis points year-over-year to 20.5% in the first quarter of 2023. Additionally, the gross margin improved by 90 basis points year-over-year to 18.3%. This growth can be attributed to strong pricing across all product lines, which offset the headwinds from higher natural gas and liquid asphalt costs and the negative impact of volume deleverage from shipment declines during the quarter.

VMC's margins (Company data, GS Analytics Research)

Looking ahead, the company is expected to face high single-digit cost inflation, primarily driven by natural gas and liquid asphalt, in the upcoming quarters. However, the strong pricing momentum should help it more than offset the inflationary headwinds. Further, diesel costs, which represent a significant portion of the company's expenses, have decreased significantly in recent months and currently remain at meaningfully lower levels compared to the previous year. This reduction should serve as an additional tailwind and support the company's margin moving forward.

The company is also focusing on effective operational execution and disciplined management of Selling, Administrative, and General (SGA) costs, and implementing its VWO (Vulcan Way of Operating) strategy, which focuses on enhancing operational efficiency through technology. This should also help it lower costs, ultimately contributing to margin expansion in the coming years.

Valuation and Conclusion

While I like the company’s growth prospects, I can’t say the same about its valuation. The company's stock is currently trading at a forward price-to-earnings (P/E) ratio of 29.82x, based on the FY23 consensus EPS estimates of $6.55. This valuation is a slight premium compared with VMC’s five-year average forward P/E of 29.50x. The stock is also trading at a premium compared to its peer Martin Marietta Material’s FY23 P/E (based on consensus estimates) of 25.42x. Both VMC and MLM are exposed to similar demand drivers and well-positioned to benefit from rising aggregate pricing and federal infrastructure funding. So, I don’t like paying a significant premium for VMC.

While the overall growth prospects of Vulcan Materials appear attractive, the stock's valuation appropriately reflects it, and hence I will rate this stock neutral as of now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Vedang S.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.