CEF Weekly Review: All's (Mostly) Quiet On The Distribution Front

Summary

- We review CEF market valuation and performance through the first week of May and highlight recent market action.

- CEFs were relatively weak as rising credit spreads and residual unease about the banking sector pushed prices lower.

- CEF distribution changes are no longer coming in waves but have slowed down to a trickle for two main reasons.

- We rotated out of the bank-focused FINS CEF this week. Although its bank overweight struggled due to the bank tremors, its structural features prevented a deeper selloff.

- Systematic Income members get exclusive access to our real-world portfolio. See all our investments here »

Darren415

This article was first released to Systematic Income subscribers and free trials on May. 5

Welcome to another installment of our CEF Market Weekly Review where we discuss closed-end fund ("CEF") market activity from both the bottom-up - highlighting individual fund news and events - as well as the top-down - providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the first week of May. Be sure to check out our other weekly updates covering the business development company ("BDC") as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

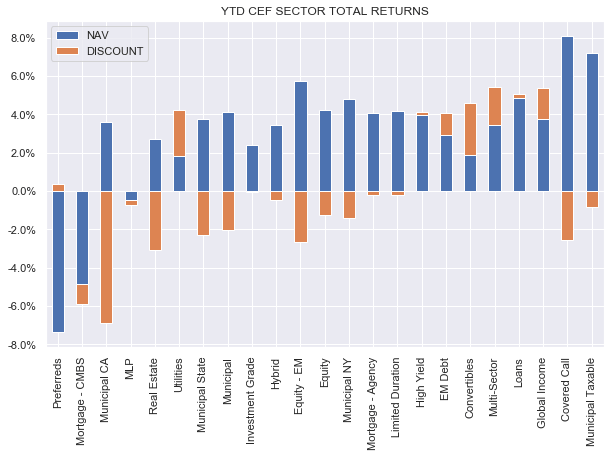

Most CEF sectors were lower this week on the back of higher credit spreads and wider discounts. Ongoing concerns about the banking sector has kept risk sentiment subdued. Year to date, the unlikely pair of Taxable Munis and Covered Call funds are in the lead as both stocks and longer-term bonds have rallied.

Systematic Income

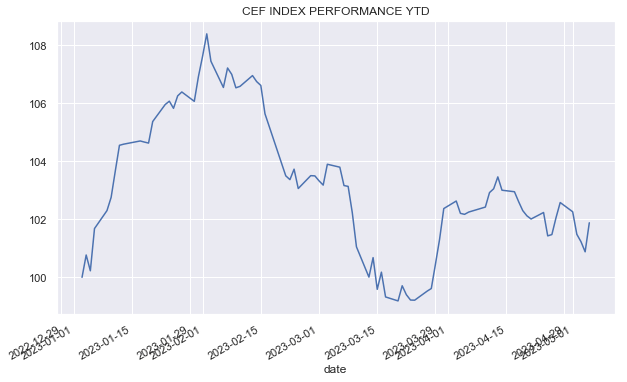

CEFs have partially recovered from their March swoon but remain well off the peak this year.

Systematic Income

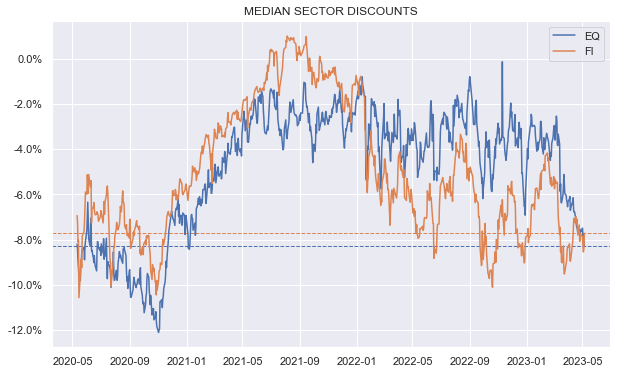

After trading at tighter levels since about 2022, equity CEF sector discounts have moved out to trade wider of their fixed-income counterparts in aggregate. This is largely due to the recent weakness in Utilities, REITs and MLPs.

Systematic Income

Market Themes

May was unusually quiet for CEF distributions. Across the five largest managers we only saw two distribution changes - for Eaton Vance limited duration CEFs. After a brutal period for many sectors, distribution changes are slowing down.

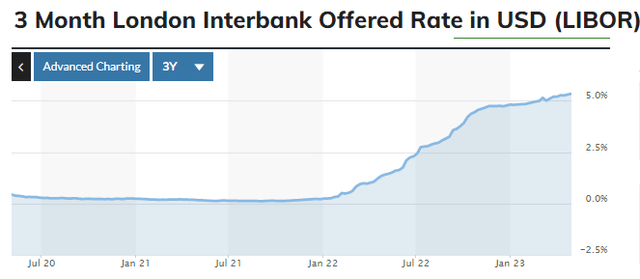

In our view this is for two reasons. One, the pace of short-term rate rises has leveled off considerably. This means that the cost of leverage is no longer rising as sharply as it was over the past year. Fund managers are also likely no longer surprised by the extent of the rise and have likely priced it in already.

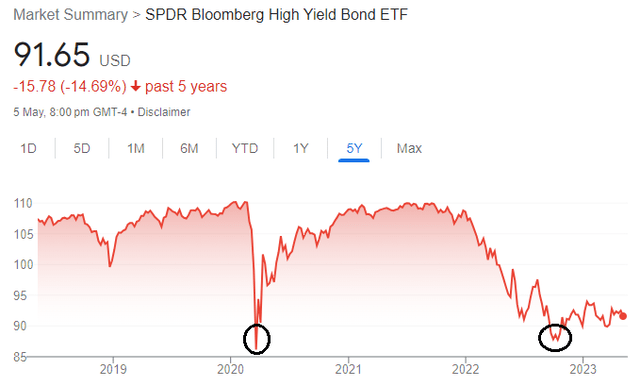

Secondly, the peak-to-trough drawdown in assets in 2022, as proxied by High-Yield corporate bonds below, was nearly as large as during COVID (on a weekly basis). Unless assets fall below their 2022 lows, CEFs have already deleveraged as much as they are going to. If anything, they might start to add leverage back, slightly raising their net income profile.

Overall, none of this means that it's nothing but blue skies from here. We wouldn't be surprised by additional cuts from any number of funds. However, we don't expect anywhere near the same kind of cumulative cuts that we have seen since the start of 2022. This also suggests that unless we see a much worse than expected macro environment, discounts are unlikely to push much wider on a sustained basis.

Market Commentary

The two Eaton Vance funds that cut distributions in May were the Eaton Vance Limited Duration Income Fund (EVV) and the Eaton Vance Short Duration Diversified Income Fund (EVG).

The two funds have a barbell allocation with a significant holding of very high-quality assets as well as lower-rated loans and bonds. However they have had a very different distribution profile with EVG making frequent small changes and EVV making few but large changes.

Prior to the cuts, both funds were clearly overdistributing (though not by as much as implied by the latest shareholder report which shows lagged data). EVV also used fairly expensive auction-rate preferreds for a significant part of its leverage, while EVV had a relatively low level of leverage - two factors which kept net income modest.

Stance And Takeaways

This week we rotated out of the Angel Oak Financial Strategies Term Trust (FINS). The fund has underperformed other credit CEFs year-to-date though its absolute performance is not terrible at -1% total NAV return, despite its bank overweight. This is largely due to the fund's structural factors such as modest duration, decent credit profile and attractive level of income generation. Ultimately, these weren't enough to drive outperformance given the timing and extent of the bank sector weakness.

Normally, lower prices would make us consider adding to a given sector. However, in the case of banks, fundamentals matter much less because many key drivers of performance such as risk sentiment and regulatory decisions are much harder to forecast. Moreover, contagion is a much larger factor for banks than in other sectors. In other sectors a failure of one company can boost the prospects of the rest of the sector while for banks, one bank failure can often spill over and instead cause additional instability. This makes it difficult for bank exposure to play a significant role in investor portfolios.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.