NNN REIT: Tune Out The Noise, This 5% Yield Is A Buy

Summary

- NNN REIT has a strong portfolio and is led by a long-tenured management team.

- It's demonstrated respectable operating fundamentals and growth on core metrics in the last quarter.

- Conservative value and income investors may want to consider layering in at current levels amidst economic uncertainty.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

PeopleImages/E+ via Getty Images

Everyone's economic situation is different, but most everyone share the same concerns over the direction of where things are headed in the future. Maybe we go into a recession, and maybe not. Whatever the consensus is, the risk is certainly not zero as the Bank of America (BAC) recently shared charts that show the elevated probability of a recession.

If that happens, then it would be likely that the Fed would cut interest rates, and those that stand to benefit the most are net lease REITs, which are generally recession resilient and benefit from lower interest rates. Income from these sturdy dividend payers can also help an investor to buffer potential negative effects on income from other sources.

This brings me to NNN REIT (NYSE:NNN), formerly National Retail Properties, which I last covered here in March, highlighting its stability and other positive qualities. The stock has given investors a 5.4% total return since my last bullish take, slightly beating the 3.5% rise in the S&P 500 (SPY), thanks in part to dividends.

NNN currently yields 5% and in this article, I cover recent developments and why it's a solid buy at present.

Why NNN?

NNN is a premier net lease REIT that is often mentioned in the same breath as other stalwarts such as Realty Income Corporation (O) and Agree Realty (ADC). It's a truly national REIT with a diversified portfolio of 3,449 properties spread across 49 U.S. states.

While the word "retail" may be scary for some investors, considering headlines around a "retail apocalypse", NNN's properties are rather immune as most of its properties are service and convenience based, and come with a long weighted average lease term of 10.3 years, which is on par with that of its peers. As shown below, convenience stores, automotive service, and restaurants make up NNN's top 3 segments comprising 40% of annual base rent.

Moreover, the current economic landscape isn't NNN's first rodeo, as it has a 38-year track record of operating in all economic environments, both good and bad. The current CEO, Stephen Horn, is long-tenured with NNN, having been with the company for 20 years and previously serving as COO and Chief Acquisition Officer.

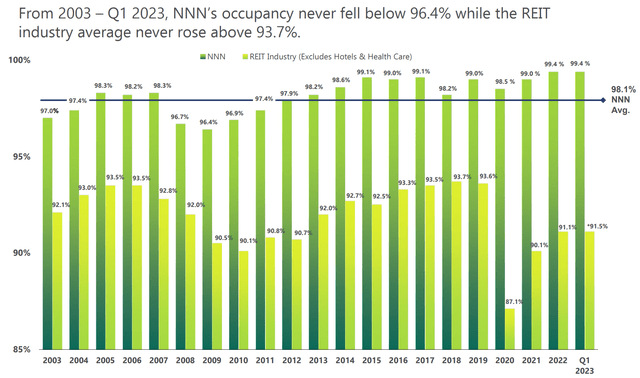

Over this timeframe, management has put together a carefully curated portfolio, and this is reflected by strong occupancy. As shown below, NNN's occupancy has never fallen below 96% and has averaged 98.1% over the past 2 decades.

Meanwhile, NNN has continued to demonstrate the hallmarks of a growing REIT amidst economic volatility. This includes Core FFO per share growing by 3.9% YoY during the first quarter. NNN's occupancy also sits comfortably above its historical mean, at 99.4%, which is the same as where it was at the end of last year, and 20 basis points higher than the prior year period.

The current higher interest rate environment puts lower leveraged REITs such as NNN in a position of strength to acquire properties with less competition. This is reflected by NNN having a BBB+ credit rating from S&P. It also has strong interest coverage ratio of 4.7x, no material debt maturities this year, and $891 million in availability in its bank credit line.

As shown below, NNN's debt to total gross assets ratio sits well under the 50% "safe" threshold at 40.4%, and is mostly comprised of unsecured debt.

The current environment has enabled NNN to find properties at attractive cap rate. This is reflected by acquisitions during Q1 having a 7% cap rate, sitting 40 basis points higher than where it was during Q4 of last year. Management is being prudent with underwriting, as it acquired 43 new properties last quarter with long average lease duration of 19 years.

Near term headline risks include the recent bankruptcy of Bed Bath & Beyond. However, management views this is being more than manageable due to its low exposure and high interest from prospective tenants, as noted during the recent conference call:

One of the recent filings of Bed Bath & Beyond, which NNN currently owns three of their assets with an average rent of $13 per square foot. We've been getting a lot of inbound interest on the assets because of the quality of real estate. So I expect when the time comes to release the assets, we'll have superior recovery rate in a timely manner. Remember, as I stated earlier, the average occupancy from NNN since 2003 is 98%. So the portfolio has stood the test of time through GFC and COVID.

NNN currently yields an attractive 5% and the dividend is well-protected by a 69% Core FFO to dividend payout ratio, based on Q1 Core FFO/share of $0.80. Notably, NNN has raised its dividend for 33 consecutive years.

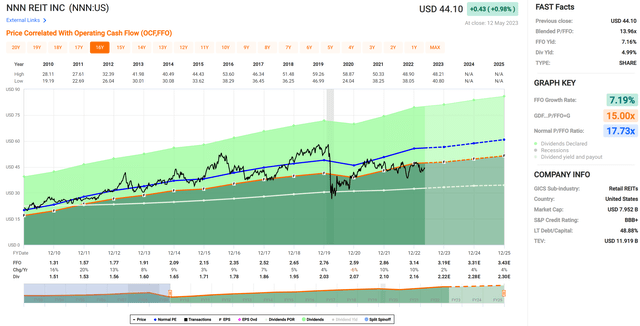

Lastly, the stock is also trading in value territory at $44.10 with a forward P/FFO of 13.7, sitting well under its normal P/FFO of 17.7. Analysts have a consensus Buy rating with a conservative average price target of $48.92, which translates to a potential 16% total return over the next 12 months.

Investor Takeaway

NNN may be a great REIT to own amidst economic uncertainty. Given its high occupancy, strong management team and track record, low leverage ratio and attractive yield, NNN appears to be an attractive option for dividend investors looking for a stable and growing real estate income stream. Additionally, NNN's strong portfolio of properties should serve as a buffer from near term headline risks. As such, sleep well at night investors may want to give NNN a hard look at the current price.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NNN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.