SunCoke Energy: Cultivating Growth Through Strategic Partnerships

Summary

- SunCoke beat on their recent earnings and did not lower guidance amid macroeconomic headwinds.

- The company's partnerships with firms such as United States Steel will expand the firm's reach and create diversification.

- Assuming my DCF figures, SunCoke is undervalued, resulting in a buy rating.

shank_ali

SunCoke Energy (NYSE:SXC) has displayed strong operational growth over the past few years. With the company exemplifying a strong dividend, strategic partnerships, and an undervaluation assuming my DCF figures, I rate SunCoke a buy.

Business Overview

SunCoke Energy, Inc. is a self-sufficient coke producer with over 1100 employees that operates in the Americas and Brazil. Its business is divided into three segments: Domestic Coke, Brazil Coke, and Logistics. The company provides metallurgical and thermal coal and also delivers handling and mixing services to a range of customers, including steel, coke, electric utility, coal producing, and other manufacturing-based clients. Additionally, SunCoke Energy, Inc. possesses and manages coke-making facilities situated in the United States and Brazil.

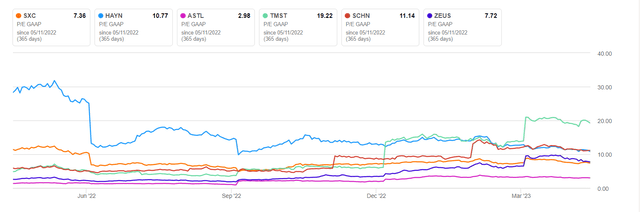

SunCoke Energy has a market capitalization of $634.599 million and a return on invested capital of 8%. Its stock has a 52-week high of $10.43 and a low of $5.72 and is currently priced at $7.59 with a P/E ratio of 7.34. This price is below the company's 200-day moving average, and its P/E ratio is relatively low compared to its peers, suggesting that the stock may offer good value potential.

SunCoke P/E Compared to Peers (Seeking Alpha)

In addition, SunCoke offers a robust dividend yield of 4.22%, with a safe payout ratio of 29.05%. This indicates that the company has significant FCF to expand its operations and explore several growth strategies.

SunCoke has exceeded expectations in its Q1 2023 results, demonstrating strong performance in the face of moderate economic headwinds. The company beat both top and bottom-line estimates, with earnings per share of $0.19, surpassing expectations by $0.01, and a year-over-year revenue increase of 10.91%, beating estimates by $67.35 million, reaching $487.80 million. SunCoke's execution against its 2023 objectives has been impressive, and it remains on track to achieve its full-year adjusted EBITDA guidance of $250 million to $265 million. This success, coupled with the company's strategic partnerships and diversified customer base, has resulted in a more resilient business model, allowing SunCoke to perform well even in potentially recessionary times.

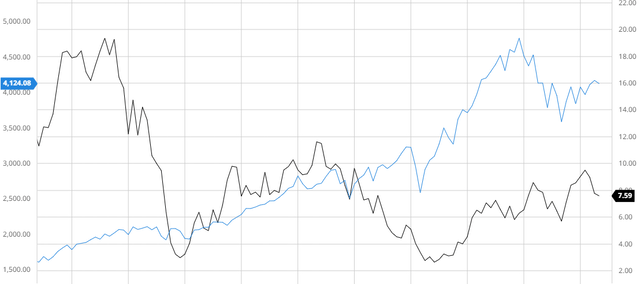

Underperforming the Broader Market

Over the last 10 years, SunCoke has underperformed the S&P 500 when adjusting for dividends. This exemplifies the difficulties SunCoke has encountered in the past and demonstrates why the company is altering its strategy using strategic partnerships as mentioned below.

SunCoke Compared to the S&P 500 (Created by author using Bar Charts)

Strategic Partnerships Fostering Growth

SunCoke has a long history of strategic partnerships which have generated long-term growth and safety for the company. One example of this would be the partnership between SunCoke and United States Steel Corporation (X). It all began in 2011 when United States Steel's factories and SunCoke Energy agreed to a long-term coke supply agreement. Through this alliance, SunCoke Energy has been able to increase the number of its customers, diversify its sources of income, and solidify its position within the sector.

SunCoke Energy has been able to expand into new areas and lessen its reliance on a select number of significant clients because to its partnership with United States Steel. This has reduced risks and produced sustainable growth. The cooperation has also made it easier to develop products together and innovate, notably in the areas of technology and process optimisation. Through this partnership, the two businesses have created more effective and economical coke manufacturing techniques, allowing for margin improvement and compound growth. Through such innovation and diversity, SunCoke Energy has been able to mitigate the risk of losing customers and prevent the catastrophic revenue and profit losses brought on by the failure of a single business.

This agreement has improved SunCoke Energy's standing in the market and increased its exposure and authority. Being connected to a reputable company in the steel industry has aided SunCoke Energy in luring new customers, investors, and employees. It has thereby solidified its position as a pioneer in the coke and energy industries.

With such success in these partnerships, it is no surprise that SunCoke has intentions to continue strengthening these existing deals as well as expand their network further to achieve growth.

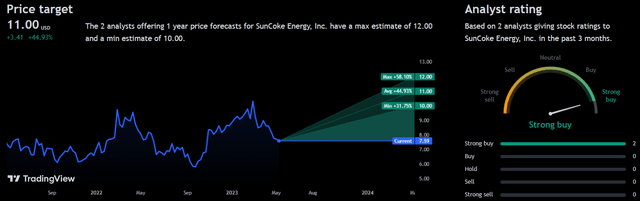

Analyst Consensus

Analyst consensus rates SunCoke as a "strong buy". The company holds great potential returns exemplified by the average 1Y price target at $11 presenting a 44.93% upside.

Valuation

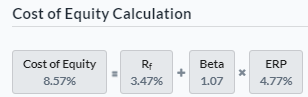

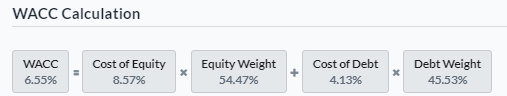

I will use the Capital Asset Pricing Model to determine SunCoke's Cost of Equity and WACC before making my assumptions and calculating my DCF. I was able to determine that the cost of equity was 8.57%, as shown in the table below, after accounting for a risk-free rate of 3.47%.

Created by author using Alpha Spread

Assuming this Cost of Equity value, I was able to determine the WACC to be 6.55%, which is below the industry average of 11.06%.

Created by author using Alpha Spread

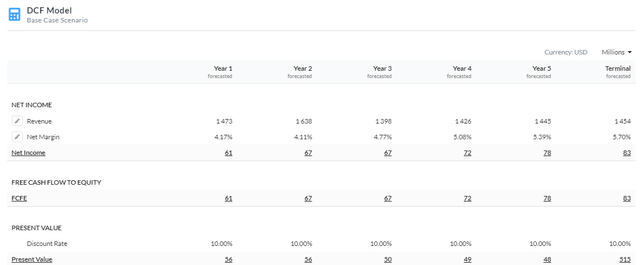

Using a Net Income-based Equity Model DCF analysis, I have determined that SunCoke is currently undervalued by 27% based on a fair value of approximately $10.35. To reach this valuation, I applied a discount rate of 10% over a five-year period. I also estimated a low-single-digit revenue growth rate beyond 2023 and predicted a slight expansion in margins over time, enabled by the company's partnerships that offer diversified revenue streams and the potential for more stable profits, despite the cyclical nature of the business.

5Y Net Income-based Equity Model DCF (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread)

Risks

Fluctuating prices of coal and coke: The business of SunCoke Energy is largely dependent on coal and coke pricing, which might change due to supply and demand dynamics, governmental restrictions, and shifts in energy policy. The company's revenue and profitability may suffer as a result of a price reduction.

Environmental regulations: Due to its effects on the environment, the industry in which the corporation operates is heavily regulated. Regulations relating to emissions, water use, and waste disposal may change, which could result in higher compliance costs or even a halt to production.

Conclusion

To summarize, I believe that SunCoke Energy is a buy in the long-term due to its strong dividend, strategic partnerships which generate long-term growth, and undervaluation assuming my DCF figures.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.