Tech Titans Aren't The Only Game In Town, Consider Biotech And, Yes, Financials

Summary

- The Regional Bank Fiasco is a classic “Baby with the Bathwater” scenario. Rising rates are great for Insurance companies and “hidden banks”.

- Since ETFs are a very popular way to participate in the market, whole sectors are being pressured. In this case, non-bank financials.

- The pain trade is still staying long, just look for niche opportunities. To me, Biotech/Pharma is the most bullish sector, while financials are the least. They both have interesting opportunities.

- We could be in for some volatility as we approach the default deadline. It could be soon if June 1 is the real D-Day. I doubt that it is so. Yellen is just doing her duty as Treasury Secretary to get the ceiling raised.

- Looking for a portfolio of ideas like this one? Members of Group Mind Investing get exclusive access to our subscriber-only portfolios. Learn More »

Devrimb/iStock via Getty Images

We have a very useful data point to reveal the message of this market. Is there a true concern about the debt ceiling or fear of recession?

Tomorrow on May 15, the actual tax revenue from April 18 will be revealed. I suspect we will have a lot more time than June 1. It will be important to see how the market reacts to this reveal. I am sure you are hearing this phrase often; it will be “better than feared”. What if it isn’t? What if we have June 1 for when the US runs out of money? If the market sells off hard on that news, then we know that the debt ceiling drama is finally a factor for the market rally to overcome. If the June 1 deadline turns out to be June 15, and the market yawns we know that the debt ceiling is not yet an issue. Of course, there are many ways that Treasury Secretary Yellen will be able to stretch out any actual default on the debt, no matter what. Just to be perfectly clear this year's revenue will be less than last year's revenue, however, June 1 was the worst-case scenario. Yellen being the loyal Democrat wanted to add pressure to stave off any deficit reduction concessions until the debt ceiling was raised. I am going to move on from here, my job is to try and guide you, my loyal reader around this minor controversy, to achieve a more successful portfolio. I think that somewhere in July is the more likely D-Day. I think if the market treats this news with nonchalance the greatest downward pressure must be exerted by recession fears. My mention of Yellen and her motives is not an invitation for political invective, or any political discussion at all. I am merely explaining why Treasury Sec. Yellen would push forward the most pessimistic deadline.

Don’t Sell in May, Hedge and Stay, for the unfolding rally.

The market has been chopping around 4100 to 4150, and trying everyone’s patience. This frustration makes it easier to take the bearish view and sell. Fight that feeling and hedge. I have spoken a number of times about hedging. You use general heading judiciously, you can target individual names, just use your stock picking skills. A word to the wise, better to pick a stock already in its death throws than to go after a company that is "overvalued" or "gone up too much". Here is a simpleton's saying but it's actually very true -- stocks tend to keep going up, until they don't. Likewise stocks falling tend to keep falling until they stop. In other words, a stock that seems crazily expensive tends to remain that way, and it is the height of hubris to think you can pick the top. Rather just wait for the market to tell you that a stock is done going up, or down.

Is May really so bad?

In the last 5 years, only 2018 was the loss greater than 2%. In 2018, the S&P 500 fell 2.2% in May. In 2019, the S&P 500 fell 1.4% in May. In 2020, the S&P 500 fell 1.2% in May.

However, it is essential to note that the "Sell in May and Go Away" theory is not always reliable. In some years, May has been a strong month for the stock market. For example, in 2021, the S&P 500 rose 2.8% in May. You should recall last year May 2022 which ended up .25% It was down hard in the beginning of the month but made it all back up in the end. I think it is worth your while to stick it out. Right now, no matter what happens with the data reveal tomorrow, the politicians and the media are going to gin up the doom and gloom worst case scenarios. The media loves it because it means more eyeballs and therefore more revenue. The Pols of a certain party want to express the worst outcomes possible because they think it will hurt the other team for the 2024 election. With enough histrionics it could dislodge a few more sellers. From my point of view the fact that the market is going nowhere but staying at this relatively elevated level, most of the “weak hands” have already moved to the sidelines. I guess we have a real life experiment in the wisdom of the crowds. That is, if, the June 1 deadline is moved to June 20 let’s say, and the market yawns. That means that the general population sees through the canard, and it is the other reason – recession fears that is holding down the rally. I don’t want to sound completely cynical but recession fears have also been ginned up. Otherwise we’d be in a depression right now. The recession mantra started 2 years ago. At some point they will be right, but I don’t think the seeds of recession have been played as yet.

I have been adding more insurance companies to my long-term investment account but Warren Buffet was the inspiration to focus on it today.

I watched the beginning of Berkshire Hathaway’s Annual Report on CNBC last Saturday. The intro went through the financials, with some interesting notions about insurance companies. Insurance income shot up because of interest rates, where in 2021 they made $50M, last year I think he said they made $5B. I have been picking up insurance companies in the previous 3 months -- Chubb (CB), Equitable (EQH), Kemper (KMPR), MetLife (MET), Goosehead (GSHD), Trupanion (TRUP). Why so many? First, I only know a little about the intricacies of the insurance business, so a large number of different names spreads risk. Second, there are subspecialties, the most recent purchase was TRUP, and the stock lost a 3rd of its value. It's a starter position, if anyone knows of another pet health insurance company exclusively, I would invest in that too. Lemonade started a pet health insurance business, but they have a whole bunch of insurance lines. If they ever stopped adding new insurance lines and started generating free-cash-flow I might get back into them again. Since I am not an expert, I rely on diversification to provide some safety, while over time I can cull one or two stinkers who are messing up the business model like LMND.

Also, consider the “hidden banks”

What do I mean by hidden banks? Both American Express (AXP) and Discover Financial (DFS) take deposits. I know that AXP makes small business loans, as well. So what I mean by “hidden banks” one does not think of Discover or Amex Cards as banks. Another “hidden bank” is SoFi Technologies (SOFI) made its splash being a refinancer of student loans, and working with mostly Gen-Z about getting their money right. They have made much of their tech-first approach and have built their own full-stack online banking system. They are not a traditional regional bank, the way to use SOFI is with a phone APP. I am not saying they aren’t a bank, I am saying that they present themselves as a fintech. The added kicker for SOFI is that the government is not going to forgive student loans. They are going to start collecting repayments again. Another “hidden back” is Charles Schwab (SCHW), a high conviction holding of mine. SCHW got dinged plenty over the regional banking mess, but I think there is some nice upside waiting for it in the coming months. It is both a long-term and short-term position for me. I have been selling the expensive shares on the rallies and buying back the shares cheaper as the stock falls back thus I have been averaging down my share price.

Goldman Sachs (GS) is not seen as a bank-bank, it has had little success on its own but its alliance with Apple (AAPL) is working

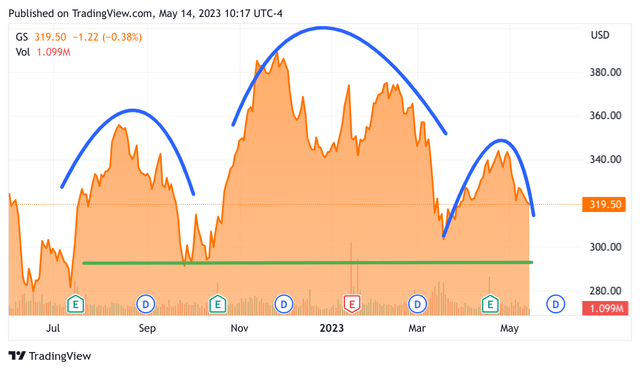

I have left out the most prominent “non-bank-bank” and that is Apple Pay. AAPL just started a money market account that is offering over 4%. Though it is basically handing off the accounts to Goldman Sachs (GS). Goldman is starting to get interesting to me. Friday it hit 317, a recent high for GS was back last November at 382. The chart is very revealing in that has formed a huge “Head and Shoulders” top. Check it out so you see what I mean.

In order for the formation to be complete it should move back down to the “neckline” (green horizontal line) that takes the price down to 292, the next stop is 280ish. I would be a buyer at these prices. Why do you ask? Well, according to my last article, IPOs are coming back, and KVUE was a big success as I expected. Other IPOs will follow and GS should have a piece of that. The other piece that is already coming back is the mergers and acquisitions. Right now it is concentrated in the biotech space, every week there are several acquisitions in Healthtech, Medtech, and Biotech. I expect this to widen. In fact, everyone is talking about how the regional banks will have to start consolidating again. Goldman will be right there. Finally, they have the best proprietary trading, bar none. While the VIX isn’t capturing all the volatility you can bet GS will be printing money as they usually do. Unfortunately, in-house trading profits have less value than profits arising from recurring revenue, hence the desire for becoming more bank-like. I will be patient and begin to accumulate GS for my long-term account starting under 300.

Why is there so much excitement in biotech and the healthtech sector right now.

We might be oblivious to it, but huge strides are being made right now in all kinds of fields related to biotech and medical devices. We expect that very shortly a cure will be approved for sickle cell anemia. This is a huge disease that affects 20,000 new cases a year in the US, yet there are only 100,000 currently counted. It doesn’t take a math genius to understand that the survival rate is sadly not great. Now with genetic therapy, this menace can be cured! Well, we expect approval from the FDA soon in any case. I understand there are several different biotech companies attempting it but bluebird bio (BLUE) is the one that I think is furthest along. They already have two other genetic diseases that have cures approved. This demonstrates that they can execute. They are setting up their own treatment centers so this is not just about creating a drug and handing it off to a hospital, at least not yet. The price for these treatments is astronomical but with the high volume required for Sickle Cell, I assume the price will come down. This is not the only encouraging development.

A much larger pharmaceutical company - Lilly (LLY) released stunning news about their Alzheimer's treatment proving that removing plaque from the brain can delay onset of Alzheimer's, This is the first drug that really shows measurable effectiveness. This is in addition to LLY submitting an application to allow Mounjaro (currently used for diabetes) for weight loss of up to 16% of body weight. At this point, I wouldn't recommend LLY as a trade or an investment. I think LLY is close to fully valued. That said if we do have the sell-off that everyone is gabbing about, it wouldn’t surprise me if LLY retreated 20%. Only because the stock has gone up so much in the last few weeks. I am only mentioning LLY as an example of how much growth health companies at all levels are contributing to our economy. It’s no wonder that Biotech and Medtech names are the hottest sector in stocks right now. The Tech titans may have upside too, and even a few names here and there will march higher, but nowhere else are the fortunes changing so quickly as they for smaller stocks.

You want more names?

Okay how about ImmunoGen (IMGN) I introduced it to the Group Mind Community late last year, I bought some shares in November at 5.08. I tend to wait a while just to watch the price action before I turn it over to the group. As of this Friday IMGN is closed at 13.68 for nearly 170%, I bought more in mid-April at 4.29 now valued at 200.19%. What is so special about IMGN? They have a new type of immunological treatment for some types of Ovarian Cancer that only have Chemo-therapy treatment right now. Immunological treatments in Cancer are another huge wave sweeping over the most intractable diseases including cancer, though this modality has been around for a few decades, the developments are accelerating. Again, the juice might already be squeezed out of this one for now. Keep it on your watch list and if you see a retreat at $10 or below start nibbling. Here is one that I am going to be buying back this week and that is TG Therapeutics (TGTX). I have been in and out of it since the beginning of the year. Luckily, I socked so shares away in April at 18.22 at 69.5%. I sold most of TGTX at 27, thinking that it would soon falter having gone up so much so quickly. It did this week, retreating 8% but not until it reached over 35 per share days before. Now that TGTX is finally coming back in, I am building back my position and also adding more shares in my long-term investment account. What’s so special about TGTX? They have an immunological treatment for multiple sclerosis. Just remember the share prices for names like these can be very volatile. I always recommend buying small amounts over time. I can’t go through all the names that we at Group Mind Investing (GMI) are working with. There are nearly a dozen names that we are monitoring or already deploying funds to. Also, if you are curious as to how I surface these opportunities, I will just say that I have repurposed a lot of the stock-picking skills I learned while trading info and cloud tech. I am also very lucky to have a diverse group of members who know a bit more about medicine than I do.

With that, I bid you all good luck this week.

Have you ever bought a stock that everyone's saying is great, only to find you bought near or at the all-time high that stock drops 20% immediately? What happened? By the time the average stock purchaser gets a stock idea, usually, it's already overbought.

If this sounds like you, join our community Group Mind Investing which adheres to a Cash Management Discipline. We watch the market for you and uncover fresh trading and investing ideas. We identify sectors, trends, and individual stocks. You learn how to target a stock, buy and sell. Try our 2-week trial

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IMGN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.