U.S. Treasury: Only ∼$231 Billion Left To Avoid $31.4 Trillion Debt Armageddon

Summary

- The US treasury department only has about $231 billion of liquidity left to avoid what could potentially be a ∼$32 trillion debt melt down.

- Accordingly, Secretary Janet Yellen has recently expressed concerns that the government could exhaust its liquidity capacity as early as June.

- In a similar episode in 2011, the S&P 500 suffered a rapid decline of 17% from its peak, in a mere 22 trading days.

- Failure to raise the debt ceiling would be disastrous, undermining the US' financial credibility and causing disruptions in financial markets.

- Amidst the chaotic landscape, I stay committed to a long-term investment strategy, anchored on diversification.

Marcos Silva/iStock via Getty Images

The X-date Is Approaching

The debt ceiling drama continues to unfold: According to a statement released by the US Treasury on Friday, the department only has about $231 billion of liquidity left to avoid what could potentially be a ∼$32 trillion debt melt down.

As of late Friday, 12th May, the US Treasury's liquidity headroom includes about $143 billion of cash and cash equivalents, and $88 billion of 'extraordinary measures'. Notably, the 'extraordinary measures' balance, which encompasses a series of accounting and investment maneuvers, decreased materially from the initial total of approximately $333 billion authorized in late Q1.

Accordingly, the deadline for solving a potential US government debt default approaches fast -- two months ago Morgan Stanley estimated that the X-date, the date when the U.S. government will be out of liquidity, will likely be in August. However, Treasury Secretary Janet Yellen has recently expressed concerns that the government could exhaust its liquidity capacity as early as June.

Meanwhile, both the equity and fixed income markets appear to ignore the debt ceiling drama: Since the start of the year, the S&P 500 (SP500) is up about 8%, while a basket of long-dated treasuries (+20 years) is up 3% respectively.

A Note On History

Historically, when the government has approached the debt ceiling in the past, political parties aimed to leverage the need for an agreement to push for policy modifications. And during the five decades from March 1962 to May 2011, the debt ceiling has been increased 74 times, including 18 times during Ronald Reagan's presidency (republican), eight times during Bill Clinton's tenure (democrat), seven occasions under George W. Bush's administration (republican), and five occurrences while Barack Obama was in office (democrat).

In the current scenario, Republicans are aiming to secure a reduction in government spending as a condition for raising the debt limit, citing the need for more austerity in the context of rising interest rates (which makes debt more expensive). Meanwhile, Democrats are advocating for an increase without any additional conditions, arguing that pressing issues such as climate change, inflation, the war in Ukraine require adequate fiscal expenditure to support the economy.

While I am not commenting on politics, I would like to remind investors about a comparable episode in 2011, when the Obama administration faced a similar situation of having to engage in negotiations with a Republican House. Likewise, this episode was marked by a discussion around a substantial fiscal expansion and amid similar concerns of an impending recession. The standoff was eventually resolved, but resulted in the decision by Standard & Poor's to downgrade the U.S. sovereign debt rating from "AAA" to "AA+".

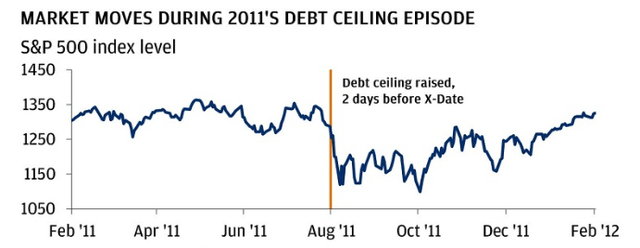

In that particular episode, the S&P 500 suffered a rapid decline of 17% from its peak, in a mere 22 trading days. And despite the debt limit being raised eventually on August 2nd, the equity markets did not reach their lowest point until six days later, and fully recovered only about 6 months later.

JP Morgan Research; Bloomberg Data

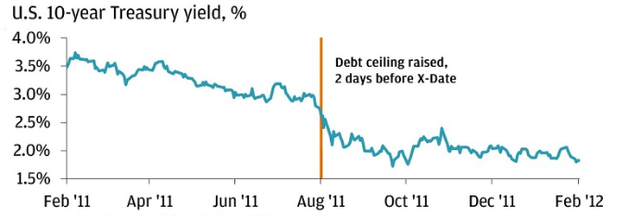

While equities fell, treasuries rallied. From February 2011 to February 2012, the yield on the 10-year treasury dropped from close to 3.5% to less than 2%.

JP Morgan Research; Bloomberg Data

No Deal Would Be Disastrous

Not raising the debt ceiling would be disastrous because it would result in the United States defaulting on its financial obligations, undermining its credibility and causing significant disruptions in financial markets. Amongst others, this would lead to increased borrowing costs, a loss of investor confidence, and potential economic turmoil with far-reaching consequences domestically and globally.

As the debt ceiling drama unfolds, the scenario that poses the lowest risk to the economy and markets is one in which a deal is reached prior to the X-date, without the implementation of austerity measures. Not only would this outcome prevent a default, but also potential adverse effects of spending cuts that could dampen economic growth. On the opposite end of the spectrum, the highest risk to the economy and markets is one in which a deal is reached after the X-date, accompanied by significant austerity measures.

In my opinion, however, a downgrade of US debt may happen be either way, because the ongoing standoff signals to rating agencies political instability and an inability to effectively manage finances.

With that frame of reference, Warren Buffett, who's holding company Berkshire Hathaway now has more liquid spending power (cash on hand) than the U.S. government has recently warned about the danger of not raising the debt limit:

A debt ceiling to start with is a mistake. The United States of 2011 has a different debt capacity than the United States of 1911. We’re always going to be a growing country and it’s always going to have a growing debt capacity. That doesn’t mean I think it’s a great idea at all to have debt growing as a percentage of GDP, but to stick debt ceilings on so these games get played, and all the time that gets wasted and everything, and the number of silly statements you hear, it’s such a waste of time for a country that has a lot of things to do ...

Diversification Will Be Key, For Whatever Happens Next

Reflecting on the debt ceiling risk/ discussion as outlined in this article, paired with other economic risk factors such as high inflation, Ukraine vs. Russia war, as well the yet-to-be-resolved regional bank crisis, I argue investment diversification is more important than ever.

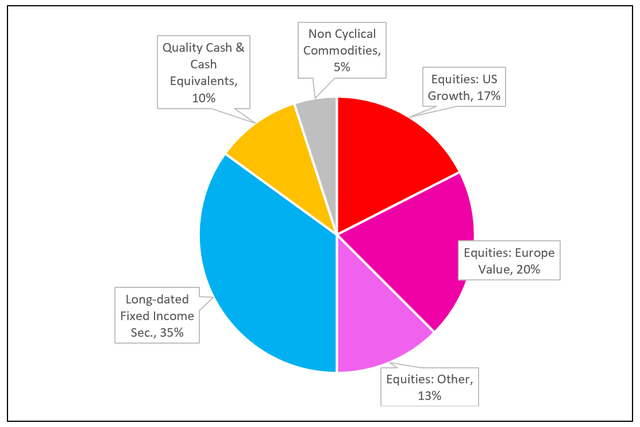

Personally, I aim to diversify across asset classes, thematics, and geographies; And I anchor my portfolio on a derivative of Ray Dalio's all weather portfolio.

(1) As the main investment bucket (∼50%) of allocation, I like high-quality international equities, which are already benefiting from China's reopening, Europe's improving energy dynamics, and greater exposure to the real economy:

- For Europe, I like the value set-up for Stellantis (STLAP), Bayer (OTCPK:BAYRY), European Banks including Deutsche (DB), Barclays (BARC) and Raiffeisen (RAIFF)

- In the U.S., I like reasonably priced tech assets such as Meta Platforms (META), Google (GOOG), Spotify (SPOT), Roblox (RBLX)

- In Asia, I like Baidu (BIDU) and Nintendo (OTCPK:NTDOY)

(2) For ∼35% of allocation, I believe an investment in long-dated fixed-income securities is prudent, as yields have risen significantly versus 2020/ 2021

(3) I attribute ∼10% of allocation to cash (or short-dated fixed-income securities), spread across the Euro, Yen, Swiss Franc, British Pound, and Norwegian Krone

(4) Finally, I assign a ∼5% allocation to non-cyclical commodities such as Gold, and Palladium

All that said, it is worth highlighting that previous debt ceiling episodes have unleashed waves of unease among investors, and this episode will likely not be different. Amidst the chaotic landscape, I stay committed to a long-term investment strategy, anchored on diversification.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPOT, RBLX, GOOG, DB, BCS, RAIFF, STLA, BIDU, META, NTDOY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice. This is market commentary and/ or a reflection of the author's opinion only.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.