Alibaba FQ4: 3 Upcoming Catalysts For A Major Rebound

Summary

- Alibaba is set to report earnings for its fourth fiscal quarter and full-year on May 18, 2023, before market opening.

- EPS estimates are low heading into earnings, despite strong recovery trends in China’s economy and retail sector in the first-quarter.

- I believe Alibaba’s e-Commerce operations have considerable surprise potential next week.

- Alibaba faces a number of catalysts that could result in a sharp upward revaluation of Alibaba’s bruised shares.

maybefalse/iStock Unreleased via Getty Images

Alibaba (NYSE:BABA)'s shares have languished ever since the Chinese Communist Party launched a crackdown on the domestic technology sector for monopolistic practices in 2021. Today, the situation is much different, however: the Chinese government has reopened the economy, done away with COVID restrictions and scaled back its regulatory assault on Chinese tech companies... which creates a favorable backdrop for Alibaba to reverse valuation losses. I believe Alibaba's situation is slowly improving and the company could see a strong FQ3'23 earnings report on May 18, 2023. I believe there are three catalysts that could drive a strong upward revaluation after the e-Commerce company submits its earnings card for FQ4'23 next week!

1. Low EPS expectations heading into FQ4'23

The first catalyst I see for Alibaba's shares next week relates to low earnings predictions.

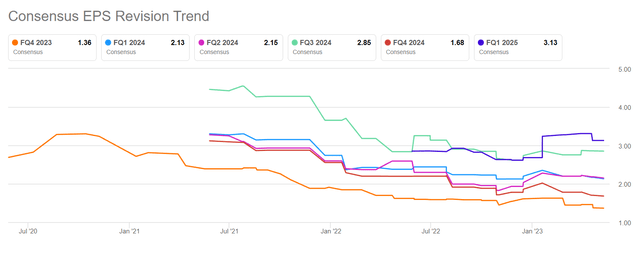

Alibaba has seen a major round of EPS downgrades in the last 90 days which indicates that investors are heading into the earnings release with very low expectations. In the last 90 days, there were 12 down-ward revisions and only 3 up-ward revisions with regard to Alibaba's FQ4'23 EPS. The trend has been negative as investors have been fearful of a disappointing recovery pace in China after the government opened up its economy in January, but I believe these concerns have already been reflected in Alibaba's negative EPS trend.

Analysts still expect Alibaba to have seen some recovery benefits as the current EPS estimate for Alibaba's FQ4'23 is $1.36 which implies 16% year over year growth. However, I believe, as I will explain next, that Alibaba could easily beat the consensus EPS figure next week as there are signs of an accelerating turnaround in China's economy.

2. Alibaba's e-Commerce business could surprise to the upside, might see revenue acceleration in FY 2024

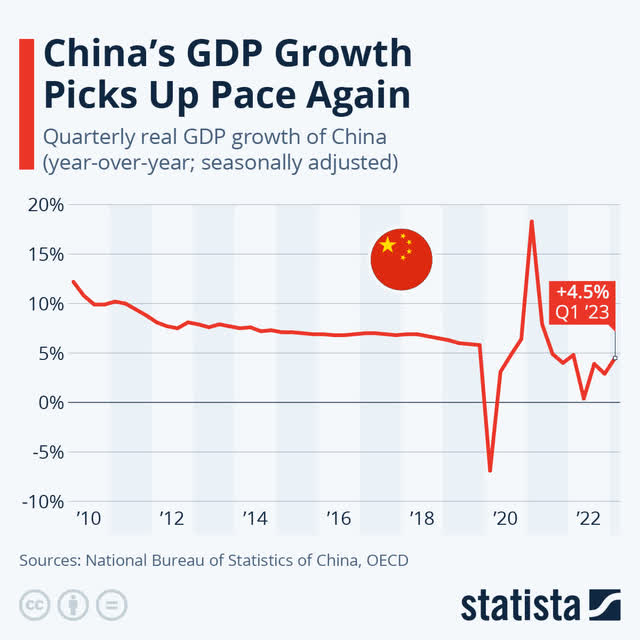

China's economy has seen a strong recovery in the first-quarter, with GDP growing 4.5% year over year. The rebound in GDP growth is due to the full reopening of China's economy after three years of lockdown measures that were implemented to control the spread of COVID-19. It was the fastest GDP expansion in a year for the China's economy and if China continues on its recovery path, Alibaba as a major e-Commerce company would likely stand to profit from it as well.

Additionally, sales in China's retail sector soared 10.6% in March 2023, indicating that pent-up consumer demand is being unleashed which could result in a major boost to Alibaba's e-Commerce growth. With Chinese consumers opening up their wallets again, signaling improving consumer confidence, I believe that Alibaba's e-Commerce operations could see a major reacceleration of growth this year.

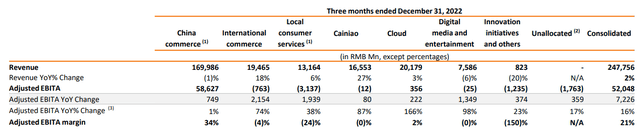

Alibaba's China commerce business saw (1)% growth in the quarter ending December 31, 2023 and the company's entire financial performance depends on a resurgence of consumer spending. For FQ4'23, I expect Alibaba to report positive China e-Commerce growth of 3-4% as a result of recovering retail sales and China's GDP rebound. Strong financial and operational results in Alibaba's e-Commerce business could be a potent catalyst for Alibaba's shares next week.

3. Alibaba's valuation reflects COVID-era fundamentals

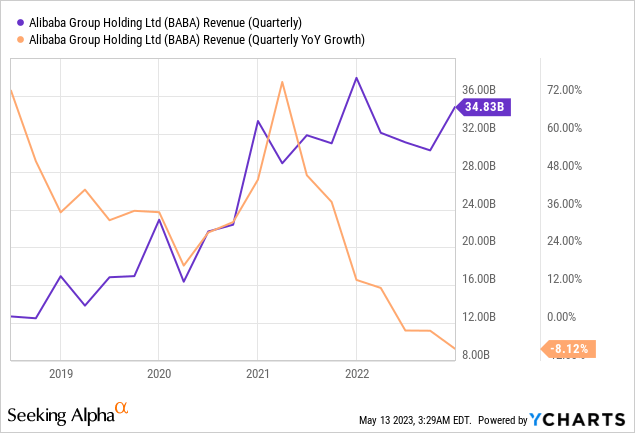

Investors in the last two to three years had very good reasons to apply a steep valuation discount to Alibaba: Beijing's technology crackdown, slowing growth in Alibaba's dominant e-Commerce operation, moderating growth in Cloud, increasing competition resulting in margin pressure and uncertainty regarding forced asset sales (Ant Group) have all weighed on Alibaba's perception as a Chinese growth stock. The result has been a serious slowdown in Alibaba's top line growth...

However, investors at some point will have to recognize that with the reopening of China's economy and a resurgence in retail spending, one big winner of a consumer spending-driven recovery could be Alibaba... and with it could come not only a reacceleration of growth in Alibaba's core business, but also a fundamental re-evaluation of Alibaba's growth prospects. The Chinese firm recently also announced, which I considered to be a really big deal, that it was splitting its business into 6 independently run divisions to unlock value which could allow investors to better value the company. Further announcements (details) next week about the progress of Alibaba's reorganization could also result in new interest in Alibaba's shares.

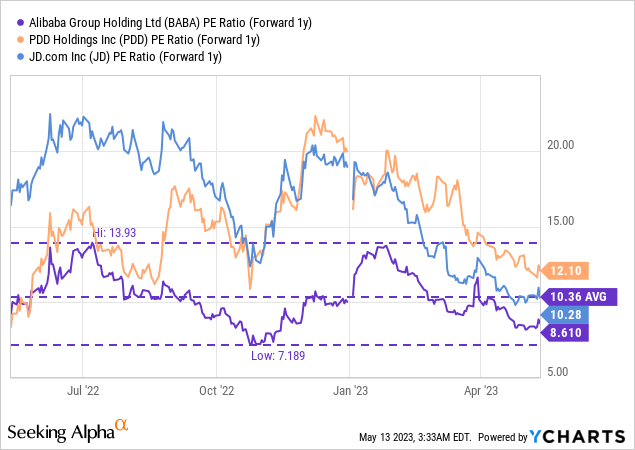

Chinese e-Commerce-focused growth companies trade at value P/E ratios

At the end of the day, Alibaba's shares are still cheap. Alibaba is currently valued at a forward P/E ratio of 8.6X which makes BABA one of the cheapest, large-scale China-based e-Commerce companies in the sector. Other Chinese e-Commerce marketplaces like PDD Holdings (PDD) and JD.com (JD) are also cheap, in my opinion, based off of earnings. Low P/E ratios about 8-10X are often associated with value stocks that have more stable earnings profiles, but also have more muted upside prospects. The Chinese e-Commerce sector as a whole seems cheap and undervalued, in my opinion, and a solid rebound in China's retail sector could be the catalyst that investors have been waiting for.

Risks with Alibaba

The biggest risk for Alibaba heading into FQ4'23 is that the economic recovery in China did not have the effect that I would expect. Alibaba has seen a serious slowdown in its top line growth in the last few years and any cracks that appear in Alibaba's FQ4'23 earnings card could be a justification for investors to push BABA yet again into another down-leg. From a risk point of view, I believe that Alibaba's risk matrix has improved greatly with the reopening of China's economy and so did the odds that China's e-Commerce could see a reacceleration of its top line growth in the coming quarters.

Final thoughts

I believe there is a very good chance that Alibaba, when it presents earnings for its fourth fiscal quarter on May 18, 2023, will surprise to the upside. A reinvigoration of Alibaba's top line growth, led by a consumer spending-driven recovery in the e-Commerce business, could create the catalyst that investors need to drive Alibaba's P/E from value back to growth territory. Other catalysts include low EPS expectations heading into earnings as well as new announcements regarding the company's reorganization effort. Considering that Alibaba's shares continue to trade at a ridiculously low valuation multiplier (P/E ratio of 8.6X), I believe Alibaba offers risk takers an asymmetric return profile!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.