UiPath: Do Executive Departures Mean Trouble Ahead?

Summary

- UiPath posted a good Q4 and narrowed its net losses from the prior year.

- A spat of executive departures, however, has us nervous.

- The company expends a large amount of money on customer acquisition.

jittawit.21

Autopilot

Pretty much everyone has tasks to accomplish at work that they dread. Consistent, droning, repeatable tasks. Often, it's these simple, mindless actions that create the most dread in our minds--after all, they seem like such a time waste. That's where UiPath (NYSE:PATH) comes in. The company develops and sells automation software to take repetitive tasks out of the hands of employees, so they can focus more on more productive functions.

UiPath went public in 2021 after being founded in Bucharest, Romania in 2015. During a time in the market when high-growth, low-or-no-profit companies fell largely out of vogue, the market was not kind to UiPath.

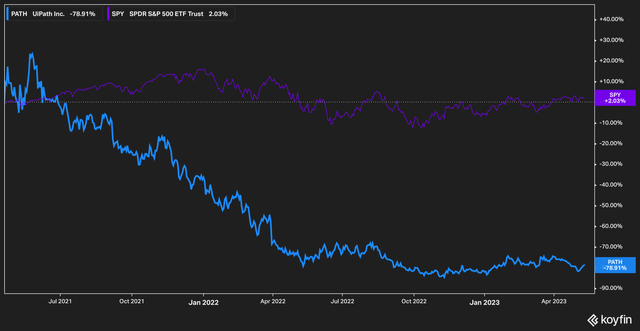

Since the IPO, UiPath is down by 78% versus the 2% return generated by the S&P 500.

There have, however, been some green shoots that investors have clung to. In Q4 2022, the company generated positive cash from operations of $94 million, with targeted growth for 2023 roughly in line with Wall Street estimates.

However, there are several issues that we believe pose a threat to the UiPath story. Let's dive in.

Corporate Merry Go Round

One of the most often ignored aspects of company research by investors is governance and corporate structure. Unlike the seemingly solid ground of accounting, assessing a company's board and executive team can feel squishy and soft; interesting perhaps, but difficult to glean anything useful from.

Sometimes this is true. But we believe there is at least one thing we keep an eye out for and is fairly easy to track and can provide a glimpse into the corporate culture: executive tenure. Long-tenured executives provide stability in investors' minds. Companies where executives come and go at rapid clips, however, generally stir up worries.

UiPath, unfortunately, falls into the latter category for us. On the latest conference call, the company bid farewell to Chris Weber, the Chief Business Officer of UiPath. This caught our eye for two reasons--first, Weber was the first ever CBO in the company's history. He had been charged with expanding the e-commerce side of the sales funnel at the company. More generally, he was "responsible for leading global go-to-market strategy and execution at UiPath, and will guide worldwide sales, services, and other go-to-market operations". The second reason the departure caught our eye was that Weber had only been at UiPath for one year.

Moreover, in the 8K filing where Weber's hiring was announced, it was also announced that Chief Revenue Officer Thomas Hansen would be leaving the company. Hansen had joined the company in May 2020, marking his tenure at just under two years with UiPath.

In February 2023, Chief Product Development Officer Ted Kummert announced he would also be leaving the company. He had been with UiPath since March 2020.

This spat of departures is, in our minds, significant. Executives--especially C-suite level executives--generally sign on with companies for specified amounts of time. Leaving before the end of that specified period generally results in the forfeiture of lucrative compensation packages (again, generally). So, we pay attention when executives leave.

Further, UiPath has... quite a few C-level executives. As of this writing, the company currently has:

- Two co-CEOs

- Chief Financial Officer

- Chief Culture Officer

- Chief Marketing Officer

- Chief Legal Officer

- Chief Strategy Officer

- Chief People Officer

- Chief Product Officer

- Chief Customer Officer

- CEO of the Company's Japan Operations

- Chief Technology Officer

- Chief Corporate Development Officer

Thirteen C-level executives (counting the two co-CEOs) seems like... a lot. Combined with the departures of other executives, it could be believed that there exists a large degree of overlap between executive responsibilities, which could create a lack of organizational efficiency.

By The Numbers

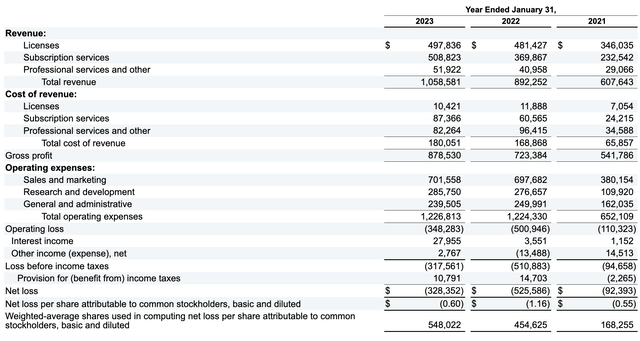

An examination of UiPath's financial results for the year ending January 31st, 2023 also shows that while operating and net losses are narrowing, a few concerns still remain.

For example, in 2022 licensing revenues grew by only 3% year over year, ceding the top spot in terms of revenue generation to subscription services, which grew at a 38% clip. The cost of those subscription services (which includes hosting costs, et cetera) grew by 44%. Of course, $87 million in expenses against $508 million in revenue can seem a bit trivial, but the net result of a loss means that the company must find ways to cut costs and minimize overhead growth.

Sales and marketing is the company's largest operational expense by far, representing 66% of total revenues. Put another way, UiPath expends $0.66 per $1 earned on sales and marketing--a fairly steep cost for customer acquisition. Given that the company's Chief Business Officer--tasked with leading the company's global sales operations--departed after only one year, we are left to wonder if a major strategy shift may be ahead for the company.

Valuation & Outlook

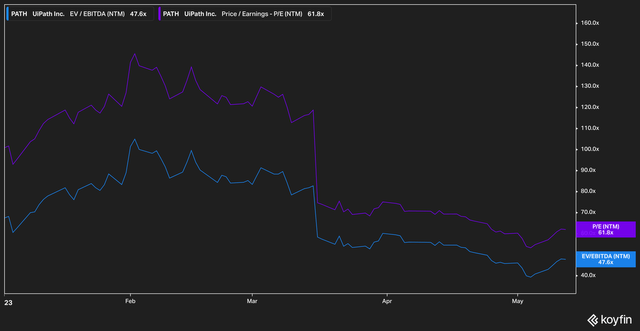

Investors may look at the chart at the top of the article, showing that UiPath has fallen by more than 70% from its IPO and conclude that the stock is cheap. Unfortunately, it doesn't appear to be.

Despite the fall in share price, on a forward basis, UiPath appears to be quite expensive. With a whopping EV/EBITDA forward multiple of 47x, UiPath still seems to be a pricey proposition even though valuation levels have fallen quite a bit.

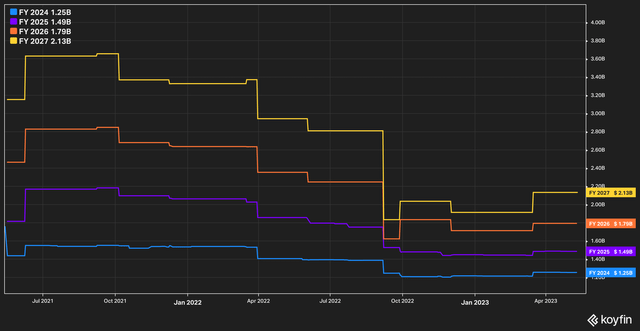

Analysts, too, seem to have soured a bit on the future revenue prospects for UiPath.

While the consensus analyst outlook for the company's revenue going out to four years has ticked up recently, the optimism for revenues of over $3 billion in four years has clearly dissipated, with top-line estimates growing only marginally for the next two years.

Looking ahead to the next quarter, we believe it's likely that the company will post a beat on top-line earnings, which are estimated to be around $272 million (UiPath has reported eight consecutive quarters of top-line beats). However, we caution investors against believing that these beats are a green light that all is well.

Pictured in the chart above are UiPath's days sales outstanding, a metric that accounts for growth in accounts receivable (which have been recognized as revenue) versus actual reported top-line revenue. If accounts receivable grow at a faster pace than revenue, it can often be indicative of lower-quality earnings or earlier recognition of revenue than in previous periods.

The Bottom Line

UiPath may have a great product to offer--the company has stellar customer reviews according to Gartner--but the executive churn within the company leaves us with a cloudy impression of its strategic vision. As investors, this makes us nervous. Factoring in that the company continues to lose money year over year gives us further pause in this non-zero interest rate environment. While we will keep an eye on UiPath, we believe the potential for more pain in the near future is high.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.